How to manage employee expenses

Employee expenses are business expenses made by an employee when carrying out their work duties. Tracking, verifying and reimbursing these expenses can create extra work and leave room for error or fraud if managed inefficiently.

That’s why a methodical and transparent expenses policy is the best way to manage employee expenses. With proper employee expenses management, you can:

- Bring down cash burn gradually

- Avoid surprises during the tax season

- Boost morale in your organisation

In this article, we’ll outline the most common employee expenses a business incurs and the measures to bring them under control.

Table of contents

- What are the common types of employee expenses?

- Why use expense management software?

- 7 tips to stay on top of your employee expenses

- Create a firm expenses policy

- Keep the processes simple

- Collect the right data

- Digitise and automate processes

- Track errors and fraud

- Audit your processes and receipts

- Make your team accountable

What are the common types of employee expenses?

Employee expenses are incurred for work-related activities such as a business trip, travel and transportation, meals, training and workshops, accommodation, business supplies and tools such as hardware or software, uniforms, fuel for a work vehicle, and so on.

For example, if employees are required to attend a workshop sponsored by your business, you should pay for their transportation to and from the event, any hotel fees and a set amount of meals or other agreed-upon amenities.

Alternatively, you may require your employees to subscribe to an industry-related magazine or report to stay up to date on the latest trends in an effort to aid employee development and business growth. You may also choose to provide certain benefits to your employees, such as paying for their lunches in the office or paying for parking spaces on their behalf.

As a small business owner, it’s entirely in your purview to decide what employee expenses and investments make sense for your business ideals and goals.

It’s important to keep in mind that you can claim certain qualifying business expenses as long as they meet HM Revenue and Customs’ (HMRC) criteria. To learn more about what qualifies for tax claims and what does not visit GOV.UK’s expenses and benefits page.

Why use expense management software?

Regardless of what expenses you choose to include in your company policy, you have several options in terms of how to manage them.

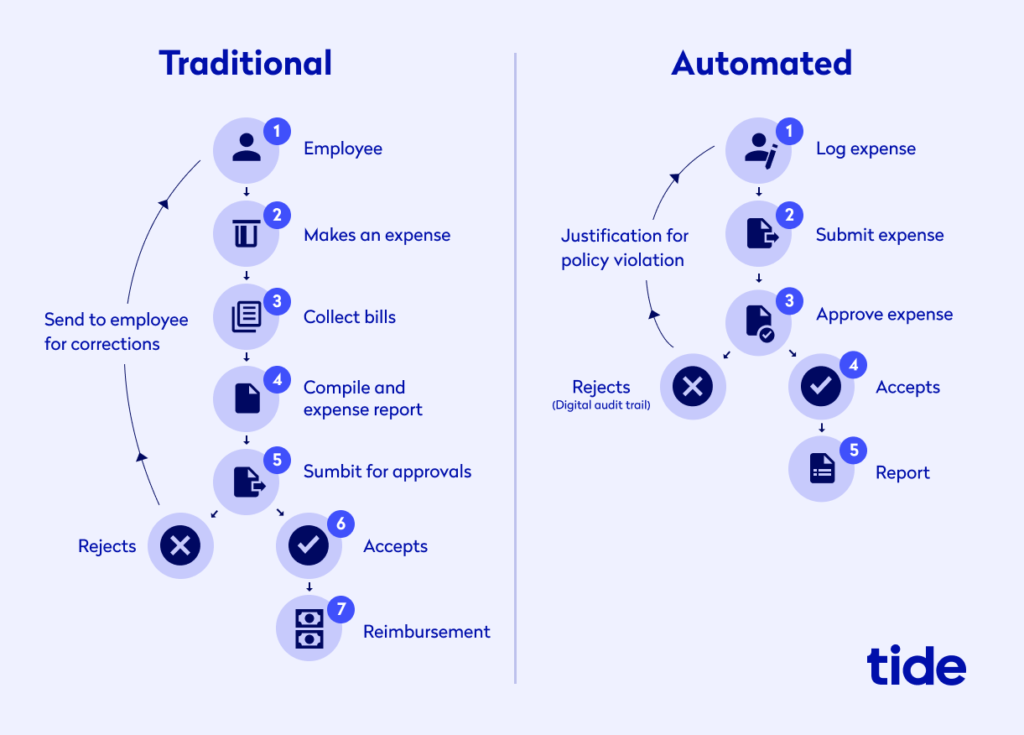

In the past, before digital expense management software came into play, reimbursable business expenses were the method of choice. Employees would pay out of pocket and then claim those expenses at the end of a pay period with the expectation of being reimbursed by their employer.

