Get paid on time

Automate tax and accounting

Control company spending

Forecast cash flow

Apply for business loans

Improve your credit score

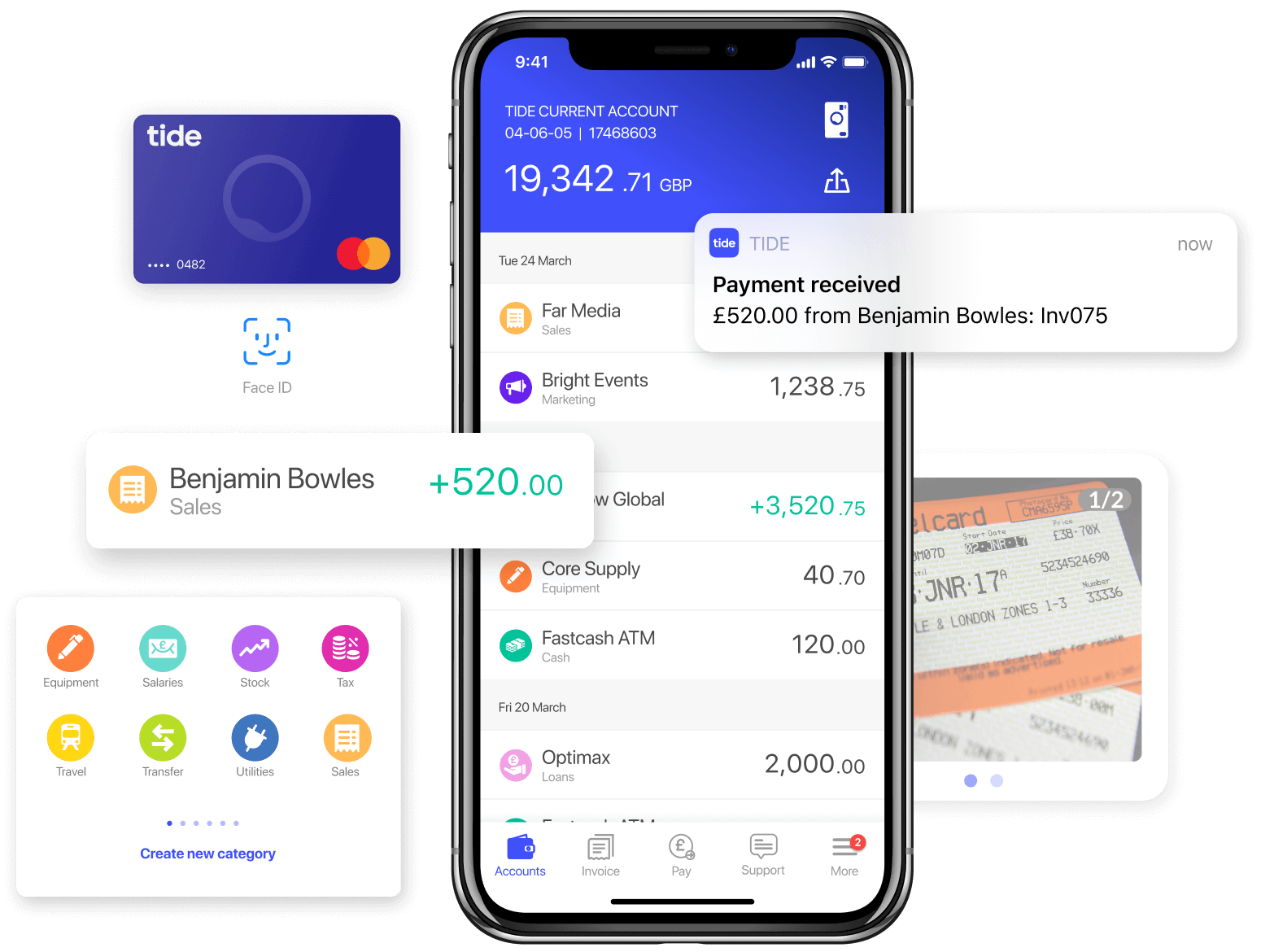

Smart features at your fingertips

