What is an invoice and how do I raise one? A guide to getting paid

Running a business can be full of exciting activities, from growing your client base with fun marketing ideas to finding new members to join your team.

But one not-so-glamorous side of working for yourself means you’re responsible for administration duties, including invoicing.

In this guide, you’ll find out exactly what an invoice is and why you need them. We’ll also show you a bullet-proof invoicing process to raise them and make sure you get paid on time.

Table of contents

- What is an invoice?

- What’s included in an invoice?

- Types of invoice

- How to create an invoice

- How to ensure an invoice is paid on time

- Avoid these common invoicing mistakes

- Expert insights

- Make life easier with a streamlined invoicing process

What is an invoice?

An invoice is a document issued by a seller to customers, asking for payment for goods or services rendered. It’s presented to the customer before or after the transaction has taken place and establishes an obligation to pay from the buyer.

Invoices act as a legal document that seals the agreement between seller and buyer. From an accounting perspective, it can’t be cancelled or removed from sales records.

If your business is registered for VAT (value-added tax), you’re legally required to issue invoices in line with HMRC requirements. We’ll cover this in more detail later.

Top Tip: Invoicing is an important part of the bookkeeping and accounting process for any business as invoices record transactions. Here’s your full guide to small business accounting 💡

What is an invoice used for?

Invoices are of high value to both your business and your customers.

They allow you to:

- Get paid promptly. An invoice provides an opportunity to outline, in detail, the full extent of the services provided. This helps to ensure you get paid on time and avoid underpayment. It also helps clients to stay organised regarding what they owe you and when, as you set a deadline for the payment and charge a late fee where appropriate.

- Provide evidence in case of an audit. All businesses are liable to be audited, regardless of how well you report your revenue. With an organised, sequenced record of services provided and income received, your auditor will be confident in your legitimacy.

- Maintaining records. A detailed sales invoice acts as a legal record of sale. In the event of a customer failing to pay or not paying the full amount, the document demonstrates to both parties and the court that an order was fulfilled, with transaction dates and total costs.

- Payment tracking. Sales invoices help both buyers and sellers keep track of the money going in and out of their businesses. This makes it easier to manage cash flow.

- Streamlined tax filing. Invoices help businesses calculate and report accurate incomings and outgoings to ensure they pay the appropriate taxes.

- Business intelligence. As all invoices contain the same or similar types of information, they act as a form of standardised data that helps businesses understand customers’ buying patterns. For example, if the average “units ordered” across all invoices regularly increases in October and falls in January, it suggests buyers like to stock up for Christmas. The seller can adjust its marketing strategy to account for this preference.

Given how easy invoices are to create and issue, using them is definitely worthwhile. Just be sure to include all the right information to make the payment and record-keeping processes for you and your customer as simple as possible.

Customers will expect an invoice when they buy from you. Failing to provide one could make your business look less professional and stop customers from making repeat purchases.

What’s included in an invoice?

Whether you’re creating invoice templates via Google Docs or Excel, raising them in your online accounting software or straight from the Tide app, the required information is still the same. Let’s run through the elements your invoices must include:

- A reference number. This will work as a unique identifier. This is especially useful when discussing payments and sales invoices with accounts payable teams.

- Your details. Your business name, trading address and contact information. For limited companies or LLPs, you’ll need to include your Companies House registered number and address. For sole traders, you’ll need to include your name and the business name you trade under (if you use one).

- Your customer’s details. The name, business or company name (if applicable), contact information and address of the customer you’re invoicing. In some cases, you may also want to identify other people, such as your contact at the business or the person who led your project.

- The date of the invoice. Include the date the invoice was raised.

- Items sold and charged for. Give a clear description of what you’re charging for. Include the name of the product or service, quantity (or time for services) and rate (per item or per hour).

- Payment terms. You can offer your customers different payment methods, such as monthly instalments or discounts.

- Shipping terms. If you ship physical products, include whether you (the seller) pay for the shipping.

