How to use credit to maximise and maintain your small business

Fluctuations in cash flow are normal for most small businesses. However, untimely or extended gaps in your income can lead to deeper problems that could affect your longevity.

By using business credit responsibly (i.e. only borrowing what you need and repaying it on time) you can give your business the investment it may need, whether that’s to maintain a steady cash flow or to fund its expansion.

Table of contents

- How credit can help small businesses

- Types of business credit and funding

- Don’t make this credit mistake

- The better your credit score, the better your credit options

- Business and personal credit scores are separate

- Open up your credit options with Tide’s Credit Builder

- Three ways we take the pain out of finding credit and loans

- Wrapping up

How credit can help small businesses

From loans to credit cards, there are plenty of business credit options to explore. But, as with any strategic business decision, planning is essential. Your cash flow forecast should tell you whether you’ll need extra money coming in.

If your cash flow forecast suggests that you’re at risk of running out of cash, business credit could help you stay afloat 🚣 It can be used to:

- Make payments on time: Pay short-term bills, bank payments and other obligations so you don’t fall behind

- Cover your operating costs: These are things like employee wages and inventory – think of those essential expenses that need to be paid

- Plan ahead: A positive cash flow gives you the ability to move money into areas of your business that need more resource

If you’re looking to expand but your cash flow forecast says you don’t have quite enough cash, business credit could help you grow 📈 It can be used to:

- Pay for extra expenses: To grow, you’ll likely need to invest in more inventory, employee training, new equipment… the list goes on!

- Become more flexible: A positive cash flow gives you more confidence when making large purchases

- Access better terms: You might be able to negotiate more favourable supplier terms if you can provide more cash upfront

Types of business credit and funding

Be sure to do your research before you start applying for business funding. Making multiple applications, especially within a short time period, can negatively impact your business credit score. Consider all the options available to you on the market, long and short-term loans, and the non-traditional.

Long term business funding

Term loans

One option is to secure a lump sum of money and repay it with regular instalments over a set period of time. Keep in mind that some lenders might require collateral, such as a property, as a safeguard in case you can’t pay it back.

The duration of the loan can also vary, and can have an impact on interest rates and associated fees.

Asset finance

With asset finance you can buy or rent machinery, vehicles or equipment without a large payment upfront. You can then repay the cost through smaller, more manageable payments spread over a specific period.

- Hire purchase: once you’ve made all the repayments, it’s all yours!

- Finance lease: you rent the asset and may handle the insurance and maintenance. Once you’ve made all the repayments, it’s up to you whether you continue to rent or return the asset

- Operating lease: you rent the asset, but the provider covers maintenance costs

- Contract hire: a provider will find and care for assets for you, and all you do is make the repayments over a set time period

Short-term business funding

Overdrafts and revolving credit

The ability to have cash whenever you need it can be a huge help for the cash flow of any business. Instead of paying instalments for a set duration, you’ll only pay interest when you’re actively using an overdraft or revolving credit facility. Just a tip — avoid maxing out the overdraft limit! Doing so can lead to expensive interest charges.

A business credit card

Swipe and repay before the end of the interest free period and you’ll avoid expensive charges.

Invoice finance

With invoice financing you could get paid for outstanding invoices before they’re even due. The more outstanding invoices you have, the more you can borrow against them.

Don’t make this business credit mistake

It’s best not to apply for lots of credit products within a short space of time. You’ll damage your business credit score as lenders will assume that you’re relying too heavily on credit.

This rings especially true if you’re a newer business. You’ll probably get rejected because you have a low score due to the fact that you haven’t had much time to build it up. It’s no different if you’ve been up and running for a while, but have a low credit score due to missed loan repayments in the past or failed credit applications.

When you make credit applications with a low business credit score, you’re damaging your already poor score and wasting time on applications that will probably get rejected at the same time. If they don’t get rejected, you’ll likely only be offered options that come with high interest rates.

The better your credit score, the better your credit options

A good credit score means lenders will deem you as a lower risk of non-repayment. That means you’re likely to be eligible for more credit options and competitive interest rates.

Having a good credit score doesn’t just mean you’ll get the best credit. Your credit score is usually taken into account when you’re applying for insurance, negotiating supplier terms and arranging contracts and tenders. That’s why it’s so important to maintain a healthy credit score at all stages of your business.

So, make sure your business credit score is in its best shape before starting any applications. If you need some help with that, check out Tide’s Credit Builder.

Business and personal credit scores are separate

Having a good personal credit score doesn’t mean you’ll have a good business one. Here are the key differences between the two, and you can read more in our blog post which explains everything you need to know about your business credit score.

| Your business credit score… | Your personal credit score… |

| Is public: Lenders, business partners, vendors and other stakeholders can see it | Is private |

| Is based on your business’s financial history, such as business loans you’ve taken out | Is based on your non-business credit such as mobile phone contracts and mortgages |

| May differ depending on the credit reporting agency you use because there isn’t a standardised system for calculating business credit scores | Should be roughly the same across all credit reporting agencies because it’s calculated using a standardised system |

| Is taken into consideration by lenders when you apply for business loans from them (if you’re a limited company) | Isn’t usually taken into consideration by lenders when you apply for business loans from them (if you’re a limited company) |

