How does VAT work? A beginner’s guide

Anyone who’s ever purchased anything is likely familiar with Value Added Tax (VAT). As a small business owner, VAT comes into play at every stage of the supply line.

Once you hit a minimum threshold in taxable turnover, you must become VAT-registered. But even before you hit that milestone, you may still be charged VAT by suppliers.

VAT is a complex process that requires top-notch recordkeeping and reporting, so you need to understand the ins and outs of how it works every step of the way.

In this article, we’ll discuss exactly how VAT works and how and when to charge and report it. We’ll also cover details around exemptions and reverse charge procedures.

Table of contents

- How does VAT work for a business?

- When do I need to charge VAT?

- How is VAT charged (and how much should I charge)?

- How do VAT returns work?

- How does VAT accounting work?

- How does reverse charge work?

- Expert insights

- Stay compliant with proper VAT procedures

How does VAT work for a business?

Value Added Tax, or VAT, is a tax imposed on goods and services. It’s a consumption tax similar to a sales tax, but instead of being collected at the final sale and charged entirely to the customer, it’s levied along the way.

VAT is paid every time a product is sold—including transactions between manufacturers, wholesalers and retailers. It’s collected throughout assembly and is evaluated at each stage of the process.

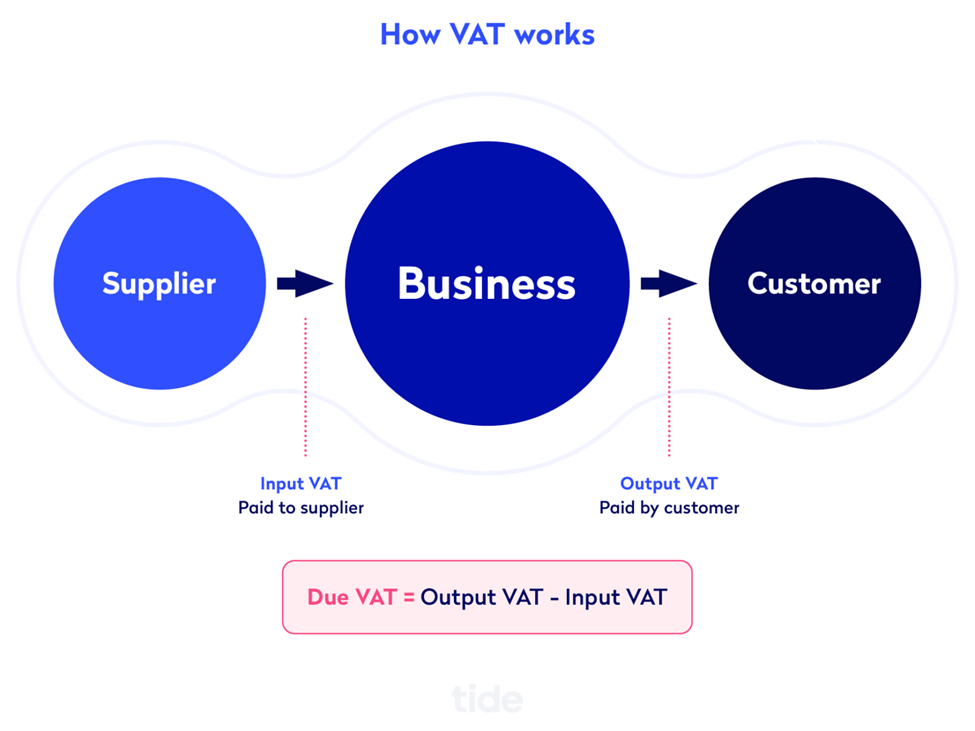

Your role as a business is to pay VAT to your VAT-registered suppliers for things like raw materials and professional services. You do not need to be registered for VAT yourself to be charged VAT by your suppliers.

The only way that you can reclaim that VAT is if your business becomes VAT-registered (either by reaching the minimum threshold or voluntarily registering). Once VAT-registered, you can collect VAT from your consumers and reclaim the VAT you’ve been charged by your suppliers from the government.

