How to manage business receipts

For small businesses, effectively managing business receipts plays a key part in properly tracking expenses and streamlining your financial admin.

Without proper management, you run the risk of losing or misplacing paper or electronic receipts which will make it difficult to conduct accurate cash flow forecasting, set effective business budgets and manage employee expenses.

Taking the time to build an effective system for managing your business receipts will also enable you to deduct allowable expenses from your tax return and avoid getting into hot water with HMRC in the event of a tax audit.

In this guide, we’ll explain why it’s important to strategically manage, store and track your business receipts. We’ll also give you some tips on why and how expense management software can help to streamline this process and save you valuable time and money.

Top Tip: Before diving into the complexities of managing different business receipts, it’s a good idea to have a clear idea of how business expenses impact cash flow, how to pay the correct amount of tax, which expenses you can claim, and how to claim them. To learn more, read our detailed guide to what expenses are and how small businesses can manage them💡. Also, check out our guide to the difference between invoices and receipts to refresh your memory on the legal differences between these two essential accounting documents 📌.

Table of contents

- Why is it important to manage business receipts?

- How long does your business need to keep receipts?

- How to track business receipts

- Wrapping up

Why is it important to manage business receipts?

A receipt is an acting proof of purchase that acknowledges that a payment has been made.

Managing business receipts effectively helps you to properly monitor your business’s cash flow and efficiently organise your record keeping. It also helps you prove that you actually did make the payments you claim to have made when filing your tax returns.

There are several situations where managing business receipts will help make your life as a small business owner much easier.

Tax audits

When you claim business expenses you will need to present all relevant receipts as proof of your business’s spending.

Once you’ve presented those receipts, you may want to throw out or delete your paper or digital copies to free up some space. That move would be ill-advised, as it could land your business in trouble if HMRC decides to investigate your expense claims and business accounts.

That’s because when HMRC requests a tax audit, you must be able to provide all relevant receipts and any other documentation to back up your expense claims (we’ll explain exactly how long you must keep this documentation in a later section).

Having a proper system for managing your business receipts will help to ensure you’re able to prove your expense claims in the event of a tax investigation and make this process quicker and easier.

Top Tip: Tracking expenses is a crucial part of managing your business’s financial health and making realistic predictions about future revenue and budgets. To learn more about how to improve your business’s financial health in the long run, read our detailed guide to how to keep track of expenses 💡.

Monitoring staff expenses

Most businesses implement a company expense policy to guide employees on how to best spend company money. Part of this policy may include having employees track their spending by saving and then presenting receipts to your accounting team via expense reports.

Without business receipts, employee expenses could be much harder to track and your business may run the risk of staff overspending. By using business receipts as a way of monitoring company spending, you’ll find it easier to create accurate expense reports during tax season.

Top Tip: Effectively tracking and monitoring employee expenses is an essential part of managing your business’s cash flow and avoiding unpleasant surprises in tax season. Creating a clear and transparent company expense policy is the best way to ensure your employees know how to spend company money appropriately and how, where and when to report and claim their company expenses. Learn more by reading our guide to how to create a company expense policy 🌟.

Managing business overheads

When your business successfully manages its receipts, you may find it easier to review your business overheads and keep them under control. While you probably have a clear idea of your larger overheads such as monthly rent, insurance and business rates, it can sometimes be trickier to track those smaller business overheads like office equipment.

It’s easy to think of these smaller costs as just petty cash that don’t require tracking. However, these small business expenses can quickly accumulate and without proper management, you may end up burning through more cash than you realise.

Properly managing your business receipts when it comes to those smaller recurring monthly overheads will help you manage your costs and ensure business overheads remain reasonable.

