A guide to spend management and best practices

Several different factors affect the long-term success of your small business, including your value proposition, strategic plans, and marketing efforts.

But perhaps the most important factor is the way you manage your business spending.

In this day and age, spend management is not just about reducing costs; it’s also about optimising value, enhancing risk management and aligning company spending with bigger business goals.

In this article, we’ll cover everything you need to know about spend management; from its basic definition to a step-by-step process of how to implement it in your own business.

Top Tip: A precursor to spend management is grasping the fundamentals of the expenses themselves. To learn about the various types of expenses you may encounter as a small business owner, as well as which ones you can claim and how to claim them, read our guide to what expenses are and how small businesses can manage them💡

Table of contents

- What is spend management?

- The difference between spend management and expense management

- The benefits of spend management

- A spend management process to improve business efficiency

- Spend management best practices

- Wrapping up

What is spend management?

Spend management is a strategic process that businesses use to collect, analyse, monitor, and control the amount of money that they spend on building and managing their products and services.

Spend management takes into account all business activities related to the procurement cycle; from budgeting, sourcing, supplier management, contract management and order requisition to travel expenses, inventory management, and product development.

By organising your spending, you can not only boost your business’s financial health, but also stay legally compliant, build better supplier relationships and improve your products and services.

The need for spend management only increases when we talk about small businesses. That’s because most small businesses are already working with a tight budget, especially with the recent financial disruptions caused by COVID-19.

If you’re not making any effort to manage your company spending, you’re missing out on a lot of potential gains for your small business.

Top Tip: Not only are you missing out on potential gains, without a spend management strategy, you could be putting your business at risk. A study of 80+ failed startups indicated that more than 50% of the founders did not have a clear budget when they launched. A business budget improves your spend management because it helps you to set clear goals and hold yourself accountable regarding expenditures. Learn exactly why a business budget matters and how to create one in our 8-step guide to creating an effective business budget 📌

The difference between spend management and expense management

Spend management and expense management might sound like the same thing, but there are several technical differences between the two concepts.

Expense management is a process used by companies to track and manage the expenses incurred by employees, such as on business-related travel.

These employee-initiated expenses are also referred to as travel and entertainment expenses.

Top Tip: To learn more about expense management regarding employee travel, including the best ways to establish fair corporate travel management policies and how to fit travel management into your company expense policy, read our guide to corporate travel management ✈️

Most businesses keep track of such expenses using expense or travel forms or expense management software. These expense forms or reports typically record the following information:

- The date and time of the expense

- Expense nature, type, or category

- The employee responsible for the expense

- The purpose of the expense

- The total amount spent by the employee

Top Tip: If mismanaged, expense management can be incredibly time-consuming and leave you open to employee fraud. Learn how to write and enforce an effective expense management policy and how expense management software and automation can save you tons of time and worry in our detailed guides to how to create a company expense policy and how to manage employee expenses 🔍

Spend management is a broader concept that goes beyond employee-initiated expenses. It dives deeper into how, when and why a business spends on building out its products and services.

Spend management is directly tied to the procurement strategy of your business, which includes invoicing, outsourcing, and the overall supply chain management.

It also takes into account the payments made by employees with company expense cards, the recurring online subscriptions of a business and the employee expense forms that are taken care of during expense management.

The spend management process is designed particularly to give decision-makers a holistic view of a company’s finances. It not only helps identify various business expenses, but also groups them together.

It may be helpful to put together a procurement team to help you to standardise, centralise and oversee procurement processes to ensure they are operating at optimal efficiency, are well organised and are following contract guidelines. This procurement team can then report to decision-makers on a regular basis.

The spend management process also helps accountants analyse each spend category and create an appropriate expense policy for the business depending on their findings.

While having a basic expense management policy in place is crucial to a company’s bottom line, it must always be part of a bigger picture (i.e. the spend management process).

Simplify your spending with Tide Expense Cards – never process expense claims again

Do expenses the smart way with Tide Expense Cards for you and your co-workers. They make managing company spending simple and straightforward, and you can simply request them via the Tide app. Get started with a free business bank account today.

The benefits of spend management

Developing a spend management process gives small businesses in-depth insight into all the expenses that go into procuring, building, and delivering products and services.

This helps you to identify the exact areas where you’re losing money and where you can optimise spending to create value, reduce risk and streamline cash flow.

Below are four major benefits of developing a spend management process.

1. Save money

Spend management can help your business save money.

