VAT invoice requirements: Information you must include

An invoice is an essential business tool for keeping track of your income and expenditures and managing cash flow. If you’re a VAT registered company, you’ll need to provide and record VAT invoices.

An invoice is an essential business tool when it comes to keeping track of your income and expenditures and managing cash flow. If you’re a VAT registered company, you’ll need to provide and record VAT invoices.

Compared to a standard invoice, a VAT invoice is more complicated. As well as the general information you would include on a regular invoice, you’ll also need to have the following on your VAT invoice:

- The unit price (for taxable goods and services that are not exempt or zero-rated)

- The rate of VAT charged

- The total amount payable either including or excluding VAT (depending on the VAT invoice type)

- A VAT registration number

In this article, we’ll cover all the information you may need to include in your VAT invoice, depending on the type of invoice you use (we’ll cover all three choices in the UK). We’ll also show you how to store and manage your VAT invoices to avoid running into any trouble with HMRC.

Top Tip: Understanding the basics of VAT will help you determine whether you need to register for and charge VAT to customers and other businesses. To learn more about what value-added tax is, how to register for VAT and VAT exemptions, read our detailed guide to everything you need to know about VAT 📑

Table of contents

- Do VAT invoice requirements differ by company type?

- Types of VAT invoices

- How to reflect foreign currency transactions on a VAT invoice

- VAT invoice requirements for cash accounting and margin schemes

- Exemption scenarios for VAT invoices

- How to record and store your VAT invoices

- Penalties for poor VAT records

- Common VAT invoice questions

- Wrapping up

Do VAT invoice requirements differ by company type?

The invoice rules differ ever so slightly depending on your company type.

If you’re a sole trader, you must make sure that your VAT invoices include your name and the business name you’re using. You’ll also need to include an address where HMRC can deliver legal documents to you if you are using a business name.

Limited companies must include the full trading name or company name as it appears on your HMRC certificate of incorporation. As the limited company owner, you can choose to put your directors’ names on your invoices. If so, you must include the names of all directors.

Types of VAT Invoices

If you’re a VAT registered business, you must start charging VAT to your customers and using VAT invoices to do so. And if you pay VAT to another VAT registered company, the only way to reclaim that VAT is by storing and recording valid VAT invoices.

There are three types of relevant VAT invoices that you may send or receive: full, modified and simplified. Most companies produce full VAT invoices, but you may be able to use a modified or simplified VAT invoice depending on your total sales amounts.

Here are the official rules:

- Full VAT invoices can be used for any sales amount

- Simplified VAT invoices can be used for amounts up to £250

- Modified VAT invoices can be used on amounts greater than £250

Here are the VAT invoice requirements for the three types of invoices in more detail.

| VAT invoice requirements | Full | Modified | Simplified |

| A description of the goods or services supplied (including quantity) | ✔️ | ✔️ | ✔️ |

| The invoice date or date of issue | ✔️ | ✔️ | ✖️ |

| The supplier’s name or business name and address | ✔️ | ✔️ | ✔️ |

| Supplier VAT registration number (obtained from HMRC) | ✔️ | ✔️ | ✔️ |

| Date of supply for goods or services (sometimes the same as the date of issue) | ✔️ | ✔️ | ✔️ |

| A unique invoice identification number | ✔️ | ✔️ | ✔️ |

| Unit price or prices | ✔️ | ✔️ | ✖️ |

| The customer’s name and address | ✔️ | ✔️ | ✖️ |

| Total amount owed excluding VAT | ✔️ | ✔️ | ✖️ |

| Total amount of VAT | ✔️ | ✔️ | ✖️ |

| Price per item, excluding VAT | ✔️ | ✔️ | ✖️ |

| Rate of VAT charged for each item | ✔️ | ✔️ | ✔️ |

| Rate of discount per item | ✔️ | ✔️ | ✖️ |

| Total amount owed including VAT | ✖️ | ✔️ | ✔️ |

Full VAT invoices

A full VAT invoice is the standard option for VAT registered companies selling taxable products or services. This invoice type can be used for any sales amount; therefore, when in doubt, use this format.