While this method works in theory, it can be complicated in practice. It requires that your employees keep track of paper receipts and remember to fill out an expense report. Then, the onus falls on your finance team to manually enter expenses into an Excel spreadsheet, for example, which is time-consuming and prone to human error. It also leaves you vulnerable to employee fraud, whether intentional or unintentional, which can cost your business money. We’ll dive into those details and how to spot and avoid them in a later section.

Expense management software, on the other hand, cuts several steps out of this risky and time-consuming process. Automation makes it easy to track receipts digitally and removes the need for any reimbursement. Employees can simply take a company card, whether it be a credit card or a debit card, and make a purchase. This significantly boosts morale and functionality as employees will never be asked to pay out of pocket for company needs and won’t have to wait for a reimbursement in their paycheck.

With expense management software, any expenses will automatically be logged in your system and employees can even match a digital receipt to the specific transaction(s) they made. Once that step is complete, there’s no need to log a manual expense report as the transactions and associated paper trail are already in your dashboard. This saves invaluable time for both your employees and your finance team and significantly decreases the possibility of manual error.

This is particularly useful when your employees are submitting expenses in a different currency, such as those incurred on a business trip abroad. You must ensure you’re reimbursing your employees fairly, taking conversion rates and fees into account. This can be tricky to do without expense management software as conversion rates change from day to day.

Top Tip: Creating an expense log helps your small business keep its spending in check, which ultimately leads to a healthy cash flow and profitable growth in the long term. You can learn about expense logs and why they’re important in our guide to creating an expense log step-by-step 🔖

Many digital payment methods such as business expense cards allow you to set limits on the cash you give to your employees to use for expenses, which makes it much easier to monitor employee spending and removes the risk of fraud.

For example, you can order up to 50 Expense Cards from Tide and keep track of employee expenses through real-time updates and notifications.

You can manage these cards directly from your app, freeze or cancel them at any time and share and hold PIN codes.

Ultimately, expense software makes it easier for your entire team to manage expenses and gives you an instant overview of your company expense spending, allowing you to keep a close eye on your cash flow and overall business financial health.

Top Tip: An expense management solution is just one of many pieces of software your small business could benefit greatly from. To see what else is out there, check out our guide to the 27 best software and tools for small businesses 🔍

7 tips to manage employee expenses efficiently

Exactly how you manage your employee expenses will be specific to your own business. However, there are several best practices you can follow to ensure you are managing expenses efficiently, in a timely manner and with minimal risk.

Here are seven tips to streamline your employee expense management processes and procedures.

1. Create a firm expense policy

An employee expense policy is a set of rules that specifies exactly what your employees can spend company money on, how they will get reimbursed and in what timeframe. A well-defined company policy not only helps to maintain transparency and avoid potential disputes, but it also builds trust. When you demonstrate the benefits of responsible expense management and place your trust in your employees, they won’t feel restricted or micromanaged. Instead, they’ll feel a sense of ownership and involvement which goes a long way to encourage smart spending.

Employee expense management policies that are unclear or inefficient can, unfortunately, lead to fraud. According to the Global Payroll Association, employee expense fraud costs UK businesses around two billion pounds per year. One in ten UK employees admits to submitting erroneous expense claims ‘all the time’ and one in five makes false claims ‘occasionally’.

A well-drafted policy should help to set boundaries and standard operating procedures (SOP)’s that make life easier for you, your employees and your accounting department. Along with fostering trust and transparency, effective employee expense guidelines will help you optimise your expenditure.

When writing your expense policy, follow these best practices to set a solid foundation.

Clearly defined sets of rules

What counts as reimbursable vs. non-reimbursable expenses should be clearly categorised. Allocate a budget for each expense type, make clear what is and isn’t allowable and put a cap on how much each employee is allowed to spend. For example, specify exactly how much employees are allowed to spend on business travel to avoid misinterpretation. If possible, make pre-approval mandatory for large expenses.

With more people working from home than ever before due to Covid, small to medium business owners must also outline what equipment will be provided to employees and what purchases they will be reimbursed for. Some computer equipment such as laptops, monitors and headphones may be essential, while a new desk may not be. This will be specific to your business and its policies.

Explain the process for how to submit expense or reimbursement claims and outline what needs to be included in these submissions, such as the receipt, total amount of purchase, date of purchase, name of the seller/supplier and a description of the goods and services bought.

