VAT Partial Exemption: What is it and who does it apply to?

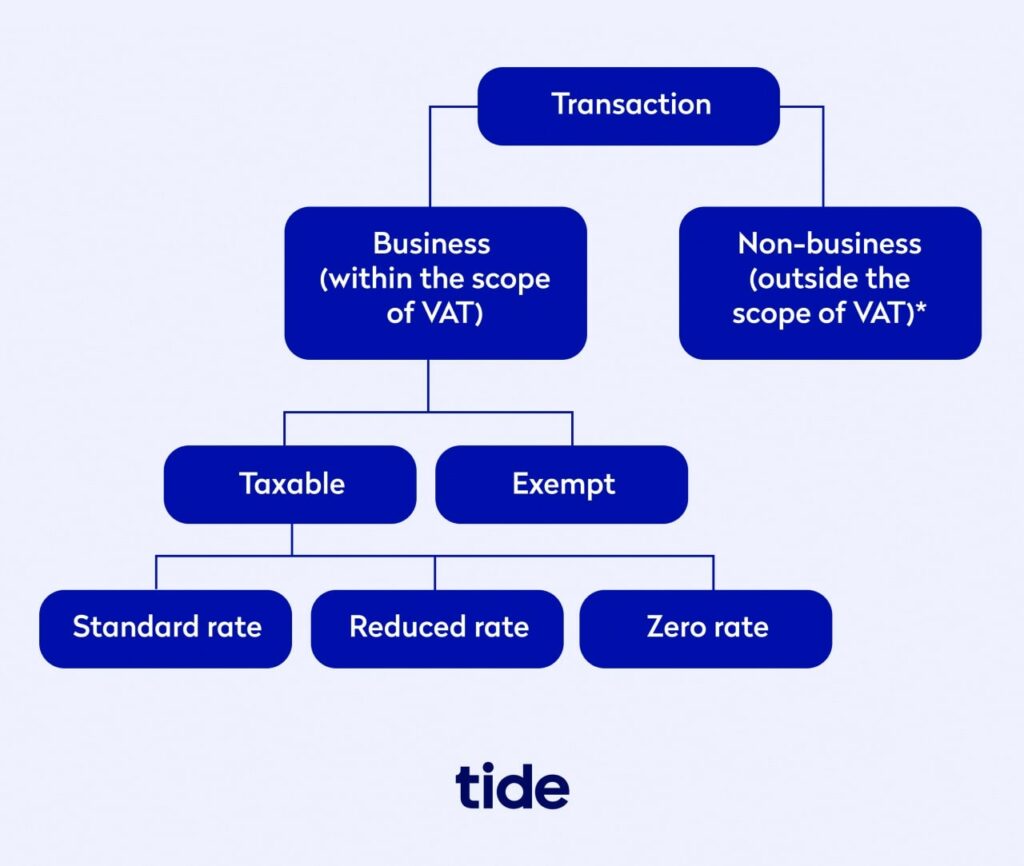

Value-added tax, or VAT, is applied to the sale of taxable goods and services at every stage of production. However, there are many items that are exempt or out or scope of what is considered taxable.

If you sell only exempt goods and services, you are a VAT exempt business. If you sell both taxable and exempt goods and services, you are a partially exempt business.

This means that if you make annual sales above the VAT registration limit, which is £85,000 at time of writing, you must register your company for VAT if your taxable sales exceed this threshold.

That said, you can also choose to voluntarily register for VAT even if your VATable sales do not reach this threshold.

In this article, we’ll dive into exactly what a partially exempt business means, the benefits and drawbacks of VAT partial exemption, various partial exemption rules and how to calculate VAT under these unique circumstances.

Top Tip: To fully grasp VAT partial exemption, it’s key to understand the ins and outs of VAT in general. To learn what VAT is, how much it costs, how to charge it and the alternative VAT schemes available to small businesses, read our guide to everything you need to know about VAT.

Table of contents:

- What is VAT partial exemption?

- The benefits and drawbacks of VAT partial exemption

- Should partially exempt businesses register for VAT?

- How to calculate VAT as a partially exempt business

- Wrapping up

What is VAT partial exemption?

Before we dive in, we must revisit the foundations of VAT so that we don’t get lost in the complexities of partial exemption.