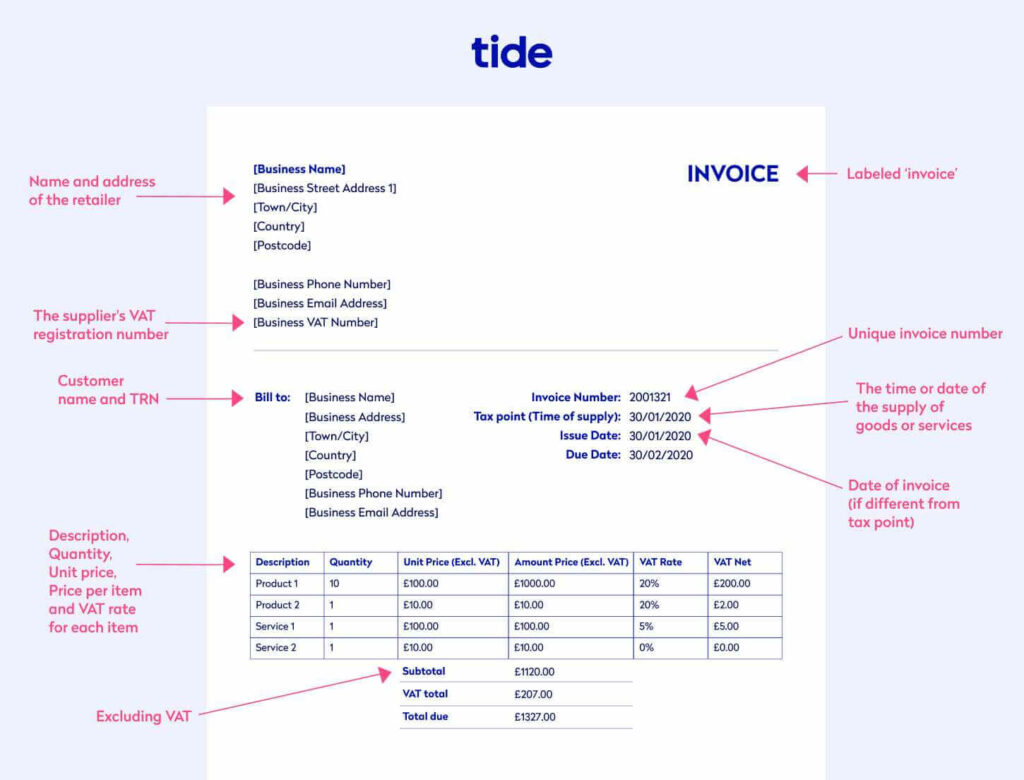

Your full VAT invoice must show:

- A description of the goods or services supplied (including quantity)

- The invoice date or date of issue

- The supplier’s name or business name and address

- Your VAT registration number (obtained from HMRC)

- Date of supply for goods or services (sometimes the same as the date of issue)

- A unique invoice identification number

- Unit price or prices

- The customer’s name and address

- The total amount owed excluding VAT

- The total VAT amount

- Rate of any discount per item

- Price per item, excluding VAT

- Rate of VAT charged for each item

Here’s an example of what a full VAT invoice looks like:

If you’re not sure how to create a full VAT invoice, use our free online full VAT invoice template to get you started.

Modified VAT invoices

Similar to a full VAT invoice, modified VAT invoices contain much of the same information. These invoices can be used for taxable retail supplies that total a value of over £250.

On the modified invoice, you must include all the same information required on a full VAT invoice except that you must show the VAT inclusive total instead of the VAT exclusive total. To use a modified invoice, your customer must agree to display VAT inclusive rather than VAT exclusive amounts.

Here’s an example of what a modified VAT invoice looks like:

If you’re not sure how to create a modified VAT invoice, try our free online modified VAT invoice template.

Simplified VAT invoices

A simplified VAT invoice is a reduced version of the full VAT document. You can use these invoices when selling goods or services that total a value of under £250.

Your simplified VAT invoice must include:

- A unique invoice identification number

- The supplier’s name and address

- The supplier’s VAT registration number

- A description of the services or goods supplied

- The time or date of the supply of goods or services

- the rate of VAT charged for each item

- The total amount including VAT

Here’s an example of what a simplified VAT invoice looks like:

If you’re not sure how to create a simplified VAT invoice, use our free online simplified VAT invoice template to get you started.

