Small business tax: a simple guide

Small business owners and sole traders in the UK have a number of business taxes they must be aware of.

From Income tax to VAT to PAYE, you might feel uncertain of which apply to you. The requirements also vary depending on the business type and performance, so it’s important to understand what pertains to your specific circumstance.

In this quick guide, we’ve compiled a comprehensive list of the different types of tax, which ones apply to your business, how to pay them and when they’re due.

Table of contents

- What are the different types of tax?

- Which tax type applies to my company?

- When to register for VAT?

- Wrapping up

What are the different types of tax?

Tax requirements vary based on how your business is structured. They also differ by business income, profits, whether you sell products or services, and many other distinct conditions.

Figuring out which category applies to your business, as well as the deadlines for each, can be complicated.

To start, we’ll outline the types of tax your business may need to pay. Then, we’ll take a deep dive into which types may apply to your business, the thresholds required for each and any reliefs you may be eligible to claim.

Here is a brief overview of the tax types. Below, we provide instructions on how and when to pay them and where to find additional help.

- Corporation tax: A tax on profits paid by corporations

- VAT (Value-added tax): A tax on products or services that exceed a turnover of £85,000 a year paid by any applicable business

- Business rates: A tax on “non-domestic properties” used to run your business paid by any applicable business

- PAYE (Pay as you earn):A tax on income that is deducted from salaries paid by any business with employees

- Income tax:A tax on income paid by any applicable business

- National insurance:Contributions paid to qualify for a state pension, as well as various government benefits

Corporation tax

Corporation tax is a direct tax that must be paid by any legal entity that fits the following criteria:

- Limited companies

- Foreign companies registered within the UK

- Clubs, co-operatives and other associations

Limited companies pay corporation tax on their profits. Currently, the rate is 19% for all companies, with the exception of Ring fence companies (or companies that make profits from oil extraction or oil rights in the UK).

Unlike other taxes, you won’t get a bill for this. It’s up to you to make sure you calculate how much you owe (or enlist the help of an accountant).

To pay, head over to GOV.UK’s page “Pay your Corporation Tax bill” and follow the process. You’ll also find additional guidance there on how much you owe based on your business income.*

Note: *You must always file a company tax return, even if you make a loss or don’t owe any corporation tax. However, if you’re self-employed as a sole trader or in a partnership, you must send a self assessment tax return (which we will discuss later).

There are two separate deadlines related to corporation tax:

- The filing deadline: Which is 12 months after the end of your accounting period.

- The payment deadline: This is due nine months and one day after the end of your accounting period. For example, if your company’s year-end is March 31st, this will be due on January 1st.*

Note: *Companies with profits of more than £1.5 million pounds are eligible to pay corporation tax in installments.

Top Tip: As a small business, you may run into a situation where you need to defer your tax payments. And, as a result of COVID-19, the UK government has been offering relief to eligible businesses and individuals in the form of delayed tax payments. To find out more about why you may wish to defer your tax, how to go about it and the potential consequences, check out our article on how to defer your tax payment 💥

If you are a limited company in your first year of business, you may have to file two tax returns. This is because you become incorporated on the day your company is set up, but your accounting reference date begins on the last day of the setup month.

If your company was set up on August 5th, for example, your accounting reference date would not apply until August 31st. Because annual accounts cannot cover a period over 12 months, two separate returns are necessary to account for the 3 extra weeks in this scenario. In the following years, this is no longer an issue.

The accounting period for your business is usually the same as your financial year. The financial year starts on April 6 and ends on April 5 of the following calendar year. The accounting period starts when a business begins their formal accounting period. The financial and accounting periods vary if you are in your first year of business and if you began publicly trading on a different day than your business was set up.

Companies can also choose their fiscal year start date based on specific business needs. For example, if a company has one quarter that’s stronger than another, they can choose that quarter as their end date and end on a positive note. Alternatively, companies that have heavier trading periods than others may want to avoid filing taxes when incredibly busy.

Companies interested in this route need to file a Change of Accounting Reference Dates form and send it to the Companies House for approval.

You can also find additional information on corporation tax at the GOV.UK website.

