How to streamline your invoice process

An invoice is a bill that you send to customers to let them know how much they owe you for your products or services, when to pay, and how to make the payment.

There are plenty of benefits to sending invoices:

- They help your business look more professional

- They act as a concrete record of any goods or services you’ve provided

- They improve your company’s cash flow by encouraging customers to pay you promptly

As your small business grows, so will your customer base, and consequently, the number of invoices you send. To keep things organised and ensure that you get paid on time, you need to have a proper invoicing process in place.

In this article, we’ll outline an easy-to-follow invoicing process to help you streamline your bills and payments and improve your company’s cash flow.

Top Tip: Before exploring the ins and outs of how to streamline your invoicing process, you first need to understand the fundamentals of what invoices are and why they are so important to your business operation. This includes what information you must add to an invoice, what an invoice address is and strategies to avoid common invoicing mistakes. To learn more, read our detailed guide to raising invoices and getting paid 💡

Table of contents:

- Step 1: Put together a standard outline

- Step 2: Determine how to create your invoice

- Step 3: Set an invoicing schedule

- Step 4: Set your payment methods

- Step 5: Maintain a record of past invoices

- Step 6: Regularly follow up with clients

- Step 7: Hire professional help for invoice processing

- Step 8: Automate your invoicing process

- Wrapping up

Step 1: Put together a standard outline

One of the most effective ways to streamline your invoicing process is to standardise the information you’re going to include in your invoices.

Putting together a standard invoice outline will help you save hours of work by eliminating the time-consuming process of creating each invoice from scratch.

Start by jotting down the necessary information that should be included in every single invoice you create.

Here are some things you might want to include in your outline:

- Invoice reference number

- Date of invoice generation

- Client details

- Your company details

- Description of the items or services provided

- Total amount due

- Payment due date

- Payment terms

- Shipping terms

While the information above is included on most invoices, what you choose to add depends entirely on the nature of your business, products or services, and clients.

For example, you might find that in your specific workflow there’s no need to add shipping terms to your invoice if you only provide services. Or, you might need to add a new field if you’re going to charge your clients late fees for late payments, such as ‘additional payment due after deadline’.

Another advantage of creating a basic outline is it ensures you don’t leave out any important information when sending invoices to clients.

Top Tip: If you are a VAT registered business owner, you’ll need to send VAT invoices. VAT invoices include all of the standard invoice data plus more specific details depending on the type of VAT invoice you choose to use. Properly calculated and recorded invoices can influence whether or not you are eligible for a VAT refund, or if you will be charged a penalty by HMRC – so accuracy is a must. To learn more, read our guide to what information you must include on your VAT invoice 🔎

Step 2: Determine how to create your invoice

Once you have a standardised outline for your invoice, it’s time to decide how to create one.

Here are two common ways that small businesses often create invoices:

1. Spreadsheet software

Creating invoices using spreadsheet software, such as Google Sheets or Microsoft Excel, is a great way to send error-free invoices.

The biggest benefit of using software is you can add formulae to do most of the invoice calculation for you. It’s also easy to save your standardised outline as a template that you can simply edit each time you need to create a new invoice.

