What are reimbursable expenses and how can you claim them?

As a small business owner, entrepreneur or freelancer, you will incur a variety of costs in the process of starting and running your business—from buying materials to promoting your brand to travelling for meetings.

The good news is that many of these costs are reimbursable and can be listed on your tax return as business expenses, effectively reducing your tax liability so you get to keep more of your money.

In this post, you’ll learn what reimbursable expenses are, what you’re entitled to and how to claim ten common types of small business expenses.

Table of contents

- Office costs

- Staff costs

- Clothing costs

- Stock and raw materials

- Training courses

- Marketing and advertising costs

- Legal and financial costs

- Subscriptions

- Travel costs

What are reimbursable expenses?

Reimbursable expenses are certain purchases you make for your business that can be claimed as business expenses to offset against your tax bill.

They fall under the category of ‘operating expenses’, which is one of the three major types of business expenses. The two other major business expense types are ‘non-operating expenses’ and ‘capital expenses’.

Top Tip: Learn more about the major types of expenses and how to keep an accurate and auditable record of them in our guide to expenses: what they are and how small businesses can manage them.

The phrase ‘reimbursable expenses’ is slightly misleading. You don’t get to claim the money back for these expenses; rather, they’re a form of tax break. This means that your taxable income is reduced by the amount of the expense so that you ultimately pay less tax.

It’s important to note that you will need to follow different rules for claiming reimbursable expenses depending on the type of business you’re running. For example, if you’re a director of a limited company, reimbursable expenses lower your Corporation Tax bill. If you’re a sole trader, the tax you pay on business profits is reduced.

Let’s assume a sole trader has a taxable income of £22,000 and claims £3,000 in allowable expenses. Reimbursable expenses, therefore, works to bring the taxable income down to £19,000, meaning this sole trader will only pay taxes on the taxable profit of £19,000.

For a purchase to be classed a reimbursable expense, HMRC states that it must be ‘wholly, exclusively and necessarily incurred in the performance of your day to day business.’

Broadly speaking, for tax purposes this means you must have made the purchase for business reasons and the item must not have personal use. However, not every expense is cut and dry as some may have a dual purpose. In this case, the part of the expense used for business could be considered valid.

For example, if your mobile phone bill is £30 a month and you use your device 50% of the time for work phone calls, you’ll be able to claim £15 a month as a reimbursable expense.

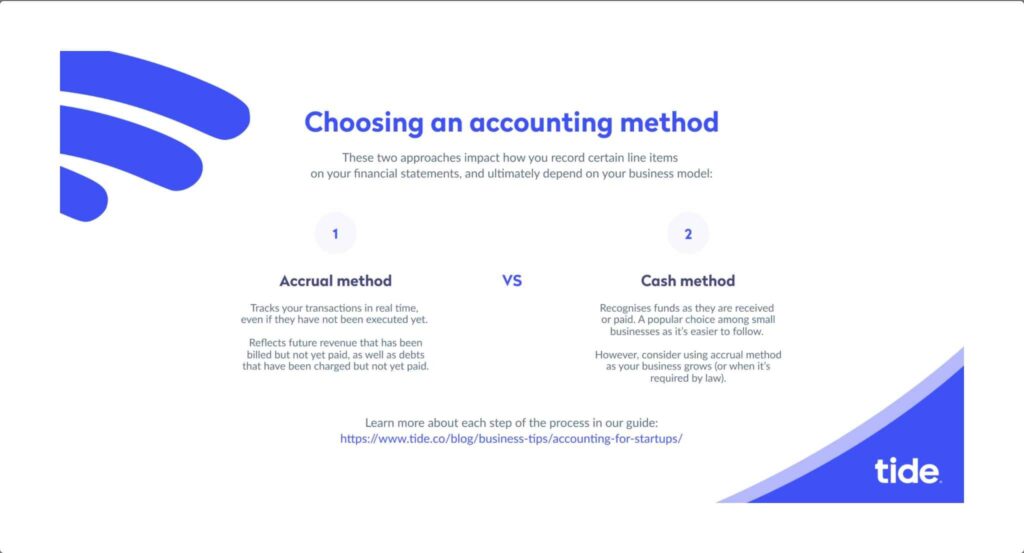

Traditional accounting vs. cash basis accounting

Before we dive into the common types of reimbursable expenses, it’s important to bring the two main accounting methods front of mind. This is because the type of accounting method that you choose for your business affects how you pay tax and thus how you can claim reimbursable expenses.

