How to create a business budget

Every business needs a solid business budget in place. A good budget will equip you with the insight you need to plan for the month or year ahead, make strong financial decisions, and increase your profits.

Whether you’re preparing to launch a brand new business, or already up and running, creating a budget for your business will help you set goals for your business, get funding, and prevent you from overspending to improve your bottom line.

In this article, you’ll learn what a business budget is, why they are important, and how to create one.

Table of contents

What is a business budget?

A business budget is a spending plan based on the income and expenses of your business. It combines key financial information to help you plan ahead and identify areas where you may need to cut costs, as well as growth opportunities.

Budgets provide an estimation of revenues and expenses over a specified period of time, such as monthly or annually. You may even want to create a budget for a specific event or project, to stress test different variables and aid decision-making.

A business budget will help you:

- Forecast your earnings. Creating a budget helps you estimate the amount of money your business will make in revenue, sales and profit.

- Plan your expenditure. A budget helps you predict spending so that you have a legitimate reason behind every penny you spend.

- Set goals for your business. A business budget helps prioritise your goals and plans for growth.

- Hold yourself accountable. Having a budget lets you evaluate your spending plan vs. spending reality to see if you’re meeting your desired goals and achieving forecasted expectations.

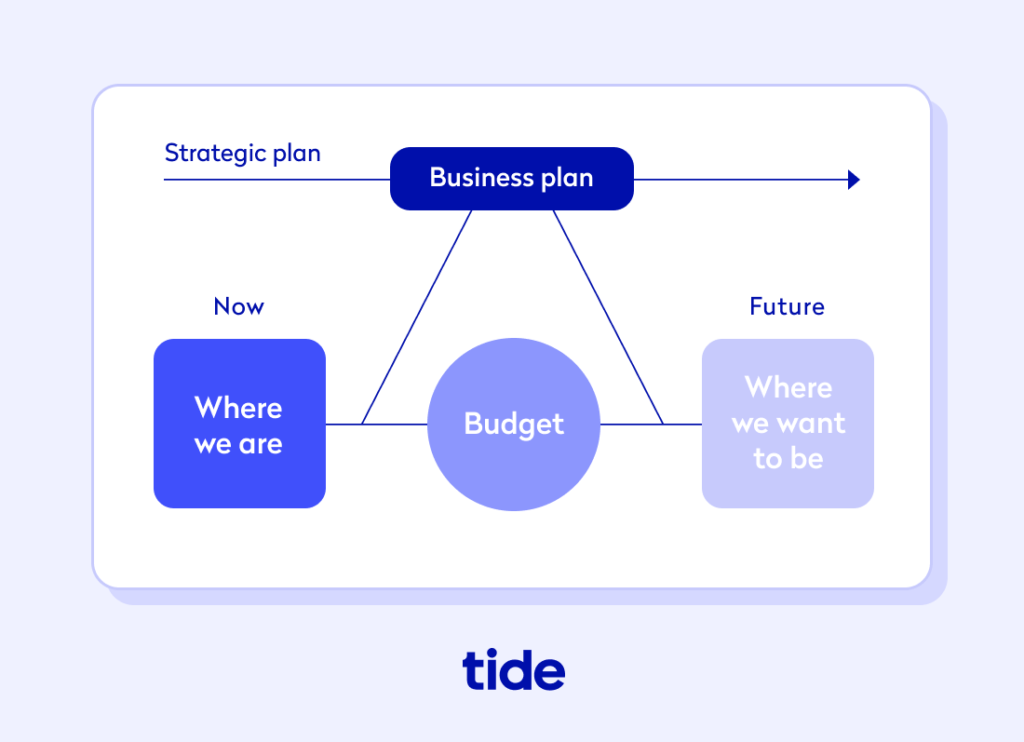

A business budget is an essential element of your strategic business plan, and vital for ensuring success. It will help you determine whether business costs are essential or optional, and help you keep your goals realistic.

If you’re hoping to get funding via business loans or raise venture capital, lenders and investors may require a detailed business plan that includes a budget so that they can get a clear picture of your forecasted spending, and feel confident that you have the financial health of your business in hand.