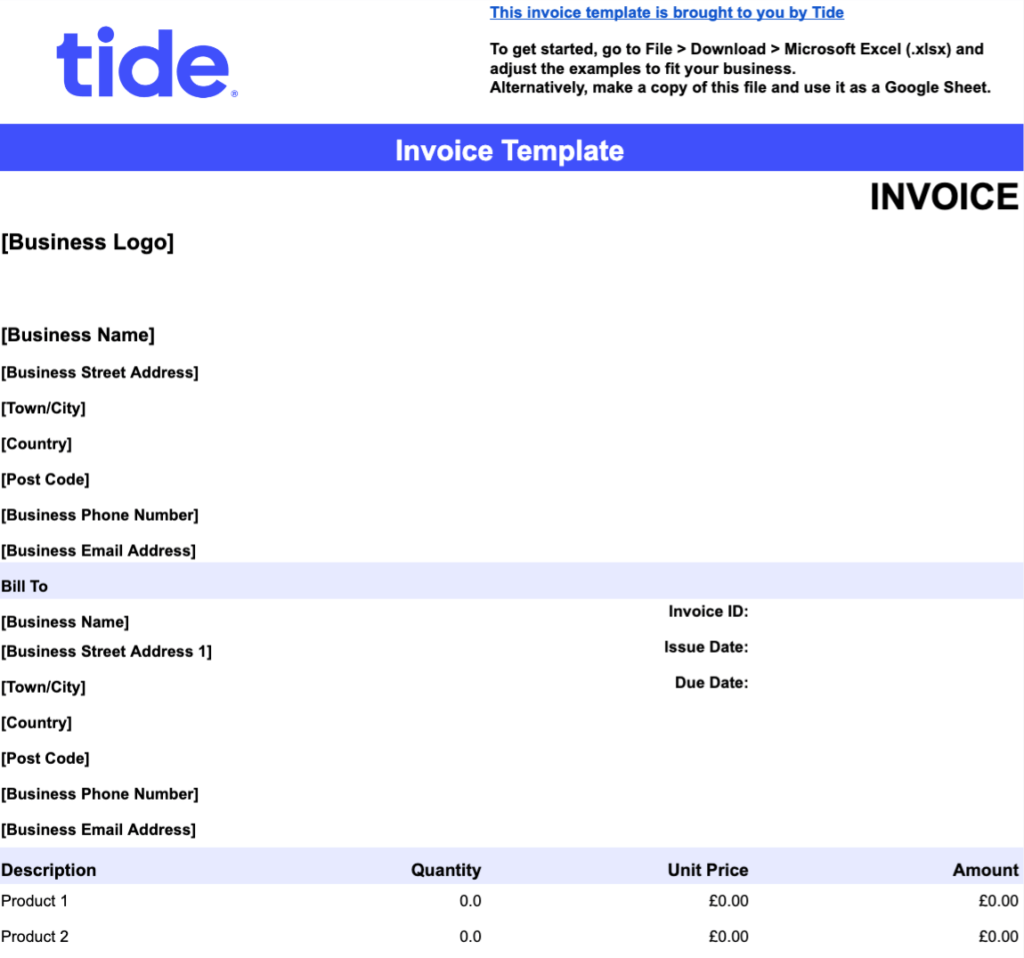

You can choose to create your own template or download one from the internet. There are hundreds of free and customisable spreadsheet templates available online.

If you prefer using a ready-made invoice template, make sure you choose one that’s relevant to your business. This will save you plenty of time as you won’t have to add or remove too many fields.

To make things easier for you, we’ve created a free invoice template that you can get started with right away.

You can customise the colours, fonts and other design elements of this spreadsheet invoice to fit your brand guidelines. Include your logo at the top to add a professional flair.

2. Invoicing tools and software

Spreadsheets are not the only software you can use to create invoices. There are tons of dedicated apps and invoicing software tools designed especially for this purpose.

Invoicing software helps you to save tons of hours otherwise spent on manually creating, managing and tracking multiple invoices at once. As 50,000 small businesses in the UK fail each year due to late payments, advanced software that automates and simplifies invoicing tasks can literally help you to stay in business.

If you’re using Tide Invoicing, for example, you can quickly create and process invoices by accessing saved customer details. The app also offers features like automatic VAT calculation to help you create more accurate invoices, as well as the ability to tie the invoice to a specific category to keep your accounts organised.

Many popular accounting software platforms, such as Xero, Intuit QuickBooks, FreeAgent and Kashflow also come with built-in invoicing tools.

Using an invoicing tool will help you save time, create professional invoices, minimise human error and avoid invoice bottlenecks. Most of these tools are fairly easy to use, which means you don’t necessarily need an accountant to make one for you.

Another advantage of using invoicing tools is they help you send automatic reminders to customers to ensure they pay you in a timely fashion.

