Start your business with Tide and Taxlab Limited

Ready to be your own boss? Now you can register your limited company and open a business account, all in one go, for £9.99 for a limited time only! Just use the code: TAXLAB

Register a limited company and open a business account, all in one go

-

Two-in-one

We register your company and open your business account in one streamlined process.

-

£9.99

£50Limited time offer: We will register your business with Companies House for only £9.99 instead of £50.

-

Fast

Your business account should be open in minutes, and your company is usually registered the same day.

-

Secure

We're a Companies House approved formation agent with a secure integration, so you're in safe hands.

Here’s why Taxlab Limited loves Tide

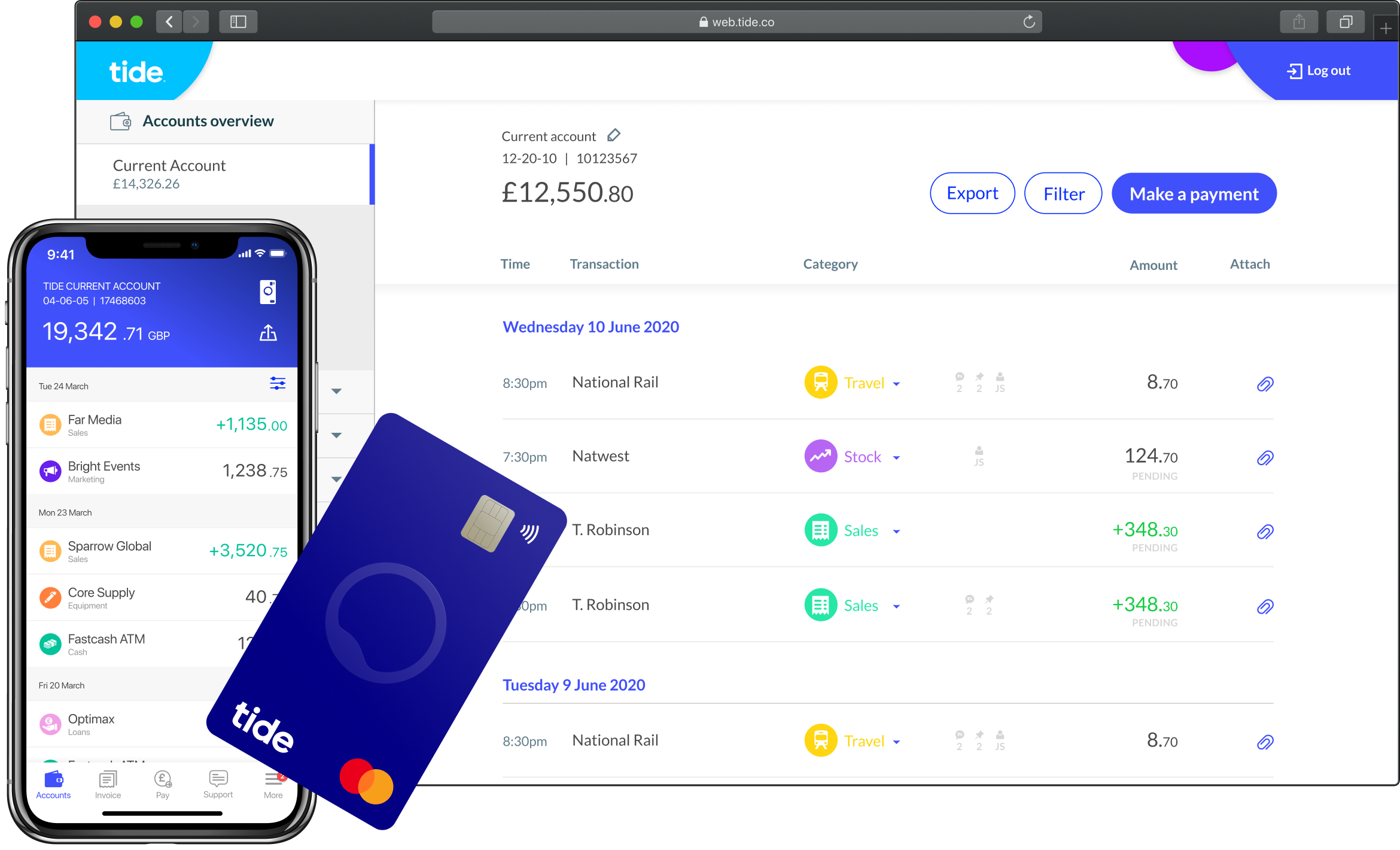

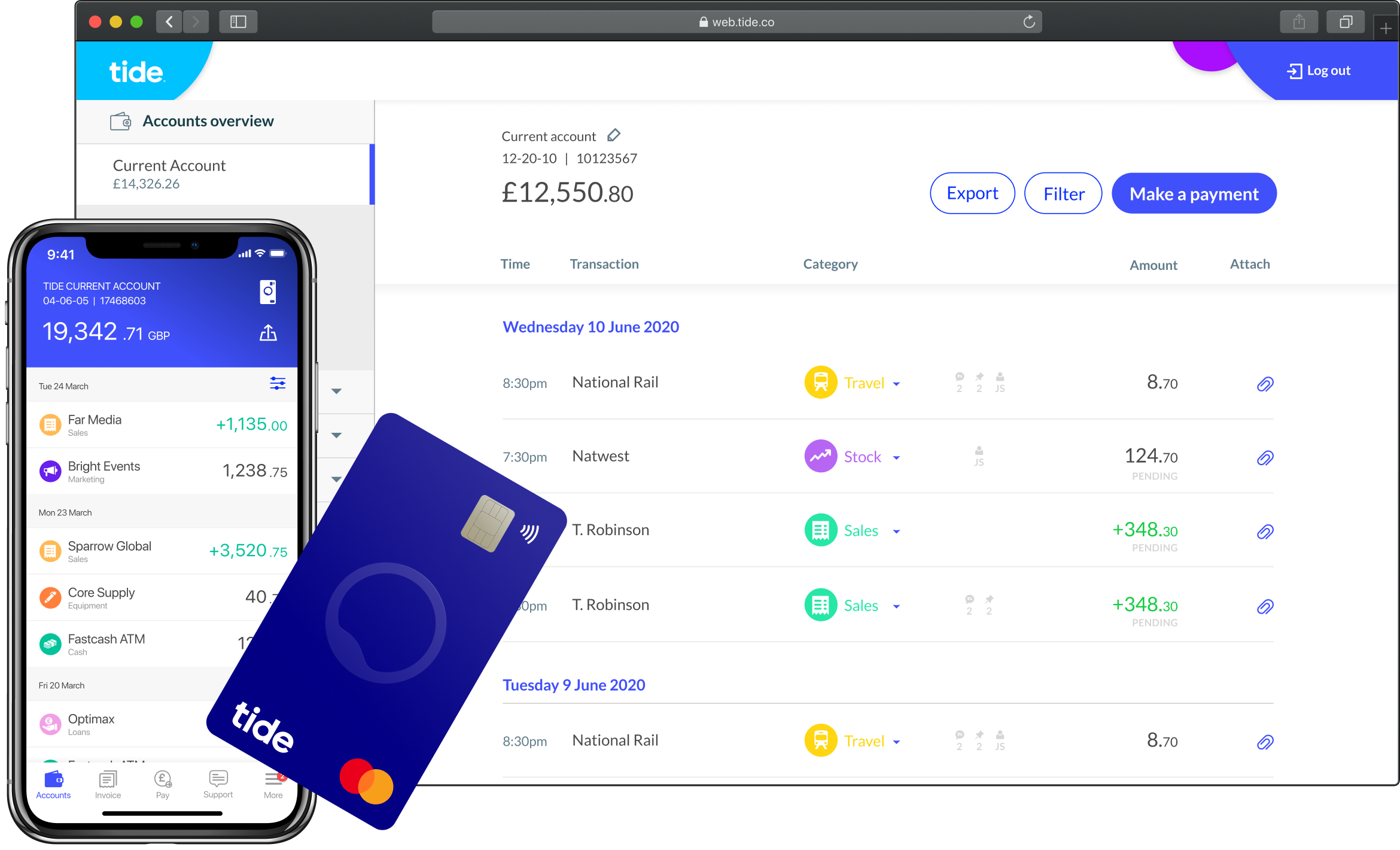

Make bookkeeping a breeze

Tag income and expenditure with labels of your choice - your accountant will love you for it!

