What is IR35 (and what does it mean for you?)

Note: Due to the challenges businesses are facing because of COVID-19, the government announced on 17 March that IR35 tax reforms would be delayed by one year. They were supposed to go into effect in April 2020, but were instead implemented on 6 April 2021. Find out more about the IR35 delay in our Coronavirus: Help for businesses hub.

Contract work offers lots of advantages for both businesses and workers. Employers get to hire skilled and specialised staff at a lower cost. And contractors gain flexibility and the ability to retain multiple income streams in tandem.

But there has long been a grey area when it comes to tax rules surrounding contract work. IR35 addresses these issues.

While contractors can often benefit from tax advantages, they must abide by the IR35 rules in order to do so. This is why, if you’re a contractor or a small business that hires contractors, it’s important that you know what IR35 is and how it works.

In this article, we’ll help you understand the basics of IR35, why it’s so important, and how it works for both businesses and contractors alike.

Table of contents

- What is IR35?

- Who does IR35 apply to?

- Is IR35 ultimately a good or bad rule?

- Inside IR35 vs outside IR35

- IR35 and small businesses

- How do businesses determine the IR35 status of workers?

- How to determine your own IR35 status as a contractor

- Wrapping up

What is IR35?

IR35 is tax legislation that aims to collect additional payment from employees “disguised” as contractors for tax avoidance purposes. It was formulated to address an inconsistency in the tax system and effectively put an end to “deemed employees” operating through a limited company structure and thus avoiding certain employment taxes.

Top Tip: Deemed or disguised employees are a category of contractors that might be granted similar rights and advantages to full-time employees, yet are not paying the correct amount of tax according to their position. Freelance contractors who do not enjoy similar rights and benefits as employees do not fall under this categorisation 📌.

To put an end to this tax avoidance, whether intentional or not, and to protect legal employment rights, HMRC is cracking down on anybody who falls into this category. People who have been using a ‘limited company status’ and avoided paying taxes and National Insurance are now obligated to do so.

The original IR35 legislation was first introduced by the UK government in 2000 but has gone through multiple changes since then due to poor implementation.

In April 2017, new legislation was introduced under the name of ‘Off-Payroll Reforms’, which was specifically targeted towards the public sector. Even though this was separate legislation, it was often (confusingly) referred to as IR35.

This new tax legislation introduced a different set of tax treatment, which held public sector clients responsible for assessing their contractor’s IR35 status and paying employment taxes on top of the fees paid to the contractor.

Soon after its launch, it was decided that the 2017 legislation would be expanded in 2020 to include the private sector, but was delayed by a year due to the COVID-19 pandemic.

These off-payroll working rules that affect both the public and private sector and were effective from April 2021, and, potentially impacting 150,000+ consultants and predicted to generate tax revenue of more than £3 billion over four years.

According to this legislation, tax and National Insurance contributions are deducted from the contractors’ fees and subsequently paid to HMRC.

However, if HMRC cannot reclaim the tax from the contractor, the hirer is the one ultimately liable to produce payment. This shift in responsibility from the contractor to the hirer, both in terms of determining whether or not the contractor is considered self-employed or a ‘disguised’ employee, as well as tax liability, means qualified business owners must take extra caution before hiring contractors.

That said, as long as you follow the appropriate steps outlined by the government (which we’ll explain in detail below), you should still be able to hire contractors with confidence even with these rules.

