Credit score brackets: The label that controls your access to credit

Your credit score affects your ability to secure funding, such as a personal loan or a mortgage. A personal credit score can even greenlight capital and growth for your business, or it can mean a closed door.

For all your efforts to launch your business, pay your bills on time and operate within your means, your complex financial history is summed up in words like “Fair”, Good” or “Poor”.

What are credit score brackets, and how do they work?

In this guide, we’ll break down how the three major credit reference agencies calculate your scores and brackets and give you tips on how to improve yours.

Table of contents

- How credit scores work in the UK

- Credit score brackets at Equifax, TransUnion and Experian explained

- What is a good credit score, and why does it matter?

- How to improve your credit score bracket: What to do and what not to do

- Wrapping up

How credit scores work in the UK

Credit reference agencies determine your credit score bracket from your credit score. A personal credit score is a number usually between 0 and 1,000 that scores how likely you are to repay a loan (though each agency uses its own range, which we’ll see in a moment).

For every agency, a higher number means you’re considered more reliable to repay, while a lower number means you’re considered at higher risk to default.

How are credit scores calculated?

Companies like lenders, utility companies and retailers send customer reliability reports to the UK’s three main credit reference agencies (or CRAs, sometimes called credit bureaus): Experian, Equifax and TransUnion.

Each agency uses its own algorithm to compile this information into a unique score for each customer. When you apply for a mobile phone contract or a loan, for example, the provider may pull your credit report and calculate your score and bracket into its calculation.

Why do different credit reference agencies report different scores?

While most CRAs in the US use FICO to determine a standardised credit score, there isn’t a single answer to the question, “What’s my credit score?” in the UK.

Every individual in the UK has three main scores, each issued by one of the big three CRAs. Here are three reasons why the scores may be different from each CRA:

- Not all creditors report to all three CRAs

- Each CRA uses a different scale (0–710; 0–999; 0–1,000)

- Scoring models vary at each agency

Beyond the three main CRA scores, many companies create their own credit score for you. A company’s proprietary credit score may also factor in your amount of debt, income, savings and payment history with that company or others in the same industry.

How your personal credit score affects your business credit score

A business credit score presents lenders and potential investors with your business’s financial history, and it rates how likely you are to repay a business loan. CRAs calculate your score by factoring in the age and size of your business, ownership structure, industry, trade credits and history of accounts and repayments.

Business credit scores in the UK range from 0 to 100. A higher score correlates with high creditworthiness and low risk in the eyes of lenders, while a lower score correlates with low creditworthiness and high risk.

If you operate a new business, you may not have enough financial data to earn a good business credit score, or you may have no data at all. If that’s the case, lenders will look at your personal credit score when considering you for a line of credit. Once your business is established, lenders will usually consider only your business credit score.

Credit score brackets at Equifax, TransUnion and Experian explained

Lenders access your credit score and credit score bracket in a credit report. Let’s look at the difference between these three terms.

Your credit score is the number itself (e.g., 742).

A credit report is a detailed report available to lenders with information about your history of repayment, how much debt you have and individuals to whom you are financially connected.

Credit score brackets assign a descriptor to your score, which can range from “Very poor” to “Excellent”. Also known as credit score ranges, buckets or banding, these categorisations help creditors determine whether you are a good candidate for lending.

Each CRA calculates its credit scores and credit card brackets differently. Here is a breakdown of the buckets at each agency.

Equifax credit score brackets

Equifax now rates consumers on a scale of 0 to 1,000 in the UK. In April 2021, Equifax replaced its previous scale (0 to 700) to “provide greater clarity around the information provided in your credit report and its impact on your score”.

