Everything you need to know about your business credit score (and how to improve it)

Many people understand how their personal credit score can impact purchases and investments in their life. However, not all business owners are as aware of how their business credit score can impact their access to business loans, contracts and other financial needs.

Statistics from the UK government show that 88.3% of startups survive their first year, but only 39.6% of new businesses make it beyond five years. This is often because their finance options are limited. Establishing a strong credit history takes some time, but the payoffs are worth the effort.

In this guide, we’ll explain how to check your business credit score, why it’s important and how to decipher your business credit report. We’ll then offer fourteen quick tips for how to improve your business credit score over time.

Table of contents

- Why your business credit score is important

- How your business credit score is determined

- How to check your credit score

- What’s inside a business credit report?

- 4 reasons to check and monitor your business credit report

- 3 key differences between your personal credit score and business credit score

- How your personal credit score can impact your business credit score

- 14 ways to improve your business credit score

- Wrapping Up

Why your business credit score is important

A good credit score shows lenders that you’re more likely to repay and be on time with your payments. Keeping a good business credit score will make it easier to get credit and give you access to competitive interest rates.

A poor business credit score may be caused by missed loan repayments in the past, or if you’ve failed several credit applications. A poor score means you may struggle to finance your business with lines of credit and you’ll likely only be offered high interest rates if you are, in fact, granted credit.

You may also want to work with a business partner. Business credit scores are public information, and a low score may cause potential business partners to see your business as a risky opportunity.

Over the lifetime of your business, keeping a good business credit score is key to ensuring you can continue to access the best credit, insurance options, low-interest loans and other valuable financial resources.

Top Tip: A line of credit, while a good option, isn’t the only way to fund your small business. Knowing what options are available to you will help you make the right decision for your business needs as you grow. To learn more about securing both debt finance and equity finance, read our guide to 10 ways to fund your small business 🌱

