The complete guide to small business accounting (with step-by-step advice)

Understanding the basics of small business accounting is a key part of building and managing a successful business.

Why?

Because it arms you with vital information that will help you make smarter decisions about your business operations, strategy and growth plan.

In this guide, we’ll share everything you need to know in order to organise your small business accounts. We’ll dive into the basics of accounting, the purpose and importance of those tasks and how to use this knowledge to run a profitable business for the long run.

Table of contents

- What is small business accounting?

- What’s the difference between accounting and bookkeeping?

- Getting started: 7 steps to setting up your small business accounting

- Stay organised for easy accounting

What is small business accounting?

Small business accounting is the process of identifying, recording, measuring and interpreting financial information.

Keeping on top of your financial records, expenses and revenue allows you to monitor your profit and loss. It also helps you manage the value of your assets, liabilities and equity.

While this makes managing your cash flow easier, you also have a legal duty to ensure your accounts reflect this information accurately.

But beyond the basics of what small business accounting is, it’s crucial to understand why it matters.

Put simply, the purpose of accounting, like any other measurable data stream, is to help you plan, evaluate and optimise your business on the whole.

In general, small business accounting can help you with the following activities.

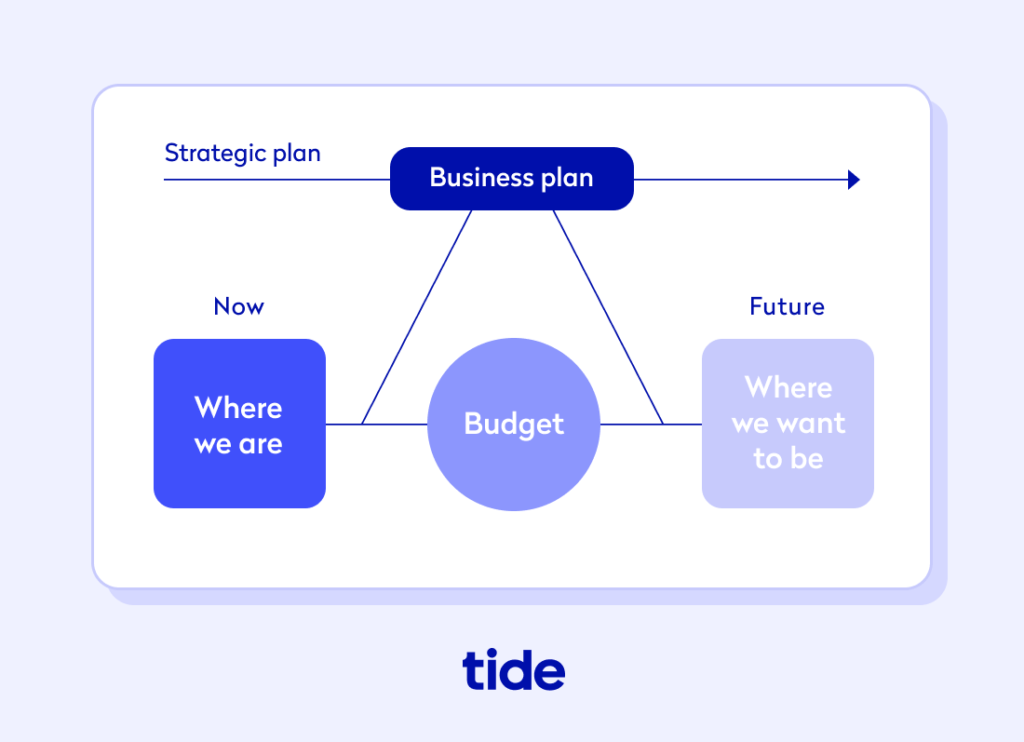

Budgeting and planning

Setting and maintaining a business budget helps you to align your spending with your business goals, forecast your earnings and hold yourself accountable.

For example, a budget helps you to determine which resources are essential or optional so that you can avoid spending money on unnecessary or ‘nice-to-have’ assets when your cash flow doesn’t support such behaviour.