This can be done in a variety of ways, such as evaluating the value of each expense, identifying better suppliers and optimising your business processes.

To implement the tactics mentioned above, you need to know exactly where your business is spending money, and how much. Consolidating this data and analysing it to make cost-effective decisions is what spend management is all about.

For example, let’s say that you sent five employees to attend important sales conferences and meetings across the country, each of whom has spent money on travelling, accommodation, food, and other activities.

Spend management will allow you to analyse the spending of your employees. Who is spending the most (and least) on these conferences? What are their major expenses? How necessary are these expenses?

You can then identify opportunities to reduce expenses, such as by booking a different hotel for their stay, or arranging transport so they don’t spend too much on taxis.

You may also want to reduce the number of employees that you send out to attend these country-wide conferences, ultimately cutting overall business costs and increasing savings.

Saving money will enable your business to invest in more important things, such as purchasing new machinery, implementing new systems, improving research and development, or boosting your ad spend to attract new business, for example.

2. Make better decisions

Developing a spend management process for your business gives you the data and transparency you need to manage each expense category and identify bottlenecks.

This helps you make less risky, more informed decisions about the future of your company, such as improving business processes.

For example, analysing spend data can allow you to forecast spend scenarios more accurately. You’ll also be able to set realistic benchmarks for employee performance, and effectively allocate your budget in the right places.

This will ultimately contribute towards the long-term success and financial growth of your business. Of course, this isn’t a one and done effort. You should aim to consistently and routinely analyse, evaluate, optimise and refine your spending habits to ensure you stay on track to achieve both your short and long-term goals.

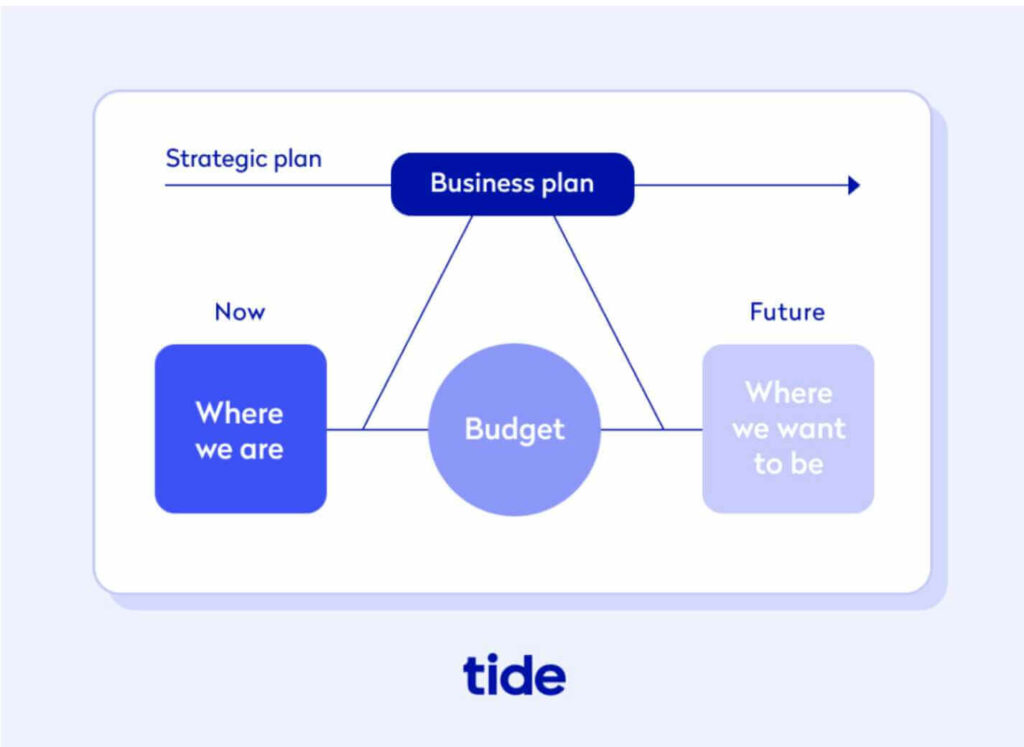

Top Tip: Another asset in your arsenal that helps you to make better decisions is your business plan. A business plan provides you with a roadmap that gives you a clear sense of direction in terms of your business journey (e.g. where you currently are, where you want to go, and how you plan to get there). To learn more, read our complete guide to how to create a business plan and write your company roadmap 🌟

3. Improve legal compliance

Documenting expenses using spend management is not just useful for internal reasons; it also helps you pay the right amount of tax and prepare for external audits.

