What is a commercial invoice (and how to raise one)

Making your goods available internationally is an exciting milestone. Naturally, you want the process of shipping your products to your overseas customers to run as smoothly as possible.

This means accurately filling out a commercial invoice, which is regarded as the most important legal document surrounding international trade.

Why? Because a commercial invoice outlines the details of the transaction between seller and buyer and is meticulously analysed by customs officials to control imports and ensure the right amount of tax is paid.

Complications from inaccurately completed commercial invoices can result in delays, cancelled shipments or legal ramifications.

So, how can you ensure your commercial paperwork is in tip-top shape and your customers receive their goods in the agreed timeframe?

In this guide, we’re going to dive further into exactly what a commercial invoice is, when and how to raise one correctly and how Brexit may affect your export activities.

Table of contents

- What is a commercial invoice and what is it used for?

- How to fill out a commercial invoice

- How to avoid common mistakes when filling out your commercial invoice

- How Brexit affects commercial invoicing

- Wrapping up

- Glossary

What is a commercial invoice and what is it used for?

A commercial invoice is an important shipping document containing information about the goods you plan to send.

It allows customs authorities to understand:

- Where the package came from and where it’s going

- How to classify your goods and thus apply the applicable duties and taxes to your package

- The reason that you’re shipping the items

- How much the goods are worth

- Who is paying for the shipment and applicable taxes

- Who you are (via identifiable VAT or EORI numbers) to ensure you are a legally recognised international trader

- Precisely what is in the package, delineated by line-item descriptions, gross and net weight of each item, the total weight of the package, type of package, etc.

Note: We’ll go into more specifics on what’s included in a commercial invoice and how to fill yours out accurately in the next section.

Correctly filling out your commercial invoice will help to:

- Ensure you, the shipper, pay all required taxes and fees

- Prevent shipment delays, as accurate paperwork will help your exporter process your package quickly

- Keep you in check legally, as failure to provide accurate commercial information leaves you liable to warnings or fines (which vary in seriousness and amount)