You are, in essence, acting as a tax collector on behalf of the government.

We’ll dive into the details of Output VAT and Input VAT in a moment. First, let’s look at when exactly you need to charge VAT and what voluntary registration means.

When do I need to charge VAT?

By law, companies must become VAT-registered and start charging once their earnings in a given tax year exceed the VAT-registration limit.

The current threshold for annual earnings in 2022 is any earnings over £85,000.

Whether you’re a limited company, a self-employed freelancer or a sole trader, you must register once you cross the VAT threshold and before you submit your first VAT return.

It’s important to note that once you cross the threshold, you must register within 30 days of the end of the month that you exceeded £85,000 in annual turnover.

So, if you exceed the threshold on 15th March, you must register within 30 days of 31st March (the last day of the month). This means your registration date can be no later than 30th April. Registering after you cross the threshold is called the backward look because you are registering after the fact.

Another option at your disposal is the forward look, in which you predict the day that you’ll cross the threshold. You then have 30 days from that prediction day to register.

Either way, your official start date is known as your Effective Date of Registration (EDR).

Voluntary VAT registration

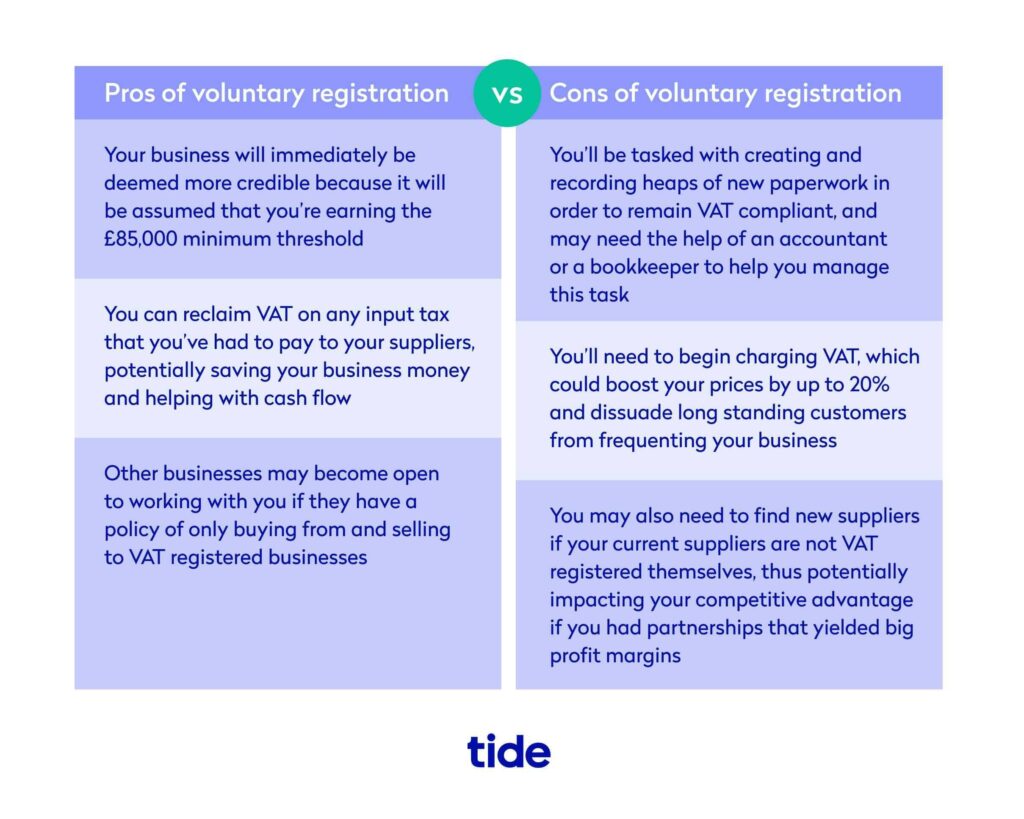

Even before you reach the VAT threshold, you do have an option to voluntarily register for VAT. As with many business decisions, there are both benefits and drawbacks to registering before you reach the threshold.