Additionally, a well-thought-out budget can help you acquire funding or raise venture capital as it gives potential investors a clear picture of your spending needs and your forecasted spending objectives.

Decision-making

Accounting plays a key role in most of the high-level decisions you’ll make as a business owner.

For example, maintaining a healthy cash flow is one of the key markers as to whether or not a business will survive long-term. If you do happen to run into cash flow problems, financial reports can help you identify potential areas where you can make adjustments to bring more cash in.

This may mean changing the price of your products to increase sales, or finding a new supplier with lower costs so that you can increase your profit margins.

Either way, having organised and up-to-date financial information allows you to assess a problem (or an opportunity) and make faster and smarter decisions as a result.

Business performance

Analysing your key performance indicators (KPIs) helps you to understand if you’re achieving your financial goals. Without these reports, you won’t have a meaningful way to determine if you need to pivot your strategy or optimise your goals in any way.

For example, if you set a revenue goal of £100,000 in your first year of business and you achieve that, that would be considered a win. But, at the same time, if you ended up spending 3x more than you planned, you may actually have lost more money than you brought in.

Financial reports allow you to evaluate not only how your business is performing, but if your goals and objectives are in line with your short and long-term growth strategy.

What’s the difference between accounting and bookkeeping?

You may hear the terms accounting and bookkeeping used interchangeably, but there are important differences.

Bookkeeping is the recording and organising of financial data, while accounting is the process of interpreting and presenting that data to inspire better business decisions.

Accounting can’t happen without bookkeeping, so accountants often oversee the bookkeeping role but never the other way around. However, in smaller and newer businesses with limited resources, the two functions sometimes overlap.

Getting started: 7 steps to setting up your small business accounting

You don’t need to be a maths expert to get started with small business accounting. Let’s run through seven basic principles to help you get set up the right way.

1. Open a separate business current account

If you’re registered as a limited company, you’re legally required to have a separate account for your business finances.

If you’re a sole trader, whilst you’re not legally required, it is recommended to keep these separate to save you some headaches. Check the T&Cs of your personal bank account as some specify that your account may be closed if it is used significantly for business purposes.

Getting your small business account in order requires two simple steps:

- Choose a business account. When choosing an account, consider factors such as transaction fees, withdrawal fees, introductory offers, customer support and admin features.

- Set up a savings account. This will help you organise your funds and plan for taxes. If you’re self-employed, set up a separate savings account to put away a percentage of each payment you receive for taxes.

Ideally, your business account will have features that make your finance admin easy to manage.

For example, when you open a free business bank account with Tide, you can use our simple and secure accounting tool (Tide Accounting) to tag and categorise some of your transactions – so you can see exactly where your money is going.

Tide Accounting also makes it possible for you to handle your essential bookkeeping and accounting jobs in one account – the same account you use for your business banking.

Designed specially for busy small business owners, Tide Accounting makes it quick and easy to:

- Get paid faster by creating and sending personalised invoices

- Manage your bills better to boost your cash flow

- Track your business performance with brilliant bookkeeping

- Get your Self Assessment and VAT returns right first time

Find out how you can take the stress out of accounting with Tide Accounting.

2. Hire an accountant

Entrepreneurs wear many hats and, as a result, company accounts can often be left unattended. This can lead to problems down the road if you make any accounting mistakes.

Here are just a few of the main ways that accountants can make your life easier:

- Accurate records allow you to track cash flow and forecasting, which helps you to evaluate business performance and make smarter business decisions.

- Having your books in order and balance sheets ready to go will make getting a loan easier (especially if you’re cash flow positive). It’ll also make tax season a much more enjoyable experience.

- Less time spent on bookkeeping means more time working on building and growing your business.

From forecasting to tax audits, loan applications to VAT registration, an accountant can make life easier for you.

When it comes to choosing an accountant that is right for your growing business, it is wise to identify your business needs, look into the accountant’s fee structure, and obtain an engagement letter. Most accountants charge flat monthly rates for their bookkeeping and accountancy services.

