What is a cash flow forecast? (And how to create one)

No matter what size your business is, financial forecasting is important. Especially so for small businesses, where cash flow is your lifeblood.

Without a positive cash flow, it’s hard to survive and make the right decisions for taking your business to the next level. The question is, how can you ensure (and predict) what your finances will look like over the next year of business?

In this article, we’re going to show you how to answer this question by creating a cash flow forecast. You’ll learn what it is, how to create one and how they can be used to make strategic business decisions.

Table of contents

- What is a cash flow forecast?

- How to create a cash flow forecast

- Expert insights

- Wrapping up

- Cash flow forecast glossary

What is a cash flow forecast?

A cash flow forecast is a report or document that estimates how much money will move in and out of your business over a 12 month period. This includes estimated sales, income and general business expenses.

While 12 months is the typical length of time cash flow is forecasted across, you can create forecasts over shorter periods of time. This is handy when making strategic business decisions that might affect your income and revenue generation.

So, why should you create a cash flow forecast in the first place? There are several benefits:

- Predict surges or shortages in cash flow

- Allow you to make better business decisions

- Predict how those decisions will affect future cash flow

- Plan for loans or lines of credit

- Provide context and information to stakeholders

Most importantly, it will allow you to answer questions around some of the bigger (and perhaps pivotal) business decisions you’ll come across in your entrepreneurial journey. These include:

- Can you expand into other territories?

- Can you start hiring talent/a new member of staff?

- Are you able to offer new products or services?

- Are you at risk of running out of cash, and if so, do you need to borrow?

Finally, let’s look at what your cash flow forecast should include (segmented by “cash inflows” and “cash outflows”):

Cash Inflows

- Accounts receivables

- Expected earnings from sales

- Investments

- Sales of company assets

- Loan advances

Cash Outflows

- Accounts payable

- Employee wages

- Operating expenses

- Loan payments

How to create a cash flow forecast

Now you know why cash flow forecasts are important, let’s look at how to create one. Here’s an example of what a cash flow forecast looks like:

(You can download a template of this cash flow forecast here).

Your cash flow forecast is made up of three separate forecasts: sales forecasts, profit and loss statements, and cash flow. Let’s look at each of these reports and how to create them.

1. Setting up your sales forecast

Your sales forecast breaks down how many sales you expect to generate on a monthly basis. By predicting sales, you’ll be able to better predict your total cash flow.

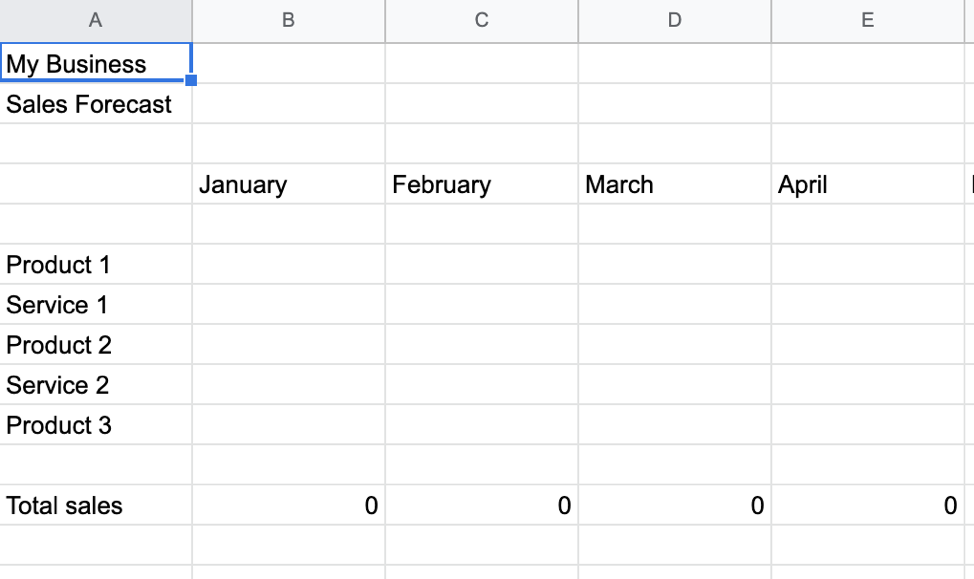

Your sales forecast doesn’t have to be complicated. Simply create a spreadsheet that breaks down the estimated sales by month and by product/service type:

To start populating your sales forecast, start by looking at the sales generated over the previous financial year. Look out for seasonal trends where sales spiked or dropped. You should also consider new markets or audiences you’re looking to serve, as well as new product or service propositions you’re developing.