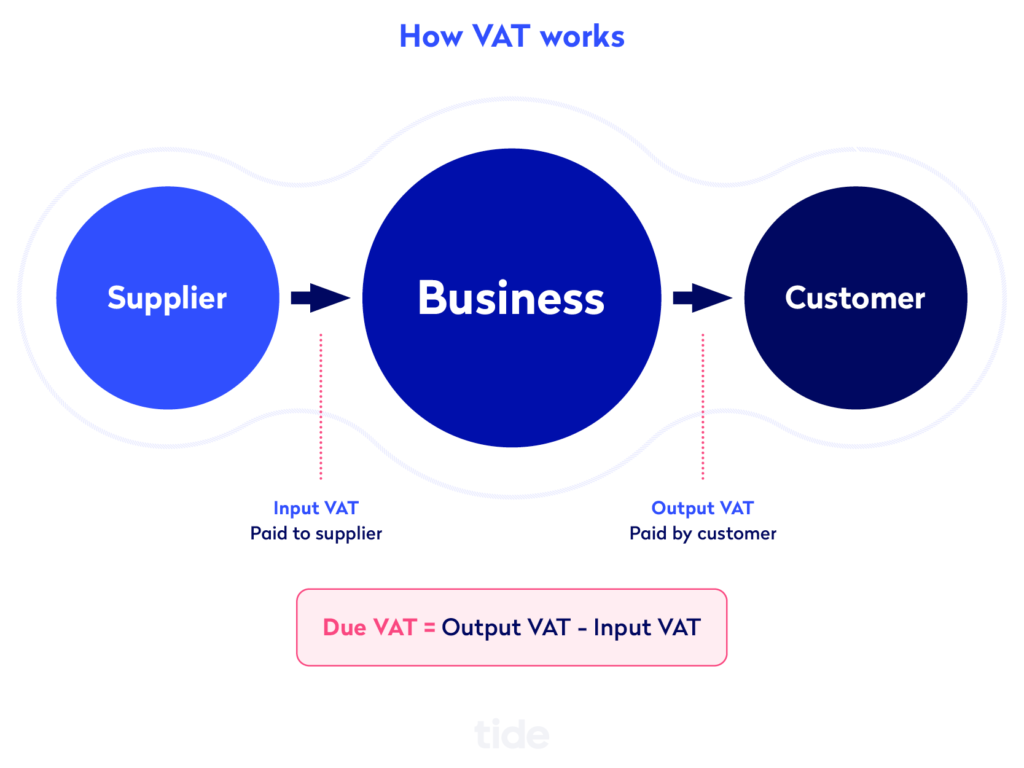

Value-added tax or VAT is a tax that is applied to goods and services at every stage in the supply chain. The idea is that businesses pay VAT when they buy items and then pass the cost onto their customers when they sell them.

If you are a VAT registered business, when it comes time to file your taxes, you must balance your VATbook, so to speak. If you paid more input tax to your suppliers than the output tax that you charged to your customers, you can reclaim the difference from HMRC. If you earned more VAT from your customers (output tax) than you paid to suppliers (input tax), you must pay HMRC the difference.

VAT partial exemption falls under the umbrella of VAT exemption, so we must understand that as well.

VAT exemption means that your business only sells or provides VAT exempt or out of scope items or services. These exempt sales range from insurance to health services provided by health professionals to donations made to a charity if nothing is received in return to granting credit loans and more.

It’s important to understand that exempt and out of scope items are not the same as zero-rated or reduced rate items, as those are still considered VATable and must be included in your taxable sales reports. Examples of zero rate or reduced-rate items include children’s car seats, heating, mobility aids, maternity products, donated goods sold by charity shops, publications such as books, brochures, leaflets, pamphlets, and more.

If you are entirely VAT exempt, you are not allowed to register for VAT at all. That said, if you buy VATable goods or services as a VAT exempt business, you must still pay VAT on those purchases and cannot reclaim that money back from the government.

For example, if your business provides educational services as an approved educational institution, you are a VAT exempt business and cannot register or charge VAT. However, this exemption does not shield you from paying VAT on VATable purchases that you need for your business operations, such as office supplies.

Top Tip: To learn more about the specifics of VAT exemption and who it applies to, as well as how reduced rate and zero-rated items affect your VAT business dealings, read our complete guide to VAT exemption.

Partial exemption, therefore, refers to businesses that sell both nontaxable (VAT exempt or out of scope) and taxable (standard, reduced and zero-rated) goods or services. As mentioned above, the items that you buy for your business have no merit on whether or not you are labelled an exempt or partially exempt business. VAT registration eligibility only applies to your sales.

If you are a partially exempt business, you must register for VAT if your sales exceed the VAT threshold. Alternatively, you can voluntarily register for VAT at any time (more on that later).

Once registered, you can reclaim the VAT that you paid on taxable purchases but you still cannot reclaim the VAT for purchases made on exempt or nontaxable items (unless they meet the criteria for the de minimis limit, which we’ll get into below).

