How to Increase Your Business Credit Score in 8 steps

Small business owners often find themselves looking for external funding sources to grow their business. But to qualify for a business loan and other financing options, you need to have a good business credit score.

Business credit scores help lenders, creditors and suppliers evaluate whether a business will be able to pay them on time. Knowing how to increase your business credit score (and keep it high) means you can secure bigger loans, lower interest rates and even flexible repayment schedules.

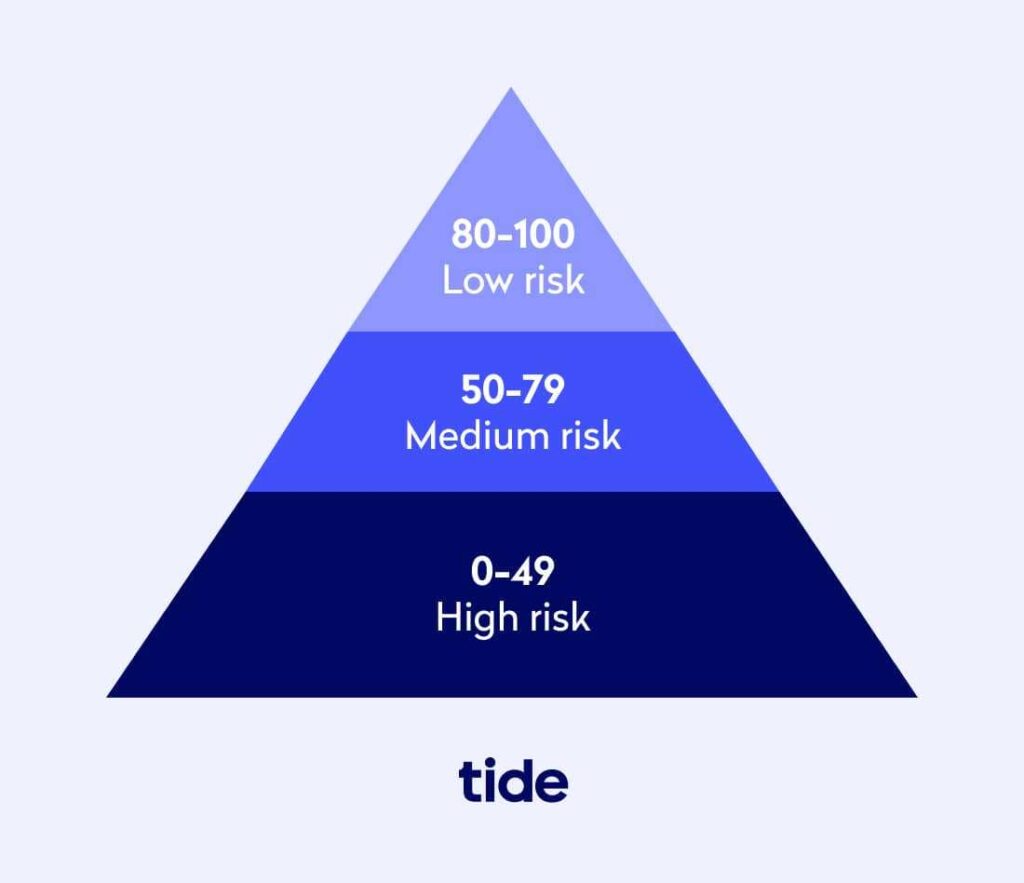

Here’s a quick overview of what qualifies as a good (low risk) or bad (high risk) business credit score.

Lenders and credit reporting agencies (CRAs) look at several factors to determine your business’s credit score—from your trade experiences to your payment history to the number of credit applications you’ve made in the past and more.

In this article, you’ll learn how to improve your business credit score so you can qualify for better financing options and grow your business successfully.

Top Tip: Establishing a good business credit score takes time, but it’s worth it for better financing options. Learn what a business credit score is, how it’s determined and why it’s important in our guide on everything you need to know about your business credit score 📈

Table of contents

- 1. Separate your business and personal finances

- 2. Regularly check your credit rating

- 3. Make your payments on time

- 4. Build good relationships with suppliers

- 5. Keep your credit utilisation ratio in check

- 6. Avoid closing your accounts

- 7. Reduce the number of credit applications

- 8. Be wary of county court judgements

- 💡 Expert insights

- Wrapping up

1. Separate your business and personal finances

Some small business owners use the same bank account for both personal and business transactions. For example, you might be tempted to use your personal credit card to make a large, one-time purchase for equipment.