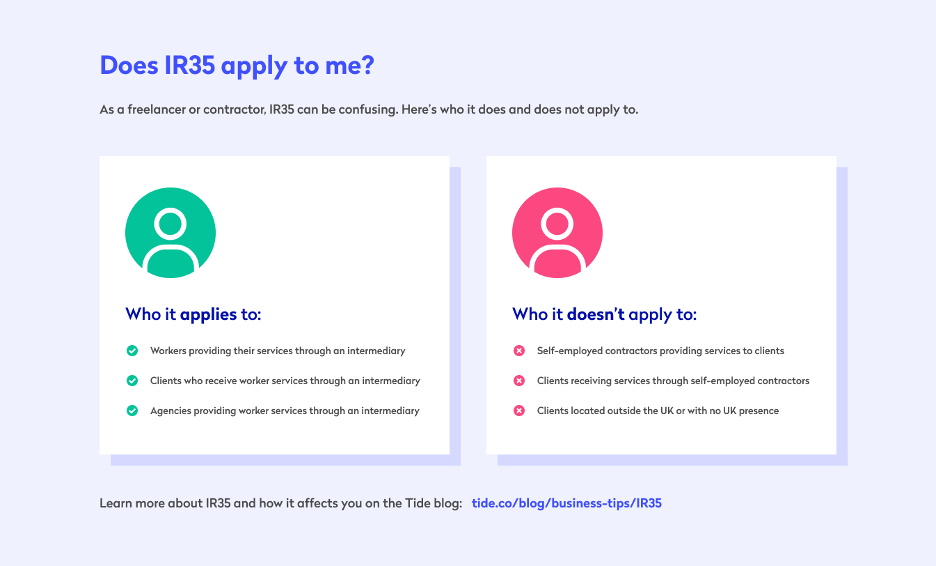

Who does IR35 apply to?

According to the UK Government, IR35 rules apply to workers who are providing their services through their own limited company, otherwise known as a Personal Service Company (PSC) or an intermediary. While a PSC is the most common form of an intermediary, workers may also qualify for IR35 if they provide services through a partnership or an individual.

Here’s a complete breakdown of who is affected by IR35:

- Workers providing their services through an intermediary

- Clients who receive worker services through an intermediary

- Agencies providing worker services through an intermediary

IR35 does not apply to:

- Self-employed contractors providing services to clients

- Clients receiving services through self-employed contractors

- Clients located outside the UK or with no UK presence

Is IR35 ultimately a good or bad rule?

IR35 has been controversial from the start. Because the 2017 rule that applied to the public sector dramatically shifted responsibility from the contractor to the hirer, many hirers applied blanket determinations that automatically put their contractors ‘Inside IR35’ to avoid any chance of being held liable for paying additional taxes.

This resulted in hirers losing the contractors they normally worked with, and vice versa, because neither party wanted to be liable to pay additional tax.

The Treasury seems to be split on how they feel about IR35. In one meeting, the Chair of the Treasury committee, Mel Stride, stated that IR35 should be abolished because it is incredibly confusing. He went on to note that due to the fact that COVID-19 has put the UK economy at risk, “you want to encourage people to be flexible and to help the UK economy out of a crisis.”

While Mel Stride was against IR35, former chancellors of the exchequer, Rishi Sunak and Sajid Javid, were for the legislation going into effect. Each chancellor made several promises to review the controversial off-payroll working rules, but both effectively concluded that no changes will be made. This infuriated the public as many parties cite the IR35 rule as putting self-employed workers out of work and diminishing the hiring pool.

That said, there are some upsides to IR35. In order to avoid qualifying for and thus paying additional tax, companies and contractors alike need to get much more detailed when it comes to generating scopes of work and milestones.

Theoretically, this is supposed to help streamline projects and remove the need for contractors to complete mundane tasks that could otherwise be carried out by an employee.

Another positive is that startups and small businesses that do not qualify for IR35 may focus on hiring contractors rather than employees in order to enjoy the expertise of a project-based worker without needing to worry about hiring an employee before they’re ready.

Of course, this benefit only applies to small businesses that qualify and leaves everybody else with limited options and stricter rules of engagement.

Who determines IR35 status?

Before 6 April 2021

According to the current IR35 rules, if a worker was providing services to a client in the public sector, the client was responsible for determining their worker’s employment status.

On the other hand, if a worker provided services to a client in the private sector, the intermediary was responsible for deciding their employment status.

However, this changed with the new off-payroll working rules in April 2021.

After 6 April 2021

According to the new legislation, medium to large-sized private sector clients, along with all public sector authorities, are held responsible for deciding if the IR35 rules apply to their workers.

And in the case of a worker providing services to small businesses in the private sector, the worker’s intermediary is held responsible for deciding their employment status.

Inside IR35 vs outside IR35

Now that we have identified what IR35 is, and how it affects businesses and workers, it’s time to learn whether you fall inside or outside IR35.

‘Inside IR35’ essentially implies that contractors are subject to Pay As You Earn (PAYE) and are required to pay the tax as well as the National Insurance (NI) contributions as a permanent employee typically would.

It’s important to note that tax and employment legislation are currently separate. So, even if you’re considered an employee for tax reasons, you may not automatically be entitled to employment rights, such as sick days or paid annual leave.

‘Outside IR35’ essentially implies that a contractor is considered as self-employed for tax reasons. They are free to pay themselves in the most tax-efficient way; typically a mixture of salary and dividends taken from their company.

These contractors are responsible for making sure all their personal and company taxes are calculated correctly and paid on time.