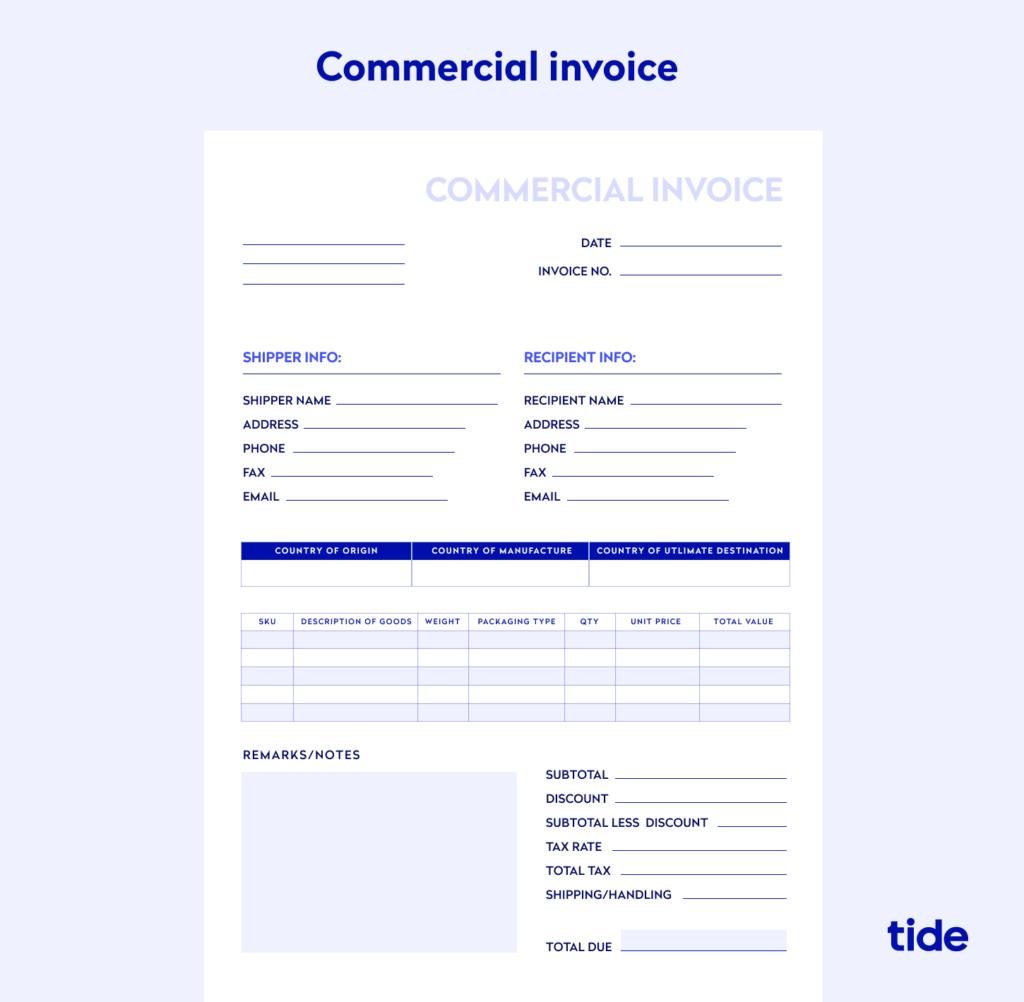

Commercial Invoice Template Example

When do I need to raise a commercial invoice?

A commercial invoice is required for any shipment that travels outside of the EU. It is used as a customs declaration and is provided by the exporter (the shipper).

In other words, every single time you ship a package from the EU to a country that is outside of the EU, you need to fill out a commercial invoice.

Note: There are some exceptions to this as certain countries, such as Gibraltar and San Marino, are members of the EU but do not fall within the EU customs territory. To see a complete list of the EU countries and certain territories wherein VAT and export rules either do or do not apply, visit the European Commission Taxation and Customs page.

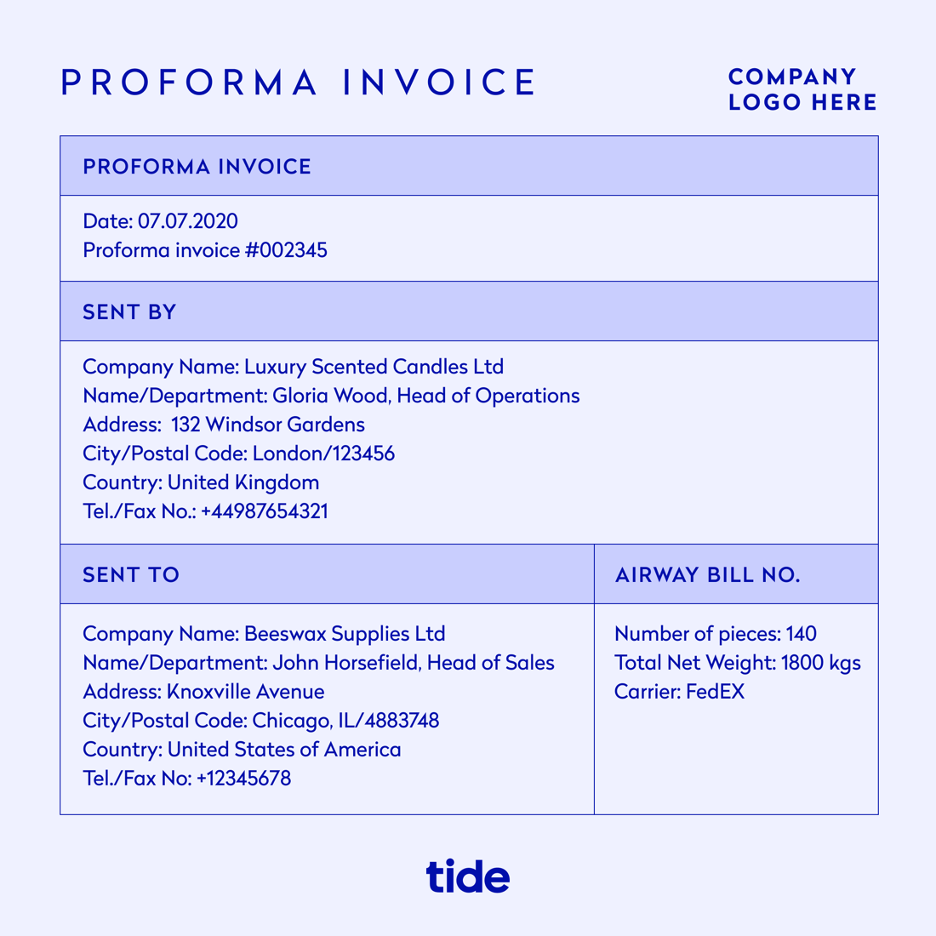

What’s the difference between a proforma invoice and a commercial invoice?