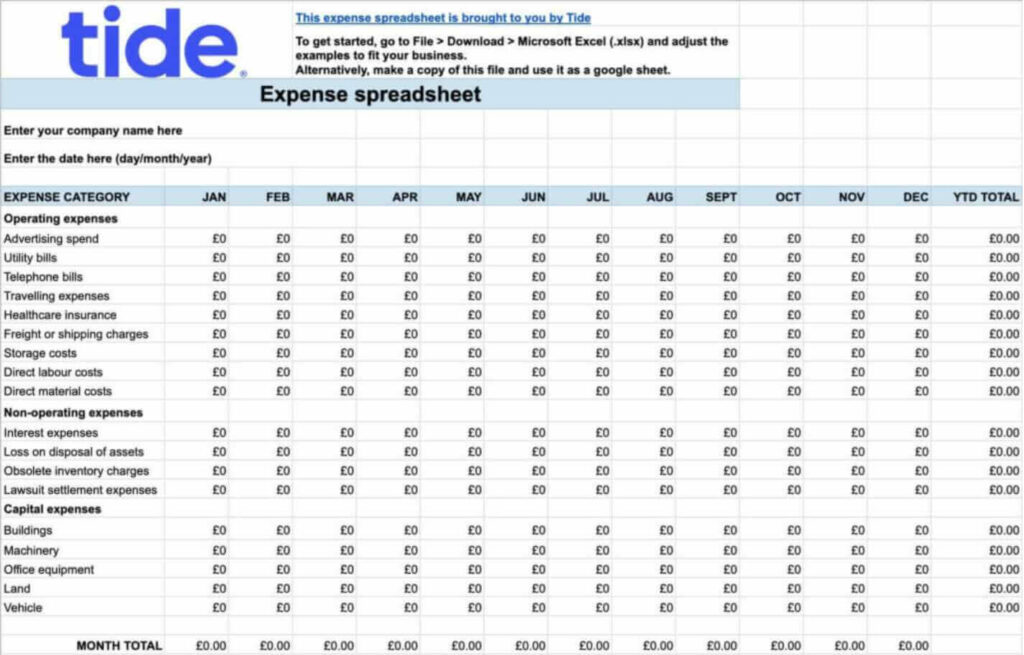

A great way to keep things organised is by using tools like Microsoft Excel or Google Sheets to create a digital spreadsheet. An online spreadsheet is much faster than recording expenses by hand and if you choose a cloud-based spreadsheet, you won’t ever need to worry about losing your hard work.

If you’re not sure how to create one from scratch, we’ve done it for you. Here’s our free online expense spreadsheet template to get you started.

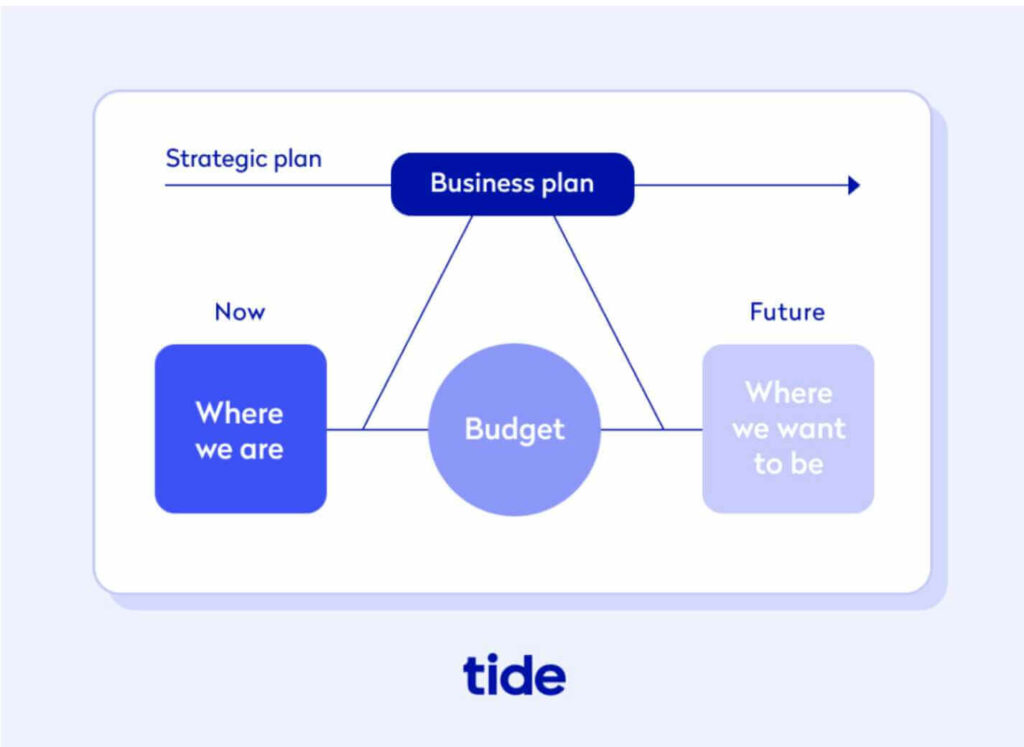

Setting informed budgets

Receipts act as a record of your business’s expenses, thus having a traceable record of all of your business receipts can make it much easier to set informed budgets. If you’re able to refer to recent and historic receipts, you may find it much easier to set realistic budgets for the next month, quarter or year.

Without evidence of your business’s day to day running costs, it can be harder to know how much to budget. For example, if you track receipts for the past three months of your employees’ business lunches, it should be easier to set an informed business lunch budget for the next quarter.

If you don’t have a record of your business’s daily expenses, your projected budgets may not be a realistic reflection of your business’s costs and spending. Having access to business receipts that date back several months or years will help paint an accurate picture of where you may need to increase or decrease budgets to stay in line with your fundamental goals.

Top Tip: Creating a clear business budget will help you to more accurately forecast your earnings, plan your expenditure and hold yourself accountable. Without a detailed spending plan, it will be more difficult to achieve your desired business goals and understand exactly where your money is going. To learn more about the importance of creating a business budget and exactly how to create an effective one, read our step-by-step guide to creating an effective business budget 💷.

How long does your business need to keep receipts?

Keeping business receipts is an essential part of maintaining accurate and accountable business records. As mentioned above, receipts are necessary for claiming tax-deductible expenses. That said, businesses are sometimes unsure about how long they need to keep hold of their business receipts.

