Purchase order vs invoices: What’s the difference?

Purchase orders and invoices are documents that contain details of your financial business activity. More specifically, they indicate whether your transactions are purchases or sales.

While they share some similarities, such as order details, price, vendor information, shipping details and general information on a transaction, purchase orders and invoices are intrinsically different documents.

A purchase order (PO) is issued by the buyer to the seller and outlines their expectations in terms of the product or service they plan to buy and the quantity. On the other hand, an invoice is issued by the seller to the buyer after the terms of a purchase order have been carried out. It includes the financial terms that were laid out in the PO as well as options for payment.

Understanding the purpose and nuances of these two important documents helps you remain compliant and organised when it comes to your business’s financial endeavours. They also allow you to maintain a healthy cash flow, something critical to ensuring your business is in a good place to handle any financial emergencies.

In this article, we’ll help you understand what purchase orders and invoices are, how they differ and why they’re essential to your business.

Table of contents

- What is a purchase order?

- Why is a purchase order important?

- What is a purchase order (PO) number?

- What is an invoice?

- Why are invoices important?

- Differences between purchase orders and invoices

- Similarities between purchase orders and invoices

- Why do businesses need both documents?

- Issuing purchase orders and invoices

- Expert insights

- Wrapping up

What is a purchase order?

A purchase order (PO) is a document a buyer sends to a seller after ordering goods or services. POs outline what the order should contain, the delivery date and the price.

Some POs also include prerequisites that both the buyer and seller have agreed to before the purchase. These could be anything from receiving a certain quantity of goods or items by airfreight to using an alternative payment method for ordering.

The document becomes a legally binding contract after the seller accepts the purchase order agreement.

Buyers can also use standing purchase orders to facilitate recurring purchases. A standing PO allows them to order the same items or services many times over or within a specific time frame with the same PO number.

Alternatively, the ordering party can draw up a blanket purchase order to get multiple deliveries for a set price over a set period. Blanket POs are typically used in B2B purchases and may include discounts or other incentives.

A basic PO usually includes the following information:

- Date of purchase

- PO number

- Order description

- Unit price

- Delivery date

- Buyer name and address of the buyer (shipping address)

- Vendor name and address of the seller (billing address)

- Terms and conditions

- Signature of the issuer

Some business owners confuse purchase orders with purchase requisitions. However, there is a notable difference between the two documents.

Employees in large companies use purchase requisitions to place orders with the purchasing department. The purchasing department then sources the required goods from an outside vendor or merchant. In other words, the order is processed internally by those who manage the procurement process.

Requisition orders are common in larger companies with either an accounting or finance department but are rarely used by small businesses.

Why is a purchase order important?

Whether you’re a small business or a large company, there are many reasons why you would want to use POs for order placement. A purchase order allows you to:

- Set clear expectations. A purchase order allows you to clarify your requirements to your vendors from day one.

- Avoid duplicate requests. When the order request volume increases, POs help track who ordered what, from whom and when. Without a purchase order, you can end up making duplicate requests and causing a loss to your business.

- Prevent cost overruns. With a PO on hand, you can check the pricing agreement with a specific supplier. If that supplier decides to increase the price, you can use the purchase order to clarify the initial cost.

- Detect performance issues. Analysing your POs can provide clues about which orders contribute towards your growth and which ones increase costs without offering any value. With such insights, you’re more likely to be strategic with your purchases.

- Manage inventory effectively. Companies usually don’t have clear inventory visibility, which causes problems like inventory stockouts. A purchase order system will help you determine how much stock to keep and when to replenish, allowing you to streamline your operation and enhance your inventory management. You can better manage your inventory by using software to manage your POs.

- Improve budgeting. To issue accurate POs for a large project, you’ll need to calculate order quantities and costs before the project commences. This should give you a better idea of how to budget for such projects.

What is a purchase order (PO) number?

A purchase order (PO) number is a unique number assigned to a purchase order. It helps ensure the seller ships the same goods that the buyer expects to receive.

Additionally, the purchase order number makes matching invoices to purchase orders easier. Mentioning the number on invoices helps the seller charge the right amount for the goods. The buyer can also match the reference number on the invoice to their PO number to ensure they’re paying for the correct order.

What is an invoice?

An invoice is a document created by the seller or supplier of goods to keep track of and solicit payments.

Sellers send out invoices after the terms of a purchase order have been met, whether through a finished physical product or a completed service.