Being VAT-registered means extra recordkeeping and paperwork, but it can save you money in the long run. This is because even if your business is operating below the registration limit, you must still pay VAT to your VAT-registered suppliers and have no way of reclaiming that money from the government (more on how this works later).

Registering does mean that you also have to charge VAT to your customers (unless you sell VAT-exempt goods and services). Of course, this means raising your prices for end customers, which can impact customers that are used to paying a certain amount. If you sell goods and services to customers that are already VAT-registered, the price increase won’t affect them because they can reclaim the VAT.

If you are considering becoming registered before it’s required, you need to weigh the implications of raising your prices and adding extra work for yourself (or your small business accountant if you’ve leveraged assistance).

Top Tip: There can be serious consequences if you begin charging VAT without being officially registered. Learn about the consequences of late registration and how to officially register by reading our guide on whether you can charge VAT when you’re not registered⚡️

VAT charges and exemptions

VAT is collected on most goods and services in the UK. Examples of VAT-taxable supplies and items include:

- Products or services sold

- Supplies purchased for business use

- Loaning goods to someone

- Sale of assets

- Commissions

Some goods and services are exempt from VAT, however. That means you cannot charge (or be charged) VAT on them. These are things that serve the public good and that the government doesn’t want suppliers or buyers to have to mark up at any stage of the journey (from production to sale).

Exemption applies to:

- Charitable organisations and fundraising events

- Energy providers

- Healthcare and medical service providers

- Education goods and services

- Services related to finance, insurance and investments

You can find a more complete list of VAT exempt goods and services on the GOV.UK website.

VAT-exempt sales are not taxable and thus don’t count toward the VAT-registration threshold. However, reduced rate and zero-rate transactions do count. You need to know which goods and services you offer to make sure your financial records and reporting are accurate. You’ll also need this information to discern if you are a full-fledged VAT-exempt business or if you qualify for VAT partial exemption.

Top Tip: If you are VAT exempt but still buy items with VAT added to run your business, you must still pay VAT but cannot claim it back. Find out if your sales are taxable, exempt, or partially exempt and learn about the benefits and drawbacks of exemption by reading our guide on VAT exemption 🌟

How is VAT charged (and how much should I charge)?

When you charge VAT, you’re adding the cost of the tax to the goods or services you sell to your customers. VAT rates are percentage-based, so calculating them is pretty straightforward. But you charge different rates depending on the types of products or services you offer.

VAT rates

There are four categories you need to be aware of when determining how to charge VAT.

Standard rate (20%)

This is the rate applied to most goods and services.

Reduced rate (5%)

This is a lower rate tax applied to some goods and services for things like fuel and power for charitable housing, or children’s car seats.

Zero rate (0%)

This is the rate applied to necessities like most food (excluding restaurant meals), children’s clothing, books and newspapers, prescriptions and new house sales. If you only supply zero-rate goods, you may not have to become VAT-registered, though you will need to apply for an exception from registering.

Exempt

As discussed earlier, these are goods and services that don’t require any VAT charge.

Once you know which rate or rates your goods and services fall under, you can calculate VAT based on the percentage that applies to each. Here are the 2022/2023 VAT rates for businesses in the UK.

| Rate | % of VAT | What the rate applies to |

| Standard | 20% | Most goods and services |

| Reduced rate | 5% | Some goods and services, eg, children’s car seats and home energy |

| Zero rate | 0% | Zero-rated goods and services, eg, most food and children’s clothes |

How do VAT returns work?

VAT-registered businesses are required to keep detailed records of their VAT payments and charges and subsequently report them in VAT returns. These records are called VAT accounts.

If you’re registered, you must keep a summary of VAT for each tax period included in your tax returns. You’re required to keep records current and easy to find. You must also maintain them for six years.