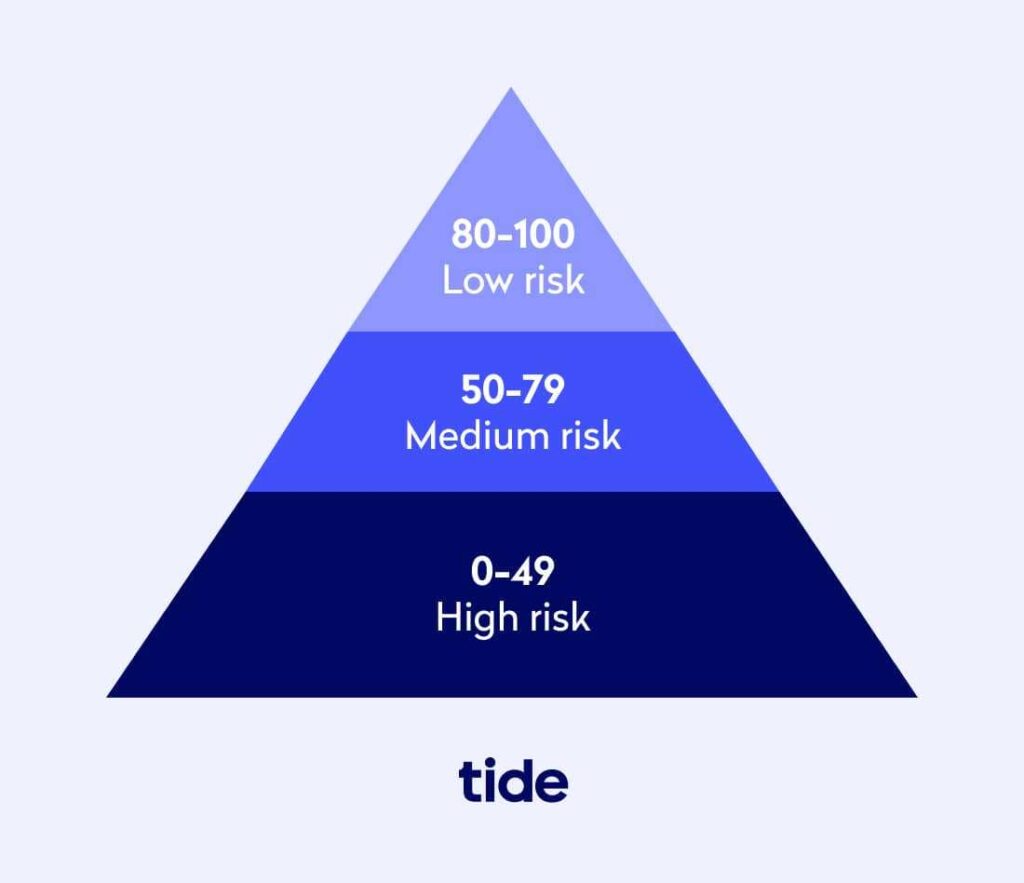

How your business credit score is determined

A business credit score is usually scored within a range from 0 to 100. The higher the credit score is, the better a company’s performance and creditworthiness, which indicates low risk to potential lenders. However, the closer a business credit score is to zero, the higher the risk and less likely they are to be offered credit.

Your business credit score is calculated based on certain criteria defined by a Credit Reference Agency (CRA), and each CRA may have a slightly different scoring range. The CRA will look at your financial history and track your record of paying back previous business loans and borrowings, as well as how timely you were with the payments.

Here is a list of aspects of your financial history that may be evaluated:

- Size and age of your business

- Your industry

- Business location

- Past repayment history if your business has borrowed before

- Amount of existing credit available to your company

- Number of past applications for finance (and whether you were successful or denied)

- Trade credits you may have secured

- Existing company accounts

- Details of ownership

- Outstanding County Court Judgements, if any

The credit score assessment criteria can take into account anything from how quickly you pay your bills to the likelihood of defaulting on payments. Your business credit score will ultimately reflect how likely vendors, suppliers and lenders are to trade with you.

Top Tip: Looking for an action plan to quickly boost your company’s financial health? Follow these eight simple steps in our guide on how to increase your business credit score 🚀

How to check your credit score

To check a business credit score, you will need to contact a business credit reporting company such as Equifax, Experian or Creditsafe for a credit report. Depending on the company, they may send your credit report in the post or by email, or they may give you access to your score through an online account.

The information held in your company credit file comes from several sources, including the Registry Trust, which holds details of County Court Judgements, and Companies House.

It’s important to note that your business does not have a single definitive business credit score because there is no standardised method for calculating it. You’ll find varying results because each credit bureau relies on its own distinct methods and scoring systems. Lenders will use different credit reporting companies when they check your credit score.

Each agency provides options for how to review your business credit report and how much it will cost. Some agencies charge a monthly fee, while others will provide a one-time report. In most cases, it’s possible to pay once to gain access to your credit report for six months or a year.

The top credit reporting agencies in the UK

The business credit scores that carry the most weight for UK businesses are:

- Dun & Bradstreet PAYDEX. D&B analyse two years of tradeline history and rate businesses between 0 and 100 on their PAYDEX scoring system.

- Equifax. Equifax provide commercial credit reports based on very comprehensive data, including financial information, credit details, and fraud information.

- Experian. Experian business credit scores can range from 1 to 100, with 80 and higher indicating a healthy credit score.

You can monitor your Experian credit score for free by connecting your bank account to Tide’s Cashflow Insights. Get real-time forecasts to help predict your cashflow and stay in control of your financial health.

What’s inside a business credit report?

A business credit report offers important information about your business and those you do business with. A typical business credit report includes these items:

- Business background information

- Company financial information

- Business credit score and potential risk factors

- Summary of banking, trade and collection history

- Summary of liens, judgements and bankruptcies

The exact information included in your business credit report will depend on which credit reporting agency you use. With the report, you can check your company’s financial health at a glance and get a clear idea of how financial institutions and other businesses perceive you.