It categorises customers into five credit score brackets ranging from “Poor” to “Excellent”.

| Credit score bracket | Rating | Implications |

| 0–438 | Poor | It’s likely your credit application will be rejected. |

| 439–530 | Fair | You have a chance of being approved for credit but are likely to be charged a high interest rate and have a low limit. |

| 531–670 | Good | You should be offered credit at reasonable interest rates but may have a low initial credit limit. |

| 671–810 | Very good | You’re likely to be approved for credit but won’t necessarily be offered the very best interest rates. |

| 811–1,000 | Excellent | You’re very likely to be approved for competitive credit offers. |

TransUnion credit score brackets

TransUnion’s rating system ranks consumer credit scores on a scale of 0 to 710. Its credit score brackets range from “Very Poor” to “Excellent”.

| Credit score bracket | Rating | Implications |

| 0–550 | Very poor | It’s highly likely your credit application will be rejected. |

| 551–565 | Poor | You have a chance of being approved for credit but are likely to be charged a high interest rate and have a low limit. |

| 566–603 | Fair | You should be offered reasonable interest rates but are likely to have a low credit limit. |

| 604–627 | Good | You’re likely to be approved for credit but won’t necessarily have the best interest rates. |

| 627–710 | Excellent | You’re very likely to be approved for competitive credit offers. |

Experian credit score brackets

What are Experian credit score brackets? Experian’s five buckets range from “Very poor” to “Excellent”. The agency also provides a description of what this means for customers in each bracket.

| Credit score bracket | Rating | Implications |

| 0–560 | Very poor | You’re more likely to be refused most credit cards, loans and mortgages. |

| 561–720 | Poor | You might be accepted for credit cards, loans and mortgages, but they may have higher interest rates. |

| 721–880 | Fair | You might get OK interest rates, but your credit limits may not be very high. |

| 881–960 | Good | You should get most credit cards, loans and mortgages, but you might not get the very best deals. |

| 961–999 | Excellent | You should get the best credit cards, loans and mortgages, but there are no guarantees. |

What is a good credit score, and why does it matter?

What is a good credit score, and why does it matter? To have a good credit score, it will need to be at least 531 with Equifax, 604 with TransUnion and 881 with Experian.

As you can see, it’s a little more complicated than having a blanket “good credit score” or “bad credit score”. Rather than labelling yourself this way, think of your credit score bracket as classifying the breadth of financial products and rates you have available to you.

While a score classified as “Very poor” might eliminate you from most or all lending products, all other brackets contain the possibility for some access to credit. You might have fewer products, higher rates or a lower credit limit with a lower score.

Generally, aim for a credit score that is at least at “Fair” or above to see a good range of products and rates available to you.

What is the average credit score in the UK?

While the CRAs don’t publish a national average, Experian offers an interactive map where you can search for the average credit score in the UK by age and region. Checking your score against your local averages helps you to see how a lender might see you and your rating in comparison to those nearby.

Don’t get too hung up on your score in relation to averages, though—it’s not a tool to base big decisions on. Your individual situation is different, and the access to credit that you need may differ from your neighbours.

Top Tip: Personal credit scores and business credit scores are different. If you run a business, you’ll need to keep track of your business credit score too. Learn how to check your business credit score here ✔️

What are the implications of your credit score bracket?

Your credit score bracket has a wide range of implications on everyday decisions. Here are examples of transactions where your credit score may affect your access:

- Applying for a credit card

- Raising the limit on a credit card

- Applying for lower interest rates

- Applying for a mortgage or lease

- Applying for a business or personal loan

- Setting up a monthly contract for gas or electricity

- Setting up a mobile phone contract

- Accessing instalment plans and lower rates for insurance

- Accessing retail credit or instalment payments

If you’ve been denied one or more of these or have avoided applying for loans because of a low credit score, there’s hope.

A credit score is a living number that can change up or down depending on your financial habits and health. If you want to improve your score and move up a bracket or two, there are many steps you can take.

Top Tip: Looking for ways to improve your business credit score too? A favourable credit score for your business can help you secure important resources such as lines of credit, insurance and business loans. Learn ways to boost your business credit score in our guide on everything you need to know about your business credit score (and how to improve it) 📈

How to improve your credit score bracket: What to do and what not to do

The models that Experian, Equifax and TransUnion use to score your credit try to reward you for good financial choices as much as they penalise you for poor financial decisions. To improve your score, you need to be consistent with good financial habits as well as be diligent to avoid missteps.