Top Tip: When in doubt, ask an accountant for help. Managing taxes yourself is doable, but can be overwhelming – especially when running a busy business. Accountants can help you effectively manage your finances, ensure you stay compliant and never miss deadlines. Get started with our guide to choosing an accountant for your small business 💬

VAT

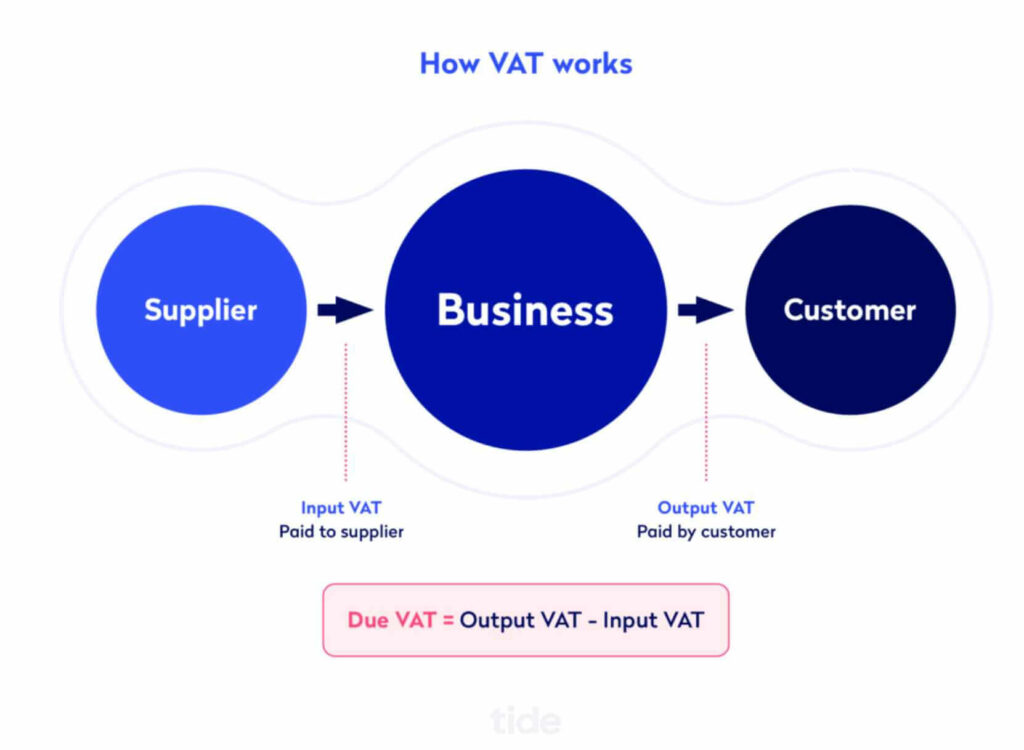

VAT (short for value-added tax) is applicable to any business, regardless of business type, selling products or services that exceed a turnover of £85,000 a year. It’s essentially a tax levied on the value added to a product when it moves from a supplier to a buyer to a customer.

VAT is paid every time an item is sold. When the buyer makes a purchase from the supplier, this is called input VAT, and when a customer makes a purchase from the buyer, it’s called output VAT.

VAT registered businesses must pay VAT throughout the course of doing business, and must file a VAT tax return to declare how much VAT they’ve charged or paid. If you’ve paid more VAT than you’ve charged, you can reclaim the difference from HMRC. Conversely, if you’ve paid less than you’ve charged, you’ll need to pay HMRC what you owe.

The standard VAT rate is 20%, but some products or services are sometimes subject to lower rates (or are exempt entirely). Examples of zero-rated goods are water, sewage services, certain food and beverage items and donated goods sold by charity shops.

It’s possible to register your business for VAT at any time, but best-practice is to register right away. If your turnover is approaching £85,000, make registering an urgent priority.

You can also find the date you must pay VAT using GOV.UK’s VAT payment deadline calculator:

Top tip: According to Quickbooks, only 27% of small business owners are confident in the accuracy of their VAT returns. Assessing your VAT liability can be a complex process, so make sure to refer to our guide and learn how to avoid and rectify common VAT mistakes 🚀

VAT is usually due one calendar month and seven days after your accounting period. The exact date will be provided on your VAT return or on your VAT online account.

The amount owed may vary depending on whether you use the Annual Account Scheme or payments on account.

With the Annual Account Scheme, you make advanced VAT payments four times a year. At the end of the year, you pay the amount remaining or get reimbursed if you have overpaid. This is the most common VAT payment choice.

If you choose the payments on account option you will pay VAT twice a year. While this gives you more breathing room between payments, the bill will subsequently be larger, meaning you’ll need to plan ahead to save enough to cover the fees.

For additional information, check out GOV.UK’s VAT index. Alternatively, head to their general enquiries page to seek guidance.

Top Tip: In 2020, VAT payments were shifted to an electronic MTD (making tax digital) system. MTD aims to combat millions of pounds worth of paper tax calculation errors. All businesses that are not eligible for exemption must make the switch to digital. You can sign up for MTD at GOV.UK. Want to know more? Check out our guide to making tax digital and what it means for small businesses 💣

Business rates

You’ll need to pay business rates if you use any “non-domestic properties” to run your business. These include shops, warehouses and offices. It also incorporates any part of a domestic property that is used for non-domestic purposes (e.g. a home office).

