Accounting for startups – The complete guide

Did you know that over 30% of new businesses fail due to running out of cash? This is unfortunate, but can be prevented by knowing the proper accounting systems.

Accounting is an important subject for any business owner to know, especially as it’s often considered the “language of business”.

Luckily, you don’t need to master accounting, but you do need to have a solid grasp of the fundamentals to ensure that your business remains profitable.

In this guide, we’ll cover how to streamline your startup accounting process. This includes choosing the right accounting method, knowing the three main financial statements, hiring the right people, using the appropriate software and having a business plan that outlines weekly and monthly bookkeeping tasks.

Table of contents

- Choose an accounting method

- Know the three main financial statements

- Use the right accounting software

- Hire the right people

- Fundamental accounting tasks

- Expert insights

- Wrapping up

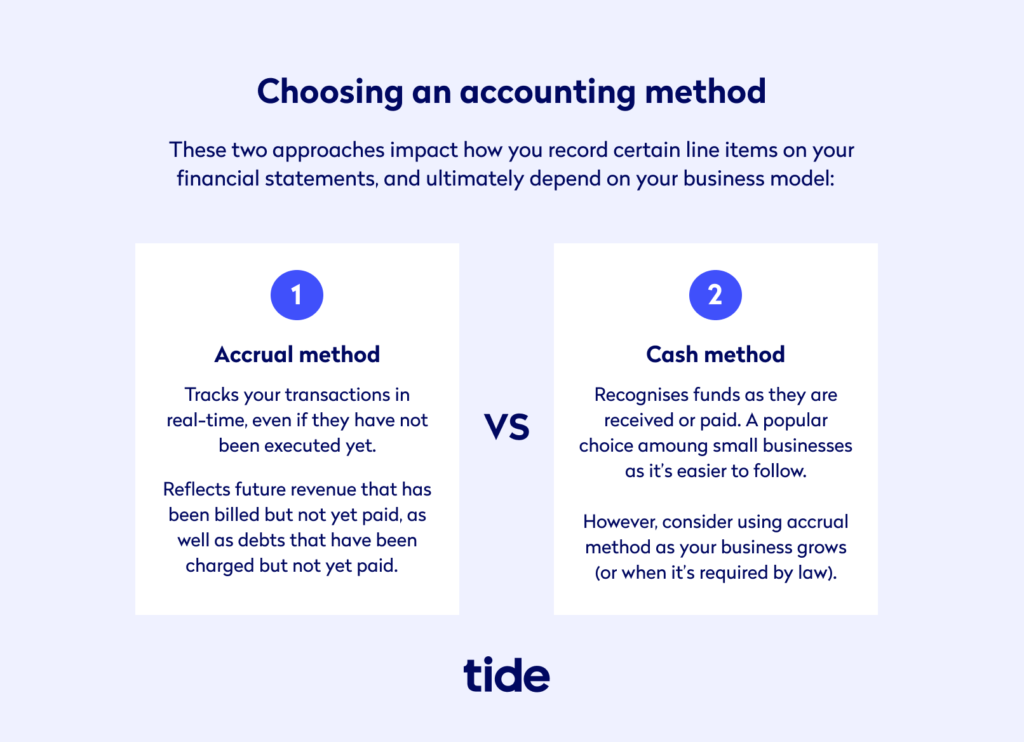

Choose an accounting method

Accounting has two main methods; the accrual method and the cash method. These approaches impact how you record certain line items like sales and debts on your financial statements. Also, some business types are required to choose the accrual method, but this varies based on industry as well as the country.

As per Gov.uk, small businesses and sole traders that have revenue or turnover of less than £150,000 per year can use cash accounting. Businesses can change from cash to accrual accounting during this stage and once they grow beyond this figure.

Accrual method

This method recognises when you bill clients or owe money to creditors. It is a form of tracking transactions as they occur in real-time, even if payment hasn’t yet been executed. You don’t actually have to receive or pay the funds in order to include them in your financial statements.

One of the main features of this standard are the line items Accounts Receivable and Accounts Payable. Accounts Receivable reflects future revenue that has been billed but not yet received.

Conversely, Accounts Payable shows future debts that have been charged but not yet paid.

This standard is more commonly used than the cash method as it gives you a more realistic version of income and expenses during a specific time period. However, be sure to monitor your cash flow, as not accounting for future income and payables can hurt your business in the long term.

Lastly, check with a competent tax professional to see if you’re required by law to use this method.

