Everything you need to know about VAT

If you’re running a business and selling goods or services, you’re required to charge a tax on most items if your business surpasses a minimum threshold in turnover.

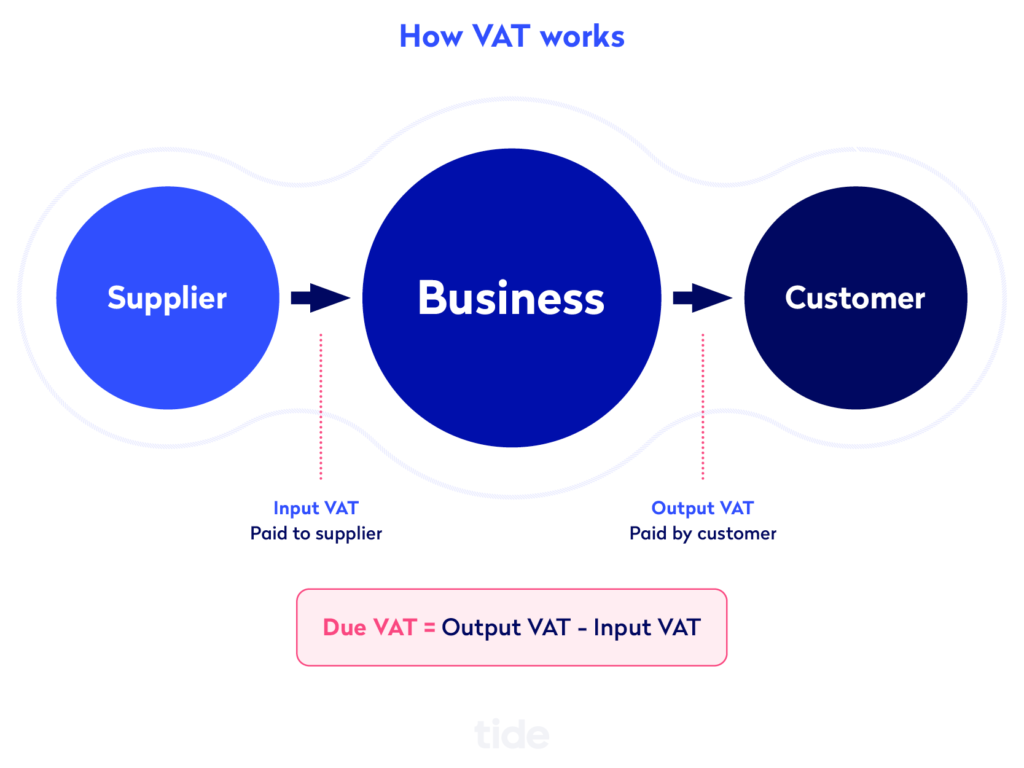

In the UK, Value-Added Tax, or VAT is collected by businesses and then remitted to the government. It is applied to taxable items based on their value, which changes throughout an item’s production stages.

This differs from sales tax in that VAT is collected throughout assembly and paid by both businesses and consumers, whereas sales tax is collected at the final point of purchase and paid solely by consumers. The sales tax and VAT are wrapped into one line item on the end user’s receipt and labelled as ‘VAT’. The business collects this amount, paid by the customer, and then passes it on to the government.

It’s important to understand how VAT works and how to calculate the correct amount that applies to your business.

This article will explain the current VAT rates, how to register for VAT, and how to charge VAT correctly.

Additionally, we’ll introduce you to some alternative VAT schemes designed to make the entire process easier for small businesses.

Table of contents

- What is VAT?

- How much is VAT?

- How to charge VAT

- Alternative VAT schemes for small businesses

- Wrapping up

What is VAT?

Value Added Tax, or VAT, is a form of tax that’s levied on the purchase of certain taxable goods and services.

Both businesses and consumers are subjected to pay VAT; whether it’s a manufacturer purchasing raw material or a customer making a direct purchase from a company.

Think of VAT as a type of sales tax that represents the ‘value added’ to a product between a supplier and the buyer.

As mentioned above, the difference between VAT and sales tax is that the latter is paid once—when the item is sold.

VAT, on the other hand, has to be paid every time the item is sold—from manufacturer to wholesaler to retailer to customer.