Simple to understand

The way you present your policies is as important as the guidelines laid down. It is easy to get lost in the details while drafting policies and compromise on readability. Make sure the language is comprehensible and keep it simple when possible. Avoid overexplaining and ending up with a 30+ page document that nobody will fully read. Include all of the important details, but keep it user friendly.

Up to date

If possible, seek help from a lawyer to ensure that the policy is in line with the most recent fiscal laws and regulations in your locality. The policies should also fit your company size and culture and evolve as you grow. Your expenses policy should act as a living document, so make sure to update it as often as needed.

Fair

Ensure your policy treats every employee the same, regardless of rank or tenure. Don’t make any exceptions that could make certain employees feel less valued than others. Also, explain exactly how quickly employees can expect to be reimbursed for any out of pocket expenses to set expectations and avoid misunderstandings.

Once the final draft is ready, make it readily available for all the stakeholders in the process, including employees, managers and the finance department.

2. Keep the processes simple

Complicated expense reporting processes can take valuable time out of your finance team’s day. They can also lead to human error, which can jeopardise your financial health.

This is particularly true for organisations that still use manual systems and require security clearance and triplicate forms to approve expenditures and claims. A quick and straightforward set of processes not only saves your team time but also encourages timely reporting and approval processes.

Keeping track of the receipts, invoices, credit card statements, ticket stubs and vehicle logs can also become cumbersome. For better organisation, create a centralised system for making claims. The process of uploading the documents and verifying their authenticity should be simple, whether in digital or physical form.

Top Tip: Effective receipt management is key when tracking business expenses. Learn how to strategically manage, store and track your business receipts in our guide on how to manage business receipts 📂

3. Collect the right data

Businesses should have an efficient system in place to capture all relevant data like invoices, signatures and contracts for validating and approving claims. Relevant data is timely data. Invoices and reports should be submitted to the finance team within a reasonable amount of time.

For example, for a claim to enter into the next pay cycle, make it mandatory for employees to submit it at least five days before the pay date. This way, the finance department will have enough time to review the expense reports and comply with the guidelines laid down in your expenses policy.

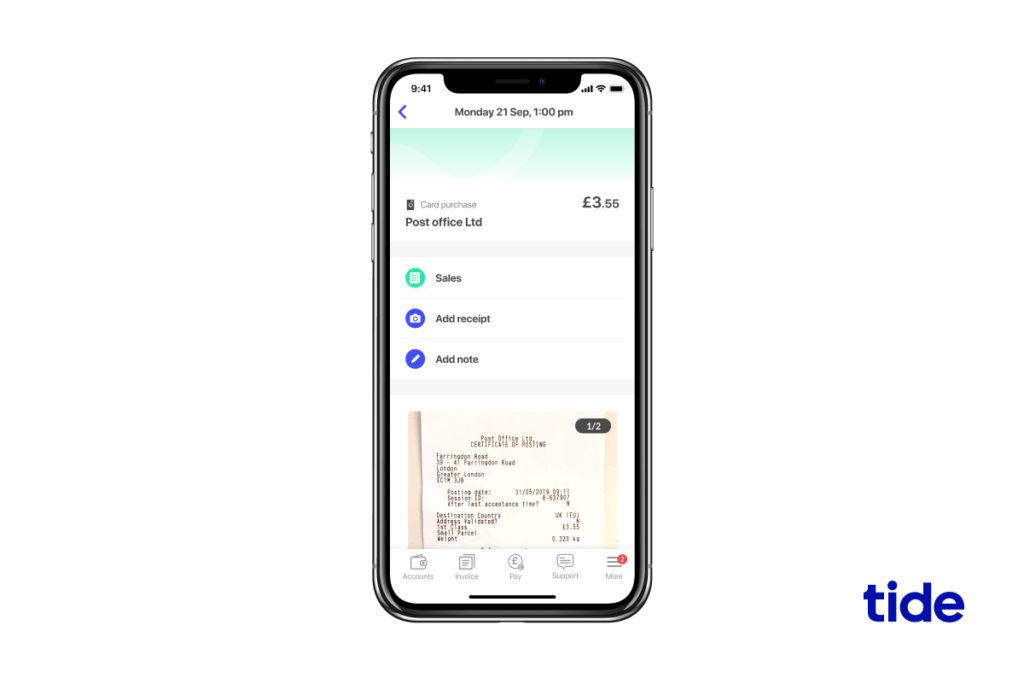

Top Tip: With the Tide mobile app you can scan and upload receipts, auto-match them to transactions and add notes, making financial management a breeze. Check out how you can manage your expenses all within the Tide app 🙌

4. Digitise and automate processes

As mentioned above, manual expense management demands a lot of time, money and effort. An automated expense management system with ready-made templates streamlines the spending and employee reimbursement process (if applicable) and helps you to be more efficient.