Cash method

Cash method is more simple than accrual as it recognises funds when they are received or paid. There are no Accounts Receivable or Accounts Payable line items with this method. Many small businesses choose to use this approach as it is easier to follow, and pinpoint when transactions have occurred.

However, consider using the accrual method as your business grows or if it’s mandated by law. The accrual method will make it easier to organise your financials, especially as your business scales. The Accounts Receivable and Accounts Payable can enable you to keep up to date on assets and liabilities in real time.

Know the three main financial statements

Every startup accounting system is built on the three main financial statements. These are the balance sheet, income statement and cash flow statement.

Each statement breaks down key components of your business like revenue, expenses, assets, liabilities and different types of cash flow.

You don’t need to understand every single detail of each statement. But you should know the high-level meaning of each one along with its relationship to the other main financial statements.

Let’s break down these three statements, key line items that show on the financial reports, and other important facts you should know to help you make informed accounting decisions for your business.

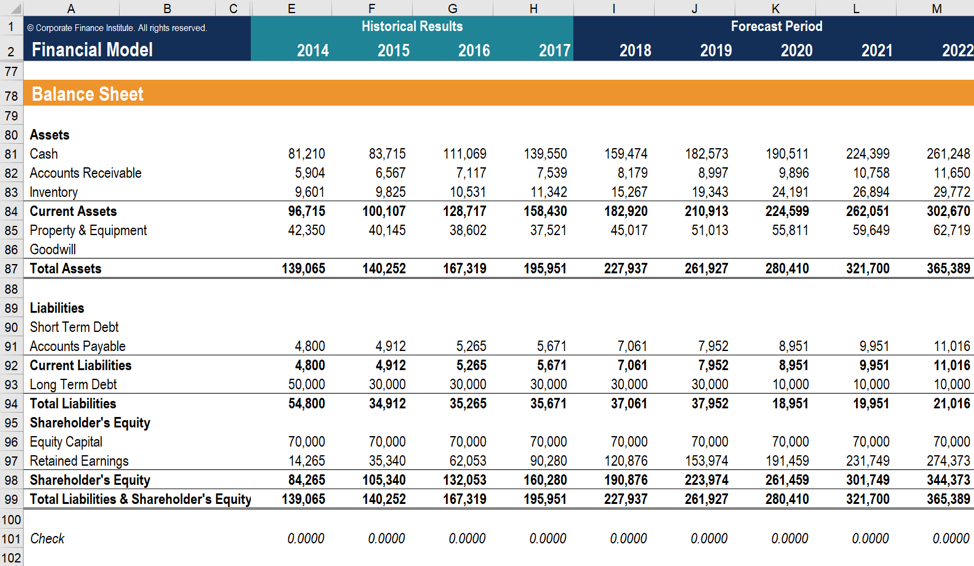

Balance sheet

The balance sheet shows your assets and liabilities, which lay the foundation for your company’s financial status.

The balance sheet formula:

Assets = Liabilities + Equity

Let’s break this down:

- Assets are items that your company owns that can produce future economic benefits, such as cash and inventory

- Liabilities are your company’s obligations and include short term debts along with taxes payable

- Equity is what you are worth from a cost perspective. Anything left over after subtracting liabilities from assets belongs to the owner(s) of the company. It represents the value of the owner’s investment into the business

If you’re a publicly traded company, however, the equation is slightly different to reflect shareholders’ equity.

The formula for this scenario is assets = liabilities + shareholders’ equity. Shareholders’ equity refers to money that investors have given your firm to help it grow. A common example of equity financing is when a company sells its stock, also called equities, to the public during an Initial Public Offering (IPO). These investors purchase your company’s equity and desire to receive a positive return on their money.

The balance sheet is broken down into current or long term assets and liabilities:

Current assets and liabilities: These appear on the first line of the balance sheet. They refer to the short term funds and debts that your company has, respectively. Also, these items are more liquid than long term assets and liabilities, as they can be converted into cash easier. For example, inventory can be sold or liquidated much easier than a piece of equipment or office warehouse.

Long term assets and liabilities: These appear beneath current assets and liabilities on the balance sheet. Long term assets include real property and machinery, which aren’t as liquid and therefore take more time to convert to cash. Some common long term liabilities for small businesses are notes payable to banks for the financing of equipment, or paying off a loan for a car you purchased for your business. Another example, if you have investors, is paying off interest on outstanding bonds issued to your investors.