The purpose of a proforma invoice is to help buyers decide if they want to place an order.

A proforma invoice is almost identical to a commercial invoice; however it is not considered a final invoice. Sellers issue a proforma invoice to outline the cost of goods and services to a potential customer. This way, the buyer can see if the sale is within their budget.

Here’s what a proforma invoice looks like:

The purpose of a commercial invoice, on the other hand, is to request payment for a completed sale of goods.

Once accepted by the customer, a commercial invoice acts as a legal document and details the amount owed to the seller.

Top Tip: Before completing a sale, it’s important that you’re aware of all the different types of invoices and how they function. To learn more, read our in-depth guide to what an invoice is and how to raise them and get paid💡

Do you need to keep records of commercial invoices?

Yes, it’s essential to keep records of commercial invoices and any customs paperwork.

If you’re VAT registered, you’ll also need to record your exported goods in your VAT account. This is important, as you’ll want this information readily available when it’s time to complete your VAT return.

Top Tip: Understanding the basics of VAT will help you work out if you need to register for VAT and charge this tax to your customers. To learn more, read our detailed guide to everything you need to know about VAT 📒

How to fill out a commercial invoice

To ensure that your package makes it through customs and to your buyer, you must be meticulous when filling out your commercial invoice. If you fail to provide all relevant information, customs authorities will likely delay your shipment.

Here’s a detailed rundown of what you need to include:

Accurate product information

Provide a detailed description of what you are shipping to ensure customs authorities are aware of the entire contents of your package.

Outline each item by:

- Description of goods

- Quantity

- Net and gross weight

- Value

- HS code (we’ll describe what this is in a moment)

- Location of origin

You’ll also need to disclose the total:

- Number of items

- Weight

- Value

Additionally, you’ll need to include the type of shipment container (i.e. box, carton, etc.).

Country of origin

Customs officials must be vigilant when determining a package’s country of origin as trade agreements and import and export duties vary from region to region. Verifying the country of origin ensures the correct import duties and shipping fees are applied.

Incoterms

The International Commercial Terms (Incoterms), founded by the Intenational Chamber of Commerce (ICC) in 2020, are a global agreement on the transportation of goods. In essence, Incoterms reduce shipping confusion between international buyers and sellers by standardising rules and guidelines on a universal level.

Incoterms between parties outline:

- The point of delivery. This process defines the stage at which the shipment is transferred from the hands of the seller to the buyer, for example, “EXW” (we’ll explain these common terms in a moment).

- Transportation costs. The Incoterms determine which party pays for each stage of the transportation process.

- Insurance costs. The Incoterms decide which party will cover insurance fees for the shipment.

The various Incoterm options are updated every 10 years, with the most recent update occurring in 2020.

Here is a list of the most common Incoterms and how they work:

- Ex Works (EXW). The seller makes the goods available at a predetermined location. The buyer takes care of all transportation costs and bears the risks of bringing the goods to their final destination.

- Free on Board (FOB). The seller loads the goods onto the ship. Costs and risks are then divided between the parties.

- Cost and Freight (CFR). The seller must pay the costs to bring the goods to the port of destination. Risk is transferred to the buyer as soon as the goods are loaded onto the ship.

- Delivered Duty Paid (DDP). The seller is responsible for delivering the goods to the nominated destination of the buyer and pays all transport costs until that point.

- Delivered at Place (DAP). Here, the shipper will take care of international shipping costs, insurance and export documents and the importer will pay all customs and import duties. This is the simplest way to organise shipments. If you’re unsure which Incoterms work best for you, it’s best practice to stick with DAP.

Understanding Incoterms is vital, as they outline the responsibilities of all parties involved in a trade and are recognised by global authorities and legal agreements.

