What’s the difference between an invoice and a receipt?

Understanding the fundamental differences between invoices and receipts will help you maintain accurate and healthy financial records and business practices.

Simply put, an invoice is a request issued by a vendor when there’s an exchange of goods or services for payment.

A receipt acknowledges that the agreed payment has been made and acts as the customer’s proof of purchase.

Not registering the different purposes between the two documents could make it much harder to organise your business finances effectively and adhere to proper rules and guidelines.

In this guide, we’ll share everything you need to know about invoices and receipts for your small business. You’ll discover the similarities and main differences, how to format each and why it’s essential to keep clear records of both documents.

Top Tip: Before diving into the differences between an invoice and a receipt, it’s important to understand the complexities and rules surrounding invoices themselves. To learn what should be included in an invoice and how to ensure it gets paid on time, read our guide to raising invoices and getting them paid 🔥

Table of contents

- What is the difference between an invoice and a receipt?

- What is the difference between an invoice and a tax invoice?

- How are invoices and receipts written differently?

- When to use invoices and receipts

- Should I issue both an invoice and a receipt?

- Why are invoices and receipts important in business?

- Wrapping up

What is the difference between an invoice and a receipt?

Invoices and receipts are essential accounting documents for maintaining business records. They are useful to both buyers and vendors when a transaction involves an exchange of goods or services for payment.

The two documents provide details on the amounts owed and paid for the exchange of goods and services. Invoices and receipts usually include the vendor and customer information as well as the total amount due.

Since they share many similarities, it’s understandable why invoices and receipts are often considered interchangeable. However, operating as if they are the same can land your business in trouble when filing your taxes or claiming expenses, as we’ll explain throughout this article.

Invoices and receipts shouldn’t be confused with a purchase order either. A purchase order is essentially a document issued by the buyer to the vendor or client describing the requested goods or services along with quantities and agreed-upon prices.

Top Tip: To dive into the differences between an invoice and a purchase order in more detail, including why certain companies may need both documents in business dealings, read our guide on the difference between a purchase order and an invoice 🔍

Let’s examine the key differences between invoices and receipts in more detail:

- Since an invoice is a payment request, it’s always issued before payment is made. Given that receipts acknowledge payment, they’re provided after the payment.

- While an invoice is a legally-binding document that advises the buyer of the total amount due, a receipt is a legal document that proves a payment has been made and can act as proof of ownership.

- An invoice is a commercial document that typically lists the goods and services for which payment is due; expect to see details like product quantities or hours of service. A receipt shows how much has been paid and the payment method but may not include the same level of detail as an invoice.

- Invoices always go directly to the consumer who must make a payment, whereas a receipt may go to either the customer or a third party since it’s proof of payment.

- Businesses use invoices to track the sale of products and services, while a receipt’s primary purpose is to prove the amount a buyer has paid for the goods or services.

Top Tip: Creating a consistent and accurate invoicing system is an essential part of small business accounting. When your business’s accounting processes are streamlined, you’ll find planning for its growth and development much easier. Learn more about how to streamline your business’s accounting processes in our complete guide to small business accounting ⚡️

What is the difference between an invoice and a tax invoice?

You might have come across the term “tax invoice”, also known as a VAT invoice, and wondered how it differs from a regular invoice.

They are almost identical in function; both record legally recognisable transactions. There are a few differences between the two, however, such as:

- Conditions. Tax invoices require the invoice-issuer to be VAT registered. It is illegal to issue a VAT invoice or receipt showing VAT if you are not correctly registered with HMRC.

- Main purpose. A regular invoice records and requests payment for the sale of goods and services. A tax invoice helps buyers, sellers and relevant authorities understand the tax due on a particular sale. This way, when VAT gets reported to HMRC, it’s easy to understand if there’s any outstanding VAT owed to the government or if there’s VAT that the business can reclaim.

- Contents. A tax invoice will contain everything a regular invoice does; however, it will also include the amount of tax or VAT payable (if applicable).

- Duplication. A tax invoice is retained by the seller and issued to the buyer like a regular invoice. However, if you use the VAT margin scheme, a copy must be sent to HMRC for audit and reporting purposes.

- Distribution. In many cases, a tax invoice is issued to or from a distributor. The VAT is passed onto the consumer (if the business doing so is VAT registered), often in the form of a sales receipt. Because of this, the buyer is rarely the end consumer, thus rarely deals with the VAT invoice itself.

In essence, a regular invoice indicates how much a buyer owes a seller for goods or services. A tax invoice outlines all payable VAT during a transaction.