The balance sheet is important because it shows a clear picture of liquidity. If current assets are higher than current liabilities, that shows your company is able to cover its short-term obligations. It also outlines your company’s efficiency in how it utilises its assets and its ability to generate returns.

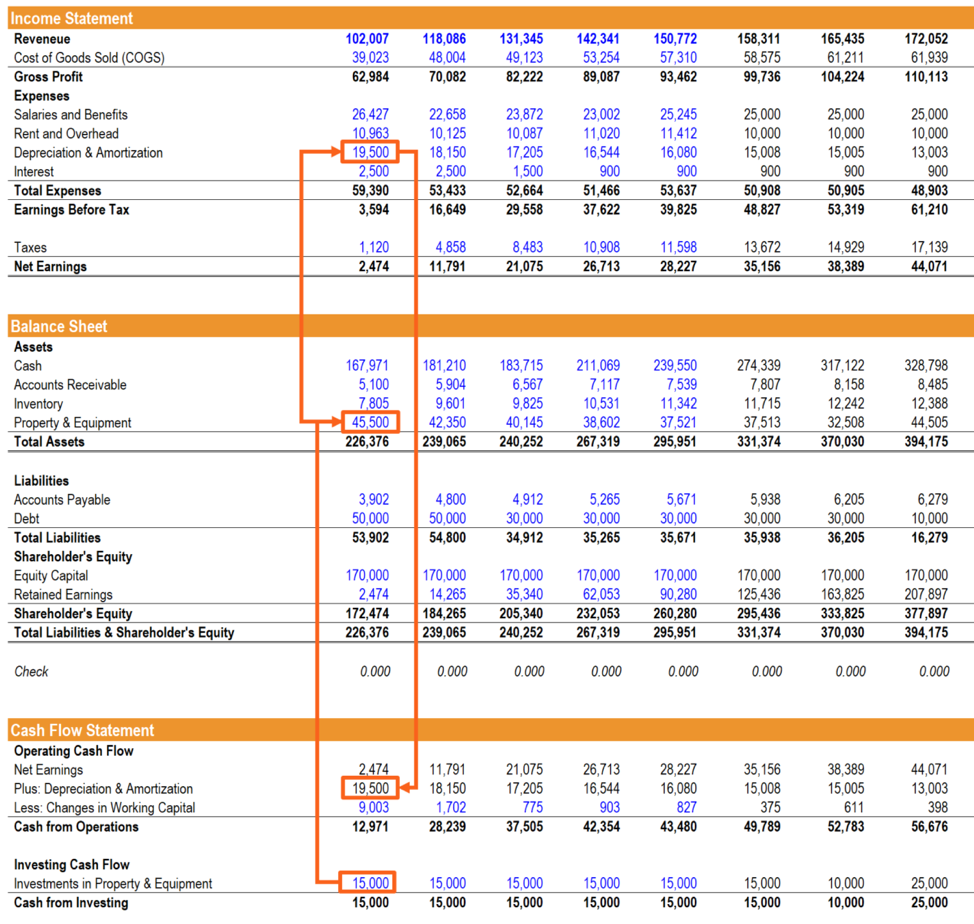

Income statement or Profit & Loss (P&L) Statement

The income statement, also referred to as the Profit & Loss or P&L statement (as illustrated in CFI’s example above), is arguably the most important financial statement. Every business plan should include an income statement because it’s a key financial snapshot that helps to evaluate your company’s performance.

The income statement formula:

Net Income = Revenue – Expenses

Let’s simplify this:

- Revenue is the gross amount of money you earn from selling products or services. It is the total amount of income a business has earned before subtracting any expenses.

- Expenses are the outflow of cash or assets that your business spends for marketing, promotion, advertising, general administrative tasks, and so on.

- Cost of sales, or cost of goods sold (COGs), are part of the expenses category, but are specific to the direct costs of materials and labour associated with selling products to generate revenue. If you don’t sell products, it can be called Cost of Sales for the costs of the service you provide.

- Net Income or Net Profit Margin is referred to as your ‘bottom line’. It is what’s left over after all operating expenses and cost of sales are subtracted from your revenue, making up your true profitability.

Before we can calculate our net income, we first need our gross profit number.

An income statement is laid out with revenue as the top line item, followed by cost of sales and then gross profit. If you subtract cost of sales from revenue, you get your gross profit line item, which accounts for the revenue your company has earned minus the cost of sales, but before expenses are subtracted.