VAT is usually forwarded on to the customer. This is so companies can simply reclaim the VAT they pay to the government in the course of doing business.

| Circumstance | Threshold |

| VAT registration | More than £85,000 |

| Registration for distance selling into the UK | More than £70,000 |

| Registration for bringing goods into the UK from the EU | More than £85,000 |

| Deregistration threshold | Less than £83,000 |

| Completing simplified EC Sales List | £106,500 or less and supplies to EU countries of £11,000 or less |

If your business is making sales in excess of the VAT registration limit annually, you have to register your company for VAT, regardless of your business type.

The current VAT registration limit is £85,000. If your business does not reach this limit on a 12-month rolling basis, you are not required to register.

If you do surpass the limit, you must register for VAT within 30 days of the end of the month in which you exceed the threshold. Further, if you predict that your sales will exceed the minimum threshold within a 12 month period, you need to notify HMRC. Once registered, you will then be required to officially charge VAT, and the start date is known as your Effective Date of Registration (EDR).

For example, if you exceed the registration threshold on 22 June, you will become liable to be registered on 30 June. You must notify HMRC by 29 July, which is within 30 days of the end of the month in which you exceeded the threshold. Your EDR, or official date of registration, will then be 1 August . This is known as the backward look.

If you predict that you will exceed the threshold but have yet to surpass it, then you become liable from the day that you first formed that prediction. If that day is 20 March, then you must notify HMRC within 30 days of 20 March, or by 19 April. Your EDR will then be the day in which you formed the prediction, or 20 March. This is known as the forward look.

If you do not register on time, you are still required to pay VAT from the moment you are eligible. HMRC may charge a penalty depending on how much you owe and how late you are in registering, but this is on a case by case basis.

Voluntary VAT registration

At any time, you can choose to voluntarily register for VAT even if you know you won’t exceed the threshold. The process to register voluntarily is the same as for businesses that are required to register.

Once registered, you are eligible to reclaim the VAT that you’ve been charged by other businesses. Taking this step has several benefits and drawbacks.

It’s a huge advantage for businesses who have yet to hit the threshold but want to reap the financial benefits of reclaiming the VAT they’re being charged by other businesses.

Note: You can only reclaim VAT throughout the year if you are enrolled in the standard rate scheme. HMRC has several alternative VAT schemes that you can apply for as well. We will discuss all of the possible VAT payment schemes in detail below.

For example, the fictional bracelet business ‘LocalLink’ is on track to turnover £55,000 in their first year. Because they’re beneath the VAT threshold, they are not required to register for VAT. However, their suppliers are registered for VAT and therefore charge them a VAT fee every time they buy a new batch of materials.

The team at LocalLink decides they want to reclaim the VAT they’re being charged, so they take the step to voluntarily register for VAT. Now, LocalLink needs to start charging their own customers VAT. As long as the amount they are paying to suppliers is more than the amount they are charging their customers at the end of a sale, they can reclaim the difference in their VAT return.

Another benefit of voluntarily registering for VAT is that it makes your business look more established. If you are not required to register, the world will know that your turnover is less than £85,000. Once registered, your customers and suppliers will assume your turnover is over the minimum threshold, thus boosting your credibility and impressions.

Yet, while the benefits are strong, there are several key drawbacks. Registering for VAT means more paperwork and deadlines to keep track of. This adds an extra step to your accounting process and reporting procedures. If this will create a time-suck you can’t afford, it may not be worth the potential benefits.

Also, if you are selling supplies to businesses that are not VAT registered, your invoices may suddenly increase by 20%. The exact percentage that you must charge depends on your industry, and we will discuss that in detail below. If your clients cannot reclaim the VAT fee, they may choose to find a cheaper supplier or one who is not VAT registered to reduce their costs.

The VAT will also be passed onto your customers, meaning the cost of your goods or services will increase. It’s up to you to decide if you want to pass the full amount onto your customers or lower your prices to make up the difference.

Finally, if for whatever reason you are being charged more VAT than you can pass onto your customers, you may end up needing to pay more to HMRC to make up the difference yourself.

Carefully assess how voluntarily registering for VAT will affect your business before making a decision.

VAT responsibilities

Once registered, you must start filing your VAT in tax returns. This applies to both the VAT that you charge customers and the VAT that you pay to other businesses for goods and services.

The amount that you charge suppliers, customers or clients is called output tax. Another way to think of this is that you are sending out an invoice to a customer.

Conversely, the amount that you owe to other businesses when purchasing goods, services or materials is called input tax. Think of it as the invoices that are coming in that you must then pay.

On your VAT tax return, you must account for VAT on the full value of what you sell or purchase. This, therefore, includes both your output and your input taxes.