3. Track your expenses

You should always keep on top of your expenses and outgoings. By neglecting your expenses, you may come across cash flow issues that can be avoided (especially in the early days of running your business).

What are expenses?

An expense is an amount spent or cost incurred in your efforts to generate revenue. In other words, it is your cost of doing business.

These costs range from employee salaries to materials for making your products to marketing expenses and anything else that you need to spend money on to run your business.

Expenses can be deducted from your business’s income before it is subject to taxation. You do not need to send in proof of your expenses, but you must keep accurate records of every expense in case HMRC asks—yet another reason why accounting not only saves you headaches, but money (we’ll dive into the specifics of what you can claim in a moment).

Why is it important to track your expenses?

Tracking your expenses may sound like hard work, but as mentioned above, advanced business accounts (as well as most online accounting software) will track your outgoings for you.

It’s important to track your expenses because it gives you a better understanding of how you’re spending your money and could help you claim some of it back.

In turn, this helps you to control your outgoings and identify what you’re spending your money on, ultimately allowing you to save money and free up some capital to invest in other areas of your business (such as marketing).

What can you claim as a business expense?

This area can often cause confusion. To clarify, here are some examples of what can be claimed as an expense when doing your small business accounting:

- Labour. Full-time employees, independent contractors, consultants and freelancers all fall within this category.

- Rent, utilities, phone and supplies. Rent, bills and other office costs can be deductible as business expenses. If you work from home, a percentage of your bills and rent can be claimed against the business.

- Business travel. If the purpose of a trip is for business (eg meeting suppliers or clients), then you can claim it as an expense.

- Transportation. Record when, where and why you used any vehicle for business and keep any rental and fuel receipts (HMRC allows some mileage allowance relief). You can also claim for other modes of travel, such as train, bus, air and taxi fares.

- Benefits, education and training. If you offer your employees dental insurance or the opportunity to further their education or learn new skills, these can be deductible business expenses for you and/or your employees.

- Entertainment. You’re allowed to claim £150 a year per employee for entertainment (which includes yourself). For example, if you host a holiday party for your staff, you can claim £150 (including VAT) per guest. Note that you cannot claim any entertainment expenses if you’re a sole trader.

- Food. Meals purchased whilst travelling for business purposes can be tax-deductible, depending on what HMRC deems as a ‘reasonable’ expense (they are unlikely to accept a lobster lunch on a two-hour roundtrip). Client entertainment is more complex. If you regularly entertain clients and want to be as tax-efficient as possible, seek an accountant’s advice.

What can’t you claim as a business expense?

Here is a list of outgoings or costs that are not deductible as business expenses:

- Fines and penalties. The most common fines for small business owners are for failure to file by the due date and late payment which can’t be claimed as an expense.

- Political contributions. You can’t deduct contributions your business made to a political party or candidate.

- Hobby-related expenses. If you belong to a country club, social club or fitness facility, your fees are not a deductible business expense.

How to keep track of your expenses?

Set up a system for organising your receipts and records as soon as you start your business.

Many small business owners just starting out use expense spreadsheets to track their expenses. They’re free, relatively easy to maintain and better than a handwritten record. If you fall into that category, you can download our free expense spreadsheet to get started.

As you grow, we recommend automating as much as possible. Tide Expense Cards make it easy to track your business’s spending, whether you’re a company of one or an enterprise venture.

Set spending limits per person, match receipts to transactions and automatically calculate your total expenses all in the Tide mobile app.

What about tracking employee expenses?

If you have employees, efficiently tracking their expenses is a key part of sticking to your budget, monitoring your employees’ spending patterns and reimbursing them for any out-of-pocket expenses.

Step one is to create a clear and transparent company expense policy to ensure everybody is on the same page.

Step two is to manage employee expenses in order to ensure the process is running smoothly.

And step three is to adopt modern expenses solutions to streamline your operations. Tide’s company Expense Cards make the entire employee expenses process easier for everybody involved.

How to organise your expenses?

The next step is to determine which small business accounting method you’ll be adopting to organise your expenses. There are two methods:

- Cash method. Revenues and expenses are recognised at the time they are actually received or paid.