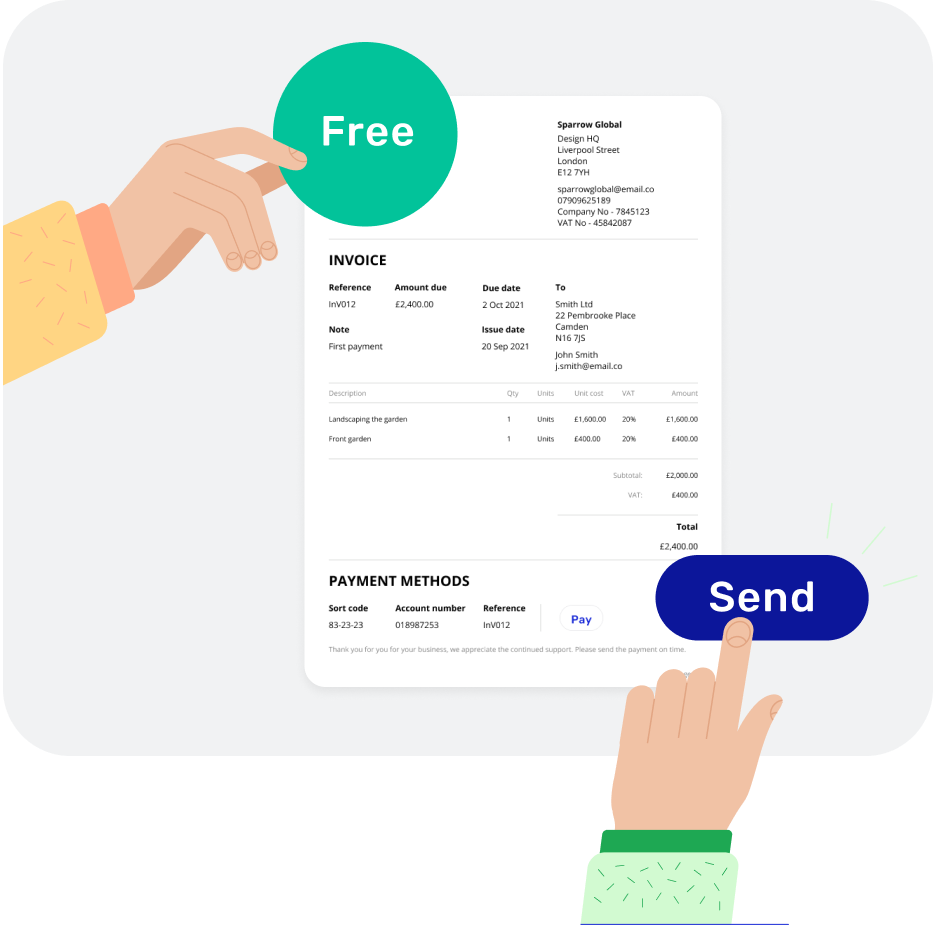

Get paid on time with in-app invoices

Generate and send professional invoices Match payments to invoices to see who’s paid Spend less time chasing late payments