Say, for example, you’re a cereal supplier and you get a PO for two hundred additional boxes of cereal from a local grocery store. When you send them the goods, you will include an invoice that details the number of products, the price per product and the payment terms.

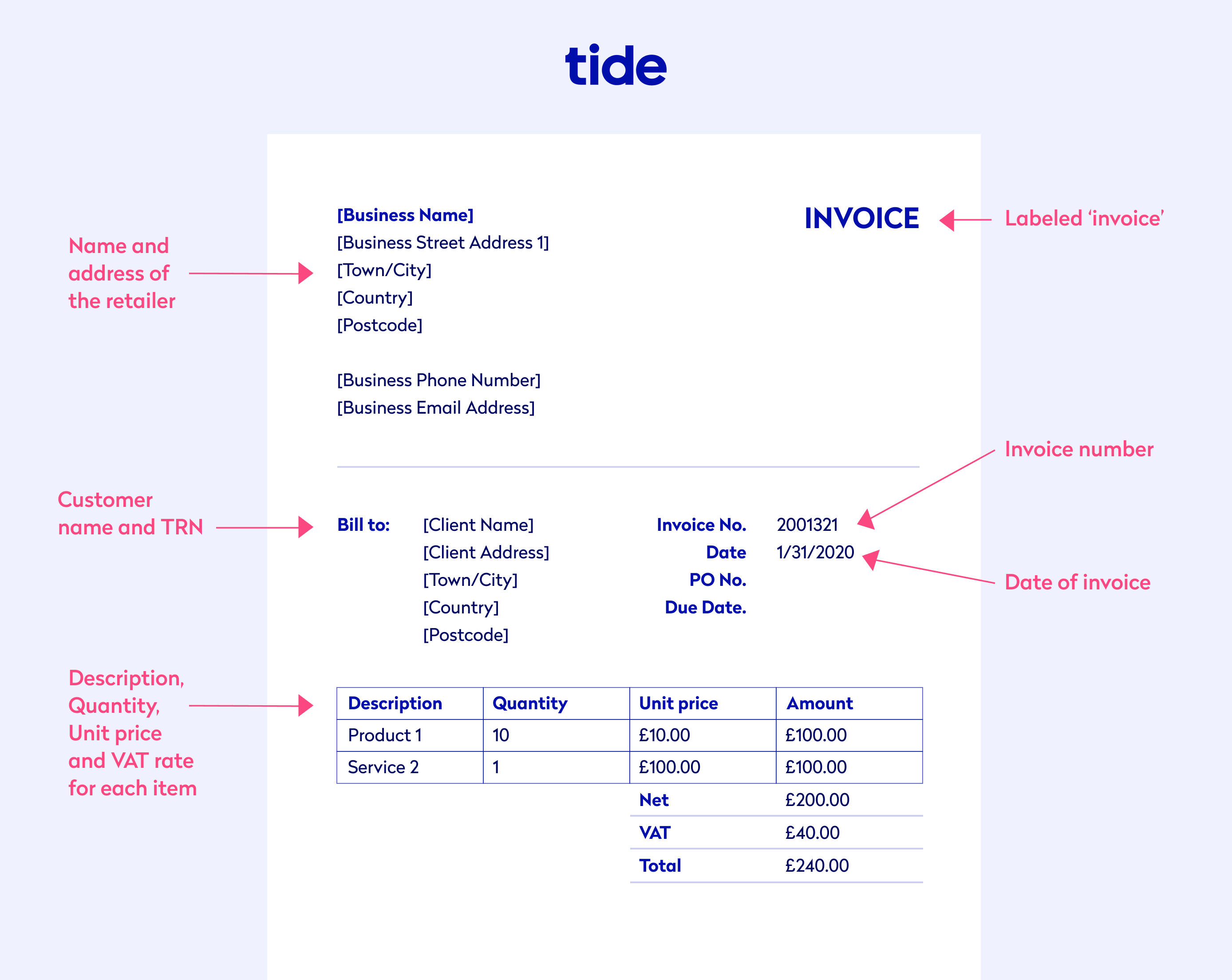

Regardless of whether your business supplies goods, services, or a mixture of both, a basic invoice usually includes the following information:

- Invoice date

- Invoice number

- PO number

- Item or service descriptions

- Agreed unit price

- Terms of payment

- Discounts (if applicable)