However, if you run a business from home you may be exempt from business rates. Here are the circumstances in which you do have to pay:

- You employ staff that work from your home

- You have renovated your home to run a business out of it (e.g. a hair salon)

- You sell goods or products to people that visit your home to buy them

- You run a business on one floor and live on another, classifying the property as part business, part domestic

Different rates will apply if you’re based in Scotland or Northern Ireland. To calculate how much your business rate is, check out the table on the GOV.UK website.

The deadline for your business rates depend on your local council. The bill showing the due date often arrives in February or March of each year.

PAYE

If you have employees, you are responsible for PAYE tax (which stands for “pay as you earn”). This is an income tax that is deducted from salaries. These salaries include your employees’, your own, and any other appointed directors.

You’ll need to be aware of the following taxes regarding PAYE:

- Class 1, 1A and 1B National Insurance

- Income tax deductions for employees

If applicable, your PAYE bill may also include student loan repayments, Apprenticeship Levy payments and Construction Industry Scheme deductions.

Here are the Income Tax rates and bands for PAYE:

| Band | Taxable income | Tax rate |

| Personal Allowance | Up to £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £150,000 | 40% |

| Additional rate | over £150,000 | 45% |

To settle up PAYE, head over to the GOV.UK website to get started. There are two deadlines based on your payment schedule choice:

- If you choose to pay monthly, you must pay by the 22nd of the following tax month.

- If you choose to pay quarterly, the bill is due by 22nd after the end of the next quarter. For example, if you are paying for the August – September quarter, you’ll need to pay by September 22nd.

Top Tip: As an employer, it is your responsibility to implement PAYE (pay as you earn) as part of your payroll. This enables you to deduct national insurance and income tax from employee wages and pay HMRC. To learn about more about how to calculate PAYE and manage your employees’ wages, read our complete PAYE guide for business owners 🔎

Income tax

Put simply, this is a tax on income. You are obliged to pay tax on any income that you as a sole trader, director or partner earn.

This isn’t just your own PAYE contributions as a director, you’ll also need to be on top of:

- Employment earnings

- Self-employed profits

- State benefits

- Pensions

- Rental income above the Rent-a-Room scheme allowance

- Job benefits

- Trust income

- Interest on savings income, if it exceeds your savings allowance

There are a few circumstances in which you are not required to pay income tax. Additionally, there are several income tax reliefs in place.

You don’t pay income tax on the following:

- The first £1,000 you earn as a sole trader, otherwise known as a ‘trading allowance’

- The first £1,000 you earn from a rental income property, unless operating under the Rent-a-Room scheme in which you can rent up to £7,500 per year tax-free

- Income from tax-exempt accounts, such as Individual Savings Accounts

- Dividends from company shares below your dividends allowance

You’ll need to pay your income tax with a self-assessment, which must be completed by January 31st (for online tax returns) or October 31st (for paper tax returns). Head over to GOV.UK’s Income Tax page for more guidance.

Top Tip: If you’re self-employed (or have additional revenue sources), you are required by law to report all income to HMRC. While it is a straightforward process, it is important to correctly disclose your income so that HMRC can assess your tax liability. To learn more, check out our guide to self assessment tax returns 🎩

National insurance

Finally, you’ll need to pay National Insurance contributions (NICs) to qualify for a state pension, as well as various government benefits.

Anybody over the age of 16 must pay NICs if they are self-employed and making a profit of £6,515 or more a year or an employee earning a weekly wage of £184 or more.

National Insurance classes range from 1-4. The type of class you pay varies by employment status, income, and whether or not you employ people.

| Employed | 2021 – 22 National Insurance |

| How much you earn | Class 1 rate |

| Less than £9,568 | 0% |

| £9,568 – £50,270 | 12% |

| More than £50,270 | 2% |

| Self-employed | |

| How much you earn | Class 2 and 4 rates |

| Less than £6,515 | 0% |

| £6,515 – £9,569 | £3.05 per week |

| £9,569 – £50,270 | 9% + £3.05 per week |

| More than £50,270 | 2% + £3.05 per week |

If you are self-employed, there are different classes you may fall under:

- Self-employed: Sole traders must pay Class 2 and Class 4 NICs

- Self-employed and employed: Limited company directors who are their own employees must pay Class 1 NICs

As a director, you pay NICs through your own PAYE payroll, and sole traders must include their contribution in their annual self-assessment. Head over to GOV.UK’s National Insurance page for more help on this.