Top Tip: If you’re a Tide customer, you’ll be pleased to know that we have integrations with many accounting software platforms. These integrations make it easy for you to feed transactions from your business bank account to your preferred accounting system every day, reducing the need for manual uploads and saving you tons of undue stress. To learn more, head over to our accounting integrations page so that you can seamlessly connect your Tide account to your accounting software today 🎉

Step 3: Set an invoicing schedule

An invoicing schedule is basically a timeline that dictates when and how frequently you’re going to be sending invoices to your customers.

A predetermined invoicing schedule will help both your business and your customers. The more promptly you send invoices, the more likely your customers will be to pay you on time.

The schedule you choose will depend on various factors, such as the type of product or service you’re selling. In some cases, the schedule may even be directed by industry standards.

Businesses may opt to send invoices at the start of the week, end of the week, bi-weekly, beginning of each month, or end of each month.

If you offer multiple short-term services, it’s a good idea to bill your clients weekly or as soon as a job has been completed. This prevents your accounts receivable from becoming backlogged and helps maintain a healthy cash flow.

Plus, for customers, it’s often easier to make smaller payments more frequently than to pay a large sum at the end of the month.

Top Tip: If you didn’t already know, accounts receivable reflects future revenue that has been billed but not yet received, and accounts payable shows future debts that have been charged but not yet paid. It’s critical to understand the fundamentals of accounting in order to maintain a healthy cash flow and sturdy business financials. Curious to learn more or run a sense-check that you do in fact grasp accounting basics? If so, read our complete guide to accounting for startups 📣

Step 4: Set your payment methods

If you want to get paid on time, you need to communicate clearly to customers when and how they can pay you.

Sometimes, the reason why clients are unable to pay you on time is that it’s inconvenient for them. For example, if you only accept cash in exchange for your services, clients who are not local might not be able to make their payment on time.

This is why it’s usually a good idea to offer multiple payment methods to clients so it’s as easy as possible for them to pay you.

Along with cash and cheque options, most small businesses also let customers make online payments, such as with their credit card, via a bank transfer or through an online platform like PayPal or Transferwise.

Online paperless payments are fast, secure, and usually trackable. Since there’s no hassle of travelling involved, customers are more likely to pay you on time, regardless of where they are located.

Step 5: Maintain a record of past invoices

It’s always good practice to store a backup of all your invoices, regardless of when you send them and who you send them to.

This may sound unnecessary, but it’s one of the best things you can do to streamline your invoicing process. Also keep in mind that if you are a VAT registered business, maintaining a detailed record of your invoices is required.

Having a record of past invoices helps you to double-check any errors, confirm details about past payments or bills, settle disputes, and create accurate cash flow forecasts, which includes estimated sales, income and general business expenses.

For example, let’s say you sent a bill of £2,500 to a client. Two months later, they send you a payment of only £1,500 and claim they don’t owe you anything else.

In this situation, you can simply pull up a backup of your invoice and show it to your client as evidence of the money they actually owe you. If you don’t have a copy of your invoice, it will be difficult for you to prove what services you provided, when you provided them and how much the client actually owes.

Another situation might be that you made a mistake in your invoice, and the client has requested some changes. In that case, having a backup copy of the invoice will help you identify exactly where you made the mistake, and will save you time as you won’t need to create everything from scratch.

In the case of referring to stored invoices to make future cash flow predictions, you can look at your accounts receivables (cash inflows) and accounts payables (cash outflows) to predict surges or shortages in cash flow.

This will help you to make better business decisions, such as whether you need to plan for a business loan or line of credit, or whether or not you have the capital to hire a new employee or expand a product line.

Top Tip: Maintaining detailed invoice records is a key part of recording your overall business expenses. Keeping track of all of your expenses, including operating expenses, non-operating expenses, and capital expenses, will help you to save money and improve your bottom line. To learn more, read our guide to how to keep track of expenses 💸

Step 6: Regularly follow up with clients

Regardless of how great your invoicing process is, your business is going to come across clients who are simply not good with deadlines.