- Taxes (if applicable)

- Total amount due

- Invoice due date

- Acceptable methods of payment

- Business name and contact of the seller and buyer

- Signature of the seller

Top Tip: If your business is VAT registered, you are required to issue VAT invoices. To find out more, read our complete guide to what information you must include on your VAT invoice 🌟

Keep track of revenue

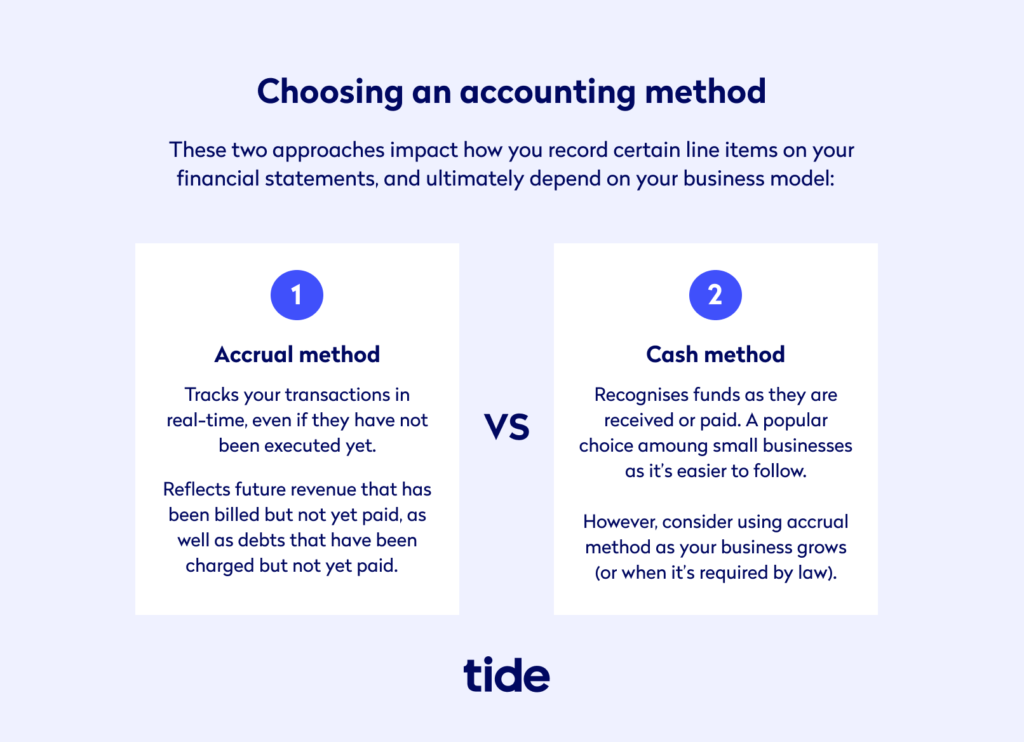

Invoices provide a way for you to keep track of your revenue, whether it be through cash basis accounting or accrual basis accounting.

Under cash basis accounting, revenue is recognised when cash is received (e.g., an invoice is paid).

In accrual basis accounting, your sales represent revenue that has been earned; revenue is listed at the top of the income statement.

Both accounting methods have their positives and negatives, but the invoice plays a vital role in how your company determines when you record expenses and revenue.

Top Tip: Understanding the basics of small business accounting will help you make more informed financial decisions. Specifically, it’s helpful to understand these two accounting methods, the three main financial statements and the difference between an accountant and a bookkeeper. To learn more, read our complete guide to accounting for startups 📚

What is a purchase invoice?

While the term is not commonly used, a purchase invoice is essentially the same as a sales invoice.

A purchase invoice is created after the buyer has presented the seller with a purchase order and the order has been confirmed and fulfilled. It contains identical information to a regular invoice and a due date by which the buyer commits to pay the seller.

“In the eyes of the buyer, a purchase invoice refers to a document that details what the seller is billing the buyer for. On the invoice, you can expect to find a breakdown of what has been purchased, how much each item costs and how much in total the seller is due to be paid.” – Dan Hogan, founder and COO, Ember

What is a sales invoice?

A sales invoice is almost identical to a purchase invoice; however, it is issued by the seller to the purchaser upon delivery of goods and services.

The purpose of a sales invoice is to outline the goods and services provided, the quantity of each and business terms such as delivery method and payment due date. This document is legally binding and serves as a request for payment.

