3 top tips to keeping track of small business expenses

Finally, some good news: the number of small businesses in the UK is on the rise! At the start of 2018, small businesses accounted for a whopping 99% of private sector enterprises.

It’s no secret that small businesses are often short on cash and time, especially when first setting up. It can sometimes feel like you’re juggling a thousand things, but if there’s one thing you shouldn’t forget to make time for – it’s managing your accounts.

Neglecting your accounts might seem tempting, but could lead to more headache later down the line. To make it easier for you, here are our 3 top tips when starting out with small business accounting:

1. Know your deadlines

Deadlines can creep up out of nowhere – and missing them could lead to fines from HMRC. Not great news for your small budget! Here are some important company accounts and tax submission and payment deadlines to be aware of:

- Filing accounts: If your company is registered as limited, you’ll need to file your first accounts with Companies House within 21 months of registering.

- Corporation tax: Due 9 months and 1 day after the end of the accounting period (see below for more on accounting periods).

- Company Tax Return: You’ll need to file these 12 months after the accounting period (see below).

- Self-Assessment Tax Return: If you’re a sole trader or member of a limited partnership, or if you’re the director of a limited company and receive dividends, you’ll be required to complete and submit a Self-Assessment Tax Return. The deadline for submitting these to HMRC is 31st January the following tax year.

- Tax Year: It is important not to get confused between the tax year and the calendar year. In the UK, the tax year runs from 6th April to 5th April. If you are submitting a tax return, HMRC will require information relating to this period.

The accounting period is usually the same as your business’s financial year. The financial year end is different for each company, and depends on when your business was incorporated. When your company is incorporated, the year end date is set as the last day of the month it was incorporated in. For example, if your company was incorporated on 11th May 2017, the year end will be set as 31st May 2018. From then on, your company’s accounting period/financial year end will be 31st May of each year. Learn more about accounting periods here.

Don’t forget – if your tax liability (the tax you pay on your annual profits) is over £1,000, then you’ll have to make two payments on account. The first payment on account is due 31st January, and the second must be paid by 31st July the same year.

2. Register for VAT

A question small businesses often have is “Should I register for VAT?”

You’ll need to register for VAT if any of the following apply to your business:

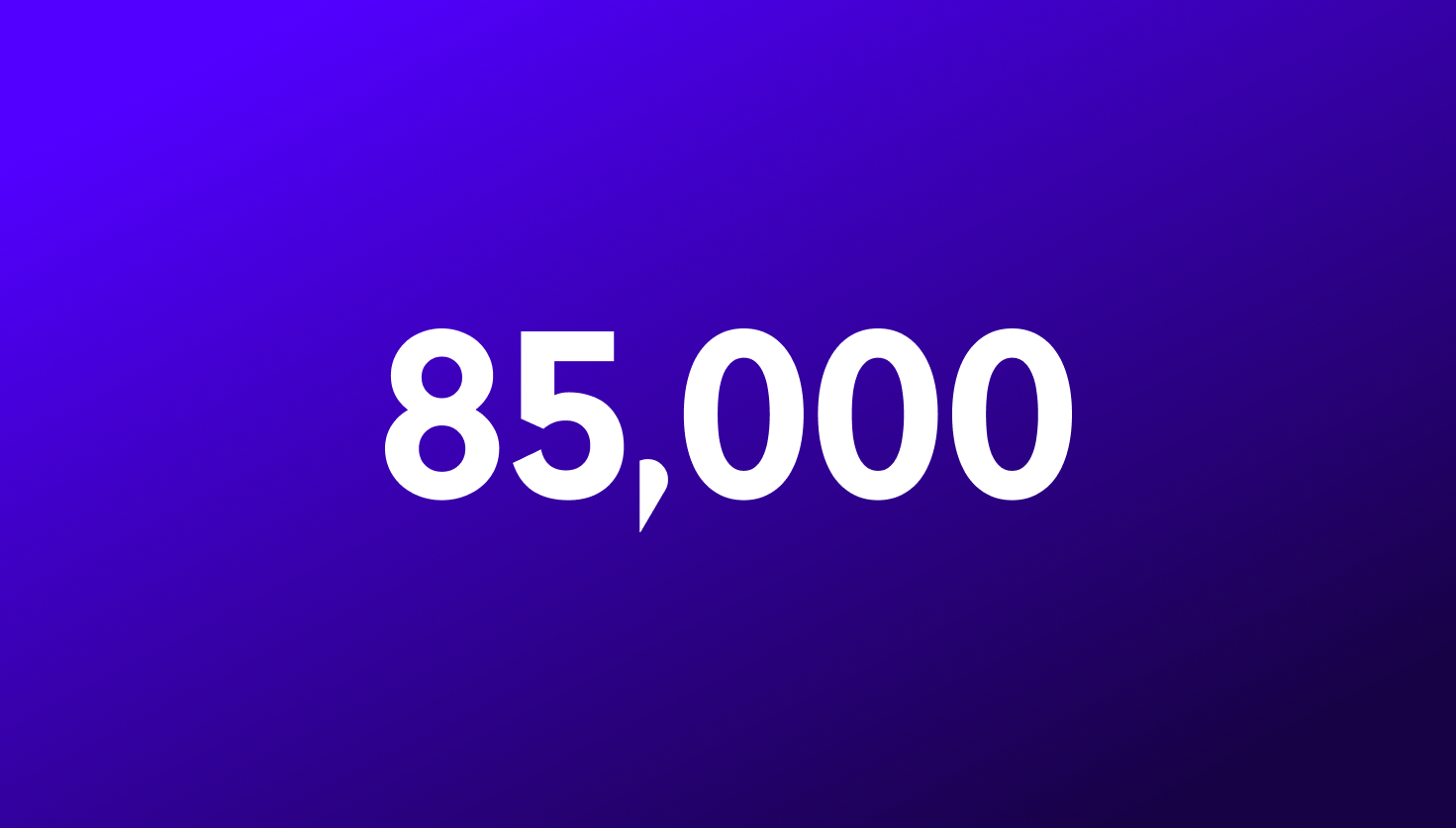

- Your VAT Taxable turnover is over the current threshold of £85,000. VAT taxable turnover is the total value of everything you sell that isn’t exempt from VAT.

- Your business only sells goods or services that are exempt from VAT

- Your business spends more than £85,000 on goods brought from EU VAT-registered suppliers

Even if the above statements don’t apply to you, you may choose to voluntarily register for VAT. It’ll come with some paperwork, and your goods or services will have VAT added on – but you’ll be able to reclaim the VAT charged to you by other businesses. Learn more about VAT registration here.

3. Track your business expenses

Be sure to record each and every one of your business expenses. Any expense that you incur that is exclusively for business purposes can be claimed. Some items are allowable for tax purposes, meaning you can deduct these costs from your revenues, and some are not.

Keeping track of your business expenses can be painful – but if you want to make it simple, you can add notes or photos of your receipt to transactions in your Tide app.

Whether you’re travelling by car, train, spaceship or unicorn for your business trip, you can claim money back. Currently, this is 45p per mile for the first 10,000 miles and 25p per mile after that.

And if you work from home, a proportion of your household bills – such as heating, lighting, telephone and rent or mortgage costs – can be claimed as an expense. Training, computer equipment, accountancy fees, stationery and professional memberships count as business expenses too. Check out the full list of expenses you can claim for here.

So get ready, get set, go claim!