- Terms of sale. The date the customer must pay by. This could be upon receipt of your invoice or 30 days later depending on your needs and preferences.

What is an invoice address?

An invoice address is the same as the billing address. It’s the name and address of the person or company who purchased your services or products, and is what will appear on the document.

So, what is the difference between an invoice address and delivery address? The invoice address is where an individual client lives or location of the company being billed. The delivery address is where goods or services are delivered to.

Take Ollie as an example. He owns Pophams Bakery, a pastry and coffee shop in London made for the Instagram age.

Let’s assume that a company has hired Ollie to cater for an event. When Ollie sends an invoice, he’ll use the registered office as the invoice address. He might also include the venue as the shipping address for his services.

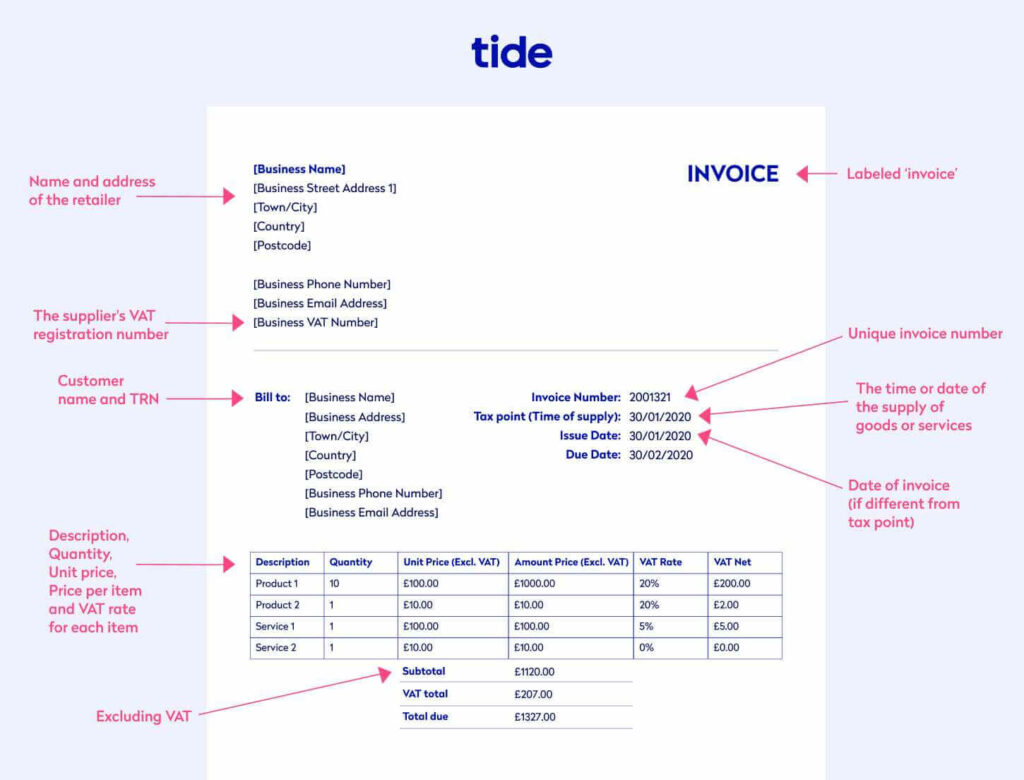

How to write an invoice if you’re VAT registered

VAT registered businesses must issue VAT invoices. For each description of goods or services, you need:

- The unit price (see here for exceptions)

- The rate of VAT charged

- The total amount payable, excluding VAT

Top Tip: On your VAT invoice, you also need to include identifiers such as your VAT registration number, date of supply for goods or services, a unique invoice identification number, and more. Plus, depending on the sales amount, you can choose to issue either a full, simplified, or modified VAT invoice. To learn more, read our complete guide to VAT invoice requirements 🔍

Here is an example of a full VAT invoice:

Upon payment, the invoice number should be included on the sales receipt. It must also be matched against the transaction in your accounting software.