When you can submit returns

While VAT is paid throughout the year and included on individual invoices, UK VAT returns are typically submitted quarterly. However, if you prefer, you can ask HMRC to submit them monthly instead.

Businesses choose when their quarterly period starts when they register. The schedule may not follow the calendar quarter but will still cover a 12-month period.

As for deadlines, VAT payments should be included on the return for the quarter in which you issued the invoice, not the one in which it was paid. And you must submit VAT returns within one calendar month and 7 days of the end of the quarter.

Note: You must pay your VAT bill online via the Making Tax Digital for VAT government scheme. To learn more, head to GOV.UK’s Overview of Making Tax Digital page.

Depending on the size and nature of your business, you can opt to submit returns monthly or yearly. However you time it, you must submit a return for each period once you’re registered—even if you don’t owe VAT or have any to reclaim.

Top Tip: While there are many benefits to being VAT-registered, completing and submitting VAT returns isn’t always straightforward. Learn how to avoid common mistakes in our guide to identifying and correcting common VAT mistakes ⚡️

While VAT returns make for more accounting work, they also allow you to recoup some of your own VAT spending. Here’s how.

How does VAT accounting work?

Your accounting will get a little more complicated once you register for VAT. For starters, you’ll need to issue VAT invoices instead of standard invoices and submit a VAT tax return.

We’ll talk about VAT invoices and tax returns in a moment. First, there are some VAT schemes that may help with your VAT accounting.

The VAT schemes

The UK government designed voluntary VAT schemes to simplify how some VAT-registered businesses calculate and account for VAT.

You’re not required to join an accounting scheme and the schemes do not change the amount of VAT you charge for your products and services, but they may help to account for cashflow issues that arise from standard accounting.

Here are the VAT schemes that small businesses can opt into.

VAT Standard Accounting Scheme

The main VAT scheme, or the way in which you typically pay, charge and report VAT is called the standard accounting scheme. You pay VAT when invoices are issued, and vice versa, and report your VAT quarterly (as described above).

VAT retail schemes

There are three retail VAT schemes you can use if you’re in the industry:

- Point of Sale Scheme. Identifying and recording VAT at the point of sale.

- Apportionment Scheme. When buying goods for resale.

- Direct Calculation Scheme. Making a small portion of sales at one rate and the rest at another.

If your turnover is over £130 million, you’ll need to speak with HMRC to work out a custom VAT retail scheme.

VAT margin scheme

Use a VAT margin scheme when you add value to an item you sell and you don’t want to charge VAT on the whole item. On this scheme, you would pay a percentage on the difference between what you bought an item for and what you sold it for.

Secondhand goods and ‘upcycled’ products would fall into this category and could benefit from using this scheme. There are many exceptions to these schemes, such as for vehicles and auctioned items, so head to GOV.UK to see if your goods or services qualify.

VAT Flat Rate Scheme

If your business has a turnover of less than £150,000, you can opt to you pay a fixed rate of VAT to HMRC with the VAT Flat Rate Scheme. Here, you do not have to keep a record of and pay VAT on every purchase. Instead, you can calculate your total VAT payments as a percentage of your total turnover. The exact percentage varies depending on the services you offer.

Because you aren’t paying VAT on purchases, you also can’t reclaim it. Instead, the input tax allowance is built into the Flat rate scheme. This scheme is great for businesses looking to simplify their recordkeeping.

VAT Cash Accounting Scheme

If your ‘VATable’ turnover is less than £1.35 million, you can opt in to the VAT Cash Accounting Scheme. This scheme that stipulates that you don’t pay or reclaim VAT until money actually changes hands.

You must still record the VAT on every transaction, but you are not required to pay VAT until your invoices are paid. This scheme is great for maintaining cash flow, as you’ll likely retain your money for a longer period of time.

VAT Annual Accounting Scheme

The VAT Annual Accounting Scheme is similar to the standard scheme, but instead of reporting and paying VAT quarterly, you only need to pay it once a year. You’ll still need to make advance payments to your VAT bill, but you only submit a return annually.