This is why you shouldn’t just sit back after you hit the send button on that invoice. Make sure you proactively follow up after every few days or weeks to encourage your customers to pay you on time.

Following up with clients acts as both a reminder and a subtle warning, especially if you’ve added a penalty to late payments. For example, you can email your clients two days after sending them an invoice to confirm if they’ve successfully received your invoice.

This nudge is both polite and professional, and from their response, you’ll be able to know for sure if the invoice has gotten through or is lost in the ether. Plus, it’s a smart way to prevent any client from making the excuse of “not receiving your invoice on time.”

If a client has been unresponsive or hasn’t been able to pay on time, you can follow up with them to ask if they’re facing any issues with your invoice.

For example, they might be having difficulties with the payment methods you’ve authorised. Or, they might have a good reason for not making the payment, such as problems in their own business.

In that case, it’s always important to communicate so you can find an appropriate solution or make any adjustments as needed.

All of this said, following up manually is a time suck. With Tide invoicing, you can automate invoice chasing by scheduling personalised reminders. Once complete, the payment will be automatically matched to the invoice, saving you even more manual admin. Simply turn on auto-matching, sit back and get notified when your invoices get paid 🔥

Top Tip: While it may sound simple, there’s a strategic method to following up with clients so that you can get paid quickly without damaging any client or vendor relationships. To learn more (and to get access to four email templates that you can use when chasing late payments), read our guide to how to chase an overdue invoice (the right way) ⏰

Step 7: Hire professional help for invoice processing

If you’ve just started your small business, you’re likely handling most, if not all, tasks on your own—including sending and keeping track of invoices.

While it’s ideal to manage as much as you can on your own in the beginning to save costs, you’ll eventually need to hire a professional to help you out.

As your small business grows, you’ll need to invest more time in strategising, planning for the future and making important business decisions. This becomes easier when a bookkeeper or accountant is handling invoices and other administrative tasks for you.

You can choose to hire professional help with accounting or bookkeeping tasks either on a full-time or contract basis. The right choice for you depends entirely on the size and nature of your business, your budget and your own comfort level.

If your business deals with confidential, high-risk information, it may not be a good idea to hire a freelance or online accountant or bookkeeper. Conversely, if you’re running a very small business with a tight budget, hiring a full-time bookkeeper might be too expensive and a freelance or online accountant may in fact be the right choice.

Top Tip: Bookkeepers are generally responsible for recording financial transactions while accountants are trained to analyse and create detailed reports for such recordings. To learn more about these differences and whether or not you should hire a professional to help you with your business finances, read our complete guide to the difference between an accountant and a bookkeeper 📊

Step 8: Automate your invoicing process

A great alternative to hiring a professional bookkeeper is to create an automated invoice process using specialised software. Automation is much cheaper, easier to manage and minimises the risk of human error.