Cash basis accounting is a way for sole traders or partners to work out income and expenses for their Self Assessment tax return by only declaring money when it comes in and out of your business. If you use cash basis accounting, you don’t pay Income Tax on money you didn’t receive within the accounting period.

Traditional accounting requires business owners to record all income and expenses by the date they were invoiced or billed. So if an invoice is recorded, you’ll pay tax on it regardless of whether money has exchanged hands. If you run a limited company, you must use traditional accounting.

Top Tip: To learn more about the fundamentals of business finances and how to manage and streamline your small business accounting process, read our complete guide to accounting for startups.

Tax Breaks

We’ll also discuss tax breaks frequently throughout the following section. There are many different types of tax breaks available to small businesses, and in certain scenarios, depending on your business type, reimbursable expenses may need to be claimed as a tax break instead.

Top Tip: To learn more about the various tax breaks that you can take advantage of to reduce your tax bill, and how to claim them, read our guide to 8 tax breaks for small businesses.

10 expenses your small businesses can claim

Let’s examine the ten most common reimbursable expenses that your small business can claim.

1. Office costs

Your office, including the items you use within your office to run your business, can be claimed as a business expense.

HMRC classifies these expenses as items you’d typically use for less than two years. In other words, ongoing costs and items you continually have to replace.

GOV.UK divides office costs into three categories:

- Stationery

- Rents, rates, power and insurance

- Business premises

Another unofficial category is reimbursable expenses that you can claim from a home office if you work remotely—something many people have experienced due to the COVID-19 pandemic.

Stationery

- Phone, mobile, fax and internet bills

- Postage

- Stationery

- Printing

- Printer ink and cartridges

- Computer software your business uses for less than 2 years

- Computer software if your business makes regular payments to renew the licence (even if you use it for more than 2 years)

Within stationery, you’ll also be able to claim for equipment (e.g. computers or machinery) used solely for work as a reimbursable expense. However, if you’re a limited company these items will need to be claimed as capital allowances using your Annual Investment Allowance (AIA). You can find more information on AIA in our aforementioned post on tax breaks for small businesses.

Rents, rates, power and insurance

- Rent for business premises

- Business and water rates

- Utility bills

- Property insurance

- Security

- Using your home as an office (only the part that’s used for business)

Business premises

- Repairs and maintenance of business premises and equipment

Other expenses, such as water heating systems and other integral parts of the building can be claimed as capital allowances using your Annual Investment Allowance (AIA).

Reimbursable expenses if you work from home

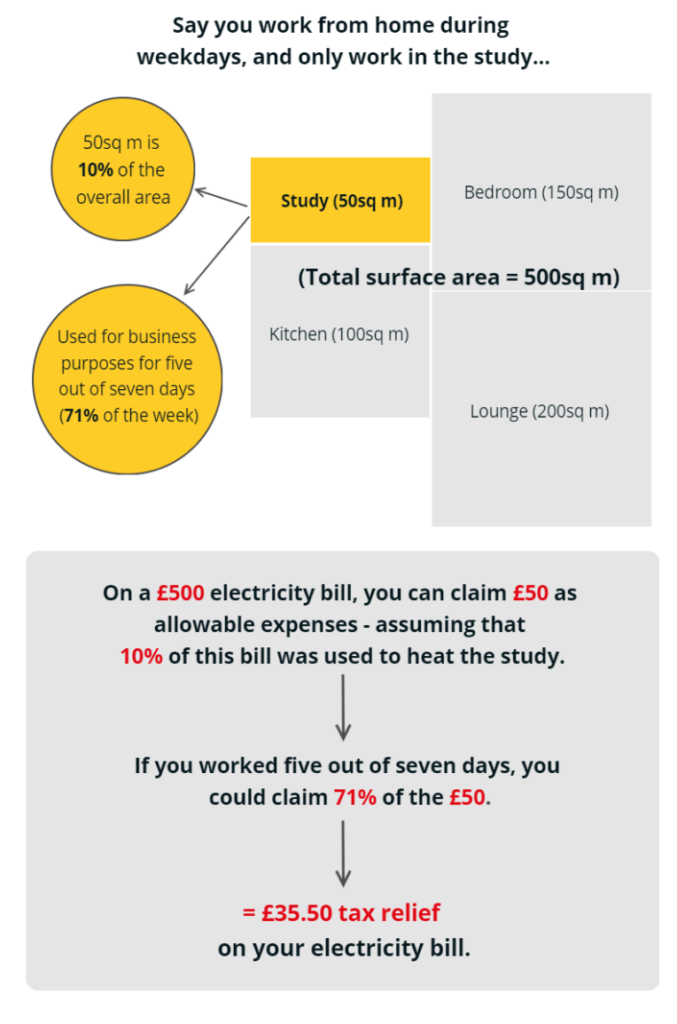

Working from home is an expense that falls under the dual-purpose grey area we mentioned earlier. While a claim for the full amount of household bills won’t be accepted, you can claim a proportion of the costs for utility bills, council tax and mortgage interest or rent.