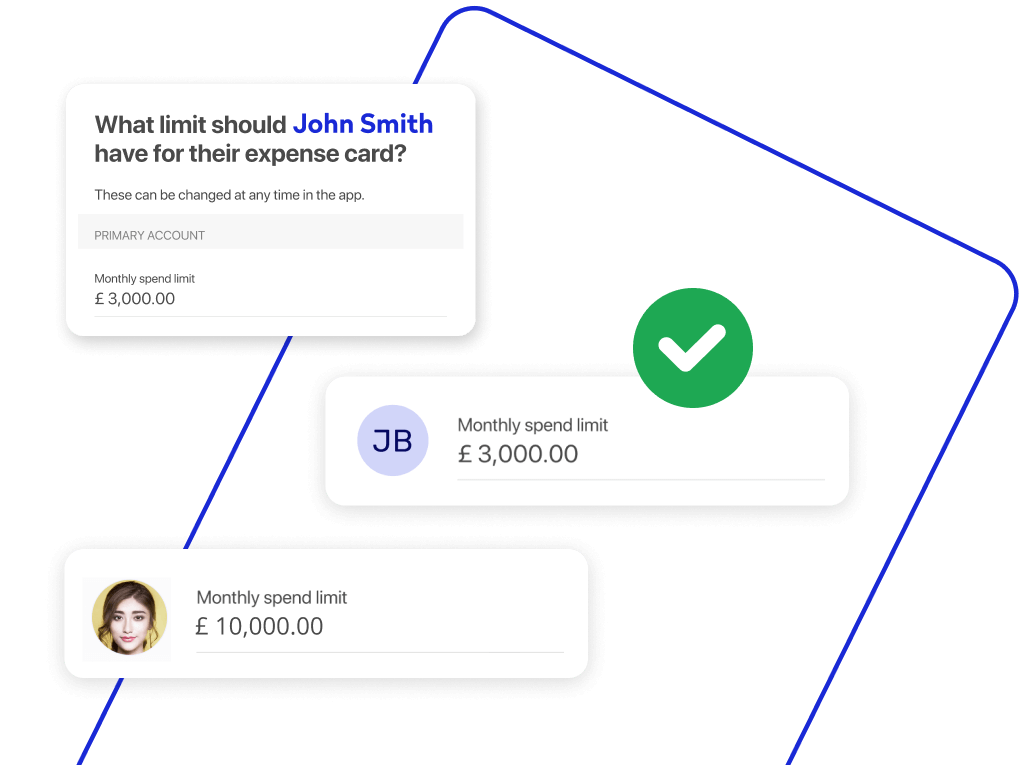

Control company spending with Expense Cards

Spending itemised by person and category Upload receipt pics and match to transactions Monitor spending and change limits instantly