However, using your personal credit cards for business finance can influence your business credit score. Exactly how varies on the type of business you run. If you run a limited company, for example, lenders can check your personal credit score (and the records of your business’s partners and directors) to gauge risk. If you have poor personal credit, you may get a smaller loan than requested or be denied a loan entirely.

If you don’t have a separate business credit card, banks and credit reporting agencies might also look at your personal credit score to assess your creditworthiness. This is often the case with startups and new businesses because they don’t yet have a meaningful financial history of loans and repayments.

Applying for a business credit card and using it for your business transactions keeps your business credit separate from your personal credit. And as long as you make your payments on time and keep your credit utilisation ratios in check, your business credit score will continue to improve, and your personal credit score will not affect your business credit score.

We’ll learn about making regular payments and credit utilisation ratios in a moment.

Top Tip: A poor personal credit rating can affect a new business’s financing and credit card eligibility. Despite this, it’s still possible to finance your business. Learn how to get a business loan with bad credit 💰

2. Regularly check your credit rating

Checking your business credit report regularly can help you catch errors and improve any potential dips, so you can avoid high interest rates when applying for loans or credit cards.

It’s important to note that checking your credit score does not impact your credit rating. Requesting too many hard checks in a short space of time may impact your credit rating.

To clarify, here’s a quick overview of hard vs soft credit checks.

- Hard credit checks are usually initiated by lenders and utility companies during the application process. They provide a comprehensive picture of your financial responsibility.

- Soft credit checks are a basic check that includes key pieces of information, such as the ones run to pre-qualify candidates for credit options or when you check your credit score.

To check your business credit score, reach out to major credit reporting companies like Dun & Bradstreet, Equifax or Experian. They’ll provide you with a soft check of your credit score, including a score range reflecting your good or bad credit status.

Top Tip: To stay on top of your finances and build good credit, you must know how business credit scores work and where you stand with yours. Learn everything you need to know in our guide on how to check your business credit score 🌱

Since these companies sell credit information to lenders looking to finance a business, data on these reports is critical. Checking them regularly can help you catch any issues in your profile.

Luckily, CRAs usually have dispute processes in place that let you fix errors and remove inaccurate negative feedback from your file. If you see something that shouldn’t be there, make sure you report it and try to get it removed.

Learning about your business credit rating can also help you identify opportunities to boost your business credit score quickly. For example, you may discover you need to ask your suppliers to report your good credit history with them.

It also allows you to make business decisions in future that can positively impact your credit rating. For example, a bad score may indicate that you need to let go of some client accounts that aren’t great at paying you promptly.

Top Tip: Starting a business comes with short and long-term costs. Good credit gives you access to more funding options to cover all your expenses. Learn what you should plan for in our guide on how much it costs to start a business in the UK 📖

Assess partnership credit risks too

You can also maintain or even boost your score by monitoring your partners’, customers’ and suppliers’ credit scores.

As a business owner, you want to ensure a reliable experience for your customers, so you need to be aware of supplier financial practices or difficulties that could disrupt your supply chain.

You also have the option to extend credit to business partners and customers, and you want to be sure they won’t create greater financial risk for your own company. If any of them fall into financial difficulty, it could affect your credit rating directly or indirectly:

- If you partner with a business, lenders will also consider the partner’s credit report when deciding your creditworthiness. A poor score from a partner may dissuade a credit provider from working with you. It can affect whether you get a loan and the terms and interest rates of any loans or lines of credit you do get.

- Indirectly, a history of late payments could mean their payments to you will also be late. Or that suppliers won’t be entirely reliable. And that means disruptions to your cash flow, potentially leaving you unable to pay your own debts on time.

Top Tip: Managing your cash flow helps you keep your credit in check. A good place to start is with your employee expenses. Create clear rules to keep spending in check, prepare for tax season and monitor your cash flow. Learn more in our complete guide on managing employee expenses 🌟

Understanding your partners’ credit standing allows you to make business decisions that positively impact your credit rating. For instance, a bad score may help you decide you need to let go of client accounts that don’t pay promptly.