The best part about digital expense management systems is they make it far easier for employees to follow the rules. This eliminates most potential mistakes from occurring, such as overspending, double-entry, lost receipts and so on.

Here is how Tide’s expense management feature will help you:

No paperwork

E-receipts and receipt scanning features make verification much easier and faster for you and your finance department.

With Tide, you can take a picture of your receipts and upload them directly to your Tide app from iOS and Android mobile devices. Not only can you attach receipts to specific transactions, but you can add multiple attachments and notes along with each scanned receipt for additional clarity, such as a picture or description of the purchased item itself.

No time to manually match receipts to transactions? No problem. Our receipt importer automatically matches bulk receipt uploads to their respective transactions.

Accurate data entry

Manual data entry always leaves room for human error and requires meticulous double and triple checking to ensure accuracy. Automation swiftly removes the need for manual entry, saving your team valuable time and hassle.

Tide’s platform is integrated with your accounting system so that you or your finance team don’t have to manually enter data. You can access our platform anytime, anywhere through a smart device and an active internet connection.

If you prefer, you can also download your transaction history with attachments and send them to your accountant. Here is how to export your expenses from the Tide platform:

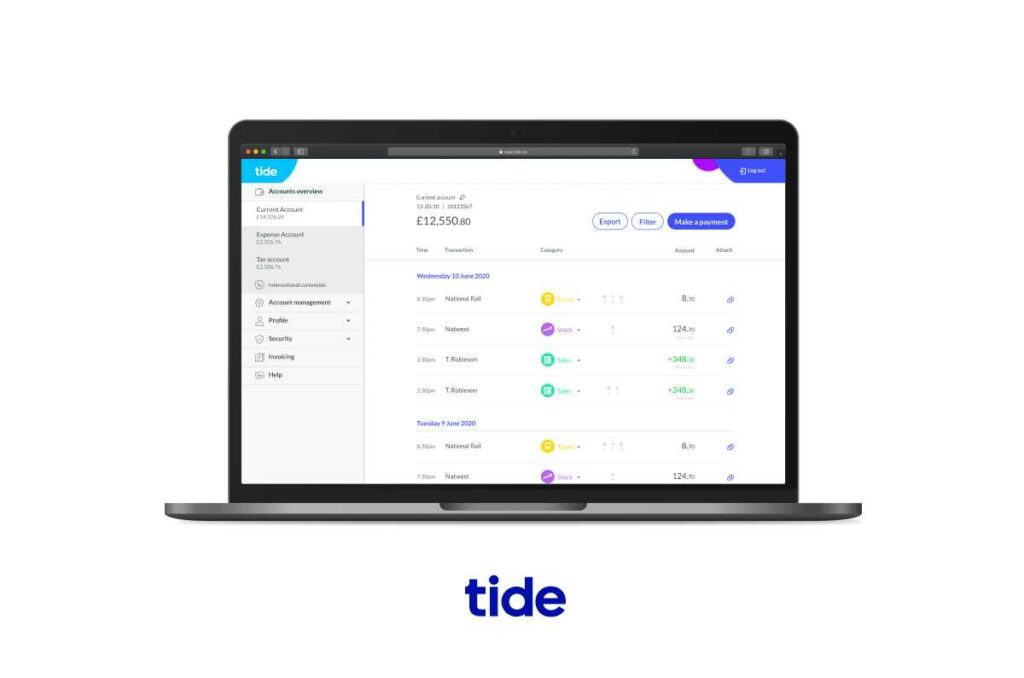

Insightful dashboards and reports

Digitised expense management systems make reporting a breeze. As everything is automatically collated online, you can simply log into your dashboard and see a high-level overview of your employee expenses without needing to lift a finger.

Tide hosts a 100% cloud-based user-friendly dashboard that gives you actionable insights into the status of expenses.

From your dashboard you can also filter by transaction type, create and pay invoices, view and export VAT paid on transactions, send categories, comments and attachments directly to your accountancy software and much more.

Top Tip: As your small business grows, so will your customer base and number of employees, and consequently, the number of invoices you send and receive. To keep things organised, you need to have a proper invoicing process in place. Learn more in our guide on how to streamline your invoice process💡

5. Track errors and fraud

Making errors is understandable, but failing to identify them can turn costly. Keep an eye out for these common types of employee expense report frauds:

- Fictitious expenses. Your finance team should be aware of the difference between real and fictitious receipts and double-check everything that is sent their way.