There are two ways you can do this:

1. By dividing your costs by the number of rooms in your home and the amount of time you spend working there. The below graphic from Which? explains how this works:

2. If you’re a sole trader or a business partnership with no companies as partners, you can use flat rate simplified expenses.

| Hours of business use per month | Flat rate per month |

|---|---|

| 25 to 50 | £10 |

| 51 to 100 | £18 |

| 101 or more | £26 |

For example, using the flat rate amounts, if you worked 40 hours a week from home you can claim £120 (12 months x £10). If you worked 40 hours a week for 10 months and 60 hours a week for two months, you can claim £136 (10 months x £10 + 2 months x £18).

Simplified expenses don’t account for phone or internet costs. These will need to be calculated by dividing your costs.

You can find out whether it’s worth using simplified expenses for your business by using GOV.UK’s simplified expenses calculator.

2. Staff costs

Staff are one of the biggest ongoing costs in any business. Fortunately, you’re able to get tax relief on your employee expenses.

All of the following can be claimed as a business expense:

- Salaries, including redundancy payments

- Bonuses

- Pension and insurance payments

- Agency fees

- Subcontractor and freelancer fees

- Staff training courses that are related to your business

You can also have up to £4,000 deducted from your employer’s National Insurance tax bill through the Government’s Employment Allowance scheme. We’ve gone into more detail on this in our post on tax breaks that we mentioned above.

It’s important to remember that the employee must be working wholly and exclusively for your business at the time. This means that you can’t claim expenses for carers or domestic help such as a cleaner or nanny.

You also can’t claim for your own wages, salary, National Insurance contributions, insurance or pension costs.

Top Tip: Hiring your first employee is an exciting milestone. It can help to relieve you of some stress and is a positive step towards business growth. To learn more about calculating hiring costs, whether to hire a full time employee or a freelancer, complying with legislation and more, read our guide to how to employ someone (for the first time).

3. Clothing costs

Clothing that you buy to use for work can be claimed and deducted from your profits or taxable income. GOV.UK lists allowable clothing expenses as:

- Uniforms

- Protective clothing needed for your work (for example, a high visibility jacket, overalls or gloves)

- Costumes for actors or entertainers

You can’t claim for everyday clothing even if you wear it for work. For example, a suit that you bought for work but also wear out to dinner on a weekend is unlikely to be a valid claim.

However, if its dual purpose is incidental because of a business necessity, your claim may still be valid. For example, protective clothing you bought for work could be used for personal use for doing a DIY job at home.

4. Stock and raw materials

HMRC classifies stock and raw materials as ‘reselling goods’. This applies to small businesses selling products or services. Expenses that you buy to sell on include:

- Stock

- Materials that you use to produce goods (e.g. ingredients, parts or components)

- Direct costs from producing goods

You won’t be able to claim for goods or materials you’ve bought for private use, or depreciation of equipment (e.g. the reduction in value of a business asset due to wear and tear).

5. Training courses

If you pay for a training course that helps you to improve the skills and knowledge you use in your business, you’ll be able to claim it as an expense. However, that course must be related to your trading activity and not taken as a way to start a new business, branch out into a new sector or provide a different service.

For example, if you run a small plumbing company, taking a health and safety refresher course or advanced heating engineer course would directly benefit your business. But taking an intensive joinery course will be seen as training that’s unrelated to your work and not eligible to claim.

6. Marketing and advertising costs

For your business to succeed you need to make people aware of who you are and what you do. While marketing on a budget is possible thanks to the internet and social media, there are still ongoing costs involved, especially if you’re advertising your products and services.

Fortunately, most of these costs are classed as reimbursable expenses. But there are a few exceptions.

You can claim for:

- Advertising your business in newspapers, directories, magazines and other media such as radio, TV and online search and social media ads. This includes costs incurred for writing, designing, producing and placing the ad. So if you hired a freelancer or agency to create your ad, you can claim their fees as expenses.

- Direct mail costs for designing, writing, printing and posting letters, leaflets or brochures.