Open up your credit options with Tide’s Credit Builder

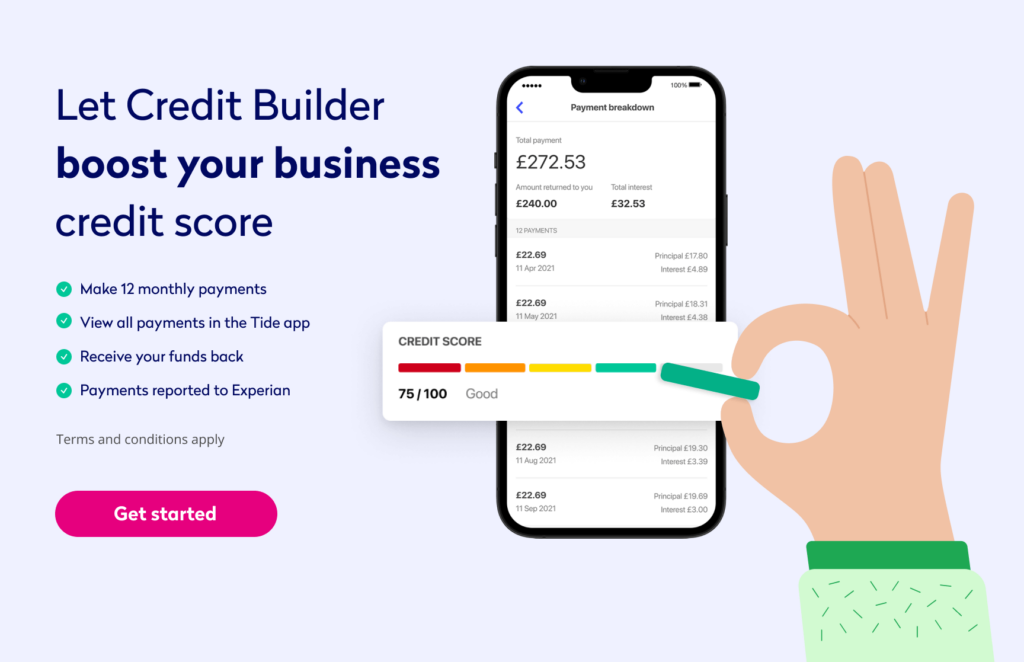

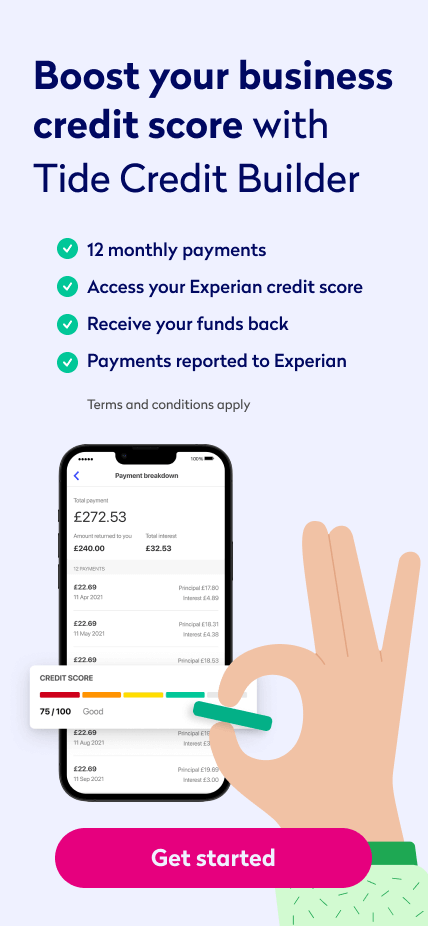

If your business credit score needs a bit of work, you’ll need to build it up before applying for business credit. We’ve developed our Credit Builder feature to help you do just that with minimal effort!

It works like a ‘reverse loan’, to help you demonstrate your lending potential by reporting monthly loan repayments to Credit Reference Agencies. By making payments on time and in full, you can help improve your business credit score for your future finance applications. You can track your credit score’s growth at any time in your Tide app, too.

Three ways we take the pain out of finding credit and loans

At Tide, we like to keep things simple for you so you can concentrate on what you do best. Using the following credit features in your Tide app, you can see credit options you’re eligible for without wasting time scouring the market.

Credit Flex

Tide directly provides a short term loan of its own called Credit Flex which requires no application (subject to eligibility).

Credit Flex is a short term loan facility that helps Tide members manage their short term cash flow needs. Members can spread business purchases into smaller monthly repayments to avoid a sudden balance dip, and they can get an instant cash boost by using Credit Flex for a previous payment.

And unlike other loans, there’s no application needed. Tide does all the eligibility checks in the background meaning if you’re eligible, you’ll see Credit Flex as an option when you’re making a payment or when you tap on a past transaction in the Tide app.

You could have pre-eligible offers waiting in your Tide app

We work with our finance providers to access instant offers that we believe could match your business needs. By assessing your lending profile, we’re able to qualify your business for a loan without you having to lift a finger. If you qualify, these offers will automatically show in your Tide app.

Funding Options by Tide

With a good business credit score in hand, your next step might be to dig a little deeper. There could be even more finance solutions available for your small business right at your fingertips.

With Funding Options by Tide, you can compare finance from over 120 lenders ranging from £1,000 and £20m, giving you access to the best product tailored to your business needs and eligibility.

Wrapping up

Business credit is one option to consider as part of a wider financial plan. It can be used to finance growth or maintain a healthy cash flow. Remember, before applying for anything, make sure you have a good business credit score and have researched all your funding options.