Top Tip: Creating standalone invoices makes sense when you’re starting out, but as your business grows, so will the number of invoices you need to manage. Desktop and mobile invoicing solutions give you greater flexibility and security. Read more about how Tide invoicing can save you time and money 💰

VAT invoice requirements for cash accounting and margin schemes

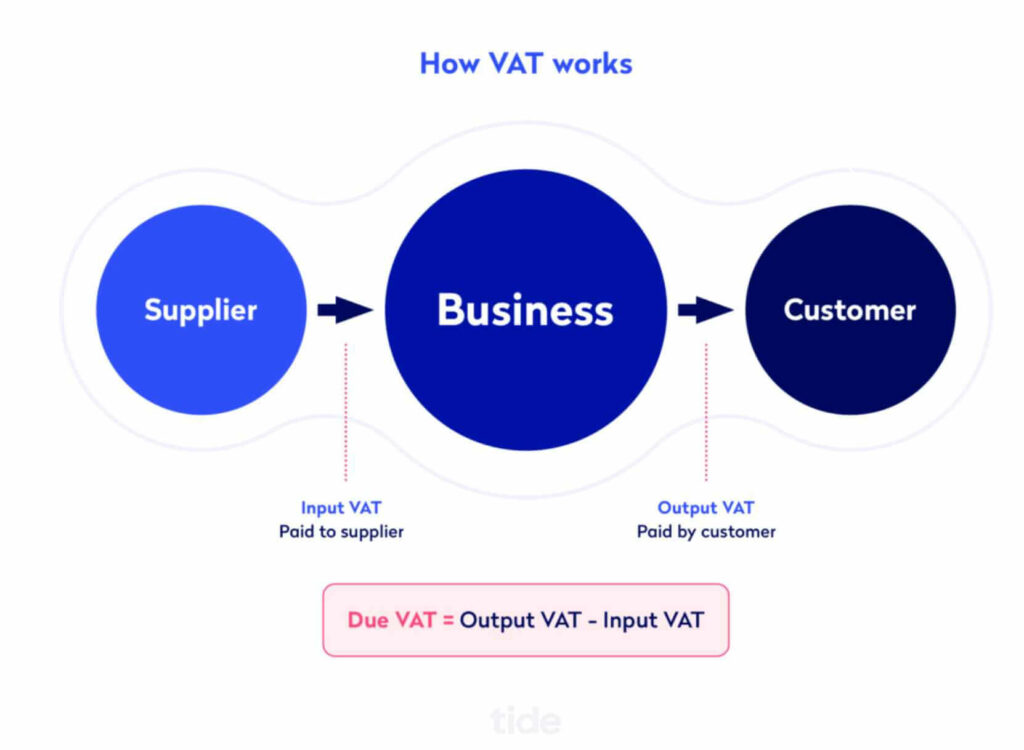

If you use the cash accounting scheme, the rules for VAT invoices are slightly different. Usually, the amount you pay to HMRC for VAT is the difference between your sales invoices (output tax) and purchase invoices (input tax).

With the cash accounting scheme, you’ll need to stamp each invoice with the amount of cash paid and the date of the payment. Check with an accountant if you’re unsure of the VAT invoice requirements for cash accounting programmes.

If you’re using the margin scheme, your VAT records will include a VAT account with a stock book that tracks each item sold under the margin scheme, and you will need to track each item sold individually. You will also need copies of purchase and sales invoices for every item.

To claim the VAT back from a margin VAT invoice, you’ll need an invoice from the seller that dates when you bought it.

Exemption scenarios for VAT invoices

You may not need to send an invoice for every transaction. For instance, a VAT invoice isn’t necessary if your invoice is for exempt or zero-rated sales in the UK.

That’s because some items and services aren’t subject to VAT. Examples include health services, donations made to charities, insurance and postage services or stamps.

Other scenarios that affect VAT invoice requirements include:

- When you’re gifting goods to someone

- If you’re selling goods under the second-hand margin program

- When your customer operates under the self-billing arrangement

Remember that the VAT invoice requirements when charging customers from an EU member state may differ depending on what you’re supplying.

Top Tip: Learning which transactions are subject to VAT is tough. The last thing you want to do is charge VAT for an item or service that isn’t subject to value-added tax. To learn more about which purchases don’t qualify for a VAT invoice, read our complete guide to VAT exemption 📒

How to record and store your VAT invoices

All business owners need to store and record their invoices correctly to reduce the risk of any issues with HMRC. The government requires you to maintain your VAT invoices for at least six years. If you use the VAT MOSS service, you’ll need to keep records for ten years.