- Website costs for creating and managing your website. This includes the initial costs for designing, developing and registering your website (you’ll only be able to claim for these once) and ongoing costs for hosting.

You can’t claim for:

- Personal entertainment

- Entertaining clients, suppliers and customers

- Event hospitality

‘Entertaining’ is a broad term, but it covers the costs of accommodation, food, drink, entry to events and venues and business gifts.

You are, however, able to claim for entertaining staff. So if you throw a holiday party or annual event to reward employees, you’re able to claim up to £150 per person.

7. Legal and financial costs

If you invest in professional services such as an accountant, solicitor, architect or surveyor to help in the running of your business, you can claim their fees as reimbursable expenses.

But not all legal costs are allowable. You can’t claim for:

- Breaking the law in any way, such as failing to adhere to rules and regulations.

- The legal costs of buying property or machinery. If you use traditional accounting, these costs can only be claimed as capital allowances.

On the financial side, there are several business costs that you can claim to help make budget management a little easier, including:

- Bank, overdraft and credit card charges

- Interest on bank and business loans

- Interest on hire purchase

- Leasing payments

- Alternative finance payments

If you’re using cash basis accounting, you can only claim up to £500 in interest and bank charges.

You won’t be able to claim for loan repayments, overdrafts or financial arrangements.

Money owed to you

If you’re using traditional accounting, you’re able to claim for money included in your turnover that you will never receive, if you’re sure you’ll never receive it.

However, you can only do this if:

- The debt is included in your business turnover

- The debt isn’t linked to the disposal of fixed assets, such as land, buildings and machinery

- The debt is properly calculated. For example, you can’t estimate that debt is equal to 3% of annual turnover.

Insurance premiums

Insurance premiums that you need for the protection of your business and customers (e.g. professional indemnity insurance or public liability insurance) can also be claimed as an allowable expense.

8. Subscriptions

If you’re a paying member of a trade body or professional organisation that’s related to your business, you can include the cost of membership as a reimbursable expense on your tax return.

You’re also able to claim for subscriptions to trade publications or journals that benefit your business by providing news and information on best practices.

Any subscription has to be strictly business-related. Payments to political parties and gym membership fees cannot be claimed for. Donations to charity are also exempt, although you may be able to claim sponsorship payments. Sponsorship is different from a donation as your business gets something in return.

If you donate to charity through Gift Aid, you can claim back the difference between tax you’ve paid on the donation and what the charity got back. We also go into more detail on this instance in our post on tax breaks for small businesses.

9. Travel costs

If the nature of your business requires you to travel regularly (outside of a daily commute to and from work), you can get the cost of travel expenses and a range of related expenses reimbursed.

The full list of what you can claim as a car, van and travel costs from HMRC is a generous one:

- Vehicle insurance

- Repairs and servicing

- Fuel

- Parking

- Hire charges

- Vehicle licence fees

- Breakdown cover

- Train, bus, air and taxi fares

- Hotel rooms

- Meals on overnight business trips

You won’t be able to claim for any personal travel expenses, fines or travel to and from a permanent workplace.

Top Tip: If you have employees that travel often for work, you’ll need to develop an efficient system for collecting their bills and receipts, compiling a travel expense report, and reimbursing them. Or, you can remove the need for expense reimbursement by giving them a prepaid debit card with allocated spending money, like our Expense Cards at Tide. Expense management software makes the travel expense process much smoother and significantly reduces the chance of employee fraud. Learn more in our guide to how to manage employee expenses.

Calculating vehicle expenses

If you’re buying a car for your business, you can claim this as a capital allowance using traditional accounting, or cash basis accounting if you’re not using simplified expenses.

To work out running costs for your vehicle you can calculate costs individually (e.g. fuel, MOT, repairs and servicing) or use simplified expenses.

Simplified expenses use the following flat rate for mileage:

| Vehicle | Flat rate per mile with simplified expenses |

|---|---|

| Cars and goods vehicles first 10,000 miles | 45p |

| Cars and goods vehicles after 10,000 miles | 25p |

| Motorcycles | 24p |

For example, using the flat rate, if you’ve driven 15,000 business miles over a year, you’d need to make the following calculation:

10,000 miles x 45p = £4,500

5,000 miles x 25p = £1,250

Total you can claim = £5,750

Simplified expenses can be used on cars, goods vehicles and motorcycles, but not cars that are designed for commercial use such as a black cab or driving instructor car. Once you’ve used the flat rate for a vehicle, you need to continue using these rates as long as you’re using that vehicle for business travel.