Top Tip: If you’re curious about the principles of VAT, what businesses it applies to, what items it applies to and how and when to register for VAT, we’ve got you covered in our guide to everything you need to know about VAT 📌

How are invoices and receipts written differently?

Understanding how invoices and receipts are written and formatted helps highlight their differences.

Formatting invoices:

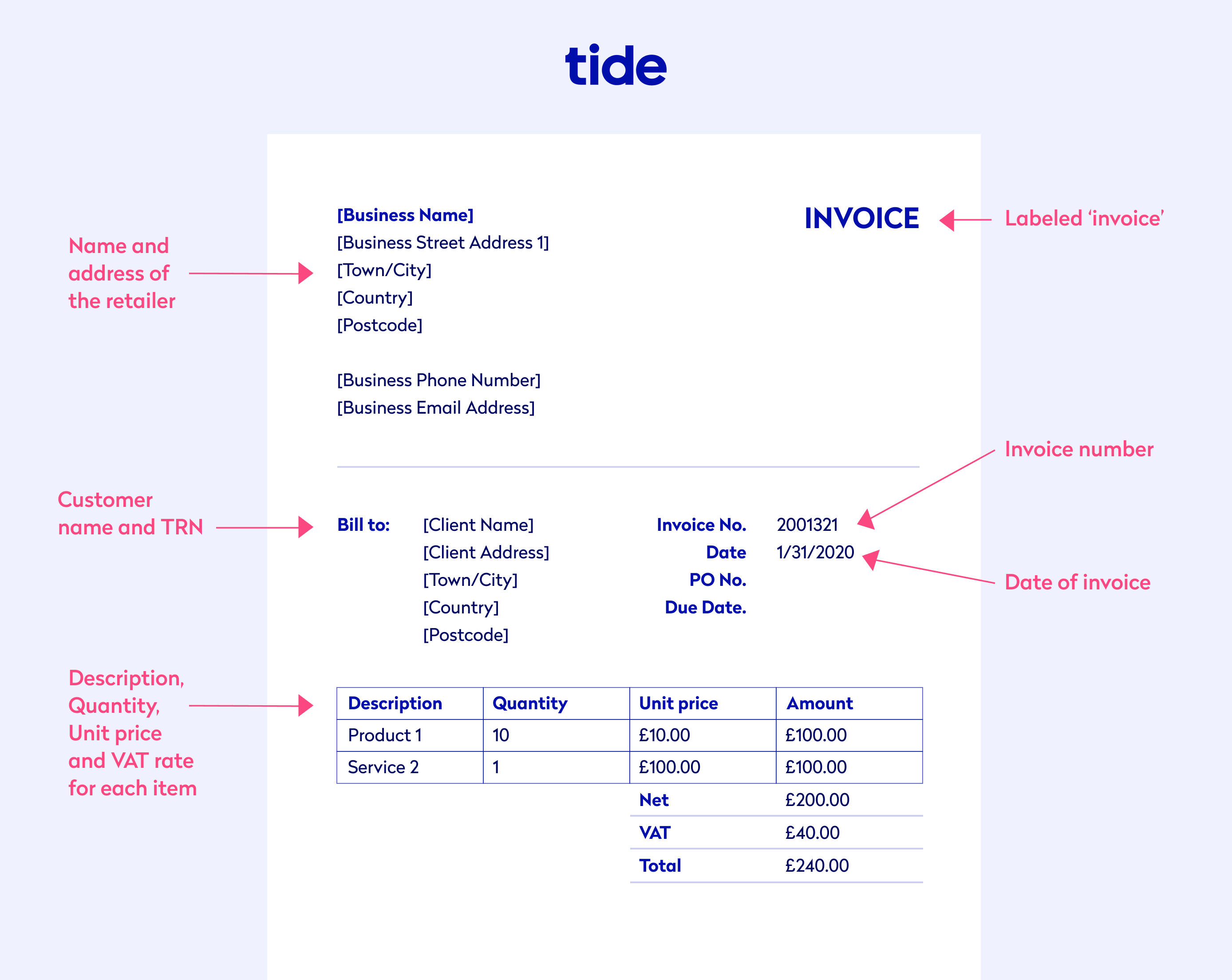

- Invoices include details about both the seller and the buyer. Most follow a standard format with the vendor’s details, such as business name, trading address and phone number, in one of the top corners of the page. The same information is provided for the customer on the opposite side of the page.

- Providing invoice numbers at the top of the page makes it easier to identify invoices and payments with your accounting team.

- Invoices give specific details on the products or services bought. There should be a name and description along with the rate and the quantity purchased.

- There are usually other details like payment terms, discounts for cash or early payment*, the date of the invoice, payment due date, acceptable payment methods, VAT (if you’re VAT registered) and more.