How invoicing works: The process

The invoicing process is straightforward for most businesses. It begins when you receive an order and finishes when payment reaches your bank account. That could take a few days, months or longer, depending on your payment terms.

The process is similar for most businesses, whatever the product. Here’s an example of what it might look like:

- Receive an order or agree to a job

- Deliver the requested service or product

- Create an invoice

- Send the invoice

- Chase payment or take legal action (if necessary)

- Receive payment

- Send a receipt

When you send the invoice, the date by which you expect to be paid should be clear to the buyer. If the buyer fails to pay on time, you may need to chase or, as a last resort, take legal action. These steps will lengthen the process.

Types of invoices

Depending on your industry, the range of clients you serve and the products you offer, you’ll most likely produce a few different types of invoices.

With that in mind, it’s important to understand the function each type of invoice serves. Here, we’ll outline and explain all of the possible invoices you may need to create for your customers. You’ll also learn the difference between a regular sales invoice and a commercial invoice.

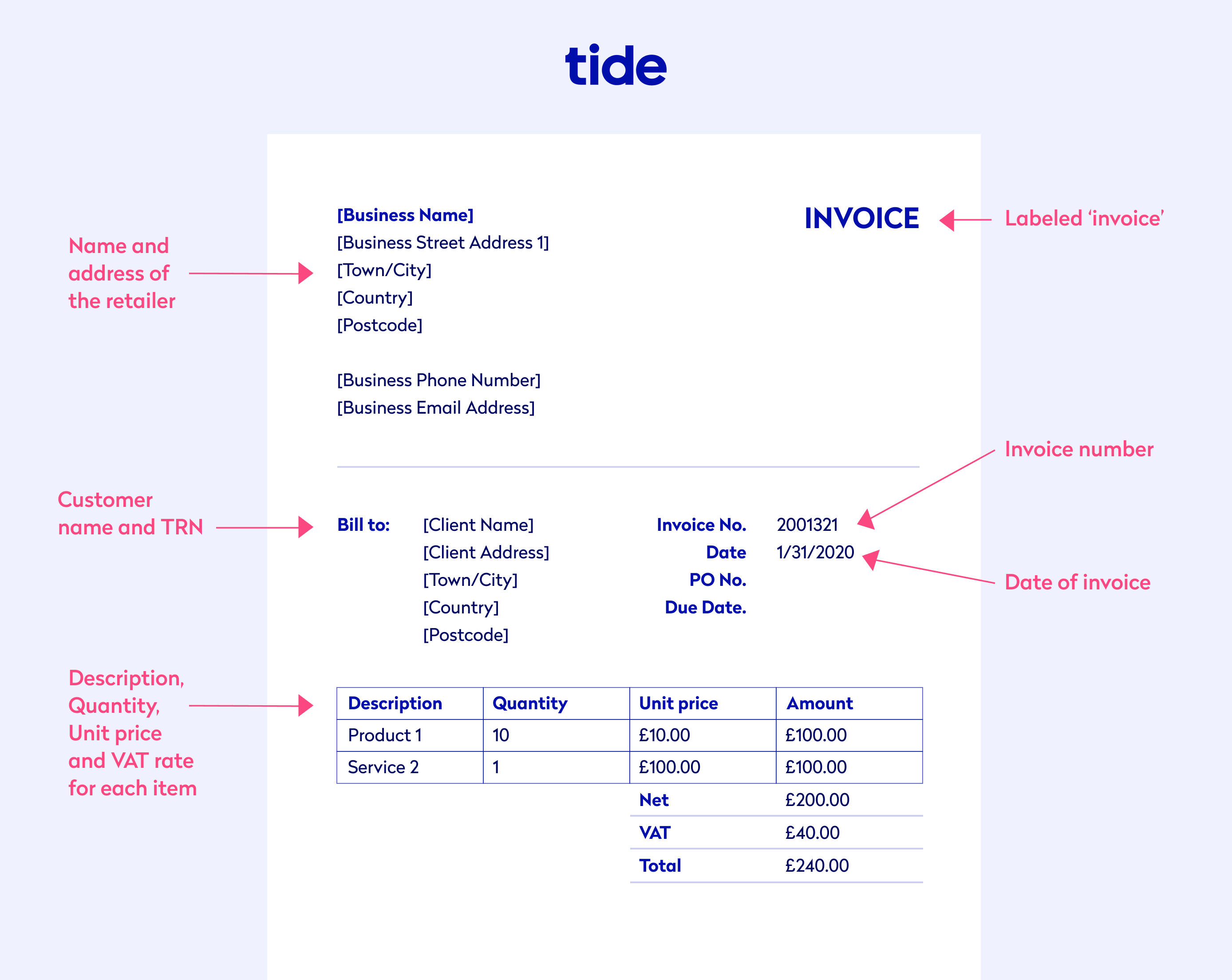

1. Final invoice

Also known as a standard invoice, the final invoice template is used to bill a customer once you have completed your work. This invoice will provide:

- A list of provided products or services

- The total cost (including a breakdown of VAT if you are VAT registered)

- Acceptable payment methods

- A payment deadline

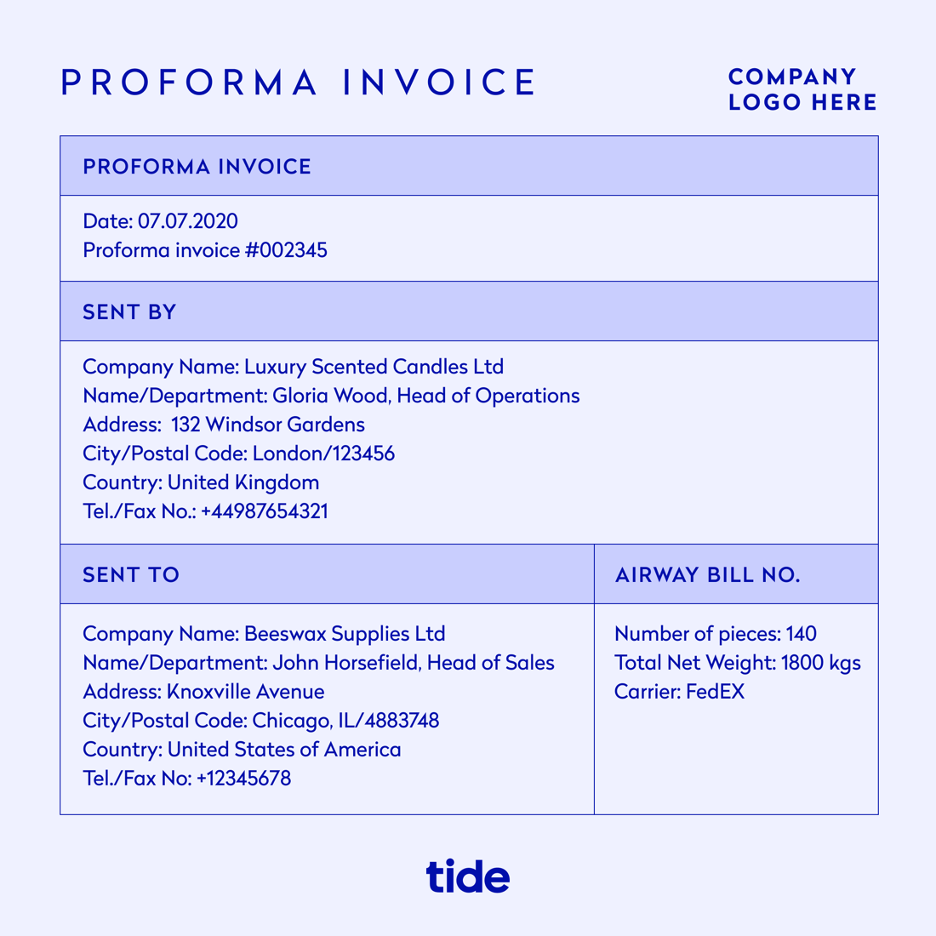

2. Proforma invoice

In many cases, a sales invoice is issued after the delivery of a product or service. However, buyers occasionally prefer an estimate before going ahead with a purchase order. This helps them to budget appropriately.