Top Tip: As well as a solid business budget, you should also have an up-to-date cash flow forecast, to ensure your business has enough money coming in at the right times to meet its financial obligations.

5 steps to create an effective business budget

An effective business budget is detailed yet flexible. It should act as a living document that you reevaluate and adjust often as your business grows and evolves.

Follow these steps to create a budget for your own business.

Top Tip: We’re about to explain some basic accounting practices, and while business accounting is not something you need to master as a small business owner, it is key that you grasp the fundamentals. To learn more, read our complete guide to accounting for startups.

Estimate your expenses

When estimating your expenses, you will need to take into account both fixed costs and variable costs. You will also need to consider any one-off expenses you expect to incur.

Fixed costs are pretty easy to identify. These are the consistent and recurring expenses that must be paid every month and are necessary to keep the business running such as:

- Rent payments

- Insurance payments

- Accounting costs

- Software subscriptions

- Leasing equipment

Knowing your fixed costs tells you the bare minimum income your business needs to survive.

Variable costs change depending on the production or sales demands of your business and can include:

- Material costs

- Inventory

- Packaging

- Shipping costs

- Travel expenses

For example, with a manufacturing business, the variable costs would be the cost of the raw materials and labour that go into producing each unit. The more units you produce, the more input you will require and the higher your variable costs will be.

Cost of sales (or cost of goods sold) will account for many of your variable costs, depending on the type of business you are running, but don’t forget about expenses such as marketing, travel, or hiring contractors.

Some costs may be either fixed or variable, so you will need to determine these based on how your business operates. For example, staff wages could be the same every month, or you might hire staff or contractors seasonally or for specific projects.

One-off expenses crop up for every business, and tend to include things like:

- Equipment costs

- Damage repairs/replacements

- Relocation costs

- Office furniture

Top Tip: One of the most important one-off expenses is incorporating your business if you choose to operate as a limited company. You can register your limited company with Tide for only £14.99! 🎉

We have provided some examples of the expenses you may wish to include in your budget, but your own expenses will be specific to your business.

If your business is already established you can use your historical accounting data to inform your expenses, or you may want to research industry standards if you are still in the planning phase of launching a new business.

Estimate your income

Once you know what your expenses will be, you need to work out how much income your business will generate. This will tell you whether you can cover your expenses, or if you need to find areas where you can cut back on spending.

If your business is already up and running, you can use your historic sales activities to forecast future revenue. You may wish to be conservative in your projections, to avoid being overconfident with your spending.

When putting together a business budget for a new venture, conduct thorough market research to understand how your competitors in your target market price similar products or services. This will help you estimate how much you could be bringing in once you launch your business.

Be sure to include any known fluctuations in income in your budget, such as seasonal highs and lows, or upcoming one-off projects. This will allow you to be realistic about how much you can spend, and whether you need to reserve funds from high-income periods to see you through quieter times.

Track your profit (or loss)

A good indication of how well your business is doing is your net profit margin. This is the money you’re left with after deducting your operating expenses, interest and taxes.

It’s important to note that profit earned is not the same as revenue generated. Revenue is the money generated through sales before deducting any of the costs. Even if your revenue boasts an impressive revenue figure, it’s still possible for your business to suffer a loss.

You can use our net profit margin calculator to quickly and easily find your profitability in relation to total revenue.

Our net profit margin calculator measures your company's profitability in relation to its total revenue, or in other words how much of each pound received by your business is net profit.