The benefits and drawbacks of VAT partial exemption

Partial exemption is somewhat of a catch 22. On the one hand, having the option to register for VAT is better than not having the option. This way, at least you maintain some control over whether or not you want to register for VAT before you reach the threshold and are required to do so.

On the other hand, registering for VAT opens the door to a mountain of additional paperwork for your business, which you may need an accountant’s help with. VAT is a complicated process that requires detailed and accurate paperwork, adherence to strict rules and guidelines that vary depending on a multitude of circumstances, multiple deadlines throughout the year, complicated calculations that you must perform, and much more.

Moreover, VAT for partially exempt businesses is even more complicated than normal because of the fact that you must meticulously track and separate your exempt vs. nonexempt purchases (we’ll dive into exactly how to do this in a later section).

In general, businesses that register for VAT enjoy many benefits:

- You can reclaim VAT on purchases that you make on taxable items. This VAT recovery can end up saving you tons of money, especially if you purchase significantly more taxable items for your business than you sell.

- VAT registered businesses often benefit from a more credible reputation, as your clients or customers will assume that you exceed the £85,000 sales threshold and thus are a fully established business.

- Some businesses flat out refuse to do business with non VAT registered businesses as it could complicate their paperwork. Registering for VAT could help to expand your options when deciding what businesses to buy and sell to.

As always, there are also several drawbacks:

- Registering for VAT means more paperwork, which equates to significant time and money spent on tracking, calculating, filing and reclaiming VAT. You can cut down on time spent managing VAT if you hire a professional accountant, but that will come with an increased cost.

- Filing VAT returns may affect your cash flow if you have to wait a period of time before getting your reclaimed VAT back from HMRC, or if you end up owing more money than you’ve charged.

- Registering for VAT means you must pass the costs of your taxable items to your customers. Increasing your prices by the standard VAT rate of 20%, or even the reduced rate of 5% (if applicable), may negatively impact your loyal customer base.

Should partially exempt businesses register for VAT?

As mentioned above, if you are a partially exempt business, you will need to register for VAT the moment that the total value of your VATable goods and services surpasses the VAT taxable turnover threshold.

If you are still below that threshold, after weighing the pros and cons mentioned above, you’ll need to look hard at your specific needs and goals to see if registering makes sense. Only you know what’s best for your business, so it’s key that you make an informed decision after careful thought and introspection.

It’s important to keep in mind that VAT rates can change and you must apply these changes to the rates that you charge to your customers from the date they do. Nobody will tell you that they changed, so you need to stay on top of the most up to date information for VAT liability purposes.

Also, VAT rates may only be applied if certain conditions are met, such as who’s buying the goods or services, where they’re bought and whether you keep the right records. This is another big reason why hiring or assigning an accountant to help you manage VAT rules and regulations may be a good idea.

The VAT rate also differs depending on your chosen VAT scheme. If you are eligible for and choose the VAT flat-rate scheme, the VAT flat rate will vary based on your type of business.

How to register for VAT

If you do choose to become VAT registered you can register online. As of 2019, companies with a turnover of more than £85,000 are required to digitally store their records and use software to submit their VAT returns.

With the recent addition of the Making Tax Digital program, it’s easier than ever to pay your VAT bill online.

If you still aren’t quite sure how your business should register, you can make an enquiry online, via the phone or through the mail on GOV.UK’s VAT general enquiries page. For further information and guidance on all things VAT, visit GOV.UK’s VAT detailed information page.

How to calculate VAT as a partially exempt business

As mentioned throughout, you will not be able to recover all of the VAT you spent on taxable purchases if you are a partially exempt business.

VAT that you incur on taxable items for business activities must be calculated, recorded and filed in your VAT return for the purpose of recovering input tax on these purchases.

Partially exempt businesses can take advantage of something called the ‘de minimis rule’. If your exempt input tax (purchases from suppliers) is below a certain limit, you can treat it as if it is a taxable purchase, thus allowing you to recover the full VAT that you pay on those purchases.

According to GOV.UK, the ‘de minimis rule’ applies if “the total value of your exempt input tax is not more than £625 per month on average or half of your total input tax in the relevant period.” To see if you qualify, you can carry out a de minimis test. There are two styles of de minimus tests that you can carry out, simplified and annual tests, and they vary based on frequency and approach. To learn more, see section 11 ‘The de minimis rule’ of the Partial exemption (VAT Notice 706).