As previously touched on, VAT registered businesses have two main responsibilities:

- Charging VAT on your goods or services. If you’ve charged more VAT than you’ve paid, you must pay the difference to HMRC.

- Voluntarily reclaiming VAT you’ve paid on goods or services. In the case that you’ve paid more VAT than you’ve charged, you can reclaim the difference from HMRC.

When do you have to submit your returns?

In the standard VAT accounting scheme, VAT is paid quarterly once registration has been completed. But, you can also ask HMRC to allow you to submit your returns on a monthly basis.

Under the standard VAT accounting scheme, you pay VAT on items purchased and sold as they occur. This is similar to the accrual accounting method, in which you report financial activities as they occur.

Therefore, you must pay or receive VAT the moment that an invoice is issued or received. The VAT payments apply to the invoices in the quarter in which they were received or issued and not the quarter in which they are actually paid.

HMRC even allows you to choose the starting quarter in which you want to submit your returns. This could be done to match payments with your company’s financial year-end.

The returns must be submitted to HMRC and paid online within 37 days after the end of the quarter.

Once registered, you have to submit a VAT return even if you don’t have any VAT to pay or reclaim.

Making tax digital

The UK government is trying to digitalise tax filing for VAT and Income Tax.

With the recent introduction of the Making Tax Digital (MTD) program, they are aiming to make submitting tax returns easier by helping companies automate payments and returns.

This program will simplify tax filing, put an end to tax-evading activities, and decrease the costs incurred by HMRC.

Companies with a turnover of more than £85,000 are required to digitally store their records, and use software to submit their VAT returns for VAT periods that started on or after 1 April 2019.

A fully digitalised system will be up and running by April 2020.

GOV.UK has a step-by-step guide to help small businesses follow the rules for Making Tax Digital for VAT.

Quick Tip: The Making Tax Digital program aims to make tax administration more effective for your business. To learn more about how it will affect your financial operations and reporting, check out our short guide on what Making Tax Digital means for your small business.

What are the VAT charges and exemptions?

There are some items that are subject to VAT and some items on which businesses can’t charge VAT.

Below are some items on which VAT is charged. These are also called ‘taxable supplies’.

- Sales of goods or services

- Acquiring goods for business use

- Loaning goods to someone

- Sale of assets

- Commissions

- Items consumed to staff (sold to staff like meals in a cafe)

- Goods and services consumed for personal reasons

Additionally, the following are exempt or ‘out of scope’ items that are not subject to VAT.

- Insurance

- Postage stamps or services

- Health services provided by doctors

- Goods and services bought for use outside EU

- Sales made as part of a hobby, like coin collection and sales

- Donations made to a charity if nothing is received in return

- Statutory fee, like the London congestion charge

How much is VAT?

For any business operating in the UK, there are three different VAT rates. Here are the VAT rates for 2019/20

| Rate | % of VAT | What the rate applies to |

| Standard | 20% | Most goods and services |

| Reduced rate | 5% | Some goods and services, e.g. children’s car seats and home energy |

| Zero rate | 0% | Zero-rated goods and services, e.g. most food and children’s clothes |

Standard rate

The standard rate applies to most goods and services, and is set at 20%.

This includes any items sold under the distance selling threshold supplied to non-VAT registered EU customers.

In case you exceed the set threshold, you’ll have to register for VAT in that country.

The standard VAT rate is also applied to services provided by a business to a non-business EU customer.

Note: You should charge the standard rate unless the goods or services are classified as reduced or zero-rated.

Reduced rate

The reduced rate is set at 5% and applies to some goods and services, like children’s car seats, health, energy, heating, mobility aids, and protective products and services.

This rate depends on the type of item being sold, as well as the circumstances of the sale.

Zero rate

As the name suggests, ‘zero rate’ items have a 0% rate applied to them.

It’s important to note that zero rate items aren’t the same as exempt items. On zero rate items, you do not pay VAT on a purchase from another business, but you can reclaim credit on the input tax for that zero rate purchase. Therefore, zero rate counts as a taxable supply, but you do not add any VAT to your selling price.

If a good or business is exempt, on the other hand, there is no VAT owed on purchases or sales, and there is no possibility to claim any credits on the expenses.

Zero rate items include health, building, publishing, books, newspapers, motorcycle helmets, most goods you export to non-EU countries, and children’s clothes and shoes.

Even though there’s no VAT applied on zero rate goods, it’s still a rate of tax. Therefore, it must be recorded in VAT accounts and reported in VAT returns.