An extra benefit of sales forecasts is knowing where to double-down. For example, if you find a particular product is generating the majority of your sales, you can make strategic decisions to invest more budget into promoting it.

If you’re running a service-based business, or offer high-ticket products, look at your sales pipeline to predict new business that are likely to close. Knowing what the common buying signals are will help you identify which sales opportunities are likely to close, and when they’re likely to do so.

Top Tip: If you’re liable to pay VAT, do not include this in your sales forecast. You want to predict sales, not gross revenue, to make your sales forecast as simple as possible.

Putting sales forecasts into action

Let’s say you’re running an e-commerce store selling 20 different varieties of socks. Next year, you plan to launch 10 new types of socks and expect to win a wholesale deal with a popular retail brand.

In your sales forecast, start with a row for each of the 20 socks you sold last year. Start with the sales amount for each variety and increase by the percentage you expect to increase by.

Next, create extra lines for each product you’re selling to the wholesaler. Include the predicted sales amount of these products based on how many units you expect them to purchase, and how much each unit costs.

Finally, add a line for each of the new varieties of sock you plan to sell, and include the expected amount you plan to sell of each. Use your product design and planning phase to identify overall demand in the market, and thus estimate how many of each new product you expect to sell.

2. Profit and loss forecast

Profit and loss statements report on your costs (in the form of expenses) and income across a specific timeframe. A profit and loss forecast (P&L forecast), therefore, predicts future income and expenses based on historical data.

Predicting your profit and loss is key, as it will help you estimate how much tax you’re likely to pay over the next year. It will also help you figure out what your future costs will be based on new product/service offerings, and any new members of staff you plan to hire.

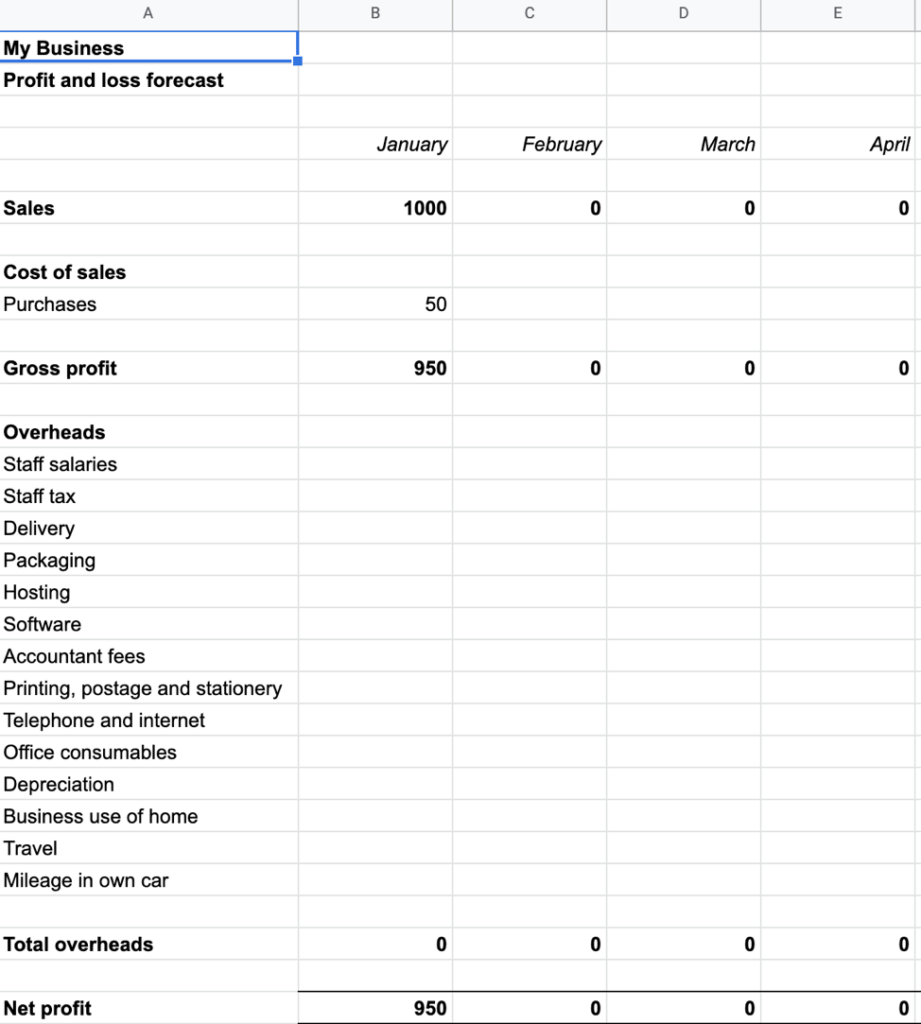

Your profit and loss forecast will look similar to your actual profit and loss statement:

The first few rows are dedicated to your predicted sales, which you’ll populate from the sales forecast you created above. It will then calculate your predicted net profit by subtracting your cost of sales and overheads from those sales. Here’s a quick breakdown of the two:

- Cost of sales is the cost of materials you need to purchase in order to create, manufacture or procure your products (not applicable for service-based businesses)

- Overheads include general business expenses, such as marketing, website hosting, staff and travel expenses

Top Tip: Want to learn everything you need to know about cost of sales? Check out our complete guide on the subject here.