Here’s some more information to help you fully understand Incoterms:

- To see the complete list of the latest terms, rules and responsibilities, visit ICC’s Incoterms 2020 page.

- For more information about why Incoterms are important and how they work, see this detailed guide.

- To help understand how the principles of non-discrimination apply to trade, visit the World Trade Organisation’s Principles of the Trading System guide.

Do Incoterms apply to shipping services?

It’s important to note that contracts in services cannot use Incoterms, as Incoterms do not apply to the delivery of services. Buyers and sellers delivering services (such as a construction project in another country) must instead define:

- The services being provided

- The standard to which they will be completed

- How you will handle customer dissatisfaction

- How you will apply the principles of non-discrimination

HS code

Developed by the World Customs Organization, Harmonized System (HS) Codes are tariff codes so that customs authorities can correctly identify goods being imported and exported and charge the appropriate tariffs and fees.

The HS system is used by hundreds of countries, which explains why over 98% of globally traded merchandise is classified in terms of the HS.

The HS comprises more than 5,000 commodity groups and each one is identifiable by a six-digit numeric code (i.e. 0901.21). Each item in your shipment must be labelled with the appropriate HS (also referred to as commodity) code.

Where can you find your HS code?

In many cases, the original manufacturer of the items you’re shipping will be able to provide you with their HS codes.

If this isn’t an option, you can look up commodity codes on the GOV.UK Trade Tariff lookup page. Alternatively, contact your local tax authorities for assistance.

Adding the commercial invoice to your shipment

When shipping from the UK, you’ll need to provide a commercial invoice for:

- The country you’re shipping to

- The country you’re shipping from

- The customer

It’s vitally important that you:

- Secure two of the copies in a packet listing envelope on the outside of the package

- Place the third copy inside the package for the customer

Don’t forget to keep copies of your commercial invoice. These will come in handy if complications arise down the line and provide valuable information that you’ll need for your VAT return (more on this in a bit).

Additionally, ensure your package is:

- Strong with the flaps intact

- Sealed with tape suitable for shipping

- Packed with sufficient padding such as bubble wrap

Securing your package and its contents, as well as correctly labelling your shipment, will protect the integrity of the goods and ensure your package passes through customs.

How to avoid common mistakes when filling out your commercial invoice

While understanding how to fill out your commercial invoice is important, learning to avoid making common mistakes is invaluable.

Here’s where things can go wrong and how to get it right:

- Wrong contact information. Having incorrect contact information on your invoice can lead to communication difficulties. Verify contact information with your buyer before proceeding with orders.

- Wrong address. If you include the wrong address on your invoice, your shipment may end up stuck in a warehouse or delivered to an incorrect location. Double-check delivery addresses with your buyer before proceeding with the shipment.

- Inaccurate packing lists. If a customer wishes to examine a particular item, but you have incorrectly labelled your packages, they may need to search the entire shipment. Make sure each package is labelled correctly to save time and grievances.

- Incorrect classification of goods. Mistakes when applying HS codes to your items can cause shipment delays. Make sure you label each item correctly to ensure the correct tariffs are paid.

- Incorrect value. When filling in the value of goods you are exporting, use the value you are selling them for. If you’re not charging for an item (for example, you’re sending free samples), include the market price of that item.

- Incorrect currency fluctuation. Currency fluctuations can cost the buyer or seller. For example, if you charge your customer in pounds, they might not want to take the risk of paying more for their order due to currency fluctuations. Avoid this by setting the exchange rate on the day of payment, charging extra to cover potential losses or accepting payment into a foreign currency account.

- Inaccurate product description. Providing vague or misleading descriptions can lead to complaints and cancellations. The buyer must receive a detailed description of the goods and services they are paying for.

- Incorrectly packaging and labelling dangerous goods. Mislabelling hazardous goods can have disastrous consequences, especially if goods aren’t packaged and handled safely. For further information, visit GOV.UK’s shipping dangerous goods page.

- Wrongly assuming your goods qualify for free trade. If you incorrectly label your goods as eligible for duty-free treatment, you’re committing fraud. This can have consequences for both you and your customer, as they may incur extra charges on delivery of the goods. For more details, head over to GOV.UK’s trade agreements page.