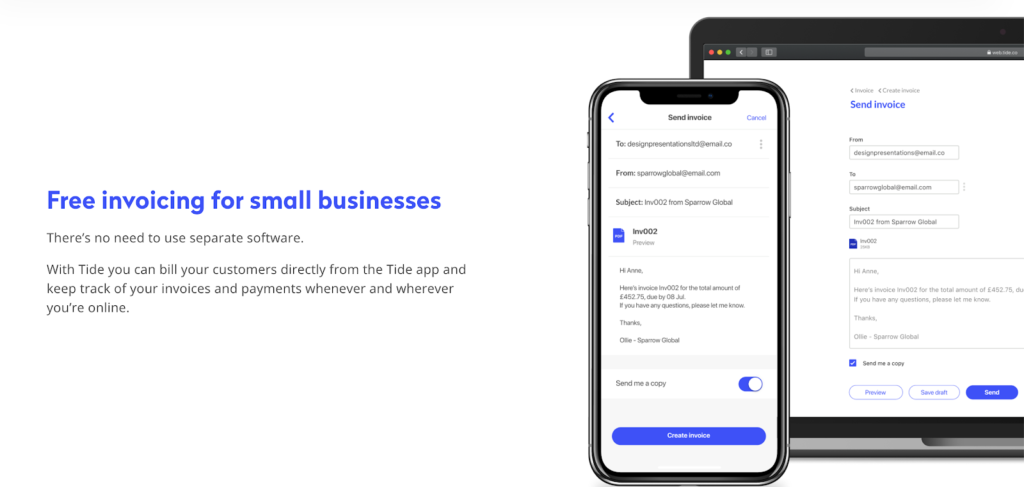

Tide, for example, comes with several built-in features that help streamline your invoicing process. One of those features is the ability to create and send invoices on the go using either a mobile app or a desktop web app if you prefer.

Tide also automatically saves your invoices so you always have an up-to-date record of the bills you’ve sent out to clients in the past. You can easily match invoices with payments, and mark invoices as paid invoices so that you know that you no longer need to follow up with reminders.

Top Tip: To learn more about the various ways to secure your invoice and protect your cash flow from late or nonpayment, read our guide to invoice financing ⚡️

Accounts payable automation

It’s all well and good streamlining your invoice process when billing your customers, but as a small business you’ll likely be on the receiving end of invoices, too.

Enterprise resource planning (ERP) systems allow companies of all sizes to track and manage business processes electronically in an efficient and collaborative manner.

AP automation, or accounts payable automation, is an example of ERP software which can streamline invoice management by fast tracking invoice approval and converting paper invoices to electronic invoices.

By implementing AP automation software into your small business’ operations, you’ll:

- Save time. Accounts payable automation will handle and process time consuming activities like submitting purchase orders and fast tracking invoice approval processes. Your accounts payable department will have more time to dedicate to more pressing matters as a result.

- Reduce error rate. Completing tedious and manual tasks can often lead to human error. AP automation software will take care of a lot of your data entry, reducing the number of human touches and minimising the risk of data input errors.

- Digitise the entire process. Creating and managing paper invoices is time consuming and documents can be easily misplaced. By digitising your invoice processing, you’ll create a seamless data flow and remove the risk of losing important documents.

- Maintain healthy supplier relationships. With an organised and timely accounts payable process, you’ll be much more efficient and likely to pay your vendors on time. They’ll appreciate the prompt payment and may even apply early payment discounts in the future.

- Send it all to the cloud. To find a document in a paper based processing system, you need to look through cabinets and folders in a physical location. By digitising your accounts payable, everyone in your organisation (not just your AP department) can access information remotely.

- Increase visibility. Once your business has successfully automated all incoming invoices and outgoing payments, you’ll have a much clearer overview of your company’s cash flow. This is a crucial benefit to your AP processes, as you’ll be able to make more informed decisions with this information.

- Cut down on paper. A major benefit of switching to an automated accounting system is reducing the amount of paper your business consumes. This is good environmental practice (and also cuts down on costs).

In essence, when you automate and centralise your data, you save valuable time, create a transparent cash flow, cut down on costs and contribute to a healthier environment. Your business’ functionality and profitability is sure to improve as a result.

Wrapping up

Streamlining your invoicing process is one of the best things you can do to improve your company’s cash flow and overall financial health.

Start by creating a standardised invoice outline, and then choose how to create the invoice. The next steps include setting a schedule, selecting payment methods, maintaining a backup of past invoices and regularly following up with clients.

To save time and minimise errors, you can also choose to hire a professional accountant or bookkeeper. Otherwise, why not sign up with Tide for easy, fast and reliable invoicing software. Send 3 invoices for free every month on Tide’s free plan!🎉

Need a bit extra from your invoicing? Tide Invoice Assistant is here!

Streamline your finance admin and get paid on time with Invoice Assistant. For just £10 per month + VAT, you can enjoy both automatic invoice matching and chasing of customer payments. You can also take advantage of Direct Debit. Perfect for growing businesses. Today. Get started with Invoice Assistant today! 🚀

Photo by Adam Winger, published on Unsplash