A proforma invoice is the solution to this request. This type of invoice outlines the estimated cost of the sale but does not serve as a final payment request.

While a proforma invoice is subject to change, it provides an accurate forecast of the total charge for the product or service.

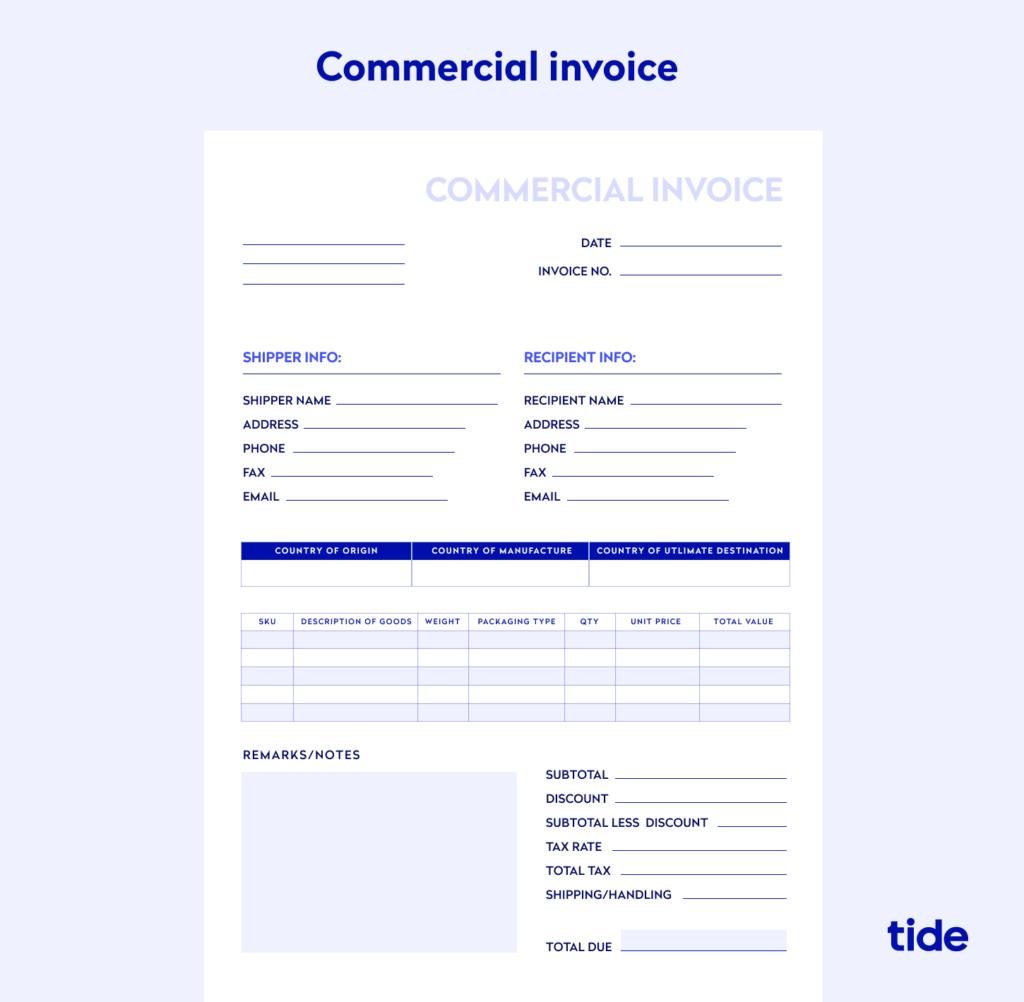

3. Commercial invoice

Businesses must issue a commercial invoice when requesting payment for products sold internationally.