*Note: An early payment discount is applied when a seller agrees to reduce the total cost of an order in return for swift payment. This accelerates cash flow for the seller.

Creating invoices using spreadsheet software or online accounting software will make formatting quicker and easier. You can create your own invoice template, download one from the internet or use Tide’s free invoice template.

If you’re a Tide user, there’s an even better way to create and send invoices directly, from the Tide app or on the web.

With our integrated invoicing feature, there’s no need for separate invoicing software and you can keep track of payments on the go.

It’s quick and easy to create and send professional, customised invoices and match payments to invoices. Happy Tide customers have referred to it as an “absolute lifesaver” when it comes to getting and staying organised.

Here’s an example of what a formatted invoice looks like:

Top Tip: VAT invoices are more complicated than standard invoices. Format VAT invoices correctly to avoid running into any trouble with HMRC. To learn about the three different types of VAT invoices and how to format each one, read our guide to what information you must include on your VAT invoice ✅

Formatting receipts:

- Receipts usually include the business name and contact information at the top of the page.

- While it’s necessary to provide the name and price of the product or services paid and the date of payment, there may not be as many details regarding discounts, descriptions or unit prices unless an itemised receipt is specifically requested.

- Most receipts are printed. For example, you receive a printed paper receipt when you pay at a cash register. As the world moves more online, it’s common to receive a digital receipt via email instead.

- Some receipts include the customer’s name. However, it’s important not to have too many customer details on the receipt to prevent identity theft since many people throw away their receipts or leave them behind.

Here’s an example of what a formatted receipt looks like:

When to use invoices and receipts

Given their different uses and purposes, it’s essential to know the various circumstances in which it’s appropriate to send an invoice, a receipt or both, and what that looks like in practice.

When to use invoices

Businesses of all sizes, sectors and industries use invoices. For example, restaurants use invoices when you ask for the bill and they bring a breakdown of what was spent. Ecommerce sellers use invoices to confirm the goods and amount sold before requesting payment and freelancers use invoices when they demand payment after a project is delivered.

If you run an online business or take orders over the phone, it’s good practice to send customers either a digital or paper invoice at the time of order that they can refer to anytime.

The document acts as proof of order and clearly shows what is owed. Invoices are generally sent to customers in this way when a company provides products or services before the payment due date.

It’s up to your business to determine how long a customer has to pay for a product or service. Some businesses require payment upon receipt of the invoice, whereas others may allow payment within 30 or 60 days of the invoice date.

Payment due dates are entirely dependent on your unique preferences and circumstances, so your decision should consider what works best for both your business and your customers.

It’s crucial to make the invoice payment date as straightforward as possible so the customer is well informed and payment expectations are clear.

That said, overdue invoices are quite common and something you may need to manage. If a client or customer is late paying their invoice, make sure you know how to chase an overdue invoice (the right way).

When to use receipts

Consumers often need receipts to prove certain expenses were made. They may need this information when deducting purchases from their tax return or requesting reimbursement from their employer (more on this later).

Receipts are also necessary when consumers return an item for a valid reason. For example, the article may be faulty or simply not what they thought they were buying.

Most businesses set their own rules for what is considered a valid reason for the return and whether a receipt is required to complete the return. The details of a return policy are usually displayed directly on the receipt, including how many days consumers have to make returns or exchanges following the purchase date.

Without a receipt, retailers often only give exchanges or credit to choose another item. That said, if your business makes sales online, through mail or on the telephone, it is required that you provide refunds even if the goods aren’t faulty.

Brick and mortar businesses often choose to provide a refund and exchange policy to improve customer satisfaction. Companies that offer returns and exchanges must provide a receipt to customers as part of this process.

Once payment has been made, it’s best practice to immediately follow up with a receipt whether the transaction has taken place in person, online or over the phone. You should always make two copies of the receipt, one for your customer and one for your business records.

Whether it’s a supermarket, street vendor or online clothes shop, consumers expect businesses to provide receipts at the point of sale.

Should I issue both an invoice and a receipt?

You may not need to issue both an invoice and a receipt depending on your industry and business structure.

For example, if you own a shop where your customers immediately pay for the items they buy, you are not legally required to issue an invoice. It would be time-consuming and impractical, so you can offer the customer a receipt only.

However, if you and your customer are both registered for VAT, you must issue a VAT invoice (and a receipt if the customer requests one).

Using the same example as above, if your customer is buying a product in-store on behalf of a business, you will need to issue a VAT invoice and a receipt.

Why are invoices and receipts important in business?

Both invoices and receipts are vital for good business bookkeeping. However, they’re important for slightly different reasons.