The exact timeframe for keeping a record of your business receipts depends on the type of business you run.

Limited companies need to keep a record of expense receipts for six years or 72 months, while sole traders must maintain their records for five years.

While HMRC has set this general guidance, they do hold the power to investigate any business’s accounts for up to two decades if they suspect tax avoidance. For this reason, many businesses choose to keep their documents for longer than the recommended time frames.

How to track business receipts

As your business evolves it’s a good idea to get into the habit of properly tracking all of your business receipts. Taking the time to set up a proper receipt tracking process will save you hours in the long run and ensure the smooth running of your daily business admin tasks.

If you’ve ever had to spend time trying to track down a paper receipt for a specific business expense, you’ll know how frustrating and time consuming the process can be.

This is where having an efficient business receipt management process can save you time that you can put back into growing your business.

Here are a few methods that could help make the process easier for you.

Store business receipts online

As your business evolves, the number of expenses that you and your team regularly generate will increase, too. As six years or more of business receipt records is a substantial amount of paperwork to store, digitally recording all of your business receipts is a viable alternative to paper (not to mention more environmentally friendly 🌎).

While HMRC recommends you keep all the original documents you receive, this doesn’t mean they need to be paper copies. In fact, HMRC encourages businesses to store their records digitally.

Keep in mind that digital versions are acceptable for business receipts, but you must still hold onto physical versions of documents showing tax deductions such as P60 forms.

These days many businesses provide the option of sending a digital receipt to an email address. Agreeing to this option means you can directly save business receipts to one specified digital location.

Even if paper copies of business receipts are unavoidable, you can scan them into your computer or smartphone and then discard the paper copy. It’s important to scan the reverse side of the receipt too since many businesses and shops print double-sided receipts with relevant information.

Tide’s receipt importer makes it easy to do just that. Simply pay with your Tide card, log into the Tide mobile app, upload, or take a photo of your receipt and match it to its relevant expense. On the web, you can even bulk upload an unlimited number of receipts to save time.

Top Tip: Managing company spending and all the accompanying paperwork is a challenge for most small businesses. Luckily, spend management accounting software is a solution that makes tracking business receipts much easier. Not only can you upload receipts to store digitally, but spend management software automatically records and often categorises expenses for you so that you don’t need to manually reconcile transactions. To learn more, read our in-depth guide to spend management and best practices 🌟.

Organise business receipts chronologically

Organising your business receipts in chronological order makes it easier to track down specific receipts at a later date.

For example, if you need to know how much your business spent on employee rail fares in any given month, having access to all related receipts in chronological order will make it easier to find what you’re looking for.

You will also need to present your expenses with dates to HMRC so they can see that the expenses have occurred with the frequency you say.

It’s important to keep your expenses organised according to the tax year. Start from the beginning of the latest tax year (6th April) and finish with expenses incurred at the end of the tax year (5th April).

Group business receipts into categories

Organising receipts by category is key to building a receipt management system that’s easy to navigate.

Grouping your business receipts together into categories that relate to different aspects of your expenses helps you manage separate budgets and see if you’ve gone over any limits.

For example, if you run a limited company, you may be able to claim up to £150 per year per employee for entertainment purposes as a tax-deductible expense. Accurately filing the business receipts related to these costs throughout the year will help you to see if you’ve stuck to the budget or have gone over the limit.

Top Tip: Wondering what other tax breaks your small business may be eligible for? There are plenty of ways to ease your tax burden and free up cash for your business. To learn more about tax reliefs, read our guide to 8 tax breaks small businesses can take 🎉.

Back up your business receipts

Storing your business receipts digitally is the first step to ensuring you never lose any important paper receipts again. Setting up a cloud storage system is the next step to ensure your business receipts are safely backed up in case of an unpredictable computer crash or another catastrophic event.

Harnessing cloud storage systems also allows you and your team to access business receipts from anywhere in the world with an internet connection.

Backing up your business receipts properly means you won’t need to worry about misplacing or accidentally deleting important receipts that you may need to back up expense claims.

You could try using Google Drive or Dropbox for storing your business receipts. Both apps allow you to quickly save images of receipts to the cloud and organise them into folders.

Or, you could use an expense management tool like Tide that automates the repetitive nature of this process and minimises the risk of human error. Besides effortless expense management, Tide also makes it easy to send customised invoices on the go, set up scheduled payments, manage limits, link your transaction feed to an integrated accounting software of your choice and much more.

Wrapping up

As your business grows so will its expenses and accompanying paperwork. Without a proper receipt management system in place, it may become difficult to effectively manage your daily administration tasks.

Properly managing your business receipts will help you manage your business’s expenses, set informed budgets and monitor cash flow. It will also save you time when it comes to filing your tax return.

Tide’s powerful spend management tools are designed to save you time and money and eliminate unnecessary worry. You can also hand out company expense cards to your employees to use as a payment method through your company account. These cards provide an added layer of security as you can set spending limits and track spending in real-time. To get started, sign up for a free business bank account today to experience what effortless expense management feels like 🆓 🙌.

Photo by Marcus Aurelius, published on Pexels