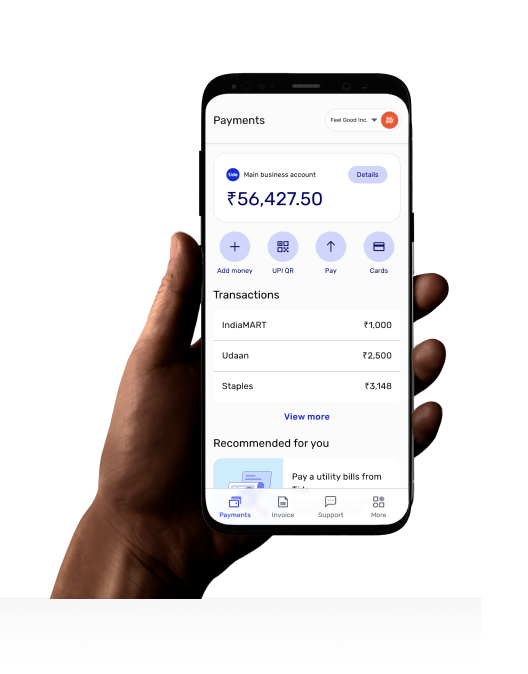

Everything you need to run your business

Sneak Peek: New Tools for Your Business Needs

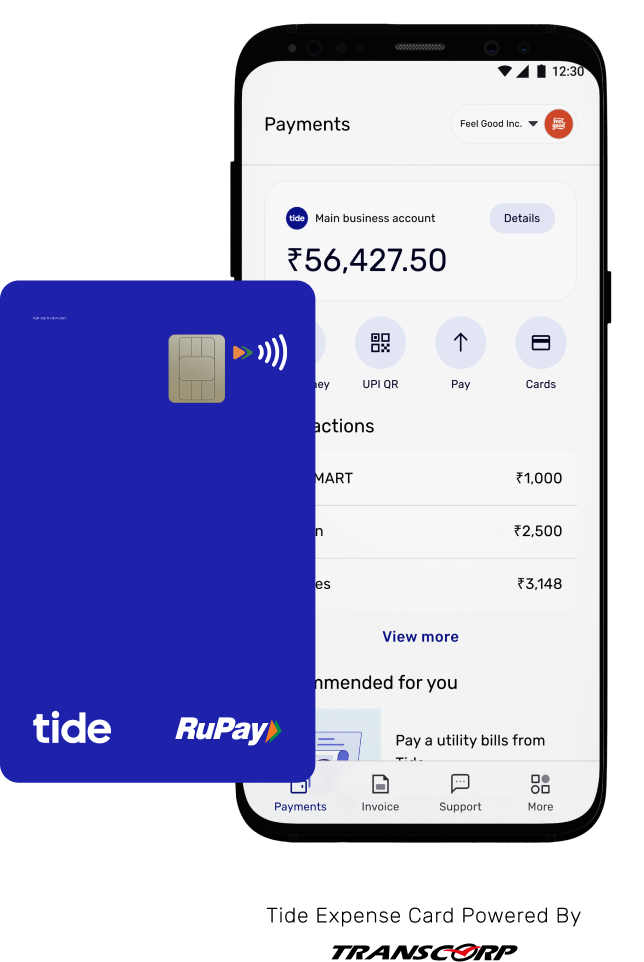

Introducing Tide Expense Card: The card that gives you back

Spend at all RuPay merchants without extra fees. Control your card from anywhere using the app. Accepted at all RuPay merchants.

Your Tide card is shipped, once you complete these steps

Download the app. Click on the link. Tell us about your business. Furnish your PAN card details. Provide your address. Furnish your address as per your Aadhar card. Appear for the video identity verification. Ensure that you have an ID proof with you. You are ready to go! You will get your expense card shortly.

Join over 4,50,000 business owners today

Chitranshu Bhatnagar

A few months back, I opened my Tide account without realizing I could become the proud owner of a brand-new iPhone- all thanks to Tide. I must mention how user-friendly and effective the Rupay card's tap feature is. Now, I rely solely on the Tide card for all my transactions.

We've Got Your Back: Ensuring Data Safety and Security

Frequently asked questions

Their age should be more than 18 years. Their Aadhaar should be linked to a mobile number. They must be an Indian citizen. They must have a valid PAN card. They must use an Android-based mobile phone.

Featured in

Get started with Tide

Fill out this form and we'll get back to you