In order to satisfy shipping requirements, a commercial invoice must outline:

- Shipper and consignee details

- Countries of origin and destination

- Package format, weight and volume

- Shipping arrangements

- All required signatures

Top Tip: Commercial invoices are analysed by customs officials to control imports and ensure the right taxes are paid. Complications from inaccurate commercial invoices can result in delays, cancelled shipments or legal action. Learn how to raise them correctly in our guide to commercial invoices 🌎

4. Interim invoice

An interim invoice helps businesses tackle the issue of billing for large, long-term projects.

If a project will span over the course of six months, an interim invoice allows you to split the cost into six smaller payments, invoiced at a specific date every month.

This method ensures monthly cash flow, and reduces the risk of not receiving payment for your hard work.

5. Recurring invoice

A recurring invoice doesn’t differ from a standard sales invoice in presentation and is perfect if you offer subscriptions or charge a fixed monthly fee for a service.

Using automated invoicing tools, you can send a recurring invoice on the same date every month. This saves you from needing to manually create identical invoices (eg the same amount, for the same client) every month.

6. Credit invoice

Also known as a credit memo, a credit invoice is issued when your business owes money to a customer.

This typically happens if:

- Products arrive damaged

- The wrong items are sent

- The customer is overcharged

- The invoice isn’t fulfilled

- A customer files for a refund

In most cases, a minus will precede the total figure of the credit invoice, indicating that the business will issue a reversal payment.

7. Debit invoice

A debit invoice, also known as a debit memo, works similar to a credit invoice but for the opposite purpose.

If you find that you have undercharged for a product, or worked more hours than previously indicated on your invoice, a debit invoice allows you to charge for extra costs.

Both of these invoices allow you to make adjustments in scenarios where a client has been over or undercharged.

8. Timesheet invoice

A timesheet invoice allows you to bill by the hour.

Common professions known to use timesheet invoices include:

- Lawyers

- Accountants

- Consultants

- Counsellors

- Freelancers

Timesheet invoices will often include a breakdown of the client’s hourly rate, services completed, hours and days worked and the period the work was completed in.