Tracking business expenses in a timely manner, and categorising them into distinguishable groups improves spend visibility and makes expense data easier to trace.

Ultimately, it helps you avoid paying heavy penalties and fines by ensuring transparency and accurate financial reporting.

Spend management also helps you pay vendors and online services on time, track client expectations in terms of the products or services that they plan to buy from you, and avoid facing late payment penalties.

This helps you maintain better working relationships with your suppliers while making sure you don’t leak any unnecessary cash.

Top Tip: To further improve your relationships with your suppliers and customers, it’s key that you grasp the fundamental differences between the various documents that acknowledge purchases, sales, and transactions. To learn more about how all of these documents tie into spend management, read our guides to the difference between purchase order and invoices and the difference between an invoice and a receipt 📣

4. Identify better sourcing opportunities

Spend management allows your business to map each and every cost involved in the supply chain process.

This helps you identify whether you need to switch suppliers or even focus on one particular vendor instead of multiple others.

For example, let’s assume your business acquires raw material from multiple suppliers in different countries.

When you collect and analyse data on raw material expenses, you’ll be able to identify which suppliers are offering you the most value.

This will enable you to secure cheaper deals, identify more cost-effective sources, or simply end unnecessarily expensive contracts.

A spend management process to improve business efficiency

Now that you’re aware of the various benefits of spend management, let’s discuss how you can implement it in your own business to improve efficiency, reduce costs and boost the long-term financial health of your company.

Before we begin, it’s important to note that there is no set way to go about spend management. The process you choose depends mostly on your business type and nature.

For example, the data and processes of a digital agency would naturally differ from those of a manufacturing business.

However, the spend management process discussed below will help most businesses collect, consolidate and analyse their spend data effectively.

Step 1: Identify sources of expenditure

The first step of the spend management process is to identify all the expenses that your business is incurring, especially those related to the procurement of goods and services.

Strategic sourcing may seem like a straightforward task at first, but when you actually start doing it, you’ll realise that it can be time-consuming, and can potentially result in expense duplication and errors.

To minimise errors and make identifying expenses easier, it’s a good idea to delegate this responsibility to department heads.

Each senior manager or head of department would record the specific expenses incurred by their department and hand them over to your accountant.

Delegating responsibility will also help your managers feel empowered as they would be involved in your company’s policy-making process, as well as contributing to its financial success.

It’s important to note that not all business expenses can be divided by departments. Make sure you take into account all other expenses, such as rent and utilities, employee salaries, licenses, and more.

Top Tip: There are a variety of ways you can track your expenses, from manually creating entries to using dedicated apps that automatically record transactions in real-time. Learn more about the various types of expenses and the best ways to manage them in our guide to how to keep track of expenses 🗂

Step 2: Gather data into a central database

After you’ve collected all the expense sources, the next step is to gather this information in a central database. This will help you easily categorise and analyse your spend data.