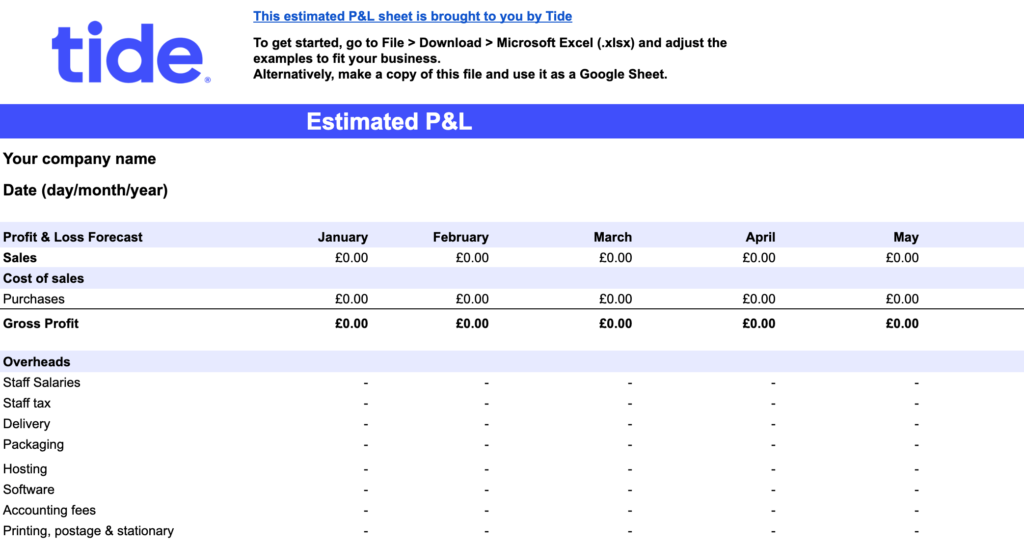

£ £ %It’s also helpful to put together all your financial results into a profit and loss (P&L) statement. With all of your relevant costs already identified and your revenue figures in hand, you only need to carry out some simple additions and subtractions to create your P&L statement.

Here’s an example of what an estimated P&L statement looks like:

You can download a template of this Estimated P&L statement here.

Using accounting software can save you time by eliminating the need to do this manually. With Tide Accounting, you can automate your bookkeeping and view and customise your financial reports, including your profit and loss statement, right from the Tide app.

Keeping track of how well your business is doing financially by evaluating its P&L will help you make more insightful budget decisions, such as whether you need to cut costs or increase prices to offset low-profit margins.

Set up an emergency fund

When running your own business, some expenses will sneak up on you when you least expect them. No matter how well you budget, emergencies will crop up from time to time such as equipment breaking, and being prepared for the unexpected will help to keep your finances healthy, and relieve some of the stress that often comes with a crisis.

Good practice is to set aside 3-6 months’ worth of expenses, however, you may wish to save more than this depending on the types of unplanned expenses you may have to deal with.

An emergency fund should be kept separate from your day-to-day business funds, so you know exactly how much you have set aside should you need it. You can even earn interest on it with a dedicated business savings account – such as our Tide Instant Saver, where you can earn 3.81% AER (variable) on your savings.

Plan regular budget reviews

It’s not enough to simply build a budget plan and refer to it every now and again. Your budget plan must be actively revisited and re-evaluated, preferably each time you deal with major expenses.

This will help you keep an eye on your financial health and stop you from spending money you can’t afford to spare.

When reviewing your business budget, there are two main areas you need to pay attention to: revenue and expenses.

At the end of each month, you should draw comparisons between the revenue projection stated in your budget plan and the actual income of your business. If there are any major shortfalls or unexpectedly high turnovers, you should analyse whether this was due to unrealistic targets or whether the business faced external difficulties.

Similarly, you should review your actual expenses against your budgeted ones and try to identify where the costs differed from your budget plan.

As your business grows, you should use your budget to plan for your long-term needs, and make strategic cashflow decisions to account for things like seasonal revenue fluctuations, or planning for large expenses you expect to incur in the future.

Wrapping up

An effective business budget takes considerable time and effort, but it is worth every moment you put into crafting it.

With a dependable business budget in place, you’ll be more likely to make insightful spending decisions. It will also serve as a barrier that helps you to steer clear of risky expenses and objectively analyse every business transaction you make.

At Tide, our objective is simple – to save business owners like you time and money. Within the Tide app you can access our accounting software, invoice generator, business loans, and everything else you need to help you run a business effectively.

Having a dedicated bank account for your business can help you keep on top of your finances, and opening a business bank account with Tide is completely free – get started and open an account today.

Photo by mentatdgt, published on Pexels