Here’s what a final sales invoice looks like:

Top Tip: Invoices are a crucial part of any business, as they provide cash flow transparency and act as proof of completion upon delivery of goods and services. For more information on creating your first invoice, read our in-depth guide to what an invoice is and how to raise them and get paid 💡

Why are invoices important?

At its most basic, an invoice is a document that gets you paid, but it has other important aspects. For instance, invoices allow you to:

Create a paper trail

One of the invoice’s key purposes is to create a paper trail between the buyer and the seller. Sending, receiving and settling invoices proves that both parties are communicating, while an invoice’s itemised nature keeps your business dealings transparent.

Help everyone stay on track

As a small business owner, you’re busy, your clients are busy and your suppliers are busy. Invoices are a necessary way to keep everyone on track with payments. Each invoice shows the itemised goods or services for the most recent deliveries, but it also keeps a running total of account balances, should you or your customer be on a payment plan.

“Invoices can help businesses keep track of what they’re spending their money on. Not only will they see how much is going out with each purchase, but finance teams will also be able to keep track of where the money is being spent and potentially figure out ways to cut back on spending.” Dan Hogan, founder and COO, Ember

Simplify tax season

Who doesn’t want tax season to run a little more smoothly? Staying on top of your invoices protects you and your business and it makes everything easier to audit and reconcile when the time comes.

Top Tip: If you’re a UK business owner, there are several business taxes you may be liable to pay. For a full breakdown of the different types of taxation, which ones apply to your business and how to pay them, check out our simple guide to small business tax 🔢

Speed up payment and processing

You may be tempted to include the bare minimum in your invoices as a way to save time, but resist that urge. The more information you include, the fewer questions your clients will have, which can speed up the payment process.

Aid accounts receivable

Creating invoices is also essential because it is the record of your accounts receivable (all the money due for goods or services that have been delivered but not yet paid for). Not only is this important for your balance sheet as an accounting document, but it also helps outside investors understand how quickly your business is receiving the funds from outstanding invoices. By analysing the accounts receivable turnover ratio, investors can see how efficient your business is at collecting cash owed to it.

Top Tip: To learn more about why accounts receivable is an integral part of keeping track of late payments (thus boosting your cash flow), read our guide to what is accounts receivable (and how to manage it) 🔍

Reinforce brand identity

If you’re using an invoicing software or app, you should be able to personalise the content and appearance of your invoices. Personalisation helps to reinforce brand identity and also enhances the customer’s perception of your business. We’ll discuss invoicing software in more detail shortly.

Differences between purchase orders and invoices

The key difference between the two documents is the objective or goal.

When you issue a purchase order, you request your suppliers to deliver the goods. When you issue an invoice, you are asking customers to make payment. Hence:

- A PO’s goal is to ensure the fulfilment of orders

- An invoice aims to collect payment for products or services sold

Another difference is timing, for example:

- A purchase order is usually sent at the beginning of the transaction to form a contract between parties

- Invoices, on the other hand, are sent at the end of the transaction using the information from the purchase order to request payment

Lastly, a purchase order contains different information than an invoice such as:

- POs include a detailed description of the order, the agreed price and the ETA for the delivery

- An invoice lists the terms of payment, applicable discounts and total amount due

| Info | Purchase Order | Invoice |

| Objective | Confirm the order | Request payment for the order |

| Sender | Buyer | Seller/Vendor |

| Receiver | Seller/Vendor | Buyer |

| When it is sent | Upon placing an order | After the order is fulfilled |

| Details | Order description, agreed price, delivery time, etc. | Terms of payment, applicable discounts, total amount due, etc. |

Similarities between purchase orders and invoices

Purchase orders and invoices also share similarities. For example, both documents often reference the same goods or services and list the buyer and seller’s information, including business names, contact information and mailing addresses.

Most significantly, both POs and invoices are legally binding agreements making them official documents for your business. Therefore, once either one is sent and received, those goods or services must be prepared and paid for according to the parties’ previously determined agreement.

Why do businesses need both documents?

Your business may use both documents at one point because the nature of business requires you to order and provide goods and services.

Even if your business mainly provides goods or services (and therefore, you mostly send out invoices), you may need to purchase something. A purchase order will help you keep track of those expenses.