Top Tip: Processing payroll is a complicated process that requires superhuman attention to detail. To learn more about the three stages of payroll processing and how to ensure you pay your employees correctly, on time, every time, read our guide on how to process payroll and pay employees on time 💶

Which tax type applies to my company?

Now that we’ve reviewed the tax types, let’s run through which categories apply to your business based on the legal structure you’ve chosen.

1. Sole traders

Sole traders must pay Income Tax on any taxable profits from their business. This is done on an annual basis as part of your self-assessment.

For 2021/2022, the tax-free Personal Allowance is £12,570. You won’t need to pay income tax until you earn anything beyond that threshold.

Your tax rate also depends on your total annual profit and is distributed as follows:

- Basic rate: 20% on annual net profit between £12,571 and £50,270

- Higher rate: 40% between £50,271 and £150,000

- Additional rate: additional 45% on profit above £150,000

You must also pay NICs, which is a Class 2 flat rate for anything you make over £6,475 a year. Additionally, you’ll need to pay a 9% Class 4 rate if you earn between £9,501-£50,270 profit.

2. Private Limited Company

All Limited Companies must pay 19% on their profits in corporation tax. As mentioned above, this will be reduced to 17% in 2020.

There are certain reliefs you can claim on corporation tax rates. Some examples of such allowances are:

- Claiming Research and Development (R&D) relief if you are working on an innovative project to develop or advance your field, most often in science or technology

- Reliefs for creative industries that pass the cultural test to qualify. Examples of industries that fall under the creative category are video game productions, film production companies, museums and qualified galleries, and more.

- Terminal, capital and property income losses wherein you need relief due to taking a loss on property income or the sale or disposal of a capital asset. If you are publicly traded, this also applies to a loss from trading.

To see the full list of reliefs that you can make a claim for, visit the GOV.UK website.

You’ll also need to pay NICs as an employee, with rates varying by NIC category if you earn over £184 per week.

Directors who pay themselves a dividend will not need to pay anything on the first £2,000. Basic-rate taxpayers pay 7.5% on dividends, higher-rate taxpayers pay 32.5% on dividends and additional-rate taxpayers pay 38.1% on dividends.

There are different rates for residents of Scotland.

Top Tip: Cash flow is crucial to growing and improving your small business. However, nearly one billion pounds in expenses are left unclaimed from HMRC every year. To make sure you’re claiming all of your expenses correctly, read our guide to the allowable expenses limited companies can claim 🎯

3. Partnerships

Partnership directors are usually self-employed, which means you must pay income tax on their share of profits (after personal allowances and other taxable income is taken into consideration).

Like sole traders, the tax-free personal amount is £12,570 for 2021/2022. Partners will also need to pay Class 2 NICs (when earning profits of £6,475 a year) and Class 4 NICs (when earning profits of £9,500-£50,270 a year).

Limited liability partnership (LLP) members are also taxed in this way. This includes income tax and Class 2 and Class 4 NICs.

4. Business rates

You’ll need to pay business rates if you pay for commercial spaces, such as offices, warehouses, factories, shops, etc.

If you run your business from your home or a small office, these won’t apply. As mentioned above, you will need to pay rates on any personal property if you make any alterations for commercial reasons or sell products or services to people who visit your personal property.

Top Tip: Evidently, there are a lot of expenses and taxes you are liable to pay as a business owner or sole trader. While these are non-negotiable, there are ways to free up cash by applying for tax breaks. Read our blog to learn what a tax break is as well as 8 tax breaks small businesses can take 🌎

When to register for VAT

When your business reaches a turnover of £85,000 or higher, you’ll need to register with HMRC for VAT. Once registered, you’ll be sent a VAT certificate, which includes:

- Your VAT number

- Effective date of registration (the date you passed the threshold)

- The date you must submit first VAT return and first VAT payment

Remember, the VAT rate is 20%, and must be held aside and paid after VAT returns are made. Thanks to Making Tax Digital, this is now easier than ever and can be done directly from your accounting software.

Top Tip: VAT differs from sales tax in that it is paid both by consumers and businesses and it is collected throughout an item’s production stage (as opposed to the final point of purchase, like sales tax). To learn more about how VAT affects small business taxes, how to register for VAT and how to calculate it, read our guide to everything you need to know about VAT 📌

Wrapping up

The world of tax is complicated, which is why we’ve created this guide to simplify things. Use it as a roadmap to determine what type of UK tax you need to pay, how much you owe, and when it’s due.

When in doubt, check out the GOV.UK website for more information.

Photo by Austin Distel