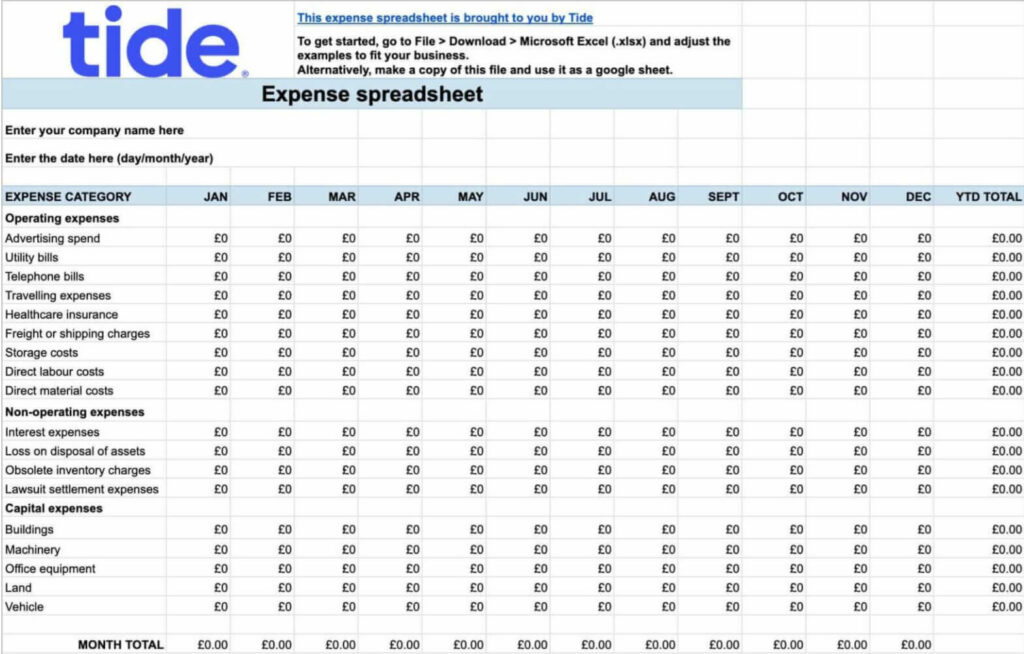

Centralising data into a repository is definitely much easier than identifying and tracking the sources of expenditure—all you need to do is create a document and input all the collected expense data in it for ease of tracking, managing and gaining insight into your performance.

You can also choose to consolidate this data using online spend management solutions, such as expense software (which we’ll explain in more detail in a later section) or accounting software (preferably one that integrates with your chosen expense software).

If you’re not quite ready to commit to a software solution, it’s also easy to gather your expense data in a digital spreadsheet that you store in the cloud. We’ve created a free online expense spreadsheet template to get you started:

Whatever decision you end up making, make sure you stick to a long-term solution. Changing your centralised spend data repository can be a cumbersome task.

The spend data of your company is extremely sensitive information. This is why it’s crucial that you appoint a reliable person to create a centralised database.

Top Tip: In most businesses, this task is handled by a professional accountant. For small businesses, hiring an in-house accountant can be expensive, which is why a good alternative is to hire an online accountant. Learn more about the ins and outs of what it’s like to work with an online account in our guide to how to find an online accountant for your small business 📈

Step 3: Cleanse collected data

The spend data that you collect and analyse will directly impact the decisions that you make for your company’s future. The more you know, the more intelligent spend management practices you can put into place.

That’s why it’s so important that you ensure the quality of the data that’s collected and stored in your database. This process is also known as data cleansing.

Cleansing your data may involve the following steps:

- Collect evidence to back recorded expenses, such as receipts

- Make sure the data is free of transposition errors

- Remove any duplicated expense data

- Correct any spelling mistakes in the database

- Standardise data recording by following one pre-decided format

- Ensure all spend data is recorded in a single currency

Cleaning your database will significantly improve the quality and reliability of your data, and ultimately help you make better decisions and sidestep any potential mistakes.

Step 4: Categorise spend data

There are tons of different expenses a business can incur at any given time; some may be related to procurement processes, while others might be tied to employee salaries and benefits.

To improve spend visibility, it’s a good idea to group your expenses into several top-level categories. This will help you read and understand expense information better.

Here are some expenses categories you might want to create:

- Vehicle expenses

- Rent and utilities

- Supplier contracts

- Employee salaries and benefits

- Online software subscriptions

- Advertising expenses

- Maintenance and repairs

- Consultancy charges

- Food expenses

The categories you choose for your spend management process will naturally depend on the type and nature of your business.

For example, an expense category related to sourcing raw material might be relevant to a manufacturing business, but not to a company selling online software.

Step 5: Analyse spend data

Analysing and interpreting spend data is just as, if not more, important, as collecting it in the first place.