4 reasons to check and monitor your business credit report

Once you run a credit check, it’s recommended that you consistently monitor your score so that you can make informed financial decisions—especially if you are trying to improve your score. On the flip side, if you have a near-perfect score, keeping a close eye on your report will help you avoid a performance dip.

Various activities can affect your business credit report one way or the other, so tracking your status will keep you updated on where you stand. Everything from transaction volume to your outstanding balance can take a toll on your credit score.

Let’s explore some of these reasons for monitoring your business credit report in more depth.

Assess partnership credit risk

One way to actively avoid bad credit decisions is by assessing the financial risk of extending credit to a particular company.

As part of this effort, you can obtain financial background information on a business, including judgements, liens and bankruptcies. If you find that the company in question is a financial risk, you’ll be able to make a smarter decision about the pros and cons of moving forward with a potential partnership.

Credit scores change

By monitoring your report, you can stay current on changes in your credit file and keep track of your score. As mentioned above, this will help you keep a pulse on your credit wellbeing so that you can make smarter cash flow decisions, and keep your interest low and credit score high.

Keeping track of your credit scoring also alerts you if someone decides to request and view your credit information before working with you. If a potential partner does do this, it’s often a good sign because it shows they care about their potential business partners’ financial health, too.

Watch for errors and fraud

Keeping an eye on your credit score can also help you monitor your report for potential errors. If there’s outdated or inaccurate information on your credit report, it could affect your status without your knowing. In this case, you could miss out on loans or be quoted high interest rates until you correct the mistakes.

In addition, by monitoring your credit file you can stay on top of and report any fraud as soon as it occurs.

If you notice any kind of activity that you don’t recognise on your business credit score report, it’s worth investigating. Reach out to the credit bureau and flag suspicious activity as soon as you see it to avoid the risk of fraud.

Make changes for the better

Some credit reports make recommendations on what might be bringing your credit score down. By analysing their suggestions, you can review the report and learn what to prioritise and address to improve your score.

In the long run, keeping an account of your company credit score will help you manage and improve your business credit so you can obtain the funding you need to expand your business.

Top Tip: You can access affordable credit offers that you are pre-qualified for and boost your credit score by paying back what you owe on time with Tide business loans💡

3 key differences between your personal credit score and your business credit score

Whereas a personal credit score only details loans and their credit accounts, the business credit score goes into the finances, subsidiaries, ownership information, risk scores and everything else that’s relevant for evaluating a company’s financial health.

Here are some important things to know about how your personal credit rating and business credit scores are different and how, in some ways, they’re connected.

Ease of access

You’re guaranteed free access to your personal credit score. However, to access your business credit score, you’ll have to pay a reporting or processing fee through a credit reference agency.

Your business’s credit score is public information, so anyone who pays the fee can access your business credit reports. The moment you register the business, your score becomes active and viewable.

Level of privacy

Your personal credit score is private, but your business credit score isn’t. Business partners, vendors, credit providers or stakeholders may choose to review and evaluate your credit score before deciding to work with you.

Score variation

Your personal credit score is calculated using standardised algorithms, which means it’ll be roughly the same no matter which credit bureau you use. However, your business credit score will fluctuate between different reporting agencies because there’s no standardised system in place for calculating company credit scores.

How your personal credit score can impact your business credit score

Your personal and business credit scores are typically considered separate and do not negatively or positively influence each other. For instance, a high personal credit score won’t improve your business credit score, and a low business credit score won’t bring down your personal credit score.

However, because new businesses often don’t have a meaningful record of loans and repayments, lenders will likely use your personal credit score to make an informed decision. In this case, the weight of how much your personal credit influences your business credit is directly connected to the type of business you own.

Top Tip: If you’re a small business owner, a poor credit profile can hurt your ability to build company credit. But it’s still possible to move forward. Learn how in our guide on how to get a business loan with bad credit 💰

Sole traders will find that your personal credit history will matter equally as much as your business’s credit history (i.e., they are going to be considered one and the same). It is important to ensure that your personal credit score is both protected and improved where possible.

