Everything you need from your business bank account

£0 /month

Personalised invoicing

Business savings

Simple accounting

Safe and secure

24/7 support

Open a free business bank account online in minutes

Download the app On Play Store or Apple Store Tell us about your company What’s your company name and industry? Upload your ID and take a selfie We’ll securely verify who you are Get your current account approved in minutes We may ask for additional information if required You’re all set! Your account is ready to go – we’ll send your card in a couple of days

Our business bank account is packed with features to save you time and money

Payment Links

Auto-categorisation

Direct Debit

Apple/Google Pay

International Payments

CSV exports and more

The all-in-one platform for managing your business seamlessly

Explore our additional tools designed to take your business to new heights.

Tide Accounting

Business Savings

Tide Card Reader

Business loans

Open a business bank account that fits just right

Free

£0.00+ VAT MONTHLY

- Your Tide business card Free

- Expense Cards for your team £5 / month

- Transfer in & out 20p per transfer

- ATM withdrawals £1

- 1.75% fee on foreign currency card transactions

Smart

£12.49+ VAT MONTHLY

- Your Tide business card Free

- Expense Cards for your team 1 free card included

- Transfer in & out 25/month free

- ATM withdrawals £1

- 0% fee on foreign currency card transactions

Pro

£18.99+ VAT MONTHLY

- Your Tide business card Free

- Expense Cards for your team 2 free expense cards included

- Transfers in & out Unlimited

- ATM withdrawals £1

- 0% on fee foreign currency card transactions

Cashback

£49.99 +VAT / month

- Your Tide business card Free

- Expense Cards for your team 3 free expense cards included

- Transfers in & out Unlimited

- ATM withdrawals £1

- 0% on fee foreign currency card transactions

Claire PedleyThe Poured Project

Once I’d filled in the application online, the account was active in about an hour. I can’t stress how easy Tide is to use.

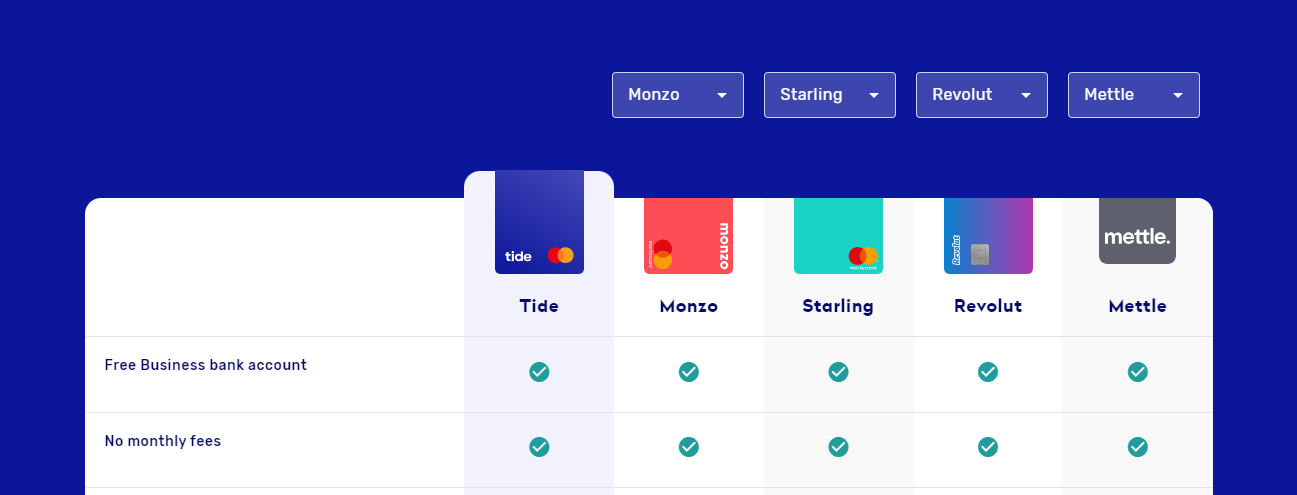

Compare our business bank account to other banks

Am I eligible for a Tide business bank account?

You must be over 18

Have a UK-based business

Show valid photo ID

Upload a selfie photo

Business bank account FAQs

The holding, managing an/or controlling of a third party’s (client’s/customer’s) funds in the Tide account. This includes using the funds on behalf of other individuals Insurance companies (incl. insurance brokers) Trading of crypto/virtual currencies Operating as a pawnbroker Extraction of precious metals and stones Investments (incl. real estate investments) Money services (such as foreign exchange, loan providers, money transfers) Banking services (incl. BCAs, loans, digital wallets, etc.) Casinos, prize draws and other betting or gambling activities Sale of unlicensed pharmaceuticals Sale or trade of cannabidiol (CBD) products Trading of weapons, explosives or armaments Unlicensed trading and processing of scrap metal Unlicensed waste management Unlicensed animal breeding Sale, import and export of used vehicles or heavy machinery Escort services and other services in the adult industry Bidding fee auctions Non-profit organizations, including charities Operating as, but not limited to, CICs and CIOs, PLC, LLP, Partnership, Trust.

Start your journey and open a business bank account today