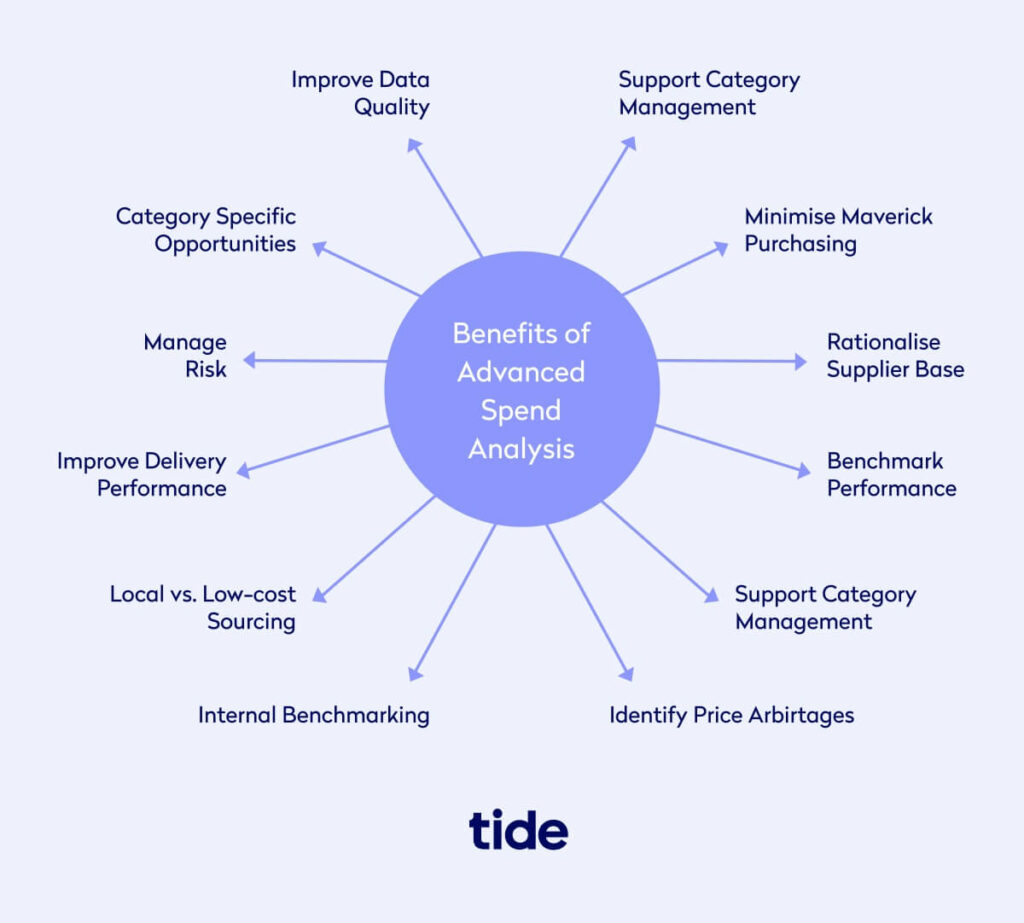

Conducting a thorough spend analysis will help you make sense of your spending patterns, identify leakages and opportunities and stay compliant with legal requirements and policies.

However, the preceding steps are crucial to ensuring a meaningful spend analysis. If you haven’t consolidated, categorised, or cleansed your data properly, you may end up doing more harm than good by making inefficient decisions for your company.

Your spend analysis should identify recurring spend activities, spot any data duplications you’ve made while recording and highlight potential opportunities to reduce costs.

Once you’ve done that, make sure you quantify your cost savings and differences in terms of percentages, aggregates, and averages. This will help you make data-driven and educated decisions in the future.

Spend management best practices

While following the spend management steps above will put you in a favourable position to make informed and effective business decisions, there are several things you can do to maximise the results that you get out of this entire process.

Here are some best practices for spend management to steer you in the right direction.

1. Create an expense policy

The spend management process can take a significant amount of time and effort.

To make sure that your employees are complying with the proposed recommendations, and to minimise the risk of fraud and unnecessary expenses, it’s a good idea to create a comprehensive expense policy.

An expense policy typically includes the types of expenses that employees can incur, the maximum amount of money that employees are authorised to spend on various categories, and the step-by-step process employees must follow to claim any expenses.

Creating an expense policy will help you have better control over your company spending. It will also help streamline the process of recording expenses, as well as identify when and if an employee steps out of line.

2. Conduct regular internal audits

Internal auditing is an important part of the spend management process. It helps you correct any potential errors that your employees or even your finance teams may have made in any part of the process.

Conducting internal audits is especially important for small businesses that can’t afford to make any mistakes. It will help them need to gain better insight into their spending patterns and make more accurate, data-backed decisions in the future.

3. Invest in a spend management tool

As your small business scales, we recommend investing in spend management software to automate some repetitive parts of the process. The future of spend management is certainly trending towards automated management systems that help save you time and money and minimise the risk of human error.