Top Tip: To ensure you always have the correct information at hand for your invoices, put in place a finely-tuned process. To help, we’ve put together a guide on how to streamline your invoice process ⏳

What to do if your commercial invoice has a mistake?

If you realise you’ve made a mistake before shipping your invoice, correct the error and send it.

But if you catch a mistake after you’ve shipped your commercial invoice, you cannot amend it. That’s because it’s now considered issued and binding.

That said, all is not lost. If you’ve shipped your invoice but your customer hasn’t yet paid, you can contact them to let them know there was an error and ask if you can send an updated invoice their way.

If they have already paid, you’ll need to adjust a future invoice with a note that corrects the error.

Top Tip: If you’ve sent your invoice but the payment is outstanding it’s easy to feel stressed. However, don’t panic. We’ve pulled together a guide for how to effectively chase overdue invoices (the right way) ✅

How Brexit affects commercial invoicing

Businesses that sell internationally are no doubt confused about the implications of Brexit on their trading activities. Let’s unpack how Brexit affects international exports and what you need to do to stay compliant.

Top Tip: When selling to customers outside of the UK, you’ll also need to consider export VAT. That’s because the rate you charge your customers is determined by several factors, including if they are VAT registered and where they’re based. To learn more, read our guide to VAT rules and rates on exports 📭

UK EORI number

If you’re a UK business that exports and imports goods to and from the European Union, you’ll need an Economic Operator Registration and Identification (EORI) number. This is an identification number unique to your business.

As a result of Brexit, shippers and receivers trading between the EU and UK will require an EORI number for their respective countries.

For example, suppose you’re a UK business sending a shipment to a buyer in Portugal. In that case, you will need a UK EORI number and the business you’re shipping to will require an EORI number registered in Portugal.

Note: If you haven’t done so already, you can apply for your EORI number on the GOV.UK website.