If you use your vehicle for both personal and business use, you’ll only be able to claim for the costs accrued while using it for work. To help you work this out, it’s worth keeping a log of your business mileage.

You won’t be able to use simplified expenses on a vehicle you’ve already claimed capital allowances for or one you’ve included as an expense when working out your business profits.

How to get expenses reimbursed

Claiming back expenses requires you to keep track of your spending to ensure you enter the correct amounts on your tax return. Maintaining accurate records throughout the year is vital, not only so that HMRC correctly reimburses you but to avoid a potential fine for submitting incorrect information.

HMRC dictates that you must keep receipts for each business purchase for up to six years after you’ve filed your tax return. They could decide to investigate your business finances at any time within this period, so it’s important that you have everything in order.

A dedicated accountant or bookkeeper can also help you to stay organised and give you professional advice and guidance.

In general, it’s best to have a dedicated expense account for your business spending. While there’s no legal requirement for this as a sole trader (it’s mandatory for limited companies), a separate business account for your small business will prevent work expenses from becoming muddled with personal purchases and make it easier to monitor your company finances.

A free business current account from Tide lets you tag income and expenditure with labels of your choice so that you can easily see what you’ve spent on a particular expense category. You can also add notes and scan receipts so you’re not left with several drawers worth of paper receipts.

Your transactions can then be exported into a spreadsheet or accountancy software to make it easier for you or your accountant to enter the correct information on your tax return.

If you decide not to use expense tracking tools, at a minimum you should keep an up-to-date spreadsheet of your expenditure and dedicate a couple of hours a week to making note of spending. To make your life easier, we’ve created a free expenses spreadsheet for you.

Top Tip: While spreadsheets are enough for some people, accountancy software makes it much easier for you to keep a pulse on your business’s financial health. With it, you can automate invoicing, generate reports, simplify payroll, and much more. At Tide, our business current account integrates with the top accountancy software on the market, making communication with your accountant a breeze.

Claiming reimbursable expenses as a limited company

As a general rule, you claim expenses that you’ve incurred for business purposes back from HMRC by entering your expenditure figures on your tax return. This is the same whether you’re a sole trader, partnership or limited company director.

However, unlike sole traders or partnerships, limited company directors do have the option of paying for personal expenses directly from the company account. This is called a “director’s loan” and is applicable if it is not a salary, dividend, expense repayment or money you’ve previously paid into or loaned to the company. Directors of limited companies may do this if they have a large personal expense that they may need help paying, for example.

On the flip side, you can also pay into your own company’s “director’s loan account” and classify it as a business expense. You may want to do this if your company is having cash flow issues, for example.

At the end of the year, you will either owe your own company money or your own company will owe you money, depending on your withdrawals or payments into the director’s loan throughout the year.

Find more information about director’s loans and the tax that applies to them on the GOV.UK website.

Claiming reimbursable expenses on your tax return

Reimbursable expenses can be claimed by adding up all of your allowable expenses for the tax year and entering the total amount on your Self Assessment tax return.

If your annual turnover is below £85,000 you can enter your total amount of expenses without having to itemise them. If your turnover is over £85,000, you’ll need to enter the amount for each kind of expense individually, with a total at the end.

There’s no need to show proof at this stage. But as said, keep hold of your receipts.

Self Assessment can be filed at any time after the end of the previous tax year on 5th April until the deadline of 31st October of the same year for paper returns or 31st January the following year for online returns.

If you’ve left a reimbursable expense off your tax return by mistake, don’t worry. You have up to four years from the end of the tax year to make a claim. You can do this by completing a P87 form online or by posting it directly to HMRC.

Wrapping up

Reimbursable expenses are designed to ease some of the financial burden of owning a business. Being able to claim for many of the purchases that account for the bulk of your running costs means that you can invest in your business rather than every expense counting as a sunk cost.

Before making a claim, bear in mind:

- You can only claim for expenses that are ‘wholly, exclusively and necessarily incurred in the performance of your day to day business.’

- As a general rule, items that have joint personal and business use are non-reimbursable expenses. Although, you can claim a proportion of the costs for expenses such as vehicle mileage, a mobile phone bill and working from home.

- Maintain accurate records of expenditure and store all expense receipts and paperwork safely for six years after submitting your tax return.

Keeping all of your small business expenses in one app will save you tons of time that you can reinvest back into your business. We’ve helped over 200,000 businesses like yours and we’re just getting started. Don’t wait, open a free business bank account today and start doing what you love.

Photo by Maria Gloss, published on Pexels