Gross Profit = Revenue – Cost of Sales

For example, if you sell candles, your revenue would be the pound amount you charge customers to buy each one. The cost of sales would include the cost of purchasing the raw materials for the candles plus the labour involved in making them.

Say you sell a candle for £50 and your cost of sales per each candle are £25. If you sold 100 candles in a month:

Revenue for 1 month = £50 x 100 = £5,000

Cost of sales for 1 month = £25 x 100 = £2,500

Gross Profit = £5,000 – £2,500

Gross Profit = £2,500

Now that we have our gross profit, we need to look at expenses. The expenses section would account for items like wages payable, rent, utilities and other administrative expenses.

Expenses differ from liabilities, as expenses are incurred to generate business revenue. For instance, advertising fees spent to market a product or service would be considered an expense. Liabilities represent debts that you owe like mortgages, short term debts, and income taxes. Also, most expenses are spent in the short term and many liabilities are long term obligations.

Returning to our candle example, say you spent £1,000 this month on advertising and marketing.

Net Income = Revenue – Expenses

We’ve calculated the revenue to be the gross profit or £2,500, after subtracting cost of sales from total revenue. If our expenses are £1,000, we can plug our numbers into the formula:

Net Income = £2,500 – £1,000

Net Income = £1,500

Your net earnings, or bottom line, for your candle business for one month is £1,500.

Cash flow statement

The cash flow statement shows how much cash flows in and out of your business in a given time period. It is used as a tool to analyse how well a company manages its cash position and its overall operation. It is generally divided into three categories: operating, investing and financing activities.

Operating activities: These are activities that are essential for day to day operations. These include cash from inventory, net income and accounts receivable. For example, the amount of money you bring in for selling goods or a service in a day or week would be categorised as operating activities.

Investing activities: These are activities used to grow the business, such as acquiring other companies and real estate. Startups often purchase many assets as they grow, therefore the cash flow from investing activities in your company may be high and produce a negative cash outflow. This is normal for the early stages of any business looking to grow.

Financing activities: Finally, these are activities the company undertakes to obtain investor financing. These are generally broken down between debt and equity financing. As mentioned earlier, debt financing occurs when companies issue debt, or bonds for investors to purchase.

This would be stated as an increase or (decrease) in debt on the cash flow statement. Equity financing occurs when a company issues its stock or equity to investors for sale. This event would be reflected as equity purchased or repurchased on the cash flow statement.

The cash flow statement is a valuable tool to analyse a company’s strength, long-term future outlook and overall profitability.

How the three main financial statements tie together

It’s important to note that each main financial statement is related to one another.

The bottom line of the income statement is net income, which links to both the balance sheet and the cash flow statement.

On the balance sheet, net income feeds into retained earnings for the owner’s equity.

On the cash flow statement, it is the top line for the cash from operations section.

Knowing the fundamentals of each statement, how they interrelate with each other, along with key line items will help your business’s profitability.

Use the right accounting software

Let’s face it, finances can be tedious and time-consuming, and running a small business is hard enough as it is. Luckily, technology has made performing accounting tasks much easier via automation tools which help to reduce human error and save valuable time and money.

The idea is that these software platforms help you manage the day-to-day finances of your business, allowing you to actually spend time running your business rather than being bogged down by financial burdens.

How accounting software works

Accounting software used to be cumbersome and more suitable for larger businesses. However, these days, there are a wide variety of accounting software tools that can help small businesses with bookkeeping, inventory, invoicing, payroll, cash flow, income statements, and much more.

Whether you use an accountant or bookkeeper to manage your finances, or handle them yourself, accounting software is a great tool to simplify your financial burden.

Of the many accounting software options on the market, each one has its benefits and drawbacks based on your business size, number of employees and other needs.

Tide offers members a business bank account that helps to relieve busy business owners of their banking admin tasks. Once you open a Tide account, you can use our Tide Accounting tool to easily categorise your income and expenses with convenient labels that help you organise your cash flow.

Even better, Tide Accounting is designed to let you handle your bookkeeping and accounting alongside your business banking, in one account – so accounting becomes simple and secure, the way it should be.

Designed specially for busy small business owners, Tide Accounting makes it quick and easy to:

- Get paid faster with personalised invoices

- Manage your bills and boost your cash flow

- Track business performance with brilliant bookkeeping

- Get your Self Assessment and VAT returns right first time

Find out how you can take the stress out of accounting with Tide Accounting.