As you make changes and maintain positive partnerships with reliable companies, you’ll prove that you’re a reliable business and a good bet for lenders.

3. Make your payments on time

The best way to improve your business credit score is to pay your bills on time. If you have a poor track record of making timely payments, you may not come across as creditworthy to lenders and suppliers.

Even worse, businesses you owe money to, like suppliers and utilities companies, can report you for late payments. Fixing a bad credit score can be tough, so make sure you do everything possible to stick to your payment deadlines.

Some things you can do to ensure timely payments include enabling reminders on your phone or computer, setting up automated payments and assigning particular days of the week or month to make payments.

Making timely payments can also help you stay in your suppliers’ good books, which can directly affect your credit score if they report your payment history.

Actively build a repayment history

If you’re just starting out with credit, it’s a good idea to intentionally build a positive repayment history to boost your score. Here are a few ideas to actively build your payment history:

- Get a commercial line of credit. You can often get a commercial line of credit early on for low-risk, short-term purchases. Apply early and keep your spending small and manageable so you can repay on time, every time.

- Apply for a business credit card. Getting a card in your business’s name is a good way to establish credit. Making regular business purchases on the card and paying it off promptly will create a record of on-time repayment.

- Make sure your vendors report payments. Not all vendors report payment histories to credit reference agencies. Ask current vendors if they do, or if they’d be willing to report on your behalf. Or consider starting accounts with new vendors after checking that they will report your repayments.

Top Tip: Predicting your cash flow can help you plan timely payments and access business credit. Connect your business bank account for spending insights and pre-eligibility checks. To increase your credit score and support your business’s financial health, explore Tide’s Cashflow Insights 🎉

4. Build good relationships with suppliers

Another thing you can do to improve your business credit score is to build good-standing, long-lasting relationships with your suppliers.

If you have a long-term relationship with a supplier and always make your payments on time, you can open a credit account with them to increase the total number of “positive” payments to your file.

Credit agencies value a business’s credit repayment history, and establishing a credit account with your supplier is a great way to boost your score.

Also, keep in mind that not all suppliers report your good credit behaviour to credit bureaus. If you have a good relationship with your suppliers, you can ask or remind them to report your positive payment history.

If they still fail to report your payments, you can manually add trade references to your company’s credit file with credit reporting agencies (such as those mentioned above). The credit reporting agency will then reach out to your supplier to verify the information.

You should reach out to your suppliers before resorting to manually adding trade references, as sometimes suppliers will not respond to the credit agency.

5. Keep your credit utilisation ratio in check

When you apply for credit, reporting agencies look at something called the credit utilisation ratio (CUR). This ratio depicts the amount of credit you’ve used as a percentage of the total amount of credit you were offered.

For example, if you have a total of £12,000 available on a credit card, but you only use £6,000, your CUR is 50%.

Even if lenders award you more than you need in credit, it’s wise not to use the entire amount. The rule of thumb is to use less than 30% of the total funds available in your credit account.

This is also helpful to know when deciding on how much credit to apply for. You should always request more than you need so you aren’t passing the CUR threshold recommendations, penalising yourself in the process.

If you have already borrowed credit from a credit card provider, you can request that they increase your credit limit in order to decrease your credit utilisation ratio. However, keep in mind that your bank may not oblige your request, and you should avoid seeing this as an opportunity to spend more.

6. Avoid closing your accounts

Some business owners make the mistake of closing credit accounts and removing them from their credit reports. However, withdrawing your credit history can negatively impact your business credit score.

Closing a credit account is not the same as closing a bank account. Closing a bank account does not impact your credit rating.

Even if you don’t use an old credit account, your history of making payments on time still contributes to your overall credit score. In fact, the older your credit line grows, the more your creditworthiness increases.

This is also related to your CUR. Your CUR is calculated based on your total credit availability. If you close accounts you no longer use, you’re actually increasing your ratio.

7. Reduce the number of credit applications

Applying for business credit several times in a short period can do more harm than good to your credit profile. Here’s why:

- Every credit application is added to your credit report, even if it’s unsuccessful.