Let’s run through the list of overheads you should include as part of your profit and loss forecast:

- Staff: Include salaries and taxes (i.e. National Insurance) of those on your books

- Software: Include the tools and platforms you use to run your business, e.g. web hosting, e-commerce platform, marketing software etc.

- Professional services: Do you hire contractors, agencies or accounting firms to help you run your business? Add these to your P&L forecast

- Telephone and communication costs: Include any phone subscriptions or software you use to run your business communications

- Office consumables: This includes cables and other hardware used to run your business

- Delivery costs: If you package and ship your goods to customers, include these costs

- Stationary: This includes everything from pens to paper clips

- Depreciation: Calculate the depreciation of your assets, as well as business use of your home and travel expenses

Top Tip: Your P&L forecast should only include regular expenses used to run your business on a day-to-day basis, not one-off purchases (such as laptops and furniture).

Putting P&L forecasts into action

Let’s re-visit our sock example from earlier, starting with cost of sales. These would include the cost of materials, as well as any manufacturing costs to get the socks created and embroidered.

These socks are then packaged up and delivered straight to customers, which would count as delivery costs, not cost of sales. Why? Because cost of sales only accounts for the production or purchasing of the product you’re selling.

Then, we have our software costs to account for, such as web hosting and e-commerce platforms. On top of this, we calculate other software subscriptions we use, such as email marketing, project management and accounting software.

For the sake of example, our sock brand is a remote company, which means our only communication costs is a monthly mobile phone subscription.

By calculating the total cost of goods and overheads, we can predict the net profit generated on a monthly basis.

3. Cash flow forecast

We now have the two forecast statements that we need to create our cash flow forecast. To remind you, this is what your cash flow forecast should look like (which you can download here):

Remember, your cash flow forecasts are built up of cash inflows and cash outflows. This includes the sales predicted in the sales forecast, as well as expenses calculated from the P&L forecast.

But you’ll also need to account for expected one-off expenses and cash injections across the year, such as new investments (computers etc.) and loans.

Use your sales forecast to predict “cash in”, segmenting by product categories as opposed to individual products or services. This will help keep your cash flow forecast more organised and easier to digest.

If you’re registered for VAT, make sure to include your sales amount exclusive of tax. In other words, if you make £100 selling a product and pay 20% on VAT, the actual amount for the purpose of your cash flow forecast would be £80.

Under the cash out section, you can simply copy-and-paste the data from your P&L forecast. You should also include the cost of expenses during the month you actually pay them. For example, if you pay your staff in arrears, put the expense under the month the money is actually transferred to their bank account.

Finally, include your closing bank balance for that month. To do this, include the amount you expect to be in your bank account in the first period (e.g. the first month of the next financial year). From here, you can calculate your predicted closing balance for each month.

This is critical, as it will allow you to see if your balance is rising or falling. If it’s rising, that’s great news! But if it’s falling, you’ll need to identify why, and look into how you can remedy the situation – either by cutting costs or borrowing cash.

Putting cash flow forecasts into action

In this final chapter of our sock narrative, let’s look at how our sales forecast and P&L forecast come together. Starting with cash in, we decide to create different rows for direct sales (through our e-commerce store) and wholesale income.

The reason for this? Direct sales are generated on the month they’re made, whereas wholesale income is invoiced one month and are expected to be paid another. Remember, you want to calculate income and expenses on the month they’re due to enter/leave your bank account.

Next, let’s look at cash moving out. Luckily, the majority of our costs are mostly the same on a monthly basis. In terms of depreciation, the only assets we own are a phone and laptop, so an estimated depreciation of that asset should be calculated.

However, we decide that we want to buy a new laptop before the end of the year, as the one we’re using is a little inefficient. So, we must include this as part of our estimated one-off costs (and when we expect it to be made).

From here, we can now see our overall cash inflow and cash outflow, and our expected bank balance at the end of each month.

💡Expert insights

Insights author: Justin Phillips is the Director of Tempo Accounting who offer online accounting services for freelancer.

What are the main benefits of cash flow forecasting and how do you manage it?