You can keep your VAT records on paper, but it’s worth making sure you have digital copies of your VAT returns and information. Creating electronic invoices using online bookkeeping software is a quick and easy way to create digital records of your VAT invoices. If your taxable turnover goes above £85,000 and you’re required to apply for VAT registration, you will need a digital record of information needed for a VAT return anyway.

HMRC can visit your company at any point to inspect your record-keeping efforts. If you lose a VAT invoice or the document becomes damaged, you’ll need to create a duplicate (marked “duplicate”). If your records aren’t in order when HMRC assesses them, you risk severe penalties.

Top Tip: Purchase orders need recording alongside your standard VAT invoices, so ensure that you understand both documents to perfect your invoicing strategy. To learn more, read our guide to the difference between a purchase order and an invoice 🔎

Penalties for poor VAT records

HMRC can check your records at any point and, to inform you of an impending check, HMRC will write to you and ask you to phone them. During the phone conversation, you’ll be asked questions to determine how well you’re keeping your records. The phone call will usually last up to 15 minutes.

From your replies to HMRC’s questions, your officer will assess whether you can submit an accurate return using your records. You will learn during the call if you need to prepare for any further action. If HMRC believes you need assistance with your VAT records, they’ll inform you and provide resources to help.

If your VAT invoices are suitable, your VAT officer will inform you and the inspection will end. If your record-keeping is inadequate, HMRC will give you a chance to bring your records up to standard. You can hire an accountant or bookkeeper at this point to help you find a different method of record keeping.

Within three months of your original VAT check, HMRC will follow up to recheck your records. If you have improved your record-keeping, you won’t have any unpleasant surprises during the inspection. However, if your records still aren’t satisfactory, you will receive a penalty. If you’re in your first year of trading, the penalty is £250. After the first year, the penalty increases to £500.

It’s also worth noting that you should never neglect VAT invoice requirements intentionally. Why? Because if HMRC learns you have deliberately not followed the requirements or destroyed information, your penalty can increase. The penalty can rise to £1,500 (if some records are destroyed) or £3,000 (if several records are missing).

If your VAT invoices aren’t suitable, HMRC will arrange an inspection in two years to make sure they improve. Any issues with your records during the second check will attract a second fine.

HMRC may also decide your tax needs auditing. This may happen if HMRC notices issues with invoice number repeats, inconsistencies in the quantity and type of item on invoices or any other tax point in your records.

Top Tip: Most VAT-registered businesses try their best to keep accurate and up-to-date VAT records. But despite our best efforts, mistakes can occur. To reduce your chances of having to adjust your records, read our guide on how to avoid and rectify common VAT mistakes ✅

Common VAT invoice questions

What is a unique identification number?

Unique identification numbers are sequential numbers that you cannot repeat. They are crucial for valid VAT invoices. You can use a different unique invoice number for each customer, as long as the invoices’ sequence is unique. You can also use customer prefixes in an invoice, but each prefix must be unique.

How do I reflect foreign currency transactions on a VAT invoice?

If you’re supplying goods or services in the UK and you issue VAT foreign currency invoices, you will need to show the amount of VAT payable in pound sterling on your invoice. You will also need to provide an English version of any receipt within no more than 30 days when requested by a VAT officer from HMRC.

How do I convert a VAT invoice for a foreign customer to pound sterling?

There are several ways to do this. You can

- Use the European Central Bank rate

- Use the market selling rate at the time of supply for your invoice

- Use the HMRC period rates of exchange (rates are consistent for each calendar month)

- Apply to HMRC to use different methods of exchange (such as the PayPal exchange rate)

There are different rules for those using the Tour Operator’s Scheme and those selling products supplied outside of the UK.

Wrapping up

To send and record accurate VAT invoices, you’ll need to ensure that your invoices include all required information. Even the smallest mistake on a credit note or your invoice details could lead to VAT penalties and subsequent headaches for your business.

If you’re VAT registered, Tide’s powerful business current account features will help you stay on top of your VAT. Once you open a Tide account, you can sign up to our Tide Accounting software to get paid faster, manage your bills, track business performance and submit your VAT returns.

Sign up for your free business bank account today to get started.

Photo by Helena Lopes, published on Unsplash