- Accrual method. Revenues and expenses are recognised when the transaction occurs (even if the cash isn’t in or out of the bank yet) and requires tracking receivables and payables.

Cash basis accounting is generally more suitable for small businesses with a turnover of £150,000 or less and is an optimal way to work out your income and expenses for your Self Assessment tax return (if you’re a sole trader or partner).

4. Set up an invoicing system

A well-oiled invoicing system is the heart of your small business accounting. An invoice is prepared based on products or services sold and needs to be fast and accurate. The sooner your invoice is sent, the better it is for your cash flow and peace of mind.

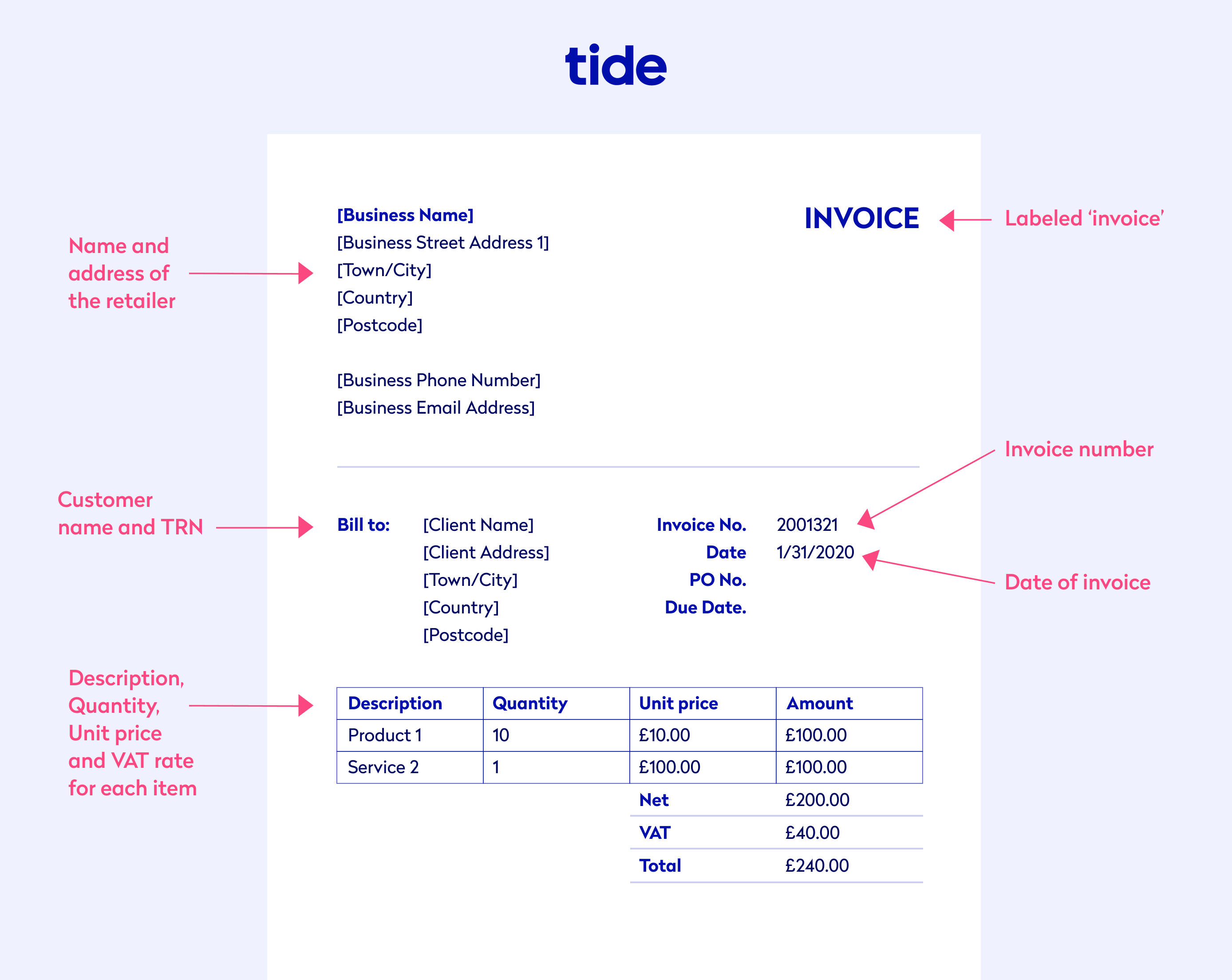

What is an invoice?

