Benefits to Partnering with Tide

Join a market leader

Earn top commissions

Get tailored partner perks

Earn free transactions for your referrals

Receive help to grow

Who can partner with Tide?

Partnerships across a range of sectors

Accountants

Couriers or Logistics

Construction

E-commerce

Gig workers

How to partner with Tide

Tide makes our on-boarding process even better - a perfect partner that our clients love!

Chris MollanCLEVER ACCOUNTS

Our clients have easy banking - and we are adding more value - exactly what we were looking for.

Lorraine BettiIN.SYNC GROUP

Tide have been amazing... The ability to setup an account in less than 5 minutes is a game changer

Samuel ForrestIMS

Our clients love how fast and efficient opening a business current account with Tide is!

Wijay KanagasundaramWIS

With Tide, our time-poor clients open accounts in minutes!

Lauren HarveyFullStop.

Partner Programme FAQs

Tide is a proven customer acquisition and retention tool Opportunity to create bespoke customer lifecycle marketing strategy Partner with a market leader Competitive tailored incentives & commission structures 1 year of free UK bank transfers for each client that signs up using your referral code* Ongoing scaling support Member perks Dedicated application support from the onboarding support team

Trading of cryptocurrencies Trading of precious metals and stones Money services (such as foreign exchange, loan providers, money transfers) Casinos, prize draws and other betting or gambling activities Sale of unlicensed pharmaceuticals Sale or trade of cannabidiol (CBD) products Trading of weapons, explosives or armaments Unlicensed trading and processing of scrap metal Unlicensed waste management Sale, import and export of used vehicles or heavy machinery Escort services and other services in the adult industry Bidding fee auctions Unregistered charities and charities that aren’t incorporate

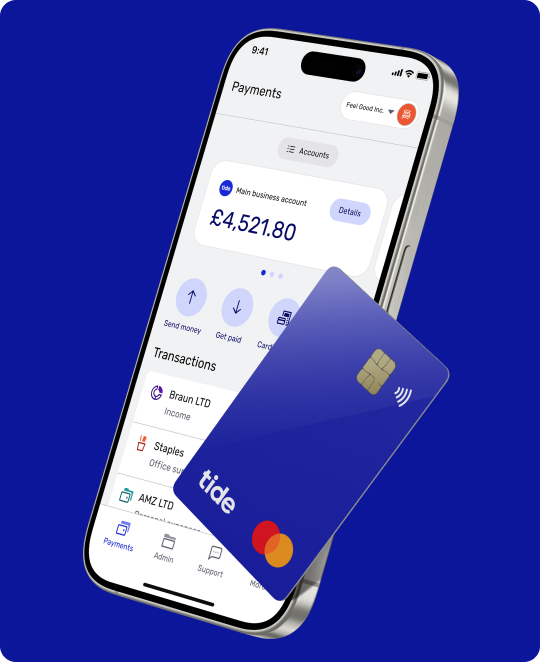

Bank transfers (in or out) - 20p Cash withdrawals in GBP - £1 Cash deposits (through the Post Office) - £2.50 for deposits up to £500, or 0.5% of the total deposit amount for deposits over £500 Cash deposits (through PayPoint) - 3% of the total deposit value Payments between Tide accounts - Free Card transactions in GBP (home and abroad) - Free