VAT rates can change, and you must apply these changes to the rates from the date they do.

The VAT rate also differs depending on the category of goods and services that you operate in.

It’s important to note that rates may only be applied if certain conditions are met, like who’s buying them, where they’re bought, and whether you keep the right records.

Note: Goods that are exported outside the EU or sent to someone registered in another EU country are zero rate, subject to conditions.

How to charge VAT

It’s essential that you charge VAT properly at the point of sale so that you can file an accurate VAT return and pay any money that you owe to HMRC.

The invoice itself is an important starting point to collect VAT from the consumer. It should include the following:

- Invoice number

- Invoice date

- Name and address of your business

- VAT registration number

- Customer details, including their name and address

- Description of the goods and services under consideration

Each item on your invoice should be presented clearly and must mention the following:

- Unit price excluding VAT

- Total quantity sold

- VAT rate

- Total amount excluding VAT

- Amount of VAT applicable

- Any discount offerings (cash or otherwise)

VAT prices

While charging VAT on goods and services, or working out the VAT amount to be reclaimed, you’ll need to make some calculations.

VAT-inclusive prices

VAT inclusive simply means that the total price displayed includes VAT in the calculation.

To work out a price including the standard rate of VAT (20%), multiply the price excluding VAT by 1.2.

For example, Business A is selling a shirt for £30 before VAT. In order to display the final VAT-inclusive price, they will follow the above formula:

£30 x 1.2 = £36

Therefore, the VAT-inclusive price is £36.

To work out a price including the reduced rate of VAT (5%), multiply the price excluding VAT by 1.05.

In this scenario, a reduced rate item may be a children’s car seat. Business B is selling children’s car seats for £40. Their VAT-inclusive price is:

£40 x 1.05 = £42

VAT-exclusive prices

VAT exclusive means, then, that the total price displayed excludes VAT in the calculation.

To work out a price excluding the standard rate of VAT (20%), divide the price including VAT by 1.2.

Using the above example, if we didn’t already know the price excluding VAT for Business A’s T-shirt, we could follow the above formula to calculate the VAT-exclusive price.

£36 / 1.2 = £30

To work out a price excluding the reduced rate of VAT (5%), divide the price including VAT by 1.05.

Using the above example again, if we didn’t know the price excluding VAT for Business B’s children’s car seat we could follow the above formula to calculate the VAT exclusive price.

£42 / 1.05 = £40

Charging VAT to charities

If you’re a VAT-registered business, the UK government allows you to sell certain goods and services to charities at the reduced or zero rate of VAT.

But before you can do that, you need to find out if that charity is eligible for a lower VAT rate.

There are many conditions in which a charity can qualify as eligible for a lower VAT rate. Some examples are aids for disabled people, advertising and items for collecting donations and ambulances.

To ensure that the charity you’re dealing with is eligible, you should ask for evidence and a written declaration that states that they meet the conditions for the particular VAT relief.

Keep in mind that it is your responsibility to apply the correct VAT rate.

As per the UK government, you must keep the completed declarations for at least 4 years.

Items qualifying for reduced rate

Under certain circumstances, a reduced VAT rate may be applied when you sell fuel and power to an eligible charity.

If fuel and power are supplied for use in residential accommodation, such as a children’s home, hospice, or a care home for the elderly or disabled.

Items qualifying for zero rate

A zero rate may be applied when you sell the following to an eligible charity:

- Advertisement for collection of donations

- Drugs and chemicals

- Medicine or ingredients for medicine

- Resuscitation training models

- Aids for disabled people

- Equipment for medical and veterinary use

- Construction services

- Lifeboats and relevant equipment, including fuel

Alternative VAT schemes for small businesses

When an item exchanges ownership between two VAT-registered business entities, it’s easy for them to claim back the VAT paid.

But if your business decides to sell to business clients who are not VAT-registered, then the prices that you charge them may increase by 20% and those businesses will have no way of getting that money back.

HMRC has come up with three special VAT schemes that aim to help out small businesses who may be negatively affected by the standard VAT scheme.

These alternative schemes give you more options for how you pay and charge VAT to other businesses and customers. They also give you the flexibility to have more control over your cash flow throughout the year.

1. Flat rate VAT scheme

A business with a turnover of less than £150,000 can opt to pay VAT under the flat rate VAT scheme.

The biggest advantage of going ahead with this scheme is that businesses don’t have to keep a record of the VAT they charge on each sale.

This means that, ultimately, they don’t have to pay VAT on every purchase either.