- If you apply for credit repeatedly, credit reporting agencies might assume that you’re struggling financially.

- When you apply for credit, your business credit score will drop by a few points.

Many businesses need financing to grow, which is why they apply for credit in the first place. But it can be off-putting for many lenders if they see that your business continually relies on credit to operate.

The solution is to only apply for credit when you absolutely need to and maintain a positive cash flow in the long run. That’s because CRAs also take into account the difference in your company’s current assets and liabilities.

One way around applying for credit repeatedly is to request a quote from lenders on how much you can borrow. This avoids lenders running official hard checks on your creditworthiness.

Top Tip: There are more ways to inject cash into your business than taking out a loan or getting a credit card. Make the right decision for your company by learning more ways to get capital in our article on 10 ways to fund your small business 🔟

8. Be wary of county court judgements

Lastly, to increase your business credit score, you must ensure there are no legal actions against your business. This usually happens when you owe money to people or when they believe you owe them money.

Disgruntled lenders or suppliers may register a case against you through a county court judgement (often referred to in reports as CCJ) or a high court judgement.

You’ll get 28 days after that to settle your case and cancel the judgement to avoid it appearing in your record. However, failing to do so may negatively impact your overall credit score for up to six years.

If a CCJ is on your credit record, it signifies a huge question mark for lenders when they’re considering whether or not you’re likely to make repayments on time, if at all.

So first, make sure you avoid getting into any legal trouble at all. And if you do, try to settle the case as soon as possible, so it doesn’t leave a lasting scar on your credit report.

💡 Expert Insights

As Tide’s Cash Flow Expert and, with over 40 years experience of credit management, Philip King is passionate about cash flow and supporting small businesses.

Previous roles he has held include that of Interim Small Business Commissioner for the UK Government during 2020 and 2021. This involved providing support and advice to small businesses on their trading relationship with customers, particularly in respect of payment issues. As the Chief Executive of the Chartered Institute of Credit Management between 2005 and 2020, he also promoted the importance of effective cash flow management across industry by working with small businesses to improve their payment performance.

Q1: Why would I want to let go of a client?

On top of the credit score issue, if a client pays you late it affects your cash flow, the sustainability and success of your business and potentially your mental health. When you’re expecting a payment to hit your account and it fails to arrive, you may be unable to pay your employees, a key supplier or the rent on time.

The lack of funds can prevent you from investing in people, materials or product development and marketing. Chasing payment distracts you from doing what you set the business up for. Having sleepless nights worrying about whether a payment is going to arrive can have serious effects.

Businesses fail when they run out of cash, so find customers that pay you, and avoid supplying those that don’t.

Q2: What are the benefits of paying a supplier promptly?

Paying on time can positively impact on your credit score but there are other benefits too. Suppliers prefer customers who pay them promptly and without having to be chased.

Being a preferred customer might get you better prices and discounts or a wider choice, you can ask for superior service and the best support from the supplier’s ‘A-team’, and you’re more likely to get materials if they’re in short supply.

Be the customer every supplier wants and you’ll enhance your reputation, strengthen your supply chain, and you’ll also be acting as a responsible business and doing the right thing.

Q3: How can I improve my relationships with suppliers?

Businesses are interdependent and rely on each other. Trying to force a supplier to reduce its prices until it loses money, or has to reduce quality, is counter-productive. Recognise that your supplier needs to make money too. It makes far more sense for businesses to see and treat each other as partners adopting a win-win mentality.

Working with your suppliers, communicating openly with them, and seeking opportunities to support and help each other will reap dividends. They’ll be around for longer, you’ll be able to rely on them and you’ll both be stronger as a result.

Wrapping up

Establishing a strong business credit score can help your business acquire finances from lenders with favourable interest rates and payment terms.

But a good credit score isn’t achieved overnight. You have to consistently make your payments on time, regularly pay off your credit balances and build great relationships with your suppliers.

If you’re looking for more ways to increase your business credit score*, open a free business bank account and explore Tide Credit Options today. Make the most of our suite of features to stay efficient, predict your cash flow and gain access to business credit.

*This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Photo by RODNAE Productions, published on Pexels