An invoice is a document sent by the provider of a service or product to the purchaser. The invoice works as a verification of the agreement between buyer and seller, establishing an obligation to pay on the part of the purchaser.

Be careful not to confuse an invoice with a receipt or a purchase order, as these are all documents that are similar but designed for specific use cases. Also, be sure to understand whether or not you need to include VAT on an invoice and if so, how exactly to do that.

To learn more, read these three helpful guides:

- The difference between an invoice and a receipt

- The difference between purchase orders and invoices

- What to include on your VAT invoice

Here are four tips to make invoicing and getting paid a breeze.

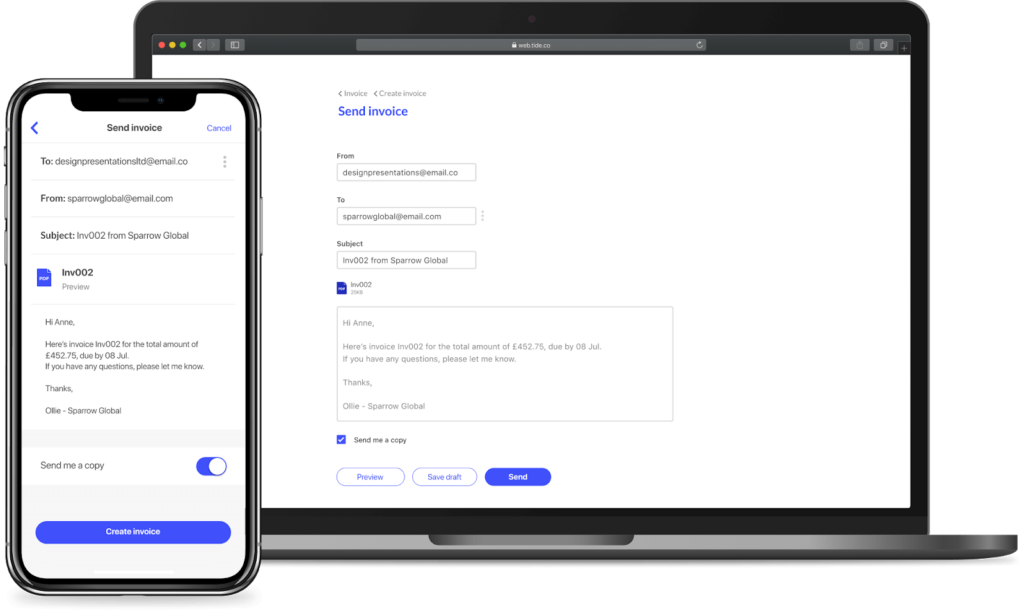

Automate your invoicing

When customers receive invoices as PDFs via email, they have to take extra steps to coordinate payment. With Tide’s online invoicing, you can easily send personalised invoices that customers can pay with the touch of a button.

Get professional-looking invoice templates that you can populate with the relevant information, including VAT, add a personal message and send from the app. Customers can pay you by the due date, and Tide will help you match the invoice to the payment.

Invoicing is a part of doing business, and staying organised will ensure fewer headaches when it comes to your small business accounting. Connect your business bank account to Tide and get free invoicing today.

Include the right details

As a minimum, your invoices should include:

- A unique identification number

- The date of the invoice

- The date the goods or service were provided (supply date)

- The client’s name (or business name)

- The client’s address

- Your name (or business name)

- Your business address

- Your contact details

- A clear description or an itemised list of products/services

- Costs for each item

- VAT amount (for VAT-registered businesses)

- Total cost/amount owed

- Your preferred payment method

You can include your BACS or account and sort details at the bottom of the invoice.

