Why you need a separate business bank account for your small business

A business bank account gives you the opportunity to apply for business loans and lines of credit, boost business credibility, and, most importantly, begin accepting payments from customers.

While limited companies are required by law to maintain a separate business account, sole traders are not obliged to do so.

That said, business accounts do offer a range of benefits and discounted services, and also make it easier to separate business and personal activities.

This reduces the risk of receiving penalties from HMRC for unintentionally submitting false information.

In this guide, we’ll show why a separate account is a good idea, what to look for in a business bank account and how to set one up in just a few clicks.

Top Tip: Before you launch, it’s vital that you lay solid foundations like your go-to-market strategy and how you plan to structure your business. Here are 10 effective steps to start your business in the UK 🏢

Table of contents

- The benefits of a separate business bank account

- What to look for in a business account

- When do you need a business bank account

- How to open a separate business account in minutes

- Business accounts: A comparison

- Wrapping up

The benefits of a separate business bank account

Many sole traders and business owners want to start a business with minimal fuss and cost. For some, this means sole proprietors prefer using their personal account as their main business bank account (at least in the very beginning).

While you may save on the card transaction fees that some banks charge, there are several reasons why you should separate your business account from your personal one.

Opening a separate business bank account has the following benefits even if you are a sole trader:

- Business credibility. Maintaining business credibility is critical to establishing trust with suppliers and clients. Make and receive payments through a separate business account to show clients that you’re serious about what you do, and give them peace of mind that they’re in good hands.

- Loans and credit. Along with business credibility, most banks won’t offer you a loan or line of credit for business purposes without a separate account.

- Some banks require it. If you’re starting a limited company or a partnership, many banks will not allow you to accept business transactions in your personal account.

- Organised bookkeeping. Using your personal credit card or debit card for business expenses leads to headaches down the road, for example, trying to calculate total business expenditure. Set up a separate business account for faster and more accurate bookkeeping.

- Accurate tax returns. Avoid combing through transactions and discerning between business and personal expenses. Easily identify taxable benefits and deductions so you can satisfy HMRC requirements (and be prepared in the event of an audit).

- A healthy business credit score. A strong business credit score will help you obtain more flexible business loans and insurance terms. Keeping your business finances separate from personal activity will lead to better informed financial decisions and a healthier credit score.

- Financial security. If you set your business up as a limited company, your personal assets won’t be under threat if your business cannot repay its debts. Similarly, a personal financial hiccup won’t have any bearing on your business’ credit score.

Furthermore, if you successfully turn a hobby into a profitable business, you’re still liable for tax if your gross trading income is above £1,000 a year. It’s at that marker that you need to think about registering as a business and opening a separate business account.

Top Tip: Small business owners and sole traders have a number of taxes they need to be aware of. To learn about which taxes apply to your business and how to register for VAT, check out our simple guide to small business tax 📪

What to look for in a business account

When researching business current accounts, there are a few things you need to keep at top of mind. To start with, many of the more popular high street banks now charge you a monthly account fee on top of transaction fees.

When looking at opening a separate business account, consider the following:

- Features and services. Make sure you choose a provider with features that suit your business, such as online banking, a mobile banking app, bill payment services and debit card access.

- Fees. Much like personal accounts, business accounts come with a variety of fees. Look at rates for services like overdrafts, ATM withdrawals and general maintenance fees.

- Sign-up bonuses. Many banking providers offer incentives for choosing their services, often in the form of cash bonuses or zero fees for the first year. Do your due diligence and find out if your business activities will satisfy the fine print of these benefits.

- Integration. You may already use accounting software to help manage your finances. Identify a bank provider that syncs with your financial workflows and further streamline your operations.

- Transaction limits. If you run a busy small business, you’ll likely make countless deposits, withdrawals, transfers and payments. Some banks place limits on various transactions, for example, you may have a limit on the number of withdrawals you can make each month. Find a provider that suits your cash-flow requirements and doesn’t hammer you with fees.

- FCA approval. Financial service providers (as well as investment and consumer credit firms) are required to be authorised by the financial conduct authority. For more information, and to double-check that your provider meets regulations, visit the FCA’s website.