Activities that hurt your credit score

Here are some decisions you may make that can negatively impact your credit score:

- Applying for credit too regularly. If you apply for credit cards often or apply for several at once, agencies may view this as evidence that you’ve been denied credit or that you’re borrowing beyond your means.

- Joint accounts. If you have a joint account or have co-signed a lease with someone with poor credit, this can negatively impact your score. Establishing separate accounts or having just one person’s name on a mortgage or lease can improve your score.

- Foreclosure or bankruptcy. The best way to hurt your credit score is by defaulting on a loan or mortgage or declaring bankruptcy. These activities can have a major impact on your credit score for up to six years.

- Having no credit history. Credit reporting agencies begin assigning you a score when you turn 18. If you don’t have any credit in your name, you may have a low score because the agencies don’t have enough information about you. While it might seem contradictory that having no debt can hurt your score, it’s just how the system works. Many people start to build credit by taking small steps, like those we’ll discuss next.

Ways to boost your credit score

Boosting your credit score is more like a marathon than a sprint. It can take consistent effort over time to see a difference. Follow steps like the following to get started on increasing your credit score:

- Build up your credit history. If you’ve never had a credit card or if you aren’t happy with your score, apply for a starter credit card with a low limit. Use the card within your means, stay under 70% of your credit limit and pay at least the minimum payment on time each month. Credit builder cards often have high interest (over 30%), so be sure to use these wisely. After a few months of consistent payments, you can apply to raise your credit limit.

- Pay your bills on time. There’s really no silver bullet to raising your credit score. Paying your bills consistently on time will raise your score. But it does take time.

- Register to vote on the electoral rolls with your current address. Credit reporting agencies check your information against the electoral voting rolls to make sure you are who you say you are. If they can’t find your information or if it doesn’t match what’s on the electoral rolls, it can hurt your score.

- Wait. If you have a bankruptcy or other major credit default on your record, you may just need time for the negative events to drop off your report. In the meantime, keep paying your bills on time until you are eligible for credit again.

Ways to maintain a good credit score

Once you’re happy with your credit score, you need to continue practising good financial habits to keep it up:

- Monitor your credit. It’s free and within your right to request your credit report and see who’s been checking it. Review your credit report at least once a year to ensure that there’s no fraudulent or errant information dragging your score down. Check your current cards and accounts for suspicious activity, and report fraudulent charges and lost or stolen cards right away.

- Keep track of your accounts. Find a personal organisation system that works for you to pay your bills on time and take charge of your finances. Whether you need to hire a bookkeeper or find a tool to help you budget and stay organised, it’s within your control to avoid costly mistakes from disorganisation.

Wrapping up

The most important thing that you can do to empower your access to credit is to know your credit score bracket and understand what decisions and activities contribute to it.

No matter which credit score bracket you fall into now, there’s always an opportunity to improve it. By continuing to make wise financial choices and following the tips in this guide, you’ll be on your way to expanding your lending potential.

If you’re looking to build a strong credit score, open a free business bank account with Tide and explore our various credit options today.

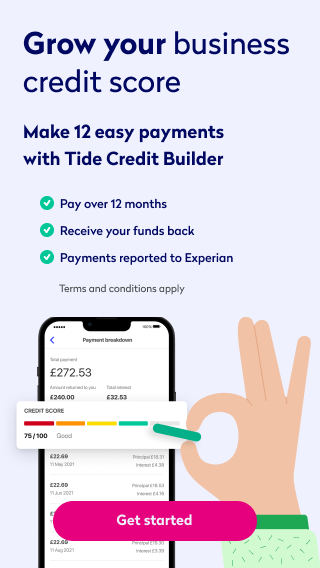

Boost your business credit score with Tide Credit BuilderGive your company credit rating the chance to grow. Make 12 easy monthly payments. Track your progress in the Tide app anytime. We’ll report your payments to Experian to help grow your business credit score. Get your funds back at the end of the year. Help boost your credit score with Credit Builder today! 🚀

Photo by Anna Nekrashevich, published on Pexels