This scheme is available to businesses that have an expected turnover of £1.35 million or less and can help to improve cash flow as you’re paying VAT in instalments. That said, you can only reclaim VAT once a year, so if you rely on that money for operations, this scheme may not make sense for your business.

VAT invoices

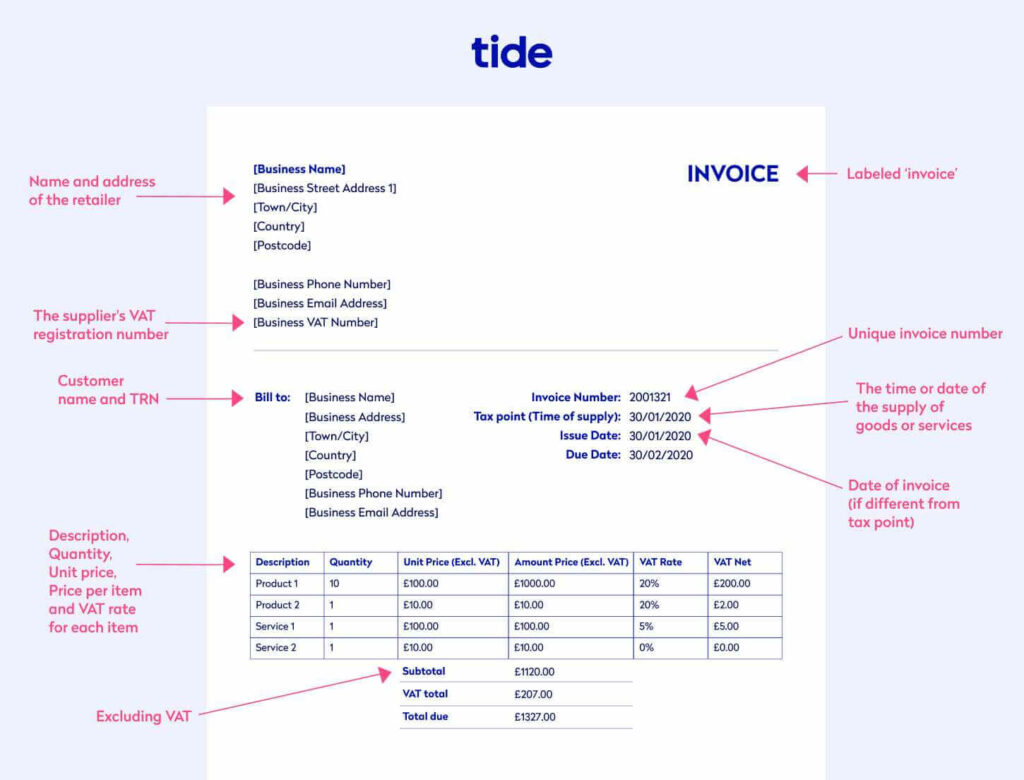

VAT invoices follow the exact same principles as regular invoices, just with VAT added into the calculation.

In addition to the information found in a regular invoice, a VAT invoice should also include the following:

- The unit price for goods and services that qualify for VAT (either excluding or including VAT depending on the type of invoice)

- The VAT rate charged (even if that rate is 0%)

- Your VAT registration number

- The total amount owed (either excluding or including VAT depending on the type of invoice)

Top Tip: There are three kinds of VAT invoices you may send or receive: full, simple and modified. Learn which kind you should be using by reading our comprehensive guide to VAT invoices💡

Here’s an example of what a full VAT invoice looks like:

You can create your own VAT invoices for free with Tide Invoicing. Simply connect your existing business bank account to the Tide platform and start creating customisable VAT invoices with due dates, personal messages and more.

How does reverse charge work?

The domestic VAT reverse charge was made mandatory for building and construction services in the UK in 2021. It takes the responsibility of paying VAT to HMRC off the supplier and places it on the consumer in certain circumstances.