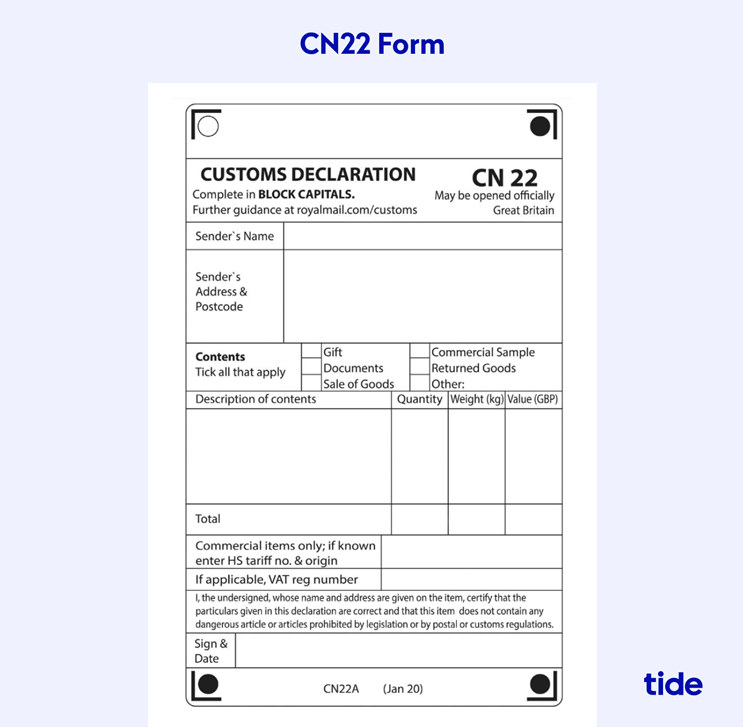

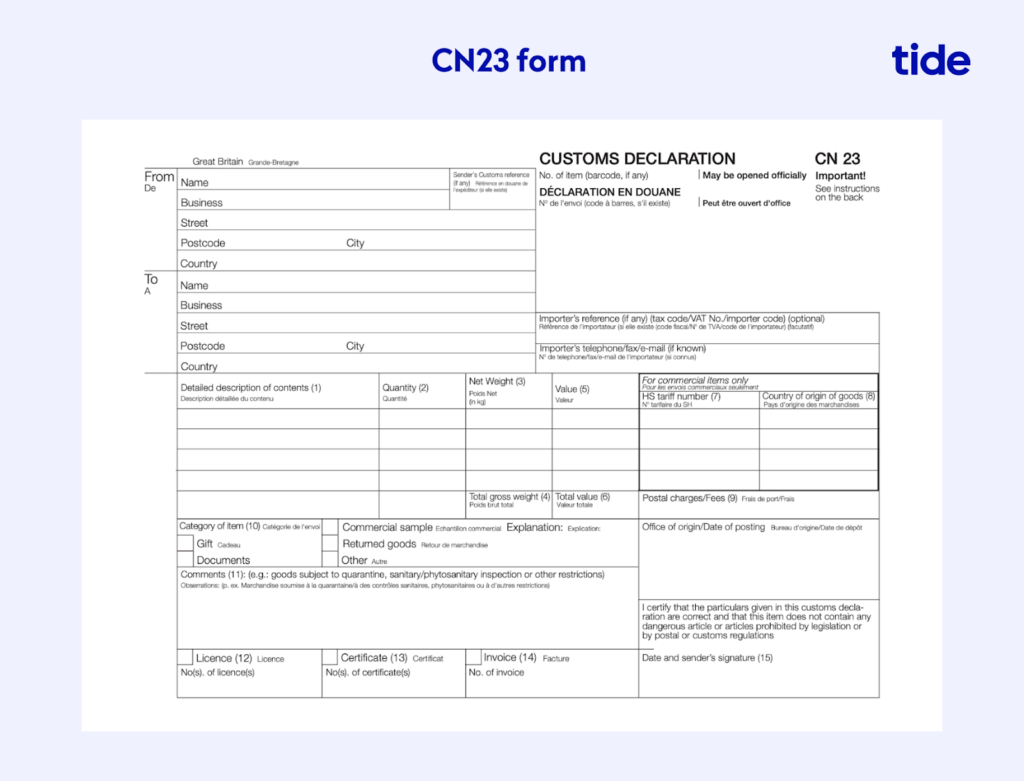

CN22 and CN23 forms

Also known as a customs declaration, a CN22 form is a customs document declaring the contents of your shipment. It is only necessary to include a CN22 form when using a postal service (Royal Mail, for example) to ship from the UK to the EU.

Brexit came into full effect on the 1st of January 2021. Since then, all postal shipments from the UK to the EU now require a CN22 or CN23 form and a commercial invoice.

Which form you need to use depends on the value and the weight of the package (which determines its monetary value). You will only ever need to use one CN form type per shipment.

A CN22 form is required for shipping goods to the EU up to the value of £270.

A CN23 form is required if the value of the goods exceeds £270.

You can obtain a CN22 or CN23 form from any Royal Mail post office branch in the UK.

Wrapping up

Your business’ survival relies on the efficient delivery of goods and services to your customers. It would be a shame to let something as trivial as incorrect paperwork interfere with your sales.

By correctly organising and filling out your commercial invoices, you’re one step closer to providing a seamless service to your buyers and a steady flow of income to your business.

Glossary

Buyer information: The full name, address and contact information of the person or company you are sending the package to

Country of origin: The country the goods originated from

Currency: The currency used for the order

Date: The date you sent the shipment

Description: A description of the goods you are sending, the material they’re made of, etc.

Extra info: Any additional shipping instructions

Final destination: The final destination of your package

Gross quantity: The total number of items to be shipped

Gross value: The total value of the shipment

Gross weight (KG): The total weight of goods including any packaging

HS code: The Harmonized System or commodity code

Incoterms: The terms of sale between the buyer and the seller

Invoice number: The invoice number for the order

Letter of credit: A letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount

Net weight (KG): The weight of goods without any packaging

Payment terms: The terms of payment between you and the seller, for example, due dates and payment methods

Purchase order number: The order number or reference number of the item

Seller information: The full name, address and contact information of the supplier (you)

Signature: All necessary signatures (including yours) to authorise the shipment

Travel arrangements: The shipping company you are working with and the route your shipment will take

Value: The value of each item

Photo by RODNAE Productions, published on Pexels