- Mischaracterised expenses. In these cases, which amount to 20% of all employee expense frauds, personal expenses are disguised as business expenses. An example is when an employee buys an office supply and keeps it for personal use.

- Overstated expenses. These are legitimate expenses inflated in order to claim a higher amount. The most common employee expense fraud is exaggerating mileage, followed by altering taxi receipts and exaggerating restaurant tips.

- Multiple reimbursements. When you submit more than one bill for the same expense, it is counted as multiple reimbursements. For example, when you submit the hotel bill and the food & beverages bill separately but the first bill includes both.

Although you should be wary of inaccurate expense claims, it’s important to note that not all discrepancies are frauds. Sometimes, typing and arithmetic errors make their way into expense reports. Or, an employee could have lost a receipt and accidentally inflated the price without realising it.

Before you confront your employees about any inaccuracies, make sure you have ruled out all other possibilities and always give them the benefit of the doubt for good measure.

Top Tip: At Tide, we’re dedicated to keeping you and your business safe. We make sure our risk systems are robust and conduct thorough checks on all payments and new members. But there are some types of fraud that are harder to stop. Here’s how you can keep your small business safe from fraudsters ⚠

6. Audit your processes and receipts

When auditing receipts and reimbursements, it is vital to make sure that the expenses are necessary and in line with your internal policy. Your processes should also be manageable and visible to ensure predictability in reporting.

Make sure you look for these anomalies while auditing employee expense receipts and reports:

- Date and time anomalies. For example, a travel bill generated on a day the employee was on leave or on a public holiday.

- Location anomalies. For example, an employee submits a restaurant reimbursement for an employee retreat they did not attend.

- Vendor detail anomalies. While forging fictitious receipts, it is common to see fictional details. Cross-check whether the details provided like tax ID, bill number and store location are real.

- Higher reimbursement amount compared to others. For example, a bill for £200 while the average expense for each employee for the same task was £75.

- Missing fields. Missing fields in reports and receipts are a red flag. Make it mandatory for employees to fill out all the specified details and recheck them while auditing.

Along with internal auditing, spot audits by an external team helps you keep frauds in check. Feedback from an outsider can be used to revisit your system and make any necessary changes to your strategy.

7. Make your team accountable

Employee motivation can go a long way in fostering integrity. Communication and teamwork are essential in creating a healthy spending culture within your organisation.

Here are a few tactics to keep in mind:

- Don’t turn a blind eye to minor discrepancies. Review your expenses policy with your team to avoid common mistakes or errors and always keep your door open to answer any questions.

- Automate your processes. This way, even if employees are not aware of the policies, they have no option but to follow them. This is the simplest way to avoid fraud, encourage compliance and boost morale.

- Ask for opinions and suggestions from employees. Encourage employee input while you’re drafting or updating policies and address any and all concerns that arise. The more that everybody is on the same page, the smoother your policy will play out in real time.

💡 Expert insights

Insights author: Dan Hogan, Co-Founder and COO at Ember, who make it simple for everyone to launch, operate and grow a business by automating the tax and accounting, allowing business owners to do just business. Ember takes a tax-first approach to finances, meaning business owners can easily see how much tax they’re paying, automatically optimise it and send it off to HMRC in a few simple steps, without needing to hire an expensive accountant.

How can small businesses make the expense claiming process as easy as possible?

To make it easier to spot the expenses you can claim tax relief on when it comes to the end of the year, we recommend going granular on categorisation. Expenses such as dining with clients or shouting evening meals at the office for late workers can go under a ‘Food’ umbrella, or one-off payments to relevant seminars and webinars can go under an ‘Education and training’ category alongside subscriptions to further industry knowledge.

Wrapping up

An efficient expense management system should strike a healthy balance between control and flexibility. Make sure that you create and maintain a fair, transparent and clearly defined expenses policy to guarantee everybody is on the same page and streamline your processes.

Regardless of your business size, digital and automated expense management will make your life a lot easier.

With Tide’s powerful features, you can digitise and automate your expenses and save a significant amount of time otherwise spent on manual entry, verification and risk management. Our all-in-one business admin platform lets you manage multiple cards from one app, tag income and expenditures with custom labels, create and pay invoices anytime, anywhere and even integrate with your accountancy software. We help you simplify your business finance so that you can focus your creative energy on growing your business.

Photo by Christina Morillo, published on Pexels