Tracking sales and revenue

Keeping hold of invoices enables you to record your business’s sales, which is handy when you’re tracking, reporting and forecasting monthly, quarterly or yearly sales.

Invoices are also a necessary tool for tracking your income and future revenue. You’ll need to have a record of all of your income and expenditures when you sit down to file your taxes. Healthy record-keeping makes that process significantly easier.

These days, many small business owners store all their invoices online to keep and view them in one place.

Top Tip: Using online invoicing software can make it easier to track invoice payments and improve your cash flow. Invoicing software also allows you to automate tasks that will free up your valuable time, such as setting recurring invoices and sending out automatic payment reminders to clients. Learn more about the benefits of invoicing software in our guide to the 11 best invoicing software solutions for your small business 💥

Restocking your inventory

Invoices are also useful for suppliers in terms of enabling the delivery of goods, helping you to track the goods and services sold and restocking your inventory.

Detailed invoices will show you exactly what you ordered and when, making it a key record to refer to when restocking goods and materials. If you make duplicate recurring orders each month, ordering more inventory will be as simple as changing the invoice number and date.

Managing employee expenses

Receipts are crucial for keeping internal accounting processes streamlined, especially when it comes to employee expenses.

For example, if your employees often travel for work purposes and make reimbursable payments, you’ll need a copy of their receipts to verify their spending and create an expense report.

Top Tip: Keeping track of employee expenses via a streamlined system is key to saving time and money and avoiding potential employee fraud. A methodological expense policy and expense management software can help you effectively handle this process. To learn more, read our guide on how to manage employee expenses 📣

Staying prepared in the event of a tax audit

Maintaining a record and up to date summary of all sales invoices and receipts is crucial in the event of a tax audit.

Both documents will help you file your taxes correctly, ensure the correct amount is paid and avoid a time-consuming tax audit. Without invoices and receipts, you may be liable to penalties and fines if you are audited.

For example, as a limited company director, you can be fined £3,000 by HMRC or disqualified as a company director if you do not keep accurate accounting records. If you cannot find certain documents, or if they get lost or stolen, you must do your best to recreate them. This is why keeping multiple copies of your invoices and receipts and storing them digitally is essential.

Maintaining a proper system for tracking your business’s invoices and receipts will save you time and money in the long run.

Top Tip: Learn more about the various types of business expenses, the importance of tracking them and specifically how to manage them in our guide on how to keep track of expenses 💡

Avoiding lawsuits

Invoices help protect small businesses from pricing disagreements and lawsuits. A sales invoice demonstrates that a good or service was sold at a certain time for an agreed-upon price.

Invoices with both the vendor and consumer’s signatures are particularly useful since they show an agreement between both parties.

If there’s no invoice, there’s no documented record, making it harder to prove that the sale took place. Without a record, small businesses leave themselves open to pricing disputes.

Claiming expenses

Keeping invoices and receipts safe and accessible is also critical when claiming expenses. You must prove any tax-deductible business expenses such as insurance, software, payroll and utilities with supporting documentation.

You’ll need all relevant invoices and sales receipts to claim any business expenses from your tax return. You must also keep an accurate and auditable record of all your expenses for up to six years.

Top Tip: Most business expenses are deducted from your income before they’re subject to VAT (if you’re VAT registered) and other taxes. Taking advantage of these allowable expenses can help you save money to invest back into your business. Dive into what expenses your business can claim and how to claim them in our guide to what business expenses are and how small businesses can manage them 🎉

Fueling business development

Businesses that closely track sales invoices and receipts can use this aggregate data to better understand their target market.

Buying behaviour provides key insights such as what products or services are selling well or poorly, in what quantity they’re being bought and at what time of the day or week they perform the best.

This data can help sales and marketing teams learn behaviour patterns to capitalise on to boost future sales. For example, if there is a seasonal uptick in sales of certain products, your team can run campaigns to motivate and incentivise certain buying behaviours.

Using invoices in this way is particularly effective if they’re stored digitally, so all the information is easily accessible in one place.

Wrapping up

Understanding the differences between invoices and receipts will help you stay organised, streamline your accounting processes, claim allowable expenses at tax time, avoid lawsuits or audits and provide your customers with peace of mind.

All of this will lead to you running your business more effectively, thus freeing up your time to focus on growing and developing your business to reach your goals.

With Tide, you can send personalised invoices to your customers directly from our user-friendly app. With all your invoices stored in one place, it will be easier than ever to avoid late payments, automate tasks and keep a pulse on your business’s financial health. To get started, open a business bank account today and register your business for free.

Photo by Vlada Karpovich, published on Pexels