Partnerships are treated similarly to sole traders. The key difference is that both you and your partners’ personal credit records are checked and examined prior to earning lending for your business. Even if your company credit score is excellent, you may not qualify for a business loan due to the poor credit of your partner.

A limited company will have a business credit score of its own. However, that doesn’t guarantee lenders won’t check on the personal credit records of the business’s partners and directors. That score represents the risk that you pose to either non-payment or financial security. It also impacts the size of the credit account that you might qualify for.

In summary, your personal credit score can influence your business credit score, but exactly how will depend on the situation and the type of business you manage.

Top Tip: Are you still in the early stages of growing your business? Choosing between being a limited company or sole trader can have big implications later on as you grow. If you’re not sure which direction to take, read our guide on what to consider before you choose between limited company or sole trader💡

14 ways to improve your business credit score

There isn’t a simple or singular way to quickly improve your credit score. It’s better to make a plan for long-term diligence around your finances. By collecting robust information, following financial management best practices and regular monitoring, you can begin to build your credit score.

Although these things take time, it’s not difficult to do. It’s important to build these habits into your normal finance routines and systems so that they become a regular part of how you operate. Over time, you’ll see your credit score begin to rise.

Here are our top tips to help you start building a favourable business credit rating:

- If possible, sign up for alerts that notify you when your company’s credit record changes or is searched. When a problem arises, get the support you need to address the issue(s) right away.

- Your business credit score can be impacted by customers, suppliers and vendors. Be sure to monitor their scores as well to ensure your credit record will not be impacted by their actions.

- Plan to check your credit rating score at regular intervals (such as each month or quarter) to be aware of any changes that could affect your status.

- Take care of your cash flow. If you run out of money and miss payment deadlines, your credit score may decrease. Consider how you can change your invoice payment terms and look at how online accounting tools can help you stay on top of your accounts receivable. In addition, consider setting restrictions around when to spend money and how low you’ll allow your accounts to get. Work with your accountant or financial advisor to determine what would work best for your business.

Top Tip: A great place to start managing cash flow is within your employee expenses. By creating clear rules and guidelines, you can lower your cash burn, avoid tax season surprises and effectively monitor your cash flow. To learn more, read our in-depth guide on how to manage employee expenses 🌟

- Ask your business partners and suppliers to share data on your payment history with CRAs to help improve your score. The more timely payments you can show, the better.

- Pay on time or early when possible. Your agreed payment terms are a form of credit, so failure to pay on time can damage your credit rating. Consistently paying bills on time will help improve your credit score and will indicate to creditors that your business has a healthy cash flow.

- Consider a business credit card. A business credit card can be pivotal to small businesses trying to get off the ground. They also come with travel and expense management rewards. If you can forecast a reliable cash flow, paying credit card bills on time is a great way to improve your credit score.

- Keep an eye on your credit utilisation ratio. Although it seems counterintuitive, lenders like to see that you use your line of credit and that you do so responsibly. The general rule is to use less than 30% of your total credit available.

- Carefully manage your personal finances. When you are just starting out or have a small enterprise, your personal financial data may be used in place of your company’s financial data.

- Avoid County Court Judgements wherever possible and pay them on time should they occur.

- File your company accounts before the deadline. Late filing can accidentally indicate financial problems.

- Start small with short-term, low-level borrowing you know you can pay right away. For example, you can pay for office furniture in instalments or organise to pay the monthly office supply order on credit. By consistently repaying debt in full and on time, you can begin to build a pattern of behaviour that credit agencies will see as an indication of likely future borrowing behaviour.

- Keep your business information updated. Inform your customers, suppliers and CRAs of any changes to your business location or status.

- Restrict the number of credit applications you make at a time. Too many applications in a short period may lead to credit searches being conducted on your business, which are then recorded on your credit record. This can make it appear like you are struggling to secure funding.