It can be tough to decide on the optimal software for your business, but you should keep the following three factors in mind when shopping for one.

1. Features

Accounting software programs vary based on what types of features they offer.

Most accounting systems cater to basic accounting needs, such as tracking spending and expenses, billing, accounts receivable, and so on.

If you’re a small business, you’ll most likely want an accounting software that can do some or all of the following:

- Invoicing: This helps you sort who owes you money, how much is owed and when to expect payment.

- Automatic Invoicing: This sends out invoices automatically so that you don’t need to manually remind clients to pay you.

- Payment Processing: This allows clients to automatically pay you so that you don’t need to waste time manually processing cheques or making bank deposits.

- Accounts Payable: This tool helps you keep track of what you owe in terms of purchase orders, vendor credit, and more.

- Automatic Payment: This allows you to schedule payments automatically so that you don’t have to set manual reminders and therefore never miss a payment.

- Reconciling Bank Accounts: Most software tools can track multiple bank accounts and reconcile/organise them in one easy-to-use dashboard.

- Standard Reports: Many software tools can generate basic reports, such as income statements, balance sheets and cash flows.

As the systems become more sophisticated, they often cater best to larger businesses, and can be more expensive to account for the added features:

- Payroll: Handling all aspects of modern payroll, like calculating hours and processing payroll related taxes. These systems can also accurately calculate how much employees are owed in a pay period and automatically pay them, too.

- Expense Reimbursements and Deductions: If your employees incur tax-deductible expenses, such as mileage on their car for performing business duties, sophisticated systems can accommodate such reimbursements and ensure they are tax compliant.

- Customised Reports: More advanced tools allow you to customise your reports. For example, you can add or remove columns, or save a custom report to be duplicated in the future.

The list goes on, but this high-level overview of basic and sophisticated accounting software features should give you a general idea of what to look for when shopping for accounting tools for your business.

2. Reviews/Customer Service

Reviews are an important factor to consider if you are looking to purchase accounting software.

You should learn more about how easy it is to become accustomed to each piece of accounting software, the varying features on offer, what is included in different pricing packages, and how customisable it can be to fit your specific needs.

If you’re a smaller business and need something that works out of the box without hassle, you may want to avoid software that takes weeks to learn through reading lengthy directions and integrating it with your current systems. Luckily, there are many out of the box software options today.

If you’re planning to look after your own accounting, good learning materials and tutorials such as videos and guides will be helpful. Also make sure to gauge how the platform handles customer service, as being able to reach somebody and get valuable answers in times of need can make or break your experience.

3. Cost

Cost is also important to factor in when purchasing accounting software. Most systems will charge you either per month or annually and you should determine which makes more sense for your business strategy.

Many software suppliers offer free trials which is a great way to test out the tools and see if they make sense for your needs. Most companies will also offer both monthly and annual contracts, which each come with benefits and drawbacks.

If you know you’ll love a tool and are ready to commit up front, investing in an annual contract probably makes more sense and may even come with a discount for your commitment. However, if you need more time to decide if a tool is right for you, monthly subscriptions are a safer bet.

Hire the right people

Regardless of whether your business is performing extremely well, and you pick the best accounting software to supplement your financial needs, you still need to ensure your cash is going as far as it can in terms of business growth.

Remember, over 30% of new businesses fail due to running out of cash.

While accounting software is helpful, it performs even better when coupled with the expertise of a chartered accountant or bookkeeper.

We’re not saying every business owner needs one, but they are worth considering to assist with fundamental tasks like creating financial statements, organising cash flow, and reconciling bank accounts.

Chartered accountant

A chartered accountant is a professional who has completed at least four years of university with a degree in accountancy. This person has also taken a rigorous exam and has knowledge of financial statements, tax law, auditing, and estate planning.

A qualified accountant is an invaluable asset for any business as he or she can guide you through complex topics, especially tax law.

Bookkeeper

Bookkeepers are also helpful resources for any business. However, they don’t have the same level of expertise as accountants and can only work on basic tasks like managing income, expenses, bank reconciliation, processing payments and paying bills.

Also, you don’t have to have a degree or a licence to become a bookkeeper. It’s important to look for bookkeepers that have some university experience as well as relevant certifications.

Hiring a bookkeeper helps so that you wouldn’t have to file taxes yourself, nor constantly be tasked with updating income and expenses.