Top Tip: Contractors who are responsible for paying their own taxes must complete a Self-Assessment tax return. This process is relatively straightforward but can be daunting when filing your tax returns for the first time. To learn more about how to file taxes as a self-employed freelancer or contractor, read our comprehensive guide to Self Assessment tax returns 🔑.

IR35 and small businesses

Fortunately, the UK government has decided that small businesses are exempt from new IR35 rules.

This means that contractual workers can carry on operating through intermediaries, such as Personal Service Companies (PSCs), and may self-assess to account for tax and NI contributions.

In order to qualify as a ‘small’ business, you must meet at least two of these three conditions:

- Have an overall turnover of £10.2m or less

- Have a workforce strength of fewer than 50 employees

- Have £5.1m or less on your balance sheet

How do businesses determine the IR35 status of workers?

The IR35 rules apply to all public sector and medium to large private sector businesses that meet two or more of the following conditions:

- You have an annual turnover of more than £10.2 million

- You have a balance sheet total of more than £5.1 million

- You have more than 50 employees

You can also use a ‘simplified test’ that primarily considers annual turnover to determine your business size. In this case, IR35 applies to your business if you have an annual turnover of more than £10.2 million and are not:

- A company

- A limited liability partnership

- An unregistered company

- An overseas company

IR35 guide for hirers

If your business does meet the above conditions, then there are two ways to determine the IR35 status of your workers.

1. Independent IR35 assessment service

An independent IR35 assessment service is a fair and compliant way for businesses to determine the status of their workers.

These services usually ask contractors a series of questions in order to gather all of the necessary details to make an informed decision. Once a decision is made and reviewed by the independent service, it is up to the client to approve or disapprove the judgment.

Independent services also ensure protection of the clients’ liabilities to encourage fair assessment.

2. Check Employment Status for Tax (CEST)

Check Employment Status for Tax (CEST) is HMRC’s tool to help you determine the status of your workers.

Before you begin, you’ll need to know a few things, including details of the employment contract, worker responsibilities, mode of payment, and so on. Once you have that information, you can use this tax tool to see if HMRC will treat the worker as employed or self-employed for tax purposes.

This IR35 tax tool should ideally be used at the time of employment, or in case of a change in an existing contract. Check out this employment status manual for more detail.

You can also check your worker’s employment status for tax purposes using the CEST tool.

Once you’ve made a determination about the employment status of your workers, you need to communicate your decision via a Status Determination Statement (SDS). Your SDS must be passed to the worker and the person or organisation you contract with as well as the specific reason(s) why you came to your decision.

Even if you determine that a worker does not qualify for off-payroll working rules, you must still communicate that information along with the reasons you drew that conclusion. This action of ‘taking reasonable care’ will help you to avoid taking on the responsibility of your worker’s tax and National Insurance contributions.

Further, you must keep detailed records of your determinations and always be ready to confirm the size of your business if asked by the person, organisation, or worker that you contract with.

What happens if a worker or deemed employer disagrees with your determination?

The contractors that you work with can also go through steps to determine whether or not they qualify for IR35 (as we’ll outline in the next section). If they come to a different conclusion than you, you will need to take the following steps:

- Consider the reasons for their disagreement

- Decide whether or not to maintain your original determination or change your mind based on new information

- Keep a record of both your determinations and the representations made to you

- Confirm which date your determination is valid from

Note: If your worker disagrees with your original determination, you must provide a response within 45 days of receiving their confliction notification. However, during this time you must continue to apply the rules in line with your original decision. Failure to reply within 45 days will result in the responsibility of the worker’s tax and National Insurance contributions falling on your shoulders ⚠️.

Your responsibilities as the fee-payer

If you do determine that off-payroll working rules apply to your workers, you must:

- Calculate the ‘deemed direct payment’ (i.e. the amount paid to the worker’s intermediary that should be treated as earnings) to account for the exact employment taxes and National Insurance contributions

- Deduct those taxes and employee National Insurance contributions from the amount that you will contractually pay to your worker’s intermediary

- Pay employer National Insurance contributions

- Report to HMRC through Real Time Information (a process designed to make PAYE submissions more efficient) the taxes and National Insurance contributions deducted

- Apply the apprenticeship levy if applicable and make any payments necessary

How to calculate deemed direct payments

Deemed direct payment refers to the net income that you pay to your worker after you’ve made all of the applicable deductions, including employer National Insurance.

However, you do not need to calculate the deemed employment payment if the amount you paid your worker as employment income for off-payroll engagements is equal to the amount you received for their off-payroll working engagements in the tax year.