Top Tip: New and small business owners can plan for future growth by focusing on building their credit score now. Explore more in-depth tips to qualify for better financing options in our guide to increasing your business credit score 📈

Focus on the little things for gradual business credit score improvement. Using a business credit card may not feel necessary if you have plenty of capital to work with, but it can improve your business credit quickly and sustainably.

Based on your business, you can pick and choose a few of these tips to prioritise in the short-term and in the long-term, make progress on each of these points. Over time, you’ll begin to see your business credit score shift for the better.

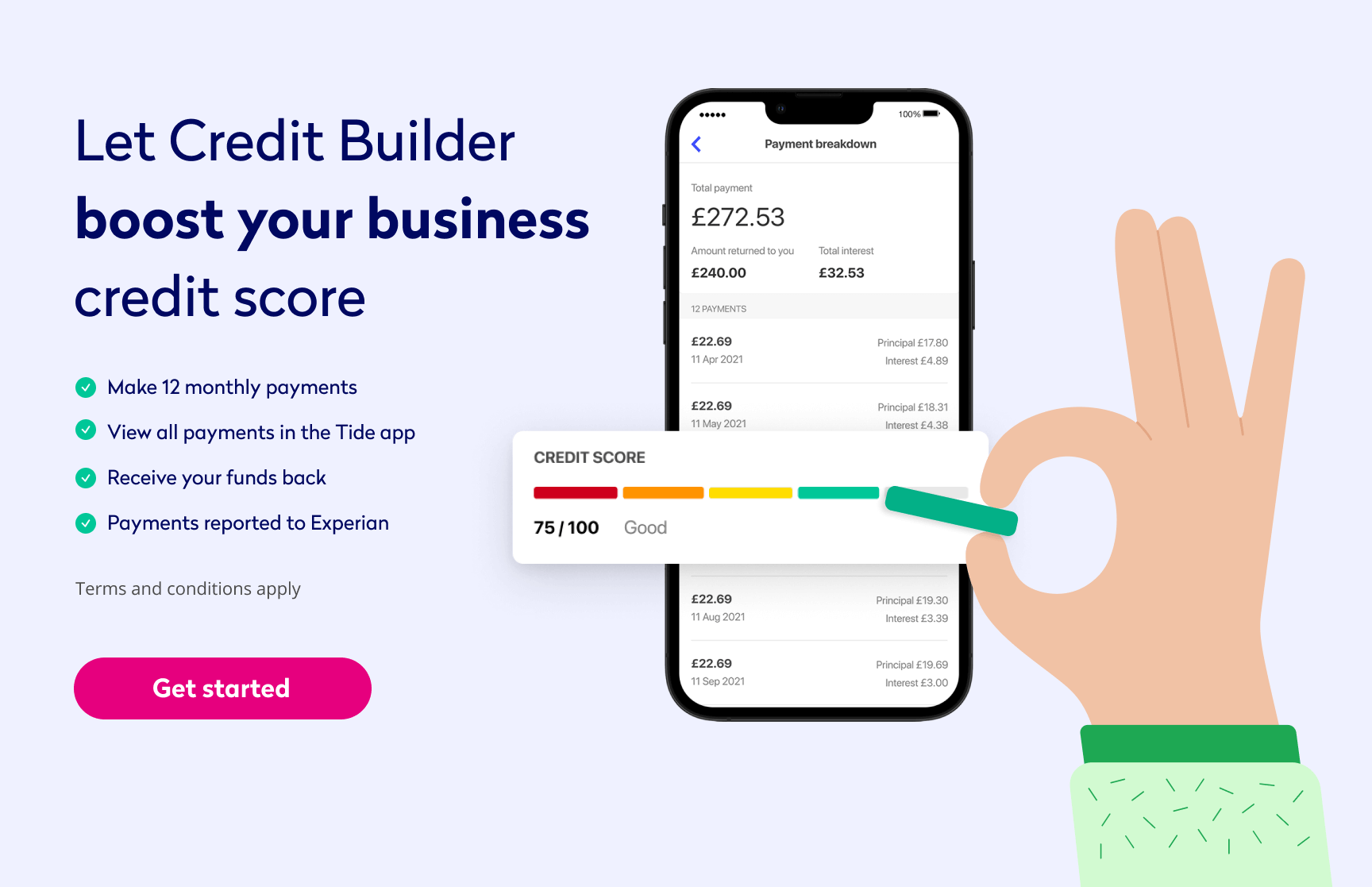

Give your business credit rating the chance to grow with Tide Credit Builder

Help boost your company credit score in just 12 months with Tide Credit Builder. Make 12 simple monthly payments, which we’ll hold in a separate account. Stay in control and view your payments and credit rating any time in the Tide app. We’ll report your progress to Experian, giving you peace of mind and helping build your business credit score. Get started with Credit Builder today! 🚀

💡 Expert insights

As Tide’s Cash Flow Expert and, with over 40 years experience of credit management, Philip King is passionate about cash flow and supporting small businesses.

Previous roles he has held include that of Interim Small Business Commissioner for the UK Government during 2020 and 2021. This involved providing support and advice to small businesses on their trading relationship with customers, particularly in respect of payment issues. As the Chief Executive of the Chartered Institute of Credit Management between 2005 and 2020, he also promoted the importance of effective cash flow management across industry by working with small businesses to improve their payment performance.

Q1: Isn’t it easier just to pay for supplies when I need them rather than going to the trouble of opening credit accounts for the sake of it?

As your business grows you’re likely to find a time lag between buying materials or products, and turning them into cash. As the numbers involved get larger, trade credit can be a helpful and free way of filling the cash flow gap, and it will certainly be cheaper than many other sources of finance you might have to find.

Having a credit line with a few small suppliers will help your cash flow, will enable you to demonstrate that you pay invoices on time and will, in turn, improve your credit score. It’s a constantly turning circle: the better your credit score, the easier you will find it to obtain credit or funding, and the more quickly you settle your bills, the better your credit score will become.