Issuing purchase orders and invoices

Purchase orders and invoices are not difficult to understand and use. However, manually creating tons of such documents is often time-consuming and error-prone, even if you’re using an invoice template.

Moreover, manual records can get disorganised or disappear, causing problems in disputes or at audit time.

Fortunately, digital PO and invoicing help you avoid tedious, paper-based processes. You don’t need paper, envelopes, ink or stamps, nor need to generate photocopies, which can get expensive if you’re issuing multiple POs and invoices every day. Using a digital solution is more cost-effective, secure and easy.

There are many invoicing software solutions available on the market. To ensure you pick the right one for your business, make sure it does what you need—for example, automated payment reminders, recurring billing, reporting, payment options, activity tracking and more.

Top Tip: Invoicing software can save you time and help you get paid thanks to task automation. To help you decide which is best, we’ve gathered the 11 best invoicing software solutions for your small business ✅

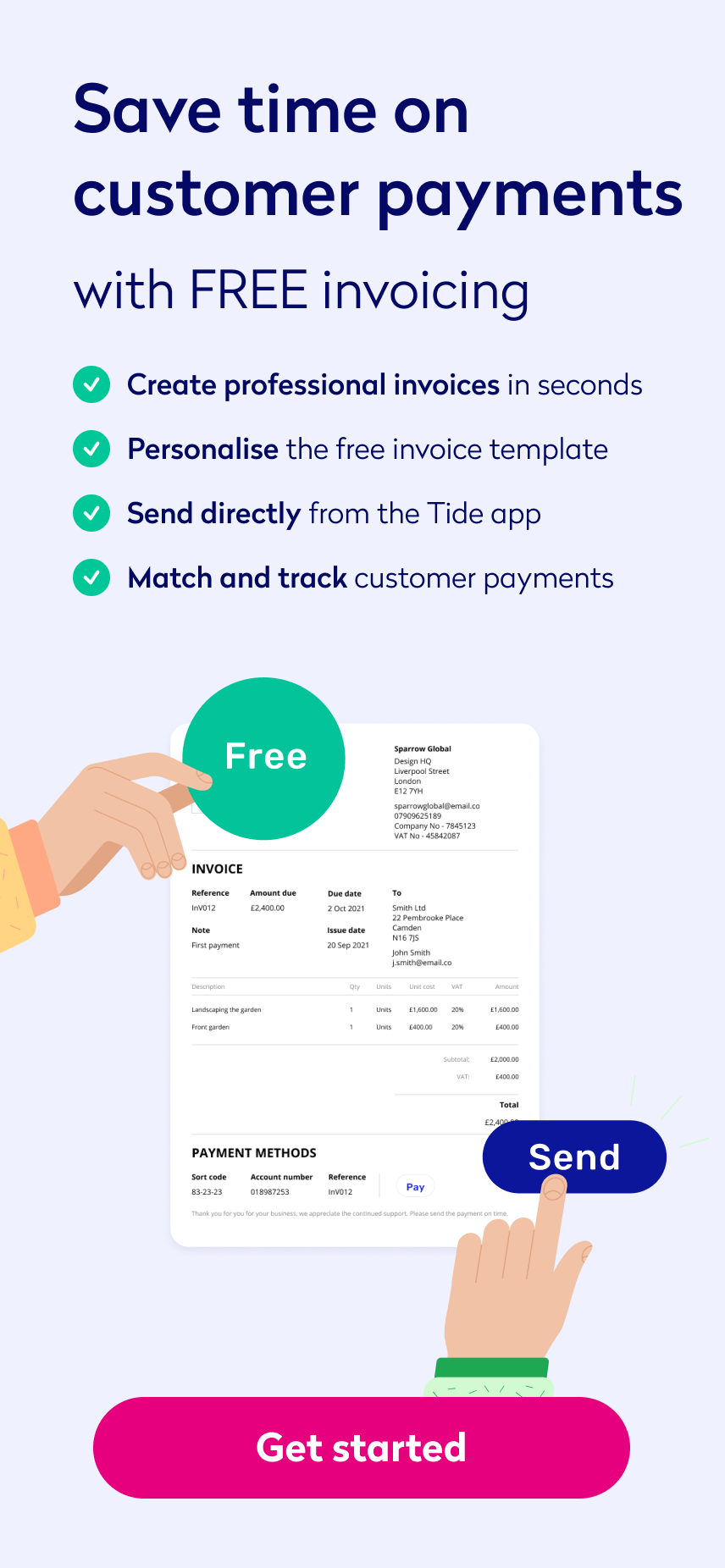

Create and send invoices on the go

One of the best ways to stay organised and efficient is to manage your business finances through a desktop or mobile app. At Tide, we have our own invoicing solution that’s free, easy to use and customisable.