When calculating how much input VAT you can recover as a partially exempt business, you must allocate your input tax into one of three categories:

- Directly attributable taxable input tax. This is VAT incurred on taxable purchases that you use in your business when making taxable items. You can recover this amount of VAT in full.

- Directly attributable exempt input tax. This is the VAT incurred on taxable purchases that you intend to use in your business when making nontaxable or exempt items. You cannot recover any amount for VAT incurred on taxable purchases that you use on exempt supplies only unless they qualify for the de minimis rule.

- Residual input tax (or non-attributable tax). This is input tax that is incurred on expenditure that cannot be wholly attributed to the making of taxable or exempt supplies. Most of your business overhead will fall into the residual category, as you will most likely make many taxable purchases that are used for both taxable and exempt purposes; such as a business advertisement that promotes both taxable and exempt items or services.

The government has created a flow chart to help you to visualise the input tax that you cannot recover.

Look at this alongside VAT Notice 706 to fully understand the rules and special exceptions in this graphic.

There are two types of partial exemption calculation methods.

1. The standard method

This is what most small businesses use and no approval is needed (see section 4 of VAT Notice 706). This method is used to calculate how much of your residual input tax is attributable to taxable supplies vs. exempt supplies so that you can recover the fair amount.

In most cases, businesses do recover a fair percentage of their residual income tax using the standard method calculation:

[Value of taxable supplies in the period (excluding VAT) / Total value of supplies in the period (excluding VAT)] x 100 = Recoverable percentage of residual input tax.

Some supplies cannot be included in this calculation so make sure you read the fine print in the VAT notice to ensure you are proceeding correctly.

Let’s look at an example of the standard method in practice:

- Input tax that relates exclusively to taxable supplies (i.e. direct attribution taxable input tax = £15,000

- Input tax that relates exclusively to exempt supplies (i.e. direct attribution exempt input tax) = £8,000

- Residual input tax (or non-attributable tax) = £10,000

- Value (excluding VAT) of all taxable supplies = £150,000

- Value of exempt supplies = £75,000

To put this information into the calculation, we divide the value of taxable supplies by the total value of supplies and multiply it by 100.

[150,000 / (150,000 + 75,000)] x 100 = 66.67%, rounded up to 66.7%. This is your recovery percentage.

Therefore, the recoverable amount of residual input tax is £10,000 x 67% = £6,700.

2. The special method

This is used by businesses with unique business circumstances and approval is needed (see section 6 of VAT Notice 706). This makes sense if your business naturally separates partially exempt activities from standard taxable activities and feel that the standard method will not produce a reasonable result.

Most often this applies to large and complex business operations. There is very little guidance on who this applies to, but you can find more information in the VAT Partial Exemption Toolkit.

Whichever method you choose, good record-keeping is essential. Your business is solely responsible for correctly tracking all relevant transactions related to your input tax and ultimately determining your input tax for partial exemption purposes. If you produce incomplete information, you may be charged fines or run into other penalties.

How often do you need to undertake a partial exemption calculation?

Partly exempt businesses must calculate their recoverable VAT at the end of each VAT period, which is often monthly or quarterly but depends on your chosen VAT scheme.

Additionally, you must also make an annual adjustment calculation at the end of the year to ensure that your calculations were accurate and re-evaluate any exempt input tax under the de minimis rules.

For example, you may qualify for de minimis in one VAT tax period because you happen to make less taxable purchases in that period of time. But, at the end of the tax year, if the amount of input tax exceeds the yearly de minimis limit, you will need to adjust for that. Any changes made during the annual adjustment calculation will affect how much you pay or owe to HMRC at year-end.

If you fail to carry out your annual adjustment in an accurate and timely manner, you may end up losing out on money you could have reclaimed, or realise that you owe more money than you planned for. If you are audited and are found to have not completed your annual adjustment, or have incorrectly overclaimed your input tax, you may be charged an interest fee or given a penalty.

Because of the complicated nature of partly exempt businesses, they are often inspected more frequently than fully taxable businesses. This is why it’s so important to stay up to date on your paperwork and complete your calculations accurately and on time.

Wrapping up

Partially exempt businesses fall into a grey area. Because you sell both taxable and exempt items, tracking your taxable vs. nontaxable input and output tax can be a complicated and time-consuming process.

Another stress-reducing tactic is to open a business current account that automatically categorises your spending and integrates with your favourite accounting software.

Tide exists to take away the stress of your banking and finance admin tasks. Once you open a Tide account, you can use our Tide Accounting tool to easily categorise your income and expenses with convenient labels that help you organise your cash flow. Open a business bank account to get started.

Photo by Jopwell, published on Pexels