Further, if you paid your worker more employment income than the amount you received for their off-payroll working engagements in the tax year then you also do not need to calculate the deemed employment payment.

To calculate the deemed employment payment, you’ll need details of:

- The payments you received

- Payments made to the worker (like salary, benefits in kind)

- Pension contributions made on behalf of the worker

- Expenses you pay

You can manually calculate this payment by following these nine steps:

- Deduct 5% from your off-payroll income. Apply a flat rate 5% deduction to the income the intermediary has received from off-payroll engagements in the tax year.

- Add payments made directly to the worker. These only include payments that were not paid by the intermediary and would not otherwise be chargeable to Income Tax.

- Deduct expenses. Deduct expenses paid by the intermediary that your worker could have claimed as a deduction under the normal rules if they had been directly employed. It’s important to note that your worker cannot claim expenses for travel and subsistence if they regularly commute from home to a workplace for an off-payroll engagement.

- Deduct capital allowances. You can only get tax relief when it comes to capital allowances if the intermediary had to provide the equipment in question, rather than providing it by choice.

- Deduct pension contributions. Deduct any applicable contributions to an approved pension scheme that the worker is part of.

- Deduct employer National Insurance contributions. Deduct any Class 1 and Class 1a National Insurance contributions paid to HMRC by the intermediary in the tax year in relation to the salary and benefits that you paid to the worker.

- Deduct salary and benefits already paid to the worker. Deduct the total amount of salary and benefits that the intermediary paid to their worker on your behalf.

- Deduct employer National Insurance contributions on the deemed payment. Calculate and deduct the amount of employer National Insurance contributions to get the final deemed payment amount.

- Pay tax and National Insurance contributions on the deemed payment. Pay what’s due to HMRC. This deemed employment payment should be reported on a Full Payment Submission on or before 5 April each year.

For more information on how to accurately calculate and report your deemed payments, if applicable, see HMRC’s guidance on private sector off-payroll working for intermediaries.

How to determine your own IR35 status as a contractor

Just like businesses can determine their workers’ IR35 status, contractors can also go ahead and check their own status using one of the following three methods.

1. IR35 tests

Control

This test requires you to figure out the extent of control that your client has over your work.

If the client/business manages and monitors the contractor’s tasks, or in other words, has ‘control’, it means that the worker falls inside IR35.

Personal service

To take this test, you need to identify whether the service you’re offering to a client is personal or business-related, and whether or not you can propose a substitute to do your job.

If it’s possible to send a substitute to finish the tasks in the contractor’s absence, it means that the worker is not providing a personal service and falls outside IR35.

Mutuality of obligation

To take this test, you need to know whether the client is obligated to provide you with consistent and paid work. You also need to consider if you’re under any obligation to accept this work.

If either of the two parties is obligated to provide or accept work from the other, the contractor falls inside IR35.

2. Contract review

Contract reviews play an extremely important role in determining your IR35 status. Since contracts cover every condition and clause of your working status with your client, they offer a detailed perspective into the service you offer.

After a thorough review of your contract, you should have enough information to take any of the IR35 tests mentioned above, such as details of what you’re responsible for or if you’re under any sort of obligation.

3. Evidence collection

All too often, evidence is required to support one’s claims of being inside or outside IR35.

This is why it’s so important to keep records and maintain proof of all business-related activity.

For example, if you have your own website, this is an indication that you’re actively running a business of your own.

The absence of requesting time-off is also an indicator of the level of control you have over your work. Time-sheets and invoices could be used as evidence of this.

In the case of remote work scenarios, you must keep a record of proof for the time you spent working. Most contractors make the mistake of not recording the time they spend working from home and eventually fail to prove it. These records can be a huge indicator of how your client has no control over your schedule or your process.

What happens if you do fall Inside IR35?

If you do qualify for IR35, you will need to report the information about your jobs to HMRC on your Self Assessment tax return and pay any other Income Tax and National Insurance contributions that are due.

If you receive a salary from your client, they should provide you with a P60 form that you’ll need to include along with any other employment income on your Self Assessment return.

Wrapping up

If you’re an honest and professional business, contractor, consultant, or freelancer, you shouldn’t have any reason to fear IR35. Nonetheless, it’s still important to know how the legislation works.

Businesses and contractors should regularly assess their contracts and pay due taxes to avoid facing any penalties or getting into legal trouble.

The rule of thumb is to exercise due diligence while defining the ‘client-contractor relationship’ in order to minimise your chances of being taxed heavily.

Photo by Brooke Cagle, published on Unsplash