For example, with Tide’s free invoicing, you can invoice directly from within the app, generate templates and make use of pre-set VAT rates to calculate and add VAT automatically. You’ll also receive notifications as soon as you’ve been paid.

And with our Invoice Assistant, you’ll be able to automate invoice matching and smart invoice chasing. All you need to get started is to sign up for our free business bank account.

We also have several accounting integrations that make it easy to reconcile your Tide transactions in your preferred accounting software.

Top Tip: As your small business grows, you will deal with more customers and, therefore, more invoices. To keep things organised and ensure a healthy cash flow, read our guide on how to streamline your invoice process 💯

💡Expert insights

Insights author: Dan Hogan, Co-Founder and COO at Ember, who helps freelancers and small businesses with full service, fuss-free accounting.

How do purchase orders help finance teams stay organised and within budget?

A purchase order is a document sent from a buyer to a seller that indicates the agreed types, quantities and prices for the products or services they intend to purchase.

The main purpose is to help finance teams understand and keep track of what different departments have been purchasing across the business.

Think of a purchase order as an instruction. Within companies, specific teams have set budgets and purchase orders are used to put together a list of what the team is looking to spend on a particular product (for example, hats). When the purchase order is given to a seller, it provides the seller with instructions on what they’re looking to buy, a transaction that can be translated as “this is within the allocated company budget”.

When delivering on a purchase (for example, the team has requested £100 worth of hats and the seller is handing over the hats), the seller will return the items with an invoice containing the purchase order number (PO number) to the buyer—otherwise known as a purchase invoice or a supplier invoice—that highlights how much the company owes to the seller for their goods or services.

Before the invoice is paid, the finance team must be given both the purchase order (generally from the internal team placing the order) and the purchase invoice (from the seller), which will be matched to verify that the final order matches what was pre-approved.

Purchase orders assist the Accounts Payable function—an arm of a larger finance team of bigger companies—to streamline the purchasing process and help control spending limits for different departments.

Why is it important to include a PO number?

This is the number that goes on both the purchase order and the supplier invoice to match the two documents. This ensures that the purchase intention (the number and type of hats the team intended to buy) matches what the seller has billed the purchaser for.

This helps the finance team and department heads keep on top of expenditure, ensuring that all outgoings are within budget and explaining any substantial purchases.

Are purchase orders still relevant today?

Purchase orders are still used by larger companies but are on the way out largely because of the administrative burden. There’s a lot of paperwork to keep an eye on, especially if multiple teams are issuing purchase orders on a regular basis.

As a result, an increasing number of alternatives are being implemented to curb departmental spending and keep better track of expenditure (rather than sending out multiple purchase orders for the sake of it).

Issuing company credit cards with spending limits is one popular way for companies to manage spending. Spending can be tracked automatically and digitally, verifying where the money is spent while ensuring departments and employees are not overspending.

What are the differences and similarities between invoices and purchase orders?

If the sale is carried out correctly, the contents of the documents should be identical. Both documents will outline what the buyer has requested from the seller (purchase order) and in turn, what the seller has delivered and is expecting payment for (purchase invoice).

Suppose there are discrepancies between the two documents. In that case, it could suggest that the seller has not delivered what was on the original purchase order, over-billed or under-billed the buyer or an admin error has occurred.

Both documents are required to:

- Verify what the buyer requested

- Ensure the request falls within the buyer’s allocated budget

- Determine that the seller has delivered what was requested on the initial purchase order

Once the two documents are matched and the finance team can confirm that the requested order is correct and within budget, they can pay the seller and deduct the amount spent from the team budget.

Wrapping up

Purchase orders and invoices are beneficial for small businesses. They help you maintain accurate, detailed records of purchases and sales for your financial statements.

You can implement paper-based POs and invoice processing in your business, or you can use a digital solution. Going digital makes it easier to issue and refer to these documents when required.

While a standalone solution may be suitable for some businesses, you may benefit from a multifunctional finance platform such as Tide to take care of all your needs in one place.

Photo by Andrea Piacquadio, published on Pexels