The reverse charge rules apply to companies operating in the Construction Industry Scheme (CIS). They’re intended to reduce what’s known as ‘missing trader fraud’—when a construction industry company or contractor charges VAT but then ceases trading. The traders effectively disappear before their return is due, keeping the money instead of paying it on.

With the reverse charge, when a company or contractor hires a subcontractor, the subcontractor doesn’t charge VAT on their services. Instead, the hiring party pays the transaction VAT directly to HMRC in their own return.

These rules apply to CIS contractors who hire subcontractors as well as subcontractors that are employed by contractors. If you fall under either category, take note that this practice could affect VAT compliance and cash flow.

If you’re the subcontractor, the invoices that you send should not charge VAT on top of your fees. But you must note on the invoice that the reverse charge applies and that the recipient is responsible to account for it on their VAT return.

Use this flowchart to determine if the VAT domestic reverse charge applies to your situation:

Top Tip: Understanding how the domestic VAT reverse charge works will help you make sure your returns are accurate. Learn the specifics of which projects require the reverse charge and how to use it in our guide to the domestic VAT reverse charge procedure 🔎

Domestic VAT reverse charge example

Suppose Jane, an electrician, does a £5,000 job for Builders Ltd, a VAT-registered construction company. The standard rate of VAT (20%) applies, but Jane doesn’t charge Builders Ltd the £1,000 VAT on the invoice she sends them. Instead, she notes that a reverse charge applies.

On Jane’s VAT return, she doesn’t record anything for the VAT charge and only reports the net sales from the job. Instead, Builders Ltd records the VAT on their quarterly VAT return as output tax. This way HMRC still receives the correct amount of tax.

💡 Expert insights

Insights author: Dan Hogan, Co-Founder and COO at Ember, who make it simple for everyone to launch, operate and grow a business by automating the tax and accounting, allowing business owners to do just business. Ember takes a tax-first approach to finances, meaning business owners can easily see how much tax they’re paying, automatically optimise it and send it off to HMRC in a few simple steps, without needing to hire an expensive accountant.

How can small business owners make managing VAT as simple as possible from day one?

To start, keeping on top of your records is crucial. Whether it’s making sure you have a clear record of your receipts or regularly updating your records with invoices and expenses as they happen, keeping everything organised is the first step to avoiding mistakes when you claim VAT.

It’s also a good idea to have some understanding of what exactly VAT is and what the VAT rules are. For example, you should brush up on what the different VAT rates for certain goods and services are, and what the difference between VAT exemption and zero-rated VAT is, to avoid over or under-paying VAT on the goods or services you provide.

Do HMRC audit VAT records? How can small business owners prepare?

HMRC conducts audits on both a random and triggered basis. Random audits are generally conducted as part of a standard practice, mainly to observe how companies manage their records and to check that they’re submitting their records correctly. Triggered VAT checks, however, are prompted if HMRC suspects there is something wrong with a submitted tax return, whether it’s from several errors in a report to suspicions of tax fraud.

With these audits, HMRC will go into a lot of detail, requesting anything from a generic overview of a company’s bookkeeping practice to specific dates of particular invoices, just to make sure the company is maintaining their records well. To make sure small business owners are prepared for such checks, we recommend keeping on top of record management, and making sure that when you do submit a tax return that correct VAT rates have been applied and that every transaction made has been recorded. If in doubt, reach out to an accountant!

Stay compliant with proper VAT procedures

Understanding VAT rules and procedures is essential to running your business, whatever field you’re in. When you know how VAT works, you can correctly pay, charge and report it. You’ll subsequently avoid penalties and be able to recover VAT as appropriate. Knowing the particulars will help keep your business compliant and running smoothly.

If you’re already registered for VAT, you can use our Tide Accounting software to get paid faster, manage your bills, track business performance and submit your VAT returns. Open a Tide business bank account today to get started.

Photo by Mikhail Nilov, published on Pexels