Prime Minister’s Employment Generation Programme (PMEGP)

PMEGP will be a central sector scheme to be administered by The Mission Coordinator: Ministry of Ministry of Micro, Small and Medium Enterprises, Government of India. PMEGP will be a central sector scheme to be administered by the Ministry of Micro, Small and Medium Enterprises (MoMSME). The Scheme will be implemented by Khadi and Village Industries Commission (KVIC), a statutory organisation under the administrative control of the Ministry of MSME as the single nodal agency at the National level. At the State level, the Scheme will be implemented through State KVIC Directorates, State Khadi and Village Industries Boards (KVIBS) and District Industries Centres (DICs) and banks.

The Government subsidy under the Scheme will be routed by KVIC through the identified Banks for eventual distribution to the beneficiaries/ entrepreneurs in their Bank accounts. The Implementing Agencies, namely KVIC, KVIBs and DICS will associate reputed Non Government Organisation (NGOs)/reputed autonomous institutions/Self Help Groups (SHGs)/ National Small Industries Industries Corporation Corporation (NSIC) / Udyami Mitras empanelled empanelled under Rajiv Gandhi Udyami Mitra Yojana (RGUMY), Panchayati Raj institutions and other relevant bodies in the implementation of the Scheme, especially in the area of identification of beneficiaries, of area specific viable projects, and providing training in entrepreneurship development.

To generate employment opportunities in rural as well as urban areas of the country through setting up of new self employment ventures/projects/micro enterprises. To bring together widely dispersed traditional artisans/ rural and urban unemployed youth and give them self-employment opportunities to the extent possible, at their place. To provide continuous and sustainable employment to a large segment of traditional and prospective artisans and rural and urban unemployed youth in the country, so as to help arrest migration of rural youth to urban areas. To increase the wage earning capacity of artisans and contribute to increase in the growth rate of rural and urban employment.

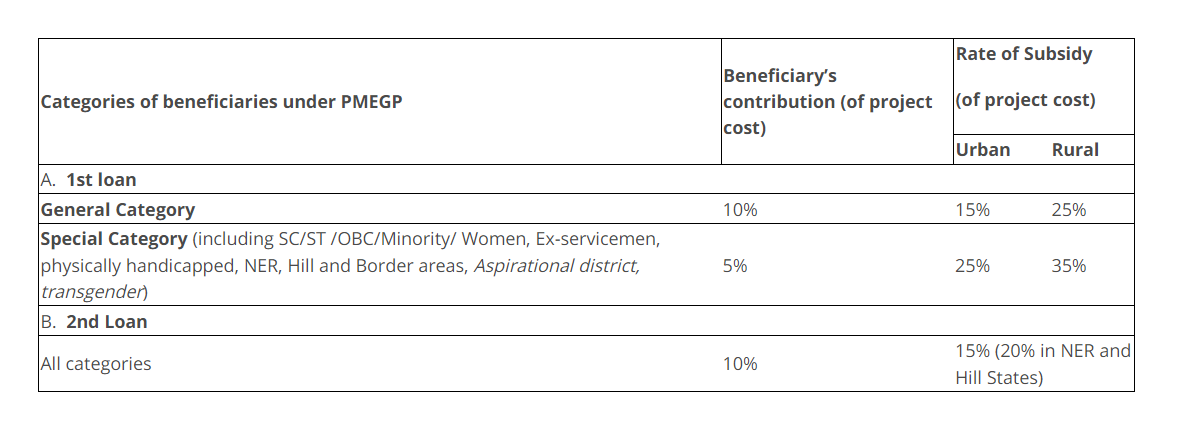

Quantum and Nature of Financial Assistance Levels of funding under PMEGP

The maximum cost of the project/unit admissible under manufacturing sector is Rs. 25 lakh. The maximum cost of the project/unit admissible under business/service sector is Rs. 10 lakh. The balance amount of the total project cost will be provided by Banks as term loan Eligibility Conditions of Beneficiaries. Any individual, above 18 years of age. There will be no income ceiling for assistance for setting up projects under PMEGP. For setting up of projects costing above Rs.10 lakh in the manufacturing sector and above Rs. 5 lakh in the business/service sector, the beneficiaries should possess at least VIII standard pass educational qualification. Assistance under the Scheme is available only for new projects sanctioned specifically under the PMEGP. Self Help Groups (including those belonging to BPL provided that they have not availed benefits under any other Scheme) are also eligible for assistance under PMEGP. Institutions registered under Societies Registration Act, 1860. Production Co-operative Societies, and Charitable Trusts. Existing Units (under PMRY, REGP or any other scheme of Government of India or State Government) and the units that have already availed Government Subsidy under any other scheme of Government of India or State Government are not eligible.

The Scheme will be implemented by Khadi and Village Industries Commission (KVIC), Mumbai, a statutory body created by the Khadi and Village Industries Commission Act, 1956, which will be the single nodal agency at the national level. At the State level, the scheme will be implemented through State Directorates of KVIC, State Khadi and Village Industries Boards (KVIBS) and District Industries Centres in rural areas. In urban areas, the Scheme will be implemented by the State District Industries Centres (DICs) only. KVIC will coordinate with State KVIBS/State DICS and monitor performance in rural and urban areas. KVIC and DICs will also involve NSIC, Udyami Mitras empanelled under Rajiv Gandhi Udyami Mitra Yojana (RGUMY), Panchayati Raj Institutions and other NGOs of repute in identification of beneficiaries under PMEGP.

Prime Minister’s Employment Generation Programme, PMEGP – https://msme.gov.in/1-prime-ministers-employment-generation-programme-pmegp PMEGP e-Portal – https://www.kviconline.gov.in/pmegpeportal/pmegphome/index.jsp