In fact, under this scheme, you can file your VAT returns easily and quickly by simply calculating VAT payments as a percentage of your total turnover—typically between 9% and 14%, depending on the industry sector.

In the case that your business offers services that fall into multiple categories, you choose the VAT percentage that applies to the majority of your sales.

For example, a sole proprietor who provides both copywriting and virtual assistant services would calculate their sales to decipher which work stream pulls in more income. If the answer is copywriting, they would charge the flat rate percentage for that category for the entirety of their turnover.

To view the full list of the 2019/2020 flat rate percentages by category, see our appendix at the end of this article.

| Type of business | |

| Accountancy or bookkeeping | 14.5 |

| Advertising | 11 |

| Agricultural services | 11 |

| Any other activity not listed elsewhere | 12 |

| Architect, civil and structural engineer or surveyor | 14.5 |

| Boarding or care of animals | 12 |

| Business services not listed elsewhere | 12 |

| Catering services including restaurants and takeaways | 12.5 |

| Computer and IT consultancy or data processing | 14.5 |

| Computer repair services | 10.5 |

| Entertainment or journalism | 12.5 |

| Estate agency or property management services | 12 |

| Farming or agriculture not listed elsewhere | 6.5 |

| Film, radio, television or video production | 13 |

| Financial services | 13.5 |

| Forestry or fishing | 10.5 |

| General building or construction services | 9.5 |

| Hairdressing or other beauty treatment services | 13 |

| Hiring or renting goods | 9.5 |

| Hotel or accommodation | 10.5 |

| Investigation or security | 12 |

| Labour-only building or construction services | 14.5 |

| Laundry or dry-cleaning services | 12 |

| Lawyers or legal services | 14.5 |

| Library, archive, museum or other cultural activity | 9.5 |

| Limited cost trader | 16.5 |

| Management consultancy | 14 |

| Manufacturing fabricated metal products | 10.5 |

| Manufacturing food | 9 |

| Manufacturing not listed elsewhere | 9.5 |

| Manufacturing yarn, textiles or clothing | 9 |

| Membership organisation | 8 |

| Mining or quarrying | 10 |

| Packaging | 9 |

| Photography | 11 |

| Post offices | 5 |

| Printing | 8.5 |

| Publishing | 11 |

| Pubs | 6.5 |

| Real estate activity not listed elsewhere | 14 |

| Repairing personal or household goods | 10 |

| Repairing vehicles | 8.5 |

| Retailing food, confectionary, tobacco, newspapers or children’s clothing | 4 |

| Retailing pharmaceuticals, medical goods, cosmetics or toiletries | 8 |

| Retailing not listed elsewhere | 7.5 |

| Retailing vehicles or fuel | 6.5 |

| Secretarial services | 13 |

| Social work | 11 |

| Sport or recreation | 8.5 |

| Transport or storage, including couriers, freight, removals, and taxis | 10 |

| Travel agency | 10.5 |

| Veterinary medicines | 11 |

| Waste or scrap dealing | 10.5 |

| Wholesaling agricultural products | 8 |

| Wholesaling food | 7.5 |

| Wholesaling not listed elsewhere | 8.5 |

Under the flat rate scheme, you also can’t reclaim VAT on any purchases you make, except for a select few capital expenditure goods, meaning you cannot reclaim input tax. This is because the flat rate scheme calculates VAT on an average and thus builds an input tax allowance into the flat rates.

The flat rate VAT scheme may save you money, but it wasn’t designed with that in mind. It entirely depends on the type of industry sector you fall into. Use the VAT Flat Rate Scheme calculator to assess how much money you’d pay under this scheme.

The flat rate scheme is beneficial for businesses looking to simplify their record keeping. If cash flow management is a pain point and saving time is a goal, the flat rate VAT scheme is a good choice.

Once enrolled, you can continue using the scheme until you expect to reach £230,000 a year in turnover.

2. Cash accounting scheme

Under the cash accounting scheme, you don’t pay or reclaim VAT until actual money changes hands for purchases and sales. While you must keep a record of VAT on each sale and purchase when they are invoiced, you are not required to actually pay the VAT until the invoices are paid.

In simpler terms, you can only reclaim VAT once you’ve paid your suppliers.

Businesses with a turnover of less than £1.35 million can opt into this scheme. But, the cash accounting scheme cannot be applied to every transaction.