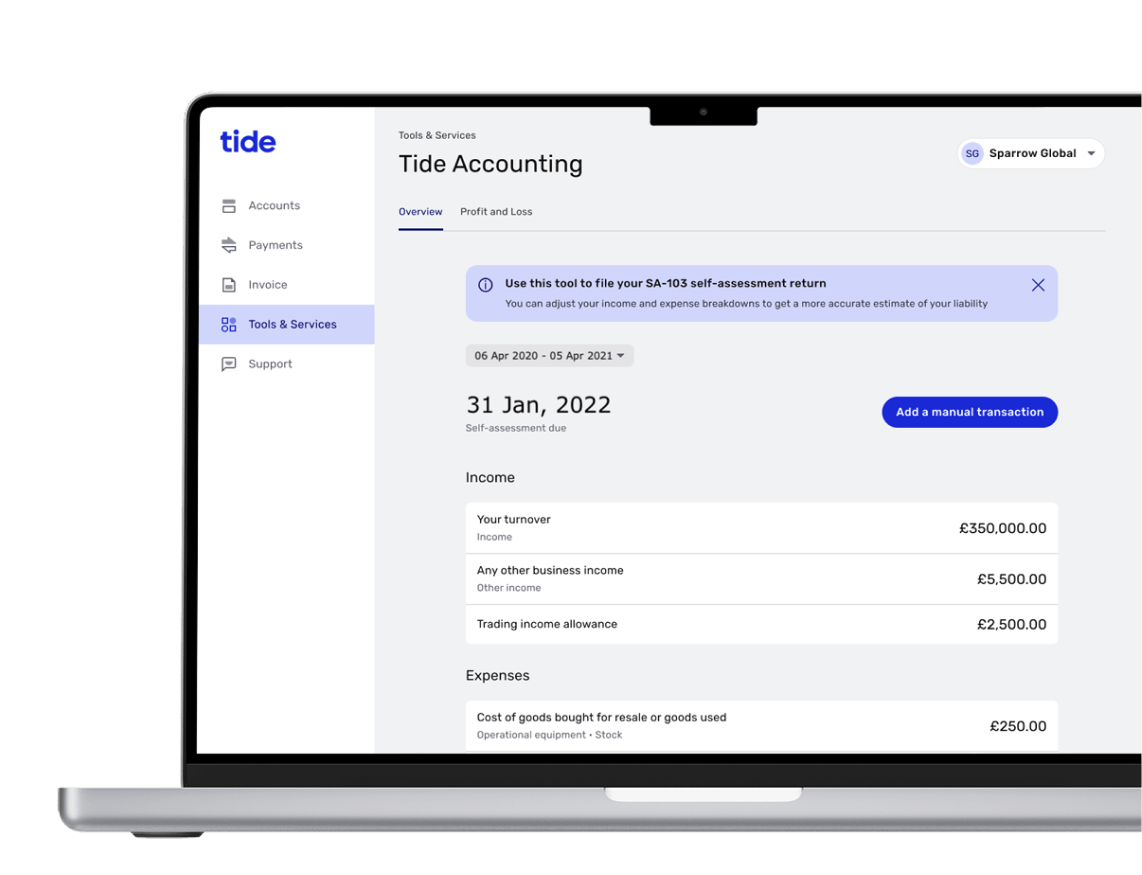

Simplify taxes with our built-in accounting software

Get paid faster with personalised invoices Manage your bills and boost cash flow Track performance with brilliant bookkeeping Get your taxes right first time, on time

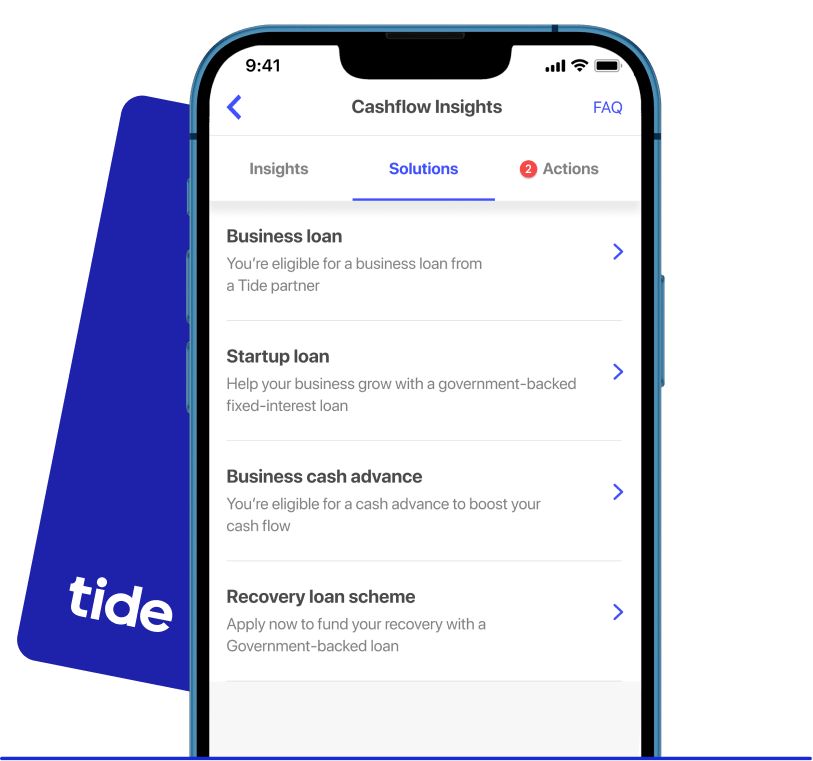

Start or grow your business with affordable borrowing

Pre-eligibility checks don’t affect your credit score Apply online within minutes for business loans Get quick decisions and receive funds within hours

Jenna HillDirector at Chill Gas Ltd | London, UK

Tide seemed (and is) the most modern option out there. We didn't want to have to run to the bank constantly or spend our days on the phone with the bank when we could be making money!

Account plans that scale with your business

Free

£0.00+ VAT MONTHLY

- Your Tide business card Free

- Expense Cards for your team £5 / month

- Transfer in & out 20p per transfer

- ATM withdrawals £1

- 1.75% fee on foreign currency card transactions

Smart

£12.49+ VAT MONTHLY

- Your Tide business card Free

- Expense Cards for your team 1 free card included

- Transfer in & out 25/month free

- ATM withdrawals £1

- 0% fee on foreign currency card transactions

Pro

£18.99+ VAT MONTHLY

- Your Tide business card Free

- Expense Cards for your team 2 free expense cards included

- Transfers in & out Unlimited

- ATM withdrawals £1

- 0% on fee foreign currency card transactions

Cashback

£49.99 +VAT / month

- Your Tide business card Free

- Expense Cards for your team 3 free expense cards included

- Transfers in & out Unlimited

- ATM withdrawals £1

- 0% on fee foreign currency card transactions

A business bank account that's free and easy to open