Establish payment terms

Your payment terms and policies determine when and how you’ll be paid. If you’re a freelancer, you should discuss this with your clients and set expectations as you establish a relationship. This way, they won’t be surprised when they receive an unexpected bill.

Below are four of the most common payment terms. Choose one that works best for your business model:

- DOR or Due On Receipt. Ensures your invoices are paid on time since the money can come to your account instantly.

- PIA or Payment In Advance. This is a payment that’s made ahead of schedule for your products and services.

- EOM or End Of Month. The payer must issue payment within a certain number of days following the end of the month.

- COD or Cash On Delivery. This means goods will be paid for on delivery.

- 7, 14 or 30-day payment terms. Payment is expected within the set timeframe.

Prepare for late payments

At some point, you’re likely to come across a client who will fail to pay you on time. This can be a huge issue for a small business trying to make ends meet.

You can extend their deadline or suggest a payment plan to make it easier on their own cash flow. You could also implement late penalty fees when the invoice goes past the due date to prevent it from happening again.

5. Set up a bookkeeping system

You can use spreadsheets or free bookkeeping tools to track your business expenses, as well as goods and services sold on a monthly basis.

However, if you want to make your bookkeeping as easy as possible, a subscription-based accounting platform will automate various tasks for you. The extra productivity you gain should justify the investment, and most tools have pricing tiers to suit different business needs.

6. Calculate your business tax

Many small business owners feel overwhelmed by the burden and complexities of small business accounting.

Filing your tax return can be a complicated and scary prospect. But as long as you do it on time you’ll be fine. Even if you do miss a deadline, it can be easy to fix by letting HMRC know of your circumstances.

Depending on the nature of your business, there may be different types of tax you’ll need to pay.

How to track your company records

If you’re not ready to invest in accounting software, you can use free alternatives to track your business expenses, as well as goods and services sold on a monthly basis.

If you want to make your bookkeeping as easy as possible, an accounting platform like Xero, QuickBooks, Sage, or KashFlow will automate various bookkeeping tasks for you.

How to calculate your tax if you’re a Sole Trader

- Work out whether your income is taxable or not

- Work out how much of your income is above your personal taxable allowance

- Work out at what rate your income is taxed

- Consider whether you can deduct anything from your tax bill

If you are registered as a Sole Trader, you must pay Income Tax through HMRC’s Self Assessment tax return.

How to calculate your tax if your company is registered as a Limited Company

If you’re running a Limited Company, you must pay Corporation Tax through HMRC’s Company Tax Return.

Corporation Tax is like Income Tax for companies, but the difference is that companies don’t have a personal allowance. This means that as soon as your business starts making a profit, you need to start paying Corporation Tax at the Corporation Tax rate (unless you’ve previously made a loss).

Remember, a good accountant will help you calculate all this for you. However, as a business owner, it is useful to know how everything works.

The Making Tax Digital program came into effect in 2019 with the intention of simplifying the tax return process. Learn what it means, why it is happening and who it impacts by reading our guide to Making Tax Digital.

7. Check if you need to register for VAT

Regardless of your business structure, you must register for Value Added Tax (VAT) if your annual turnover (sales) is £85,000 or more. Registration remains optional if your turnover is below that threshold.

That means you’ll charge your customers at the 20% rate of VAT, which means adding 20% to your invoices and keeping this amount aside from what your customers pay you.

You’ll then be able to reclaim any VAT you have paid on business-related purchases and expenses. You must also pay the net amount of the two over to HMRC. VAT returns and payments are due on a quarterly basis.

Stay organised for easy accounting

Managing your small business accounts isn’t as complicated as you might think. The more organised you are, the easier it is to keep on top of your books.

Of course, getting help from a chartered accountant can make life much easier. Ask some fellow entrepreneurs who they recommend and be sure to find someone who understands and cares about your business.

Photo by Brooke Cagle, published on Unsplash