Also, you could hire bookkeepers through agencies or work with a freelancer. It doesn’t matter which option you choose as long as the person is reliable, detail-oriented, a good communicator and comes recommended via professional or personal networks.

Pro Tip: Not sure which option is best for you? Find out more about the difference between an accountant and a bookkeeper.

Fundamental accounting tasks

As a small business owner, it is key that you practise strong bookkeeping habits on a weekly, quarterly and yearly basis. These methods are broken down by time period below:

Weekly tasks

- Reconcile each bank account at the end of the week: This means ensuring the bank account connection is current with real-time information. It also means checking that your income and expenses have synced to your accounting software seamlessly, which ensures accuracy.

- Categorise income and expenses: Be sure to pay special attention to expenses. Confirm that eligible expenses fall under government rules. Some ways to do this is by checking the HM Revenue & Customs site and using tax software to easily categorise expenses. These approved expenses then smoothly translate to your income statement in an easy-to-read format.

Quarterly tasks

- Check your net income per quarter: As mentioned above, the income statement is a crucial financial statement that provides insight into your company’s financial health. It shows you a high level and granular picture of your business’s financial health. If your net income is negative, look for ways to increase it. For example, look into ways to increase your revenue, reduce your cost of sales and reduce your operating expenses. You can do this by improving marketing efforts to increase revenue, renegotiating raw materials prices to decrease cost of sales and spending less on client dinners to reduce operating expenses, for example. Refer to our guide for even more ideas on how to improve your net profit margin!

- Compare net income throughout the year: Related to the first point, compare your net income per quarter. If net income is increasing or decreasing, pinpoint the factors behind it. Also, you can use this task to look for seasonal trends. For example, ski shops would likely have positive net income in the winter and low or negative income in the summer.

- Organise tax documents: Filing final tax returns can be stressful for anyone, especially business owners or a sole trader as they have different HMRC deadlines to keep track of. Be sure to keep your documents and financial data organised, something that accounting software can considerably help with. Treat each quarter like a mini tax season, which will make the time shortly before the final deadline more manageable. Also, consult your tax preparer and CPA to ensure this process runs smoothly.

Yearly tasks

- Calculate your company tax return: The remaining amount of money after calculating the amount owed is your profit. You will use your profit to calculate how much Corporation Tax your company must pay.

- Submit annual accounts (aka Statutory Accounts): You must submit the following to the HMRC: yearly income statement, yearly statement of financial position and footnotes. These show, respectively, your yearly P&L, a snapshot of your company’s cumulative value of business based on its assets, liabilities, capital and reserves, and information about transactions between your company and its directors.

- Get your expenses in order: Claim your business expenses for tax purposes.

- Round up overdue invoices: Your company year end should be as accurate as possible. Make sure you contact anybody who owes you an invoice and get it paid before year end.

💡 Expert insights

Insights author: Faye Hammond is a Digital Marketing Manager at Dyer & Co, who offer chartered accounting services to small and medium businesses specialising in business start-up advice, payroll, tax planning, tax enquiries, VAT assistance, auditing services and general accounting services.

What are the biggest challenges for startups setting up their accounting?

Keeping your books in order is crucial for any start up business in order to track cash flow, financial growth and understand profitability. One of the biggest challenges for startups is finding the most compatible software that matches their needs as well as the legislative requirements. We have specific software experts on hand to help navigate our clients through this.

What tips would you give new startups founders for organising their accounting?

Plan ahead and put systems in place to see you into the future. Engaging an accountant that is committed to adding value to your business, will be able to support you and offer advice on business growth and development. Having an experienced accountant on hand to guide you through this process frees up precious time for you – allowing you to concentrate on the hands-on side of running your business.

Wrapping up

Taking the time to understand accounting fundamentals is the first defence against your business failing due to running out of cash.

You don’t need to be an expert in accounting and taxes like a chartered accountant. Aim for understanding the more important concepts, and how they apply to your business.

As a small business, accounting helps you:

- Learn how to budget

- Prepare for taxes

- Stay organised

- Analyse your earning and spending patterns

- Make better decisions

- Reduce stress

- Gain a high-level overview into the financial health of your business

The best accounting practices you can implement are selecting the right accounting method, understanding the three principal financial statements, collaborating with the right accountant, implementing the right accounting software and keeping up to date on routine bookkeeping procedures.

Photo by Volkan Olmez, published on Unsplash