Ideally, you should find a provider that supports internet banking, doesn’t make you navigate multiple obstacles and is transparent with the services and benefits they provide in exchange for the fees you’re being charged.

You may also want to make sure you choose a provider who already offers additional products you may need such as a business savings account so you can do all of your banking in one place.

Top Tip: Understanding small business accounting is crucial to making smart decisions, informing operational strategy and driving growth. To learn more, read our complete guide to small business accounting 💥

When do you need a business bank account

As a sole proprietor, there’s no definitive answer, but there are best practices to follow when deciding exactly when to open your business account.

Consider opening an account if:

- You process high volumes of transactions. If your business is growing and you realise that your personal account could be easily perceived as a business, open a business account to avoid potential scrutiny from banks.

- Your transactions are becoming complex. If you’ve reached a point where it’s difficult to decipher which transactions are business vs. personal, that could complicate your tax return. Opening a business account will save you valuable time sorting through transactions when it comes time to file.

- You want to start accepting credit card payments. You can either open a merchant account or use an alternative gateway to accept credit card payments from customers. Whether or not you link those payments to a business or personal account is up to you, but it’s important to consider the risks associated with accepting payments online. Also, some banks may require that you have a business account, so opening one at this point in time will help you avoid any potential roadblocks.

- You plan to begin operating as a limited company. By law, limited companies are required to have a business account. If you’re considering making the change, it’s time to get serious about registering your company and opening a business account.

- You require a business loan. If you’re looking for a loan to boost your business operations, you’re going to need a business bank account. Similarly, you’ll need to open an account if you wish to apply for a business credit card.

Top Tip: You may also wish to open a business account as part of a more efficient payroll operation. To learn about what payroll is, how to pay your employees correctly and how to satisfy HMRC requirements, check out our complete guide to payroll for small businesses 💷

How to open a separate business account in minutes

Depending on the provider you choose to open a business account with, you’ll need one or several of the following documents:

- Identify verification. You’ll need to provide a document to prove your identity, for example, a UK or foreign passport or a driver’s license.

- Proof of address. In some cases, you’ll be required to present residential documentation to open a business account. However, your driver’s license or passport may also suffice. Some providers may ask for a backup document, such as a bank statement or utility bill.

- Companies House registration number. You must register with Companies House in order to set up your limited company. For more information on this, visit the GOV.UK website.

You’ll also need some other details about your business – such as turnover, company director details, etc.

To open a business account in the UK, you must also meet the following criteria:

- Have an annual turnover of less than £6.5 million

- Have a straightforward, clearly defined ownership structure

- Be based and operate in the UK (applicable to all business directors and owners)

Opening a business current account with Tide

We built Tide to make business simple, which is why you can open an account with us in minutes.

To open your business account, head here to get started and select whether you’re opening an account for a registered company or as a sole trader:

On the next page, you’ll be asked to fill in some basic personal information about yourself and your business. You’ll then be sent a link to download the app on your iOS or Android device. If you prefer, you can also download the app straight away and get started just as easily there.

When you open the app the first time, you’ll be asked to enter your email, take a picture of your ID, as well as a photo of yourself for verification. The approval process time frame varies depending on circumstance, but you will be sent clear instructions no matter the situation.

In most cases, it only takes a few minutes to have your account set up and ready to go. Your business card will then be sent to your business address in 2-4 working days.

Did you know you can manage all your business finances directly from the Tide app? Send and manage invoices, automatically follow-up and record payments, custom-label your income and expenditure, get paid by Direct Debit, and integrate with several accounting software platforms. Spend less time on admin and more time running and growing your business.