Small business owners have to make difficult financial decisions almost every day. The level of responsibility and risk can be a huge burden, but with the advent of cloud accounting and the availability of more sophisticated reporting, that is all has all changed.

In particular, online cash flow web based accounting solutions have been a major contributor to reducing the stress load of business owners.

Some business owners aren’t aware of the advantages of online web based cloud accounting, so we’ve got the lowdown on why business owners should be using an online web based cash flow forecast system.

What a cash flow forecast can do for your clients

Cash flow forecasting is an essential tool for business planning. It can be done in various ways, with the old fashioned spreadsheet method being the most traditional.

But what are the main advantages of a cash flow forecast for your clients?

Understand the impact of future plans and possible outcomes

For many small businesses, one late payment can lead to cash in the bank taking a nosedive very quickly. But modelling alternate scenarios can help business owners to understand how various situations will impact their cash flow, which is a crucial part of business planning. Using scenarios to test different possible future situations can provide the peace of mind a business owner needs to confidently put plans in place.

Keep track of overdue payments

Keeping on top of consistent late payers is often the bane of a business owner’s life. Having insight into late payers and the impact they have on the bottom line can alert clients to the need for more effective credit control.

Manage surplus cash

For most businesses, it’s rare to see excess cash in the bank. But using additional cash for reinvestment in new markets, or for the repayment of loans, can be essential to keeping afloat.

With cloud dynamic accounting when they’ll have surplus cash in the bank, and being able to see where and when the surplus will occur, means that business owners are better able to plan for what to do with the surplus.

With Tempo Accounting you will be able to dynamically view reporting showing exactly how much cash is in the bank as well as detailing tax liabilities helping you to avoid those late fines as well as proactive tax planning.

This up to to minute accounting makes sure you never miss a deadline!

Save time over a spreadsheet using online tools

Building a cash flow forecast in a spreadsheet, particularly if you’ve never done it before, can take a lot of time and effort. However, using cloud-based software can often take the pain out of forecasting your cash.

Saving you both time and money in the long-run, online tools are invaluable to actionable and efficient planning. With a good accounting service, this can be all entered and tracked via your mobile phone.

There are a growing number of businesses on cloud-based online platforms, making it easier than ever for business owners to owner wants.

Although there are many advantages to a cash flow forecast it is key to seek out an accountant that not only embraces online accounting but partners it will real accounting support.

Wrapping up

With the numbers behind your expenses and income at hand, you’re now able to make more strategic business decisions based on your projected cash flow. Are you in a good financial state to expand your product lines, or do you need to focus on generating more sales for your existing ones?

To summarise, the process of creating your cash flow forecast is as follows:

- Create your sales forecast to predict income over the next financial year

- Create a profit & loss forecast to predict outgoings (based on historical expenses)

- Use these forecasts to calculate your cash flow over the next year, and expected bank balance at the end of each month

If you’re just starting out in business, it’s going to be difficult to calculate cash flow forecasts. However, as you start collecting financial data, you’ll be able to predict the financial health and make the right decisions to help you reach your goals.

Cash flow forecasting glossary

Accounts Payable: The amount owed by a company to suppliers/vendors for goods or services it received on credit.

Accounts Receivable: The amount owed to a company resulting from the company providing goods or services to customers on credit.

Balance Sheet: A statement of the assets, liabilities, and capital of a business or other organisation at a particular point in time, detailing the balance of income and expenditure over the preceding period.

Capital: Wealth in the form of money or other assets owned by a person or organisation or available for a purpose such as starting a company or investing.

Cash Flow Statement: A financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources, as well as all cash outflows that pay for business activities and investments during a given period.

Cash Inflow: The cash going into a business, e.g. money from sales, investments, or financing.

Cash Outflow: The cash leaving a business, e.g. expenses on debt repayment or salaries.

Current Assets: Cash and other assets that are expected to be converted to cash within a year.

Current Liabilities: Amounts due to be paid to creditors within twelve months.

Depreciation: A decrease in the value of an asset over time, due in particular to wear and tear.

Financing Activities: The inflow and outflow of cash resulting from debt issuance and financing, the issuance of any new stock, dividend payments, and any repurchase of existing stock.

Income Statement: One of the three important financial statements used for reporting a company’s financial performance over a specific accounting period.

Investing activities: These are the second main category of net cash activities listed on the statement of cash flows and consist of buying and selling long-term assets and other investments.

Operating Activities: These are the functions of a business directly related to providing its goods or services to the market.

Profit: A financial gain, especially the difference between the amount earned and the amount spent in buying, operating, or producing something.

Photo by Ricardo Resende, published on Unsplash