The following transaction types cannot be used in this scheme:

- Transactions with payment terms longer than six months

- Goods that are imported from within the EU

- Goods that are moved outside of a customer’s warehouse

- VAT invoices that have been produced in advance

You don’t need to enroll in the cash accounting scheme as you would with the flat rate option. Yet, you must join at the beginning of an accounting period, and leave it at the end of an accounting period, if you so choose.

Quick Tip: How you choose and set up your accounting periods, accounting methods, financial statements and accounting software is fundamental to your cash flow and ultimately your business success. For expert insights into streamlining and setting up your accounting process, read our complete guide to accounting for startups.

The cash accounting scheme is beneficial for businesses that want to improve their cash flow. As you don’t pay VAT until invoices are paid, you get to retain your money for a longer period of time. And, if an invoice never gets paid, you do not need to pay VAT at all. However, if you leave the cash accounting scheme with unpaid invoices, you are required to settle up the VAT on purchases and sales you have made and received up until that point.

If your customers are regularly late with payments, the cash accounting scheme can be great for your cash flow. But if your customers pay on time, this scheme won’t make much of a difference.

You also can’t reclaim VAT on input tax, or purchases you make, until you have paid your supplier. Once paid, you are eligible to file to reclaim that money. This can negatively impact businesses who buy goods on credit, as you will be unable to recover VAT fees for these purchases until the debt is paid.

You must stop using this scheme if you expect the value of your taxable supplies, excluding VAT, to exceed £1.6 million.

3. Annual accounting scheme

Under annual VAT accounting, HMRC allows businesses that have an expected turnover of £1.35 million or less to make monthly or quarterly payments towards their annual VAT bill. Therefore you must, at a minimum, make VAT payments at least four times a year, or once a quarter.

This differs from the standard accounting scheme because you only need to file a VAT return once per year as opposed to every quarter.

If you choose to pay monthly, you must pay 10% of your estimated VAT bill and make payments at the end of months 4-12. If you choose to pay quarterly, you must pay 25% of your VAT bill and payments are due at the end of month 4,7 and 10.

The annual accounting scheme can be better for your cash flow because you make payments in instalments throughout the year. You can also choose to make additional payments if and when you have an increased cash flow and are able to do so.

This scheme can have a negative effect on businesses that reclaim a large amount in VAT as you can only reclaim your input tax once a year. If you rely on the money you reclaim from VAT for your cash flow, this scheme won’t make sense for you.

When the year comes to a close you either pay or receive the balance of your VAT bill. You have two months from your year-end to file the return. The balance will vary depending on if you’ve over or underpaid HMRC throughout the year. If you have overpaid, you should apply for a refund.

You must leave the scheme if you expect to reach £1.6 million in turnover.

Wrapping up

Regardless of what type of business you run, VAT is something you can’t ignore.

Understanding the VAT rate that applies to your business and how you can charge it successfully will help you avoid penalties, reclaim any VAT owed and ensure your business remains in good standing.

Having an accountant can significantly help you stay organized with all of the VAT rules, regulations and choices. If you don’t have an accountant yet and you aren’t sure what to look for and how to decide, you can get some help from our guide on how to choose an accountant for your small business.

Our business current account is designed with all of your small business tax needs in mind. Once you open a Tide account, you can use our Tide Accounting tool to easily categorise your income and expenses with convenient labels that help you organise your cash flow. Open a Tide account to get started.

| Turnover | Client type | VAT options | Benefits | Drawbacks |

| Less than £85,000 | Mostly non-VAT registered customers | Don’t register for VAT | – Reclaim VAT you’ve been charged – Reclaim throughout the year – Look more established | – More paperwork – Your outgoing invoices may increase to account for VAT |

| Less than £85,000 | Mostly VAT registered customers | Voluntarily register for Standard Rate VAT | Don’t need to pay or charge VAT | None |

| From £85,000 to £150,000 | Any | Register for Standard Rate VAT or Flat Rate VAT | If Flat Rate: – Don’t have to pay VAT on every purchase – Simplified record-keeping which saves time | >If Flat Rate: – The VAT % varies greatly by sector |

| Less than £1.35 million | Any | Register for Standard Rate VAT, Flat Rate VAT, Cash accounting scheme or Annual accounting scheme | If Cash accounting scheme: – Don’t pay or reclaim VAT until actual money changes hands for purchases and sales – Improves cash flow as you only pay VAT once you are paid If Annual accounting scheme: | If Cash accounting scheme: -Lots of paperwork -If customers pay invoices on time, this scheme won’t make much of a difference on cash flow If Annual accounting scheme: |

Photo by Snapwire, published on Pexels