Top Tip: As a small business owner, one of the most important administrative tasks you carry out is creating and sending invoices. They are critical to making sure you’re compensated for work and serve as a legal record of products and services provided. To learn more, check out our guide to what invoices are, raising them and getting paid 🌐

Business accounts: A comparison

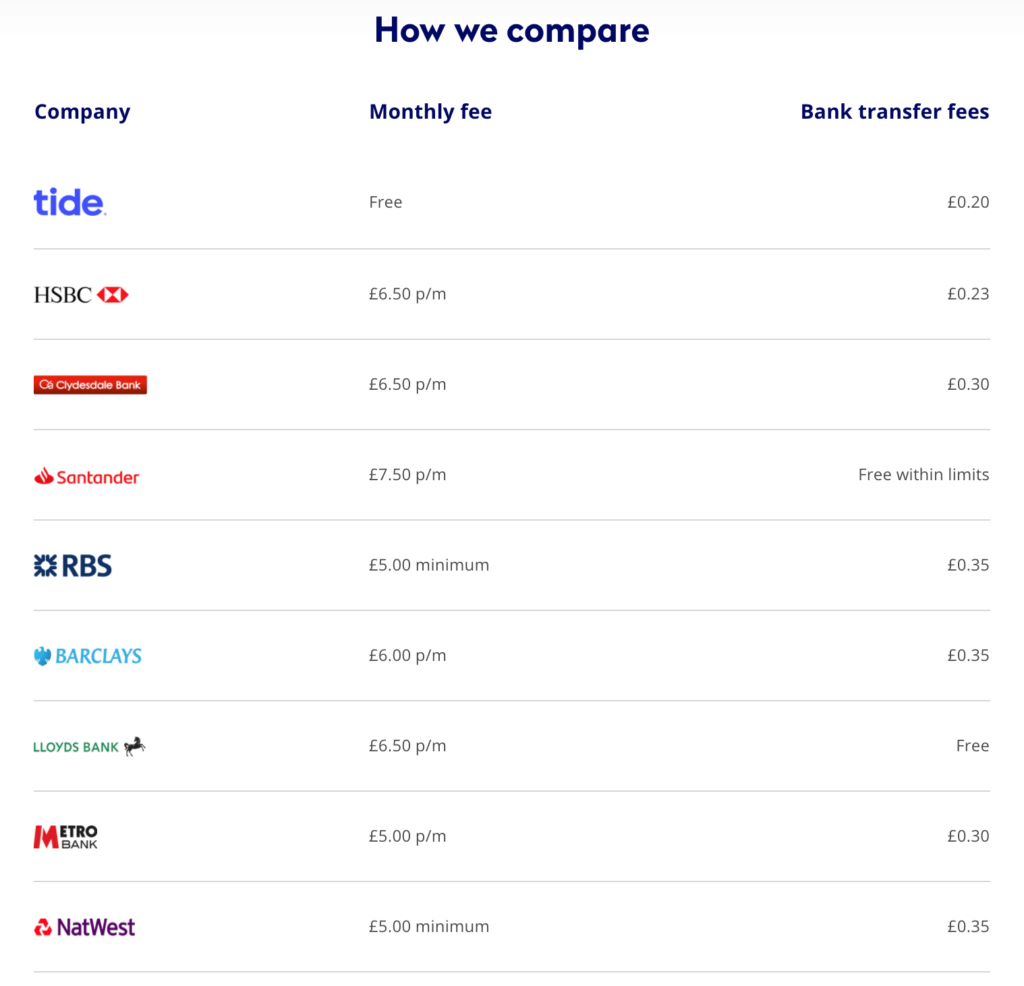

At Tide, we only charge monthly fees if you’re looking for additional services. However, if you’re just starting out, it may be more practical to use fee-free banking as you establish yourself.

Which is why we use a simple pricing structure without monthly fees. Here’s how we measure against other industry players:

Wrapping up

Opening a separate business bank account doesn’t have to be difficult.

While there are many suppliers out there who charge complicated and monthly fees, you do have other options.

With an account like Tide, for example, you’ll be up and running the same day and have your business card with you in less than a week. There are no monthly fees, and our features make accounting, invoicing and keeping track of your expenses a breeze.

Whichever solution you choose to separate your finances, make sure it helps you take your money further and allows you to focus on what you do best: running your business and making it a roaring success.

Sign up for a FREE business account

Photo by Bruce Mars, published on Pexels