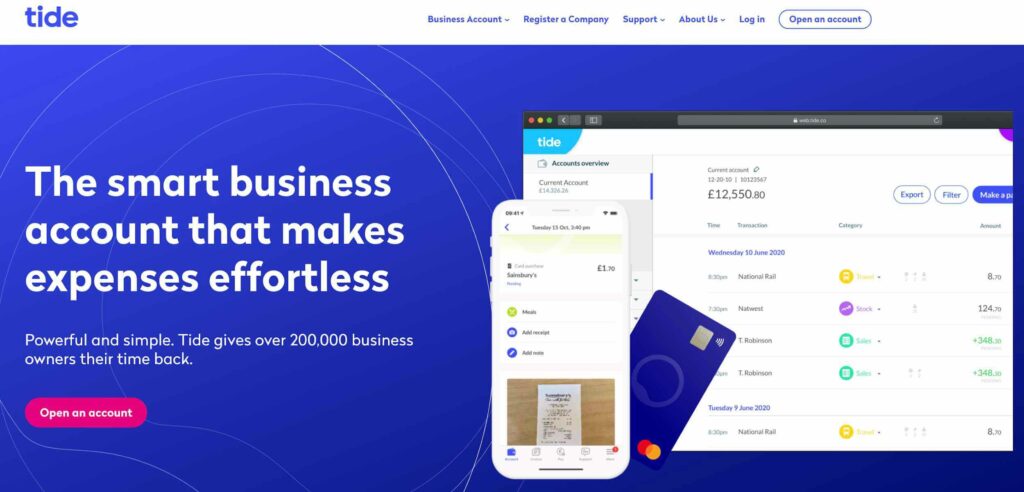

For example, Tide helps you keep track of all your business expenses on the go by automatically recording transactions, auto-categorising them, and integrating with your favourite accounting software to keep your database updated.

You can also hand out Tide expense cards to your employees to track each transaction and expense that they incur right from your dashboard.

💡 Expert insights

As Tide’s Cash Flow Expert and, with over 40 years experience of credit management, Philip King is passionate about cash flow and supporting small businesses.

Previous roles he has held include that of Interim Small Business Commissioner for the UK Government during 2020 and 2021. This involved providing support and advice to small businesses on their trading relationship with customers, particularly in respect of payment issues. As the Chief Executive of the Chartered Institute of Credit Management between 2005 and 2020, he also promoted the importance of effective cash flow management across industry by working with small businesses to improve their payment performance.

Q1: Who is best placed to enforce spend management discipline?

You are! As the business owner you have the most to gain (or lose) from controlling it well (or badly). BUT, if you’re uncomfortable being seen as always saying no, then make an accountant (internal or outsourced) or another trusted individual responsible for approving expenditure.

The aim is only to spend money on things that directly support your business’ core goals and objectives; anything else could be said to be a waste of money that you can ill-afford. If every spending decision over a set value has to be approved in advance, staff (and you!) will soon realise that the proposed expenditure is going to be measured against the benefits it brings and will stop proposing nice-to-haves.

Having a well-disciplined policy and process will bring great benefits to the budget, the cash flow plan, and to the future of the business.

Q2: How do better supplier relationships help spend management?

Your suppliers are key to the success of your business. If you can’t get the right products or services when you need them, and/or they’re not of adequate quality, then you are likely to lose customers and business. If you need to find a new supplier in a hurry, you’re likely to have to pay more and that will increase your spend and erode your profit.

Your aim should always to create a relationship that makes you a preferred customer of your suppliers. Agreeing fair prices, paying them on time and treating them as partners will all help achieve a collaborative relationship that works for all parties.

Once you’ve become the preferred customer, your suppliers are more likely to go out of their way to help you, to provide you with their ‘A-team’, and make your business a priority. You’ll never know when you need their help and support, so prepare for that now.

Q3: Can an invoice to a customer become an expense?

Sadly, yes it can. If your invoice isn’t paid because your customer goes bust or simply doesn’t pay and you end up writing it off, it’s an expense in several ways. Firstly there’s the amount of money you haven’t been paid which hits your cash flow and profitability, but there’s more. If your net profit margin is 10% and you write off an invoice for £1,500, you’ll have to sell £15,000 of goods or services to recoup the lost £1,500.

On top of that direct loss, you’ll have also invested time, resources, and materials to generate the original invoice, you’ll have wasted time in trying to obtain payment of the invoice which could have been better spent growing the business, and you’ll have invested time in winning the sale which would have been better spent courting a customer that would pay you.

Wrapping up

As your business starts to grow, so will its costs and expenses. Over time, it can get increasingly difficult to manage company spending.

An effective spend management process will help you identify all your expenses sources, consolidate them in one central database, and analyse that data to make better financial decisions for your business.

Get Tide Expense Cards for your colleagues – simplify your company spending

Request Expense Cards for your colleagues, and make expenses easy. You’ll never need to manually reimburse them for purchases they’ve made out of their own pocket again. It’s smart, streamlined, and easy. Join 300,000 businesses and open a Tide account today.

Photo by Andrea Piacquadio, published on Pexels