Always look beyond the present to what your future needs might be.

Q2: How do I know if my business credit score might be having a negative impact?

If you ever get turned down for a credit account, ask the supplier if they’ve used a CRA (Credit Reporting Agencies) report in reaching their decision and, if so, which one. If they’re willing to tell you, it’s worth getting a copy of the relevant report so you can see what it says and, if necessary, contact the CRA to correct any information that might not be right.

Q3: How can I avoid the risk of my company identity being stolen by fraudsters?

Fraudsters can change the address and directors of a company at Companies House and then use the company to obtain money or goods by deception. As stated elsewhere in this article, make sure you monitor your business credit report with Credit Reporting Agencies and it’s also worth following your company with Companies House. It’s a free service and you’ll get email alerts of any documents filed so you know if any changes of which you aren’t aware have been made. Details are here: https://www.gov.uk/government/news/follow-companies-for-free

Q4: Why, and how, does the promptness with which I pay my suppliers affect my business credit score?

You might assume that your credit score will be higher if your balance sheet is healthier. Delaying payments to suppliers will mean you have more cash in the bank and will make your accounts look stronger. A strong balance sheet will almost certainly enhance your score but remember that most CRAs capture payment data from their clients and feed the results into their scoring algorithms. If you pay invoices late, this will be likely to reduce your credit score, and it will also make future suppliers wary about granting you credit terms.

Wrapping up

Your business credit score is an important temperature check of how much financial risk your business carries. Although building a favourable business credit score takes time, it will ensure you’re able to secure important resources such as lines of credit, insurance and business loans.

One of the best ways to keep your business finances organised is by consolidating all of your business finances in one app.

A Tide business current account works for freelancers, small businesses and scaling businesses alike.

With features like scheduled payments, expense management, invoicing, account limits and auto-categorisation, it’s easy to customise, manage and track your ongoing income and expenditures. Open a free business bank account to get started today.

Photo by Andrew Piacquadio, published on Pexels