Sync with your accounting software

Forget uploading CSVs - connect your account to Xero, Quickbooks, FreeAgent, Sage, KashFlow and Reckon.

Simple receipt storage

You can attach photos and noted to transactions as you go, saving you time.

Send, pay and track invoices

No need for a separate system, keep on top of your invoices directly in our app.

No monthly or annual fees

We take a tiny fee when you move money between accounts or move cash

-

Card payments (UK and abroad)

FREE

-

Transfers in and out of accounts

20p

-

Transfers between Tide accounts

FREE

-

ATM cash withdrawals

£1

-

Replacement cards

FREE

-

Cash deposits

Post Office – 0.5% (minimum £2.50)info£2.50 for deposits up to £500 or 0.5% of the total deposit amount for deposits over £500

PayPoint – 3%

Trusted by over 575,000 UK businesses

Business Account FAQs

Can I deposit cheques?

We don’t accept cheque deposits at the moment. However, we understand that cheques aren’t going away any time soon. In 2022, we’ll look into smart ways to process cheques and will contact you when we’ve put these in place.

HM Revenue and Customs (HMRC) is one of the most common issuers of cheques. If you’ve received a cheque from HMRC, you can return it and request a direct bank transfer instead.

In instances where your account is being closed, any remaining funds will be returned to you by bank transfer only. We don’t issue remaining balance cheques at this stage.

What are Tide’s features?

Tide accounts come packed with smart and time-saving tools, letting you focus less on admin and more on your business.

- Full UK sort code and account number

- Business Mastercard, with free purchases at home and abroad

- Automatic categorisation of your transactions, for easy accounting

- Instant invoice payment and creation

- Up to £150,000 of credit, straight through the app

That’s just the beginning! You can see more on our features page.

Are there limits on my account?

That will depend on whether you’re a sole trader or a registered company.

Tap “Accounts” from your in-app More menu to see your full account limits, or to request a limit increase.

How do I deposit cash?

We’ve partnered with the Post Office and PayPoint, so you can deposit cash at over 40,000 locations in the UK!

Here’s how to make a deposit:

- Find your nearest Post Office or PayPoint location

- Let them know you’d like to add money onto your Tide card

- Hand over your Tide card and any cash you’d like to deposit

- They’ll swipe your card and hand you a receipt

Processing Times

Post Office deposits will be credited to your Tide account within a few minutes.

PayPoint deposits will show in your account after about 10 minutes.

Fees and Limits

The Post Office fees are:

- £2.50 for deposits up to £500

- 0.5% of the cash deposit amount for deposits over £500

There’s a 3% fee on the total deposit value at PayPoint.

At the Post Office, you can make monthly cash deposits of up to £25,000 and a yearly deposit of up to £300,000 (subject to transaction limits controlled by Post Office branches). Other currencies aren’t supported at the moment.

At PayPoint locations, you can deposit between £10–500 each day. Other currencies aren’t supported at the moment.

The fee is automatically deducted from the deposit at the time of processing.

You can deposit cash at any Post Office branch in the UK. If you’re having any issues, you can show them this FAQ.

How do I download my monthly statement?

You can download each monthly statement from the 4th day of the following month.

- Open the drop-down menu in the top right corner of the app

- Tap Go to settings

- Tap View statements

If you need a letter confirming your account with Tide, you can download an Account Verification Letter. Here’s how:

- Log in to Tide on the web

- Tap the wallet icon to the right of your account balance

- Tap Account Verification Letter

Can I export my transactions?

You can export transaction data to CSV files directly from the Tide app, and we also offer different accounting solutions to best suit your business needs.

To get your transaction data, tap Export – it’s in the top right corner of your Accounts page, directly under the card icon.

Please note that you’ll need to filter your transactions by date or category before you export them.

Help, my question isn’t answered here…

Find answers to all our most frequently asked questions and how to contact our Member Support team.

A business bank account that's free, easy to open, and helps you start doing what you love.

Tide is about doing what you love. That’s why we’re trusted by 575,000+ sole traders, freelancers and limited companies throughout the UK.