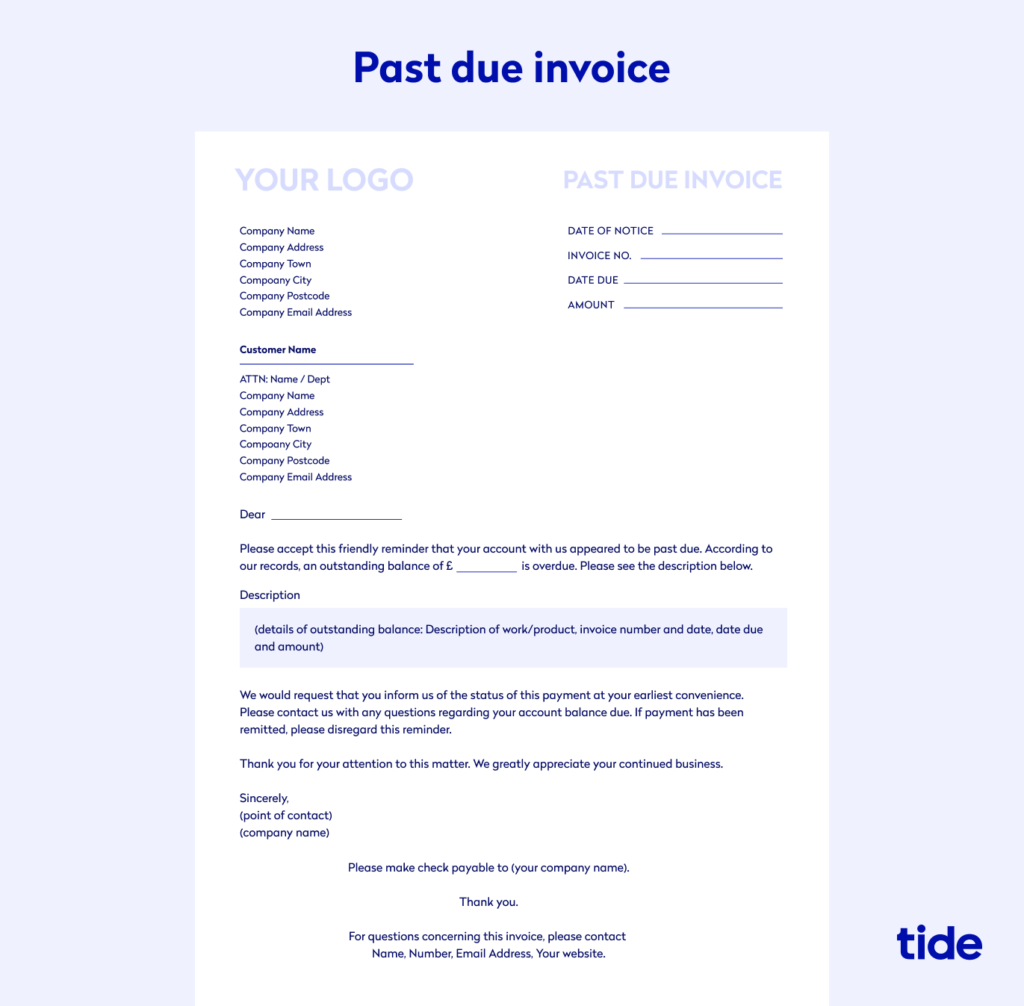

9. Past due invoice

If a client is late with a payment, a past due invoice is a reminder of the money owed.

The format will be nearly identical to your regular sales invoice template, however, you can add appropriate late fees to the amount owed.

How to create an invoice

Depending on your accounting system, there are several ways you can create, raise and send invoices to your clients.

Tide offers a free invoice generator. Simply connect your existing business bank account to Tide and you can:

- Create and send professional invoices on the go

- Customise with your logo

- Add personal messages

- Add VAT

- Match payments to invoices

- Mark invoices as paid

You can also raise them within your existing accounting software. Most platforms allow you to create and send branded sales invoices. Clients simply need to click the “pay” button, enter their billing details and your invoice will be paid.

Alternatively, you can create your own invoice template using a word processor.

Top Tip: Once you’ve created your first invoice, it’s easy to repeat the process using new information. With the right tools, you can even automate some invoicing activities, like invoice matching and issuing reminders. Learn how to get paid on time in our step-by-step guide on how to create an invoice 📃

How to ensure an invoice gets paid on time?

In the words of Paul Uppal from Small Business Commissioner:

“A healthy cash flow is the lifeblood of any small business. Getting your credit and payment process right from the start is crucial if you want to build and grow your business.”

Paul Uppal, Small Business Commissioner

Chasing payment, especially when work has been delivered, is a waste of your resources and time. According to a Xero study, late payments cost UK small businesses £684 million per year. So, how can you make sure your invoices get paid on time?

We’ve come up with five tactics you can implement to get the money that’s rightfully yours into your account as quickly as possible and handle late payments:

1. Set non-negotiable due dates

Before engaging with a client, make sure both parties have agreed on specific due dates for the delivery of work. Make these due dates clear by including them in your emails and leave no room for confusion.

2. Offer multiple payment options

Increase your chances of being paid on time by offering clients a variety of payment options designed to fit their business. This could include PayPal, bank transfer, credit card or even cash.

3. Request a deposit before starting any work

Many small business owners are reluctant to ask for deposits. However, asking for an upfront, early payment is a great way to build trust with your client and strengthen your relationship.

This is an effective way to get your client to invest in your relationship, and will help put your mind at ease so you can do what you do best: delivering high-quality work.

4. Penalties for late payments

You can also include late penalties if your client missed an invoice due date. That way, they’ll have an incentive to make the payment on time. If they don’t, you’ll be compensated for it.

Issuing penalties to clients can feel awkward, but you shouldn’t feel guilty.. You did the work, you deserve to be paid! Lay out your terms and expectations early on and send reminders as the due date approaches.

5. Set email reminders

This one can be a balancing act between coming across as aggressive and issuing friendly reminders to help clients stay organised.

Check if your invoicing software includes automated email reminders. Some platforms will offer services that send automatic reminders to pay your invoice.

If you don’t have access to auto-reminders, you can set reminders in your calendar for when you need to chase an invoice. It takes a minute to set up, but reminder emails can mean the difference between getting paid on time and a payment being late.

Here is a handy email template you can customise when you need to send reminder emails:

“Hi [Name of customer],

Just a friendly reminder that invoice [number] is now due for payment. I’d really appreciate it if you could settle it at your earliest opportunity.

I’ve attached another copy with my payment details.

Regards,

[Your name]”

Avoid these common invoicing mistakes

Sometimes, you’ll come across clients who simply lack punctuality. Knowing how to write an invoice is a major step, but collecting payments is even more important for your cash flow.

To make sure you avoid delays in getting paid, here is a list of common mistakes to look out for and (how to fix them):

Not sending your invoice promptly

The sooner you send your invoice, the sooner you’ll get paid. So don’t wait for your clients to ask you to invoice them. They’re busy, and it’s not their job to remind you. Invoicing is your responsibility as a business owner.

Sending the invoice to the wrong person

Don’t waste time by sending your invoice to the wrong person. They might disregard your email or forget to forward it to the right contact. Meanwhile, you’re left wondering why you haven’t been paid.

Avoid this by requesting the relevant contact information at the beginning of the relationship with your client.

Miscalculations

Some invoices can contain multiple items that need to be paid. This often leads to errors in calculations which can throw off the entire invoice. Another common miscalculation is taxes and fees. If you forget to include them, you may have to amend the invoice and send it again. The worst case is you’ll have to incur the cost yourself.

Double-check your invoice before sending them to your clients and use an online invoicing tool that will help you avoid miscalculations.

Using vague language

Payment terms should be included clearly in your invoice. Make sure you avoid any ambiguous language or descriptions when including item descriptions, price and quantity.

This way, there is no room for confusion. And your client will have little room to delay any payment.

💡 Expert insights

Insights author: Samantha L George, Director of Business Support and Outsourcing at BDO Drive, who help businesses of all sizes with their day to day pressures through expert advice on bookkeeping, payroll and tax.

3 top tips for ensuring clients pay on time

Getting clients to pay on time is essential for the health of any business, whether small or large, but how can you easily achieve this?

- Set your parameters – and stick to them: Step back and think about when you need to receive payment. Document it as your legal terms and conditions on sales invoices and make sure your business practices back this up; if your terms are 7 days, don’t wait 30 days to chase up overdue invoices.

- Use invoicing software to automate the task: Cloud accounting software such as Xero and Quickbooks are easy to use and can produce your invoices, on a timely basis.. And with Tide invoicing, you can create and send invoices directly from the app, and get automatically notified when they get paid.

- Build strong relationships with your clients: People don’t want to let down those they like!

What should a small business owner do if a client always pays late?

- Explore the reason: Sit down with them to discuss the situation. Are you addressing your invoices to the wrong person? Do they pay once a month and your timing always misses the cut off? A small change to when you invoice could bring payments forward one month.

- Make paying easier: Offering different payment options, such standing order, Direct Debit, etc, can help reduce late payments.

- Reset the relationship: Insist on a payment plan to bring things up to date, or request a percentage payment up front, before commencing future work. Levying a late payment interest charge is also an option. Sometimes, your client won’t change their practices for you. It’s your choice as to whether you accept that.

Make life easier with a streamlined invoicing process

By avoiding these common invoicing mistakes, you’ll improve your cash flow, make life easier for your client and free up more of your time to run your business and do what you love.

It can be easy to get overwhelmed when starting out. Keeping track and managing cash flow must be part of your daily routine if